When the European Bank for Reconstruction and Development was set up 30 years ago, it had one clear mission: to support the transition of countries in the former communist bloc towards a market-based economy. All our investments had, one way or the other, this overarching objective.

Since then, our region has evolved, and we have evolved with it. The transition to a market economy has accelerated in some countries while others have lagged behind. For many of them, accession to the European Union has been a marker of success.

More recent investee countries such as Egypt and Turkey have become our biggest investment destinations, together with Ukraine. Today, we operate in 38 economies in Europe, Asia and Africa. Our contribution is grounded in a focus on private-sector development, combining investment, policy and technical assistance with the ability to make selective interventions in the public sector.

The bank is responsive to market and reform conditions and innovative in helping economies to become competitive, well-governed, green, inclusive, resilient and integrated. We believe that progress on these six qualities of a sustainable market economy will lead to greater growth and prosperity, more jobs and opportunities, and a better environment for people, and will support the achievement of the United Nations’ Sustainable Development Goals, or SDGs.

The quality of good governance is a key determinant of differences in economic performance between and within countries. This quality has become more critical given the increase in state involvement in the economy in response to the COVID-19 crisis. Ukraine is certainly no exception, and we are redoubling our efforts to stabilize and bolster corporate governance reform, in close collaboration with other international partners.

The pandemic has made collective action to deliver sustainable development goals even more urgent and has heightened the relevance of three overarching themes that will guide EBRD operations in the next strategic cycle:

• Supporting the transition to a green, low-carbon economy to align with the principles of the Paris Agreement. The goal is to raise our green finance to at least 50 percent of our annual investment by 2025.

• Promoting equality of opportunity by supporting access to skills and employment, finance and entrepreneurship, and services for women, youth, and those in less developed regions, working with and through the private sector. There will also be a focus on mitigating potentially adverse impacts, including from the digital and green transitions.

• Accelerating the digital transition, recognizing that technology can be a key enabler of progress in economic transition.

Underlying economic and political conditions strongly influence the bank’s capacity to support its countries of operations in their progress to sustainable market economies. The COVID-19 pandemic and economic crisis are still unfolding. This fluid context will shape both the challenges that our clients face and the Bank’s ability to support countries’ responses to the crisis.

Annual gross domestic product growth rates in the EBRD regions have roughly halved from the levels seen before the global financial crisis, and estimates of potential growth in these economies average around 3 percent, limiting the prospects for income convergence with advanced economies.

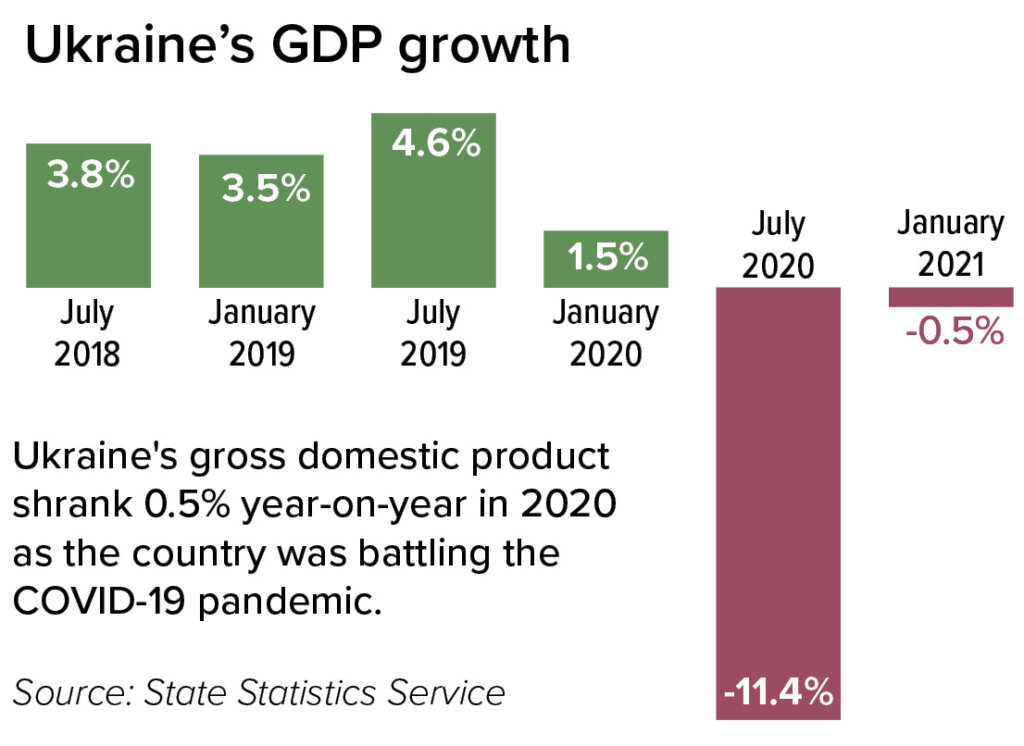

Measures to contain the spread of COVID-19 have had a dramatic effect on the economic outlook, with an estimated contraction of 2.2 percent (4 percent for Ukraine) in the EBRD regions for 2020, before a recovery to 3.6 percent (3.5 percent for Ukraine) in 2021, with per capita incomes returning to pre-crisis levels by early 2022.

However, there is considerable uncertainty in making projections at this time. Significant risks remain in economies that are highly dependent on tourism, commodity prices, and remittances.

Public indebtedness is projected to increase significantly because of the COVID-19 crisis, and debt sustainability will be a key concern. The crisis is also reshaping financial sectors, as private debt increases and non-performing loans rise.

China dwarfs all other trading partners of Ukraine with $15.4 billion in turnover in 2020. Bunched closer together in second, third, and fourth place — with $7+ billion in trade — are Poland, Russia, and Germany. Each with $4+ billion: Turkey, Belarus, Italy, and the United States. Rounding out the top 10 are India and Hungary, each with $2.7 billion in bilateral trade.

A number of factors merit consideration when assessing the prospects for growth in the years ahead:

• Demographics: If the labor force grows more quickly than the population, living standards rise. This is unfortunately not the case for Ukraine, where, like other economies in the EBRD regions, the challenge is to manage an aging workforce and a growing old-age dependency ratio. Cross-border and within-country migration is a medium-term factor that affects growth in emerging economies, including Ukraine, with younger and better-qualified workers frequently the most mobile.

• Trade, global supply chains and onshoring: Ukraine is yet to be fully integrated into global supply chains and this has partially shielded its economy from supply chain disruption. However, the crisis presents an opportunity for the Ukrainian economy, as firms may be seeking to increase their operational resilience by diversifying the locations of their suppliers, reducing dependence and focusing on regional supply chains.

• Digitalization: The crisis has accelerated digital transition. Automation may quickly erode the advantages of a development model that relies on lower wages in manufacturing. Technology also leads to the creation of better-paid and higher-skilled jobs at the expense of mid-skilled jobs, resulting in greater inequality. However, businesses that are able to integrate new technologies can take advantage of structural changes accelerated by the crisis, such as the move towards business models (e-commerce, for instance) that require lower upfront capital expenditure.

• Resilience to future shocks: The course of the COVID-19 outbreak is highly uncertain and it is impossible to rule out future pandemics. The level of any direct impact — and the capacity to recover quickly after a new shock — depends on the resilience of economies. Some countries where the EBRD invests, including Ukraine, are judged to have relatively low economic resilience to renewed health crises.

Ukraine has climbed steadily in the World Bank’s annual Ease of Doing Business ranking but still has not climbed high enough to achieve an investment breakthrough.

The creation and preservation of sustainable jobs will be a key goal for policymakers. Workers in economies that have a greater degree of informal employment are worse affected. In addition, the

sectors most impacted by the crisis — for example, hospitality and tourism — are sources of employment for women in particular. Overall, the crisis is likely to accelerate trends in inequality, with the most adverse effects falling on already disadvantaged groups.

The vast majority of countries, including Ukraine, are committed to the international community’s objectives, set out in the Paris Agreement of 2015, to limit the increase in average global temperatures to well below 2 degrees Celsius. Although contributing a relatively small part of global emissions, countries like Ukraine remain more energy-intensive than comparable peers. As a result, making the transition to a more energy-efficient and decarbonized economy offers a growth opportunity. As we have seen recently in the renewable sector of Ukraine, there is a risk that populist measures and a need to address the consequences of the COVID-19 crisis will dissipate the political will to tackle climate change. On the contrary, we believe that there is an opportunity to integrate a “tilt to green” into the public and private investment programs aimed at speeding up recovery from the coronavirus crisis. For the EBRD, the overarching goal is to preserve and accelerate transition during the phases of recovery from the pandemic and to continue tackling broader, deep-rooted challenges, including environmental issues, demographics and technological transformation.

This endeavor requires willing partners and political commitment to a positive reform trajectory. We remain committed to and trustful in such a partnership with the Ukrainian leadership.

Matteo Patrone is the European Bank for Reconstruction and Development’s managing director for Eastern Europe and the Caucasus.

The COVID-19 pandemic triggered a 4% shrinkage of Ukraine’s economy in 2020, which is officially measured at approximately $150 billion.