Ukraine is at the beginning of its economic recovery. It has gone through a severe economic crisis but undertaken the necessary adjustments. After two years of severe output contraction in 2014–15, the economy saw a hesitant recover of 2.3 percent last year. The standard forecasts suggest growth will continue at 2–3 percent a year. That is unlikely — a higher growth rate seems more probable.

While Ukraine’s recovery remains fragile, the preconditions look pretty good, especially the macroeconomic fundamentals. Two key conditions are the budget deficit and the current account deficit, which Ukraine has reduced to about 3 percent of gross domestic product.

Inflation has fallen to 12 percent and is set to decline further. With $17.6 billion in international currency reserves, Ukraine can cover four months of imports, which is sufficient. The hryvnia exchange rate is highly competitive and has stabilized, being more likely to rise than to fall.

Better than normal

Two big risks have gone away. Naftogaz’s extraordinary victory against Gazprom in the Stockholm arbitration on May 31 saved the country the risk of a Russian claim of $40 billion or more. Ukraine might even get substantial compensation for Gazprom overpricing. The nationalization of PrivatBank last December eliminated the risk of financial chaos. Ukraine’s current debt is 83 percent of GDP, less than anticipated, and it will decline with the likely appreciation of the hryvnia and growing GDP.

Ukraine has not only returned to normal but improved. The fiscal burden on the Ukrainian economy has eased. Public expenditures have been slashed heroically from 53 percent of GDP in 2014 to 40 percent of GDP, mainly cutting corrupt subsidies to energy traders and state enterprises, which has leveled the playing field. The ProZorro electronic procurement system has accomplished the same. The reduction of the payroll tax from 45 percent to 22 percent was a great improvement. Ukraine’s banking sector has been cleaned out, and is ready for a sound expansion. The arrest of much of the former leadership of the State Fiscal Service can lead to a cleansing of the tax collection and customs. The notorious value-added tax refunds for exports are supposed to be automatic now. Ukraine has come out with a much more liberal market economy that is now ready to grow fast.

Land market reform

The next big step should be land market reform. Farmers need to own their land to invest fully and to be able to use it as collateral for bank loans, so that they can invest more and so that the banks can expand their lending securely. The Ukrainian myth is that the “oligarchs” will buy all the land, but they cannot. Land prices will rise with the development of a land market, probably by three times, and the “oligarchs” have too little capital.

The current large agroholdings do not have sufficient capital to buy the land they now lease so cheaply. Ukraine’s current agroholdings are often too large to manage. Latifundias work for extensive agriculture, but not for intensive cultivation. The large farms will have to reduce the size of their holdings, rendering them more manageable and efficient. Instead, medium-sized family farms of some 2,000 hectares are likely to develop, as is predominantly the case in Illinois, where the agricultural conditions are very similar to Ukraine. Ukraine can no longer afford to deprive itself of its greatest asset.

A worker carries a step ladder to change light bulbs in the session hall of the Supreme Court of Ukraine in Kyiv on April 5. (Volodymyr Petrov)

Property rights

After years of resistance from the old judges and prosecutors, some progress is finally visible with the formation of a new Supreme Court and mass arrests of corrupt tax officials. Admittedly, this is only a first step, which is not all too convincing, but at least something is happening. I would much rather see the sacking of all old prosecutors and judges and their replacement with a new guard. The essence is that property rights must be secured, which is the ultimate duty of the president.

An economic recovery is under way. GDP grew by 2.3 percent last year and by 4.8 percent during the last quarter of 2016. Ukraine was set for a take off, but then some politicians in the Self-Reliance party started a blockade against Rinat Akhmetov’s transit of coal from his coal mines in occupied Donbas to his power stations in free Ukraine.

Everything was wrong with this action. Foreign policy should be the monopoly of the government, and not in play for activists. This action alone shaved off at least 1 percent of 2017 GDP, and it offered Russia an excuse to confiscate 40 private Ukrainian companies in the occupied territories, and incite their further integration into Russia. This wrong-headed action continues to drive down Ukraine’s industrial production.

More political fireworks can delay the badly needed land market reform, but the fear of early elections has abated. Growth continues, though on a lower trajectory. It is driven by investment, construction, consumption and recently exports.

One often-posed question is which industries will drive Ukraine’s economic recovery. Two of the growth engines are already in place, the quickly expanding agriculture and related industries, and computer programming, accounting for more than 3 percent of GDP.

The third latent growth engine is the European supply chain, the European outsourcing of manufacturing and services to Ukraine now when the border barriers have largely come down. Why produce in Poland, when the salaries are one-fifth on the Ukrainian side of the border?

Anders Åslund is a senior fellow at the Atlantic Council in Washington and a former economic advisor to the Ukrainian government.

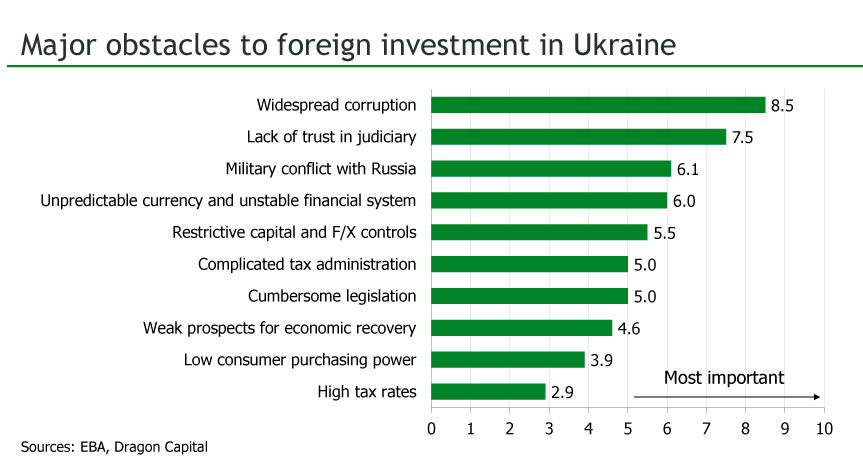

Many Ukrainians have concluded that President Petro Poroshenko is unwilling or unable to extinguish the burning fire of corruption in Ukraine. Despite $40 billion being stolen by ex-Ukrainian President Viktor Yanukovych and his associates, and $20 billion in losses from the corrupt banking sector, no one has been convicted in a major criminal case and only small amounts have been recovered for the national treasury. The competition-stifling oligarchy, meanwhile, lives on.

World’s fastest-growing economies, 2017 projections

1. Ethiopia – 8.3%

2. Uzbekistan – 7.6%

3. Nepal – 7.5%

4. Tanzania – 7.3%

4. India – 7.2%

6. Laos – 7%

7. Philippines – 6.9%

7. Cambodia – 6.9%

9. Myanmar – 6.8%

9. Ivory Coast – 6.8%

9. Bhutan – 6.8%

9. Bangladesh – 6.8%

The World Bank projects that the global economy will grow 2.7 percent while Ukraine’s economy will be only 2 percent. The nation has a long way to go to catch up to the world’s fastest-growing economies.

Source: World Bank