According to the Tax Code of Ukraine (TCU), Ukrainian companies paying certain types of income (including, dividends, interest, royalties) to foreign companies are required to withhold Ukrainian withholding tax (WHT) from such income and remit it to the state budget. Contractual tax clauses envisaging grossing-up of income due to foreign recipients for the amount of WHT are explicitly disallowed by the TCU.

The standard WHT rate is 15%. WHT can be eliminated or reduced based on the applicable double tax treaty between Ukraine and the country of tax residence of income recipient.

Importantly, the TCU provides that the reduced WHT rate or WHT exemption can only apply if the recipient is a beneficial owner of income payable by a Ukrainian company. This rule gives rise to tax disputes even in respect of service fees paid by Ukrainian corporate taxpayers to foreign companies that do not own the assets necessary to provide the relevant services.

The Ukrainian tax authorities usually scrutinize the transactions of Ukrainian taxpayers with foreign companies during tax audits. The tax penalties for failure to pay the WHT due may be as high as 75%. Given this, Ukrainian businesses tend to apply aconservative approach towards application of WHT to payments due to foreign companies. In certain cases, Ukrainian businesses overpay the WHT due resulting in receipt of lower income by their foreign business partners or parent companies.

It appears that only a limited number of foreign companies and investors are aware that they can effectively recover WHT excessively withheld by their business partners or subsidiaries at source.

In this article we will briefly cover the procedure of WHT refund, as well as provide our thoughts on how the Ukrainian companies may use this procedure to strengthen their position in respect of WHT treatment of payments to foreign income recipients.

Procedure to recover overpaid WHT

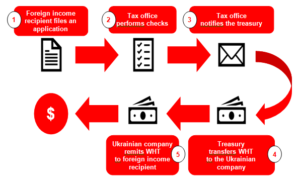

The TCU provides for a specific procedure to recover overpaid WHT. This procedure implies that the foreign income recipient submits a relevant application to the Ukrainian tax office. Upon receipt of such an application the tax office is to perform the necessary verifications and to confirm or deny the fact that the WHT has been overpaid.

If the tax office confirms the WHT overpayment, they are to provide their decision to the foreign applicant and the Ukrainian company having overpaid WHT.

In addition, the tax office should provide the relevant conclusion to the Ukrainian treasury authorities. In turn, the treasury authorities are to refund the amount of WHT specified in the conclusion of the tax authorities. Importantly, the Ukrainian treasury authorities shall remit the amount of such WHT to the bank account of the Ukrainian company that has excessively withheld such tax.

Interestingly, the Ukrainian company having received the decision of the tax authorities confirming the WHT overpayment may transfer the amount of excessively withheld WHT to the foreign income recipient before or after such a Ukrainian company gets a refund of such WHT from the treasury.

The simplified procedure of WHT refund is illustrated in the chart below.

Based on our experience, the tax authorities may be reluctant to confirm the fact of WHT overpayment and to seek for grounds to refuse granting a refund. If the tax authorities do not confirm that the WHT has been overpaid based on formal or artificial grounds, the foreign income recipient may challenge the decision of the tax authorities to the court of law.

Alternative application of the procedure of WHT refund

Apart from the purpose of actually refunding the overpaid WHT to the foreign income recipients, the Ukrainian companies may use the procedure of WHT refund to support their position in respect of WHT exemption or reduced WHT rate applicable to payments due to their foreign business partners or parent companies.

For instance, if the Ukrainian company is unsure whether the WHT should be withheld or whether the lower WHT rate is applicable to the material income payable to the foreign company, such a Ukrainian company can make an immaterial payment (e.g. EUR 100) to such a foreign company and withhold WHT at the standard 15% rate from the amount of income paid. Subsequently, the foreign income recipient initiates the procedure of WHT refund. If the tax authorities confirm the WHT overpayment, the Ukrainian company may use the relevant decision of the tax authorities to support WHT exemption or reduced WHT rate applicable to identical future material payments due to such a foreign income recipient. If the tax authorities do not confirm the WHT overpayment, but the foreign income recipient successfully challenges the decision rejecting the WHT refund in the court of law, the relevant court ruling would be even a stronger argument supporting the favorable WHT treatment of the specific transactions.

To conclude, the opportunities for recovery of overpaid WHT appear to be largely underutilized. Apart from the clear benefit of receiving additional cash funds for the foreign companies, the procedure for reclaiming the excessively paid WHT may also provide an advance certainty on WHT treatment of specific transactions without a risk of material penalties.

Only a limited number of foreign companies and investors are aware that they can effectively recover Ukrainian withholding tax excessively paid by the Ukrainian companies. The Ukrainian companies can use the procedure of recovery of overpaid WHT to support their position in respect of WHT treatment of specific transactions.

Andriy Reun

Head of Tax

Evris Law Firm