The global capital markets operate without prejudice, they don’t play favorites. Capitalism at its heart is a ruthless entity seeking only to maximize returns on a risk-adjusted basis. Any person, corporation or indeed nation that thinks otherwise lacks a basic understanding of how the investment community operates at its very core.

Capitalism and the investors who operate within its structures seek only one thing – a place to deploy financial resources and get a return on such resources that satisfies shareholders. Assessing the worth of the global capital market, many researchers and economists have concluded that the total represents more than $200,000 billion and will continue to grow well into the future.

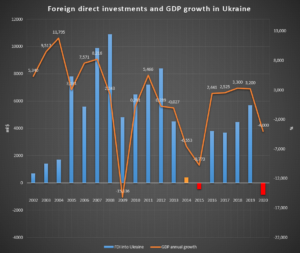

So why is it then that Ukraine, a nation of 40 million citizens, with a capital city that is one of Europe’s largest, blessed with rich soils, abundant natural advantages for major industries such as renewable energy, agriculture, mineral extraction and even tourism, is lagging so far behind other less fortunate nations in this regard? Why is it that net capital inflows – a measure of money in vs money out – turned negative in 2020, reaching $868 million in outflows? For the previous 20 years, a negative Foreign Direct Investment (FDI) inflow occurred only in 2015, which was influenced by the Russian occupation of the Crimea and the start of the conflict in Eastern Ukraine.

We can blame the 2020 results on the impact of the COVID-19 pandemic and the economic downturn but the reality is that globally companies didn’t stop investing, they just reduced their investments in Ukraine even further. For example, in 2020, the total volume of capital investments into Ukraine’s economy plummeted by 38%. In comparison, the volume of FDI in the other countries of Eastern Europe, with which Ukraine competes in the capital market, amounted to tens of billions of dollars in 2020. Hungary attracted $4.2 billion, Romania – $2.3 billion, Bulgaria – $2.4 billion, Slovakia – $1.9 billion and Poland – $10 billion.

So why did Ukraine’s position weaken further when compared to its neighbors? To understand this requires an understanding of the important caveat placed on the ‘returns’ or profits: RISK-adjusted.

Ukraine has been perceived for too long as too risky by the western institutional investment community. The causes are well known, and regularly cited in this publication and others – corruption, low levels of legal protection for investors, regulatory policy, underdeveloped and weak local markets, the ongoing military conflict in the Donbas region, etc. The opportunities are clear but the risks of investing in Ukraine are too high on a relative basis when compared to neighboring countries.

Ukraine’s track record of economic and political blunders with foreign investments speaks for itself. Two years ago, the Ukrainian government called for renewable energy investments into the country, promising lucrative permits and agreements as long as investors came in. As a result, companies invested €3 billion, only to have the Ukrainian government revoke their offers and pull out of the agreements without warning. Another example is the Canadian corporation TIU, which invested over $65 million into building 4 solar energy stations in Ukraine, and then fell victim to a malicious attack on its assets. Additionally, SkyMall’s Estonian and Zernoff’s Moldovan investors have been involved in high profile legal disputes with the Ukrainian government with regards to their investments. Even the oil and gas sector, which until six years ago consisted of all of the major players – Shell, Exxon Mobil, Chevron, Eni, has been decimated with all but Shell leaving Ukraine.

Why? Because there are no rules in this market. An analysis of the investment risks shows that in any country in which oligarchs reign supreme, the risks are much higher. High risk usually means high reward but in Ukraine the rewards are questionable because the Ukrainian government, instead of fighting for capital and creating favorable business conditions, raises taxes, increases administrative pressure on businesses, fails to complete judicial system reform and constantly cuts costs. This is the reality of the situation, one which Ukrainians can bemoan and find excuses for, or one which they can take actions to address and change.

Such deep systemic changes require forward thinking, progressive and intuitive ambassadors, who believe in their country’s future, to be the driving force behind their implementation. One such individual who has been actively involved in promoting pro-Western agenda and building stronger relations with western institutions is Vadym Ivchenko. Ivchenko is a member of the Ukrainian Parliament and an expert in sustainable agriculture and green energy with extensive experience in international investment projects, who wants to put Ukraine on the investment map. We took this opportunity to interview him along with representatives of innovative US companies that he is determined to bring to Ukraine.

The interviewer is political observer and parliamentary journalist Yulia Zabelina.

Question:

‘During your visit to the US in August 2021, you met with representatives of a number of private equity funds and prominent industry players to discuss joint initiatives in the agricultural field. Amongst them was Matthew Kennedy, founder of international business development firm Kennedy Merchant Partners. I would imagine that his feedback would be invaluable with regards to attracting foreign investors to Ukraine. What did he say about this?’

Vadym Ivchenko:

‘I had the chance to discuss opportunities and investments with leading figures from politics and business in the world’s largest economy. The message I heard time and time again was the same – we would love to do more business in Ukraine, but we have major concerns. Whether I talked with Matthew Kennedy, or Brooke Coleman, who is the executive director of the Advanced Biofuels Business Council, former Members of Congress who are very familiar with Ukraine – John Slattery and Chet Atkins, or the leadership of a number of innovative companies in agricultural industry or biomass processing, the concerns were the same. While there is no such confidence, there will be no investment forthcoming into Ukraine, and in fact these projects will be located in other countries.’

Question:

‘You’re alluding to your August negotiations with the Executive Director of the Advanced Biofuels Business Council (a coalition of worldwide leaders in the advanced biofuels industry), Brooke Coleman. Coleman’s organization is involved with dozens of promising projects, some of which operate in Bulgaria. Don’t you believe that these industries would be better suited to being located in Ukraine?’

Vadym Ivchenko:

‘Absolutely. For example, their investment partners are currently building 10 biomass processing plants in Bulgaria – given our markets here and our agricultural advantages, when they tell me these factories could be built in Ukraine, I am more inclined to think they SHOULD be built in Ukraine. It is my personal mission as a patriot and my duty as a representative of the people to ensure that in the future they are.’

Matt Kennedy served in senior roles in the Obama Administration at the Department of Commerce, Department of the Treasury and in the White House. As the Director of the Office of Strategic Partnerships in the Department of Commerce, Kennedy worked closely with the Overseas Private Investment Corporation and the Export-Import Bank of the United States to develop innovative, public-private partnerships with leading trade organizations and Fortune 500 businesses. We decided to contact Kennedy ourselves, in order to obtain his personal feedback on the investment opportunities in Ukraine and his recent negotiations with Ivchenko.

Question:

‘We know that you have met with Vadym Ivchenko and discussed the prospects of Western investments into Ukraine. In your professional opinion, is this likely?’

Matt Kennedy:

I would love to give an optimistic answer, but I believe that the short-term significant FDI is unlikely. There are too many discount factors, very low level of integration with American institutions and most importantly – the prevalentbusiness etiquette in Ukraine is still quite far from the American norms. However, I believe there is real opportunity in the medium and long-term, provided Ukraine makes necessary reforms. Ivchenko’s vision is not just about attracting capital to Ukraine, but about bringing foreign businesses to operate and become the role models for local companies to follow, thereby effectuating the changes necessary to regenerate investor interest.

Question:

‘What needs to be done, both on political and economic levels, in order for the major players to come into the country?’

Matt Kennedy:

The answer to this question is always the same: systematic work that is based on the favorable climate created by the country’s government and certainly on the enthusiasm and leadership of people who believe in what they are doing.

Unfortunately, I do not believe there is a quick fix. Ukraine needs to make the difficult reforms related to strengthening governance of the central bank, improvements to the legislative and regulatory framework for bank supervision and resolution, policies to reduce the medium-term fiscal deficit, legislation restoring and strengthening the anti-corruption framework and the judiciary, as well as changing the energy policy.

Matt Kennedy was among the group of highly influential decision-makers that Ivchenko met during his recent trip to DC. Other senior figures included Jim McGovern, member of the US House Committee on Agriculture; former Secretary of the Agriculture Dan Glickman and Deputy-secretary of Agriculture Randy Russell, former Members of Congress John Slattery and Chet Atkins, member of Issue One, the leading cross partisan political reform group in Washington DC. Ivchenko also led negotiations with a number of corporations while in the US, including:

- Indigo Agriculture, the US agtech unicorn, which recently appointed Moderna’s CEO to its board

- ProtonPower, which is willing to share its patented technology of converting biomass into synthetic fuel and electricity with its Ukrainian partners

- GrainPro, the leader in smart agribusiness with a global presence, which is interested in expanding into Ukraine

All of the parties involved in these meetings supported the idea of creating the US Agricultural Trade Mission to Ukraine. Ivchenko is driving this initiative and plans to finalize the agenda for the mission delegation’s visit to Ukraine during his upcoming visit to the United States in October. We decided to ask Ivchenko about this exciting new initiative:

Question:

‘Can you tell us more about your devotion to the mission of reassuring the West in Ukraine’s suitability for their investments and the upcoming Trade Mission?’

Vadym Ivchenko:

‘By developing personal relationships and giving my own assurance that I would intervene to prevent the stain of corruption and influence touching their enterprises, I was able to secure commitments from several companies s to come to Ukraine as participants of the trade mission from the USA, which we are organizing this year with our American colleagues. As part of this mission, we plan to present Ukraine as an attractive country for investment, convince American companies to build production facilities and bring innovative technologies to our nation. Such projects will not only bring thousands of new jobs and GDP growth, but also create additional demand for the products of farmers.

Vadym Ivchenko with Jim McGovern, member of the US House Committee on Agriculture

One of the companies to visit Ukraine as part of the mission was Indigo Agriculture Europe, which discussed what instruments are necessary to stimulate the adaptation of agribusinesses to climate change. These include strategic innovations ranging from the generation of and trade in carbon farming credits to the development of biological inputs which can help crops use nutrients and water more efficiently. Ivchencko also organized Indigo’s presentation at the headquarters of the National Academy of Agrarian Sciences in Kyiv, where the academy endorsed the idea of developing climate-orientated agricultural practices, signing a memorandum that can help to serve as a bridge between the USA and Ukraine in ecological innovations and agtechdevelopment.

Ivchenko and Indigo’s Head of Europe, Georg Goeres, outlined the roadmap and strategic direction for joint projects of both countries in the eco-agrarian field. We asked Ivchenkoto elaborate on Indigo’s decision to collaborate with Ukraine:

Question:

‘What can you personally say about Indigo’s initiative in Ukraine, what it may spell for the country and the people in general?’

Vadym Ivchenko:

‘I know for sure that Ukraine is in dire need of such initiatives. They are indispensable for those entrepreneurs who plan to find partners, financing and innovation opportunities for their ventures’

We reached out to Indigo’s Georg Goeres to enquire about their vision and perspective on entering into Ukrainian agricultural field:

Question:

‘Why Ukraine, what is your vision of cooperation and perspectives?’

Indigo:

‘The potential of Ukrainian agriculture is enormous and we have been very encouraged by what we see here. We are already working with some of the large agro-holdings to introduce our portfolio of biological inputs which can help improve the efficiency with which crops use nutrients and water. And we are also working with the International Finance Corporation to explore the feasibility of developing our carbon farming program in the country. This would enable Ukrainian growers to generate carbon farming credits from the adoption of practices which not only reduce their own emissions but drawn down and store carbon from the atmosphere in the soil. These credits can then be sold to governments, corporations and philanthropic foundations providing growers with an additional source of revenue, as well as enriching their soil. We’ll have to see what the feasibility study outcome is but we are encouraged by what we have seen so far,’

Question:

‘From what we know, Vadym Ivchenko took on your corporation’s goals and agenda quite personally, becoming somewhat of an ambassador for you and other US agro corporations entering Ukraine, so much so that the Trade Mission is being plotted out as we speak. Can you elaborate on that?’

Indigo:

‘Wherever we operate, we try to form partnerships with people and organisations that have a similar vision to ours in harnessing nature to sustainably feed the planet in ways which reward farmers. Vadym is clearly passionate about this and and it has been good to work with him in this respect, alongside our other partners in Ukraine.’

While all this may sound impressive, Ivchenko’scritics have labelled him as a ‘lone ranger’, describing his goals as fantasies. We asked Ivchenko about his somewhat romantic ‘one man on a mission’ vision:

Question:

‘Some may label you as naïve or romantic, given the harsh Ukrainian realities in which you are trying to implement this international cooperation. Do you really believe that you alone can make a difference?’

Vadym Ivchenko:

‘Of course, one man alone or one trade mission or one investment project cannot make all the changes and reforms needed. It does however create a roadmap to a future in which companies from the US and elsewhere will put aside their inherent reluctance to deal with Ukraine if they feel that there is a reliable, incorruptible person representing them in this country. Their success stories will be an example to others that Ukraine is a fruitful destination for investors.’

Question:

‘Were there other signals, messages voiced by your Western partners and politicians while in DC and in the course of your further communication with them?’

Vadym Ivchenko:

‘Another recurring message was about the lack of knowledge of the opportunities available to overseas investors. As a member of the Committee on Agrarian and Land Policy I would like now to devote my focus and efforts on opportunities for agriculture and biofuels, although the same could be done in other sectors too. American investors are intrigued by the potential in Ukraine in so many different economic areas. As a businessman I was able to convey to them clear and concise concepts for working together in each of these areas, which they responded to positively.’

Question:

‘If you had to pinpoint one major reason for Ukraine to take foreign investments seriously and cater to the investor’s needs – what would your argument be?’

Vadym Ivchenko:

‘If Ukraine received the same level, per citizen, of foreign investment that was achieved by, say, Hungary that would mean an increase annually of $17 billion in capital inflows to the country. This is a massive percentage of the national economy, it dwarfs what we receive from the IMF in loans and yet currently we are only willing to talk about how to get our $750 million in handouts from the World Bank.’

Hard to disagree here with Ivchenko. It would make more sense for businesses, the economy, national pride and every one of the 40 million Ukrainians who would benefit from a more modern economy and new jobs, for the government to prioritize this. Ivchenko vouches to continue to make these visits to our Western partners and to bring more overseas corporations to Ukraine, but it will take more than one member of parliament. His ambition requires commitment, vision and leadership from our government, and the understanding of the basic requirements of foreign investors to say the least.