On the face of it, a well-managed monopoly looks like an interesting idea: it will employ the best researchers in a given industry; there will be no need for expensive marketing or advertisement budgets; all hands will be on the production, which will achieve scale faster as it serves an entire country, thus generating massive savings; its workers will be guaranteed employment and social benefits. Nothing short of socialist paradise.

Quiet life

But we all know it is not true. Monopolies generally lead to lower service quality, less innovation, higher costs and, to quote Sir John Hicks, the famous British economist: “the best of all monopoly profits is a quiet life.” They preserve outdated industries and end up underpaying their employees. The entire economy suffers. Monopolies are not a uniquely Ukrainian issue, but few countries have paid a higher price for them than Ukraine. It is a price that Ukraine continues to pay, for they are unusually prevalent, and their regulation unusually weak.

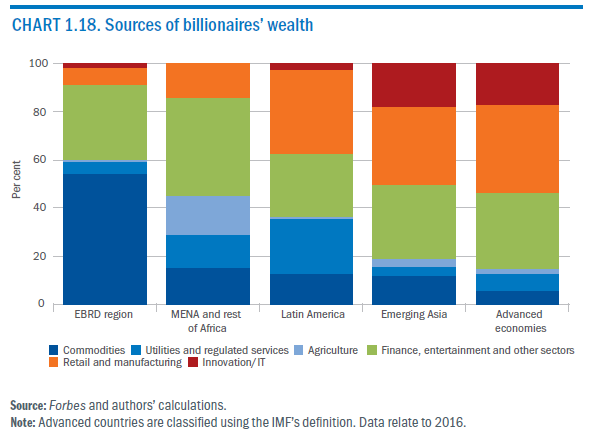

Often they are linked to natural resources, and result in creating fabulous wealth. It is striking that natural resources are the primary source of the wealth of billionaires in the European Bank for Reconstruction and Development’s countries of operations (see chart, from the EBRD 2016 Transition Report, available at www.ebrd.com/publications/transition-report-2016-17.pdf). This prevalence of natural resources in billionaires’ wealth leads to a peculiar form of economic organization of society: as natural resources sectors are generally much more dependent on governmental policies than other sectors (through production licences, for example), they tend to generate blurred relationships, where businessmen use their wealth to buy and maintain political advantage, and to maintain their dominant share of specific sectors of the economy. That type of economic organization bears a specific name: it’s referred to as oligarchic.

Energy dominance

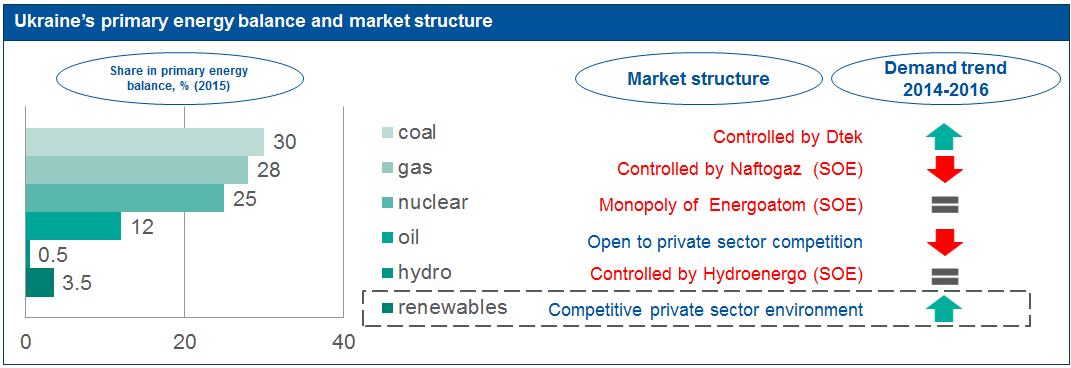

Take the example of the energy sector. Currently a number of key energy sub-sectors are dominated by the state or by a few influential groups. The State runs nuclear power generation (traditionally justified by security reasons), but also hydro power and large parts of the gas sector, which together account for 56.5 percent of primary energy balance. The coal-based energy production (30 percent of energy supply), is dominated by DTEK Group.

Only renewables have been able to attract competitive private sector participation and new foreign investors. This is due to the supportive feed-in-tariff regime in the country and the global trend in cost reductions in renewable energy technology.

There is theoretically an open market for gas production. In practice, bureaucratic obstacles and the dominant position of UkrGasVydobuvannya have deterred new entrants. This quite clearly results in underinvestment, and in Ukraine not being able to improve energy security. If the private sector, especially the sort of strategic investor that brings new technologies, could invest in Ukraine’s gas sector, many experts reckon that the country could become a net exporter of gas. According to BP statistics Ukraine has 0.6 trillion cubic meter of gas reserves in the ground, this could translate potentially in 10 to 20 billion cubic metres (bcm) of gas per annum to its current 20.5 bcm production. That would represent $2-4 billion of revenue for Ukraine every year, thousands of good, well-paid jobs, additional tax revenue for the government; incidentally it would also give the country energy freedom, which is priceless.

Freeing the market

The advantages of opening a market are already visible in the wholesale gas import market: in 2014 Naftogaz had an import monopoly. While the reforms needed to fully open the market are not yet complete, we have already seen a seismic shift. From five in 2014, the number of private independent gas importers multiplied thirteen fold to sixty seven in 2017. Industrial customers have a choice.

For consumers the situation is more difficult. Utility prices have risen, not due to competition but to make them reflect market realities. This has triggered the need for subsidies to the people for whom affordability is an issue. Such subsidies now reach 46 percent of the population and cost around 2.5 percent of gross domestic product (from 0.13 percent in 2014) – but one should not forget that lower prices for everyone, as existed beforehand, are a subsidy too, and that they favour the richer people, who tend to have larger, warmer houses. In 2014, prior to the start of reforms, government spent 6.1 percent of GDP on Naftogaz. This high figure illustrates the cost of providing lower prices to everyone. So targeted subsidies are inherently more efficient – and fair!

Under the European Union model (that Ukraine has signed on to), the retail market can be competitive and transparent. Consumers can use modern technologies to access their energy use and charges, and adjust their consumption, tariff plan, or supplier accordingly. German consumers receive energy invoices that are far more detailed than Ukrainians do. A German energy bill includes information on actual consumption over time in various tariff bands; breakdown into e.g. taxes, renewable energy support charges; network costs; energy costs; and service costs. Suppliers are obligated to provide this information, which enables customers to make informed decisions.

Solutions

Oligarchs tend to want to create monopolies. Monopolies in a weak state tend to spawn oligarchs. Oligarchs do not like a strong, transparent state that could regulate away their advantage. What can be done to break this circle?

One of the answers is that the authorities have to demonstrate courage and determination, in the energy sector as in others. Cooperation with the EU and with institutions like the International Monetary Fund, the World Bank the EBRD, helps the resolute by providing the sort of technical support that underpins progress.

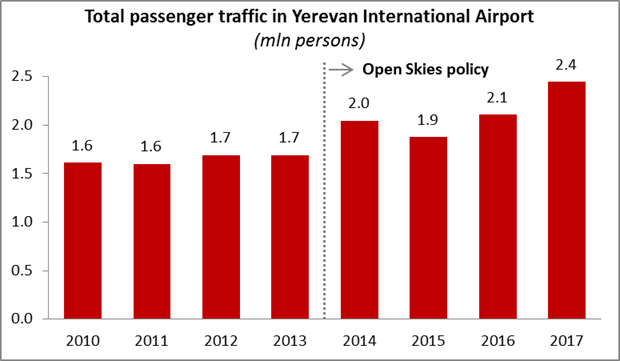

Take the example of the airline sector. In 2013, as Armenia’s national carrier was in the throes of going bust, the Armenian authorities decided to adopt an open skies policy. That was a major strategic decision with far reaching implications in a landlocked country whose Eastern and Western borders are closed. A number of people predicted chaos, a drastic drop of air traffic: which airline would be interested in the Armenian market in the first place? Four years later, passenger traffic at Yerevan’s Zvarnots airport was up by 45 percent.

Another answer is that transparency can work.

Low transparency

Insufficient transparency cripples the Ukrainian economy. For example, there appears to be unusually close cooperation between Ukraine International Airlines, Dniproavia and Windrose: recently I booked a ticket on an UIA flight, which listed itself as the operator of the flight, but the aircraft wore a Dniproavia livery and the safety leaflet in the seat pocket was from Windrose. Many people say these three airlines, along with Dnipro airport, are controlled by the same persons. But absent proof or disclosure, it is impossible to take antimonopoly actions. Yet consider the facts: on a recent day this week, there were 2 scheduled departures from Dnipro, as compared to 18 from Lviv, a city of comparable size. We looked up prices for various dates: Kyiv-Dnipro consistently costs between twice and three times the price of Kyiv-Lviv, for an equivalent distance. Dnipro is the only airport in the top ten in Ukraine to have seen passenger traffic go down last year. Higher costs, lower levels of service, lower growth: if it is not a monopoly, it looks like one. It need not be this way; regulators (from the Anti-Monopoly Committee to the air traffic safety regulator) ought to be able to access information as to who the ultimate controlling party of a company is. Banks should require that information before lending, or even opening an account, as is increasingly the norm worldwide. Failing this, Ukraine will continue underexploiting its potential, and monopolists will continue to prosper.

“Extracting rent”

The economic term for what monopolists are doing is “extracting rent”. Like a malevolent landlord, monopolists extract unjustifiably high prices from the rest of the economy, leveraging their political connections to maintain protection from competition. There are very few justified monopolies, like the gas or electricity transmission infrastructure, roads or railtracks. These need to be transparently, honestly and fairly regulated. Others should go, for the sake of Ukraine and its people’s prosperity.

I’d like to thank my colleagues Giuseppe Grimaldi, Sergei Guriev, Adil Hanif, Konstantine Kintsurasvhili and Mark Magaletsky for their support, suggestions and critique.

Francis Malige is the managing director for Eastern Europe and the Caucasus for the European Bank of Reconstruction and Development. He has been based in Kyiv since his appointment in 2014 and is responsible for leading the bank’s operations and policy initiatives in Ukraine, Belarus, Moldova, Armenia, Azerbaijan and Georgia. A French national, Malige joined the EBRD in February 2010 as a director in the financial institutions team. Before joining the EBRD, he was managing director for corporate development at BNP Paribas, focusing on bank acquisitions. Malige is a graduate of ESCP Europe, a French business school. In addition to his native French, he is fluent in German, Italian and English.