Editor’s note: Our 2019 Doing Business in Ukraine magazine is out. Get a PDF version online or pick up a copy in Kyiv.

Kyiv’s commercial real estate market has recovered since the EuroMaidan Revolution that ousted ex-President Viktor Yanukovych in 2014. But it struggles to reach new historic growth due to constraints of a soft economy.

The four major commercial markets — office, retail, hotels and warehouse — all have managed to stabilize. Vacancy rates are at healthy levels, prime rents are within European averages, and construction projects are, for the most part, moving forward.

‘Unbalanced’ office market

According to JLL, a leading firm in real estate and investment management, the office vacancy rate in the capital has decreased during the past three years to 7.6 percent in the last quarter of 2018, down from 27.9 percent in the fourth quarter of 2014.

Yevgenia Rozumna, an office expert at Colliers International in Kyiv, says that this figure is too low.

“The low vacancy rate is not always an indicator of a healthy economy. Our market is still developing in comparison to Western markets, which means that there always are shortages of office space,” she told the Kyiv Post.

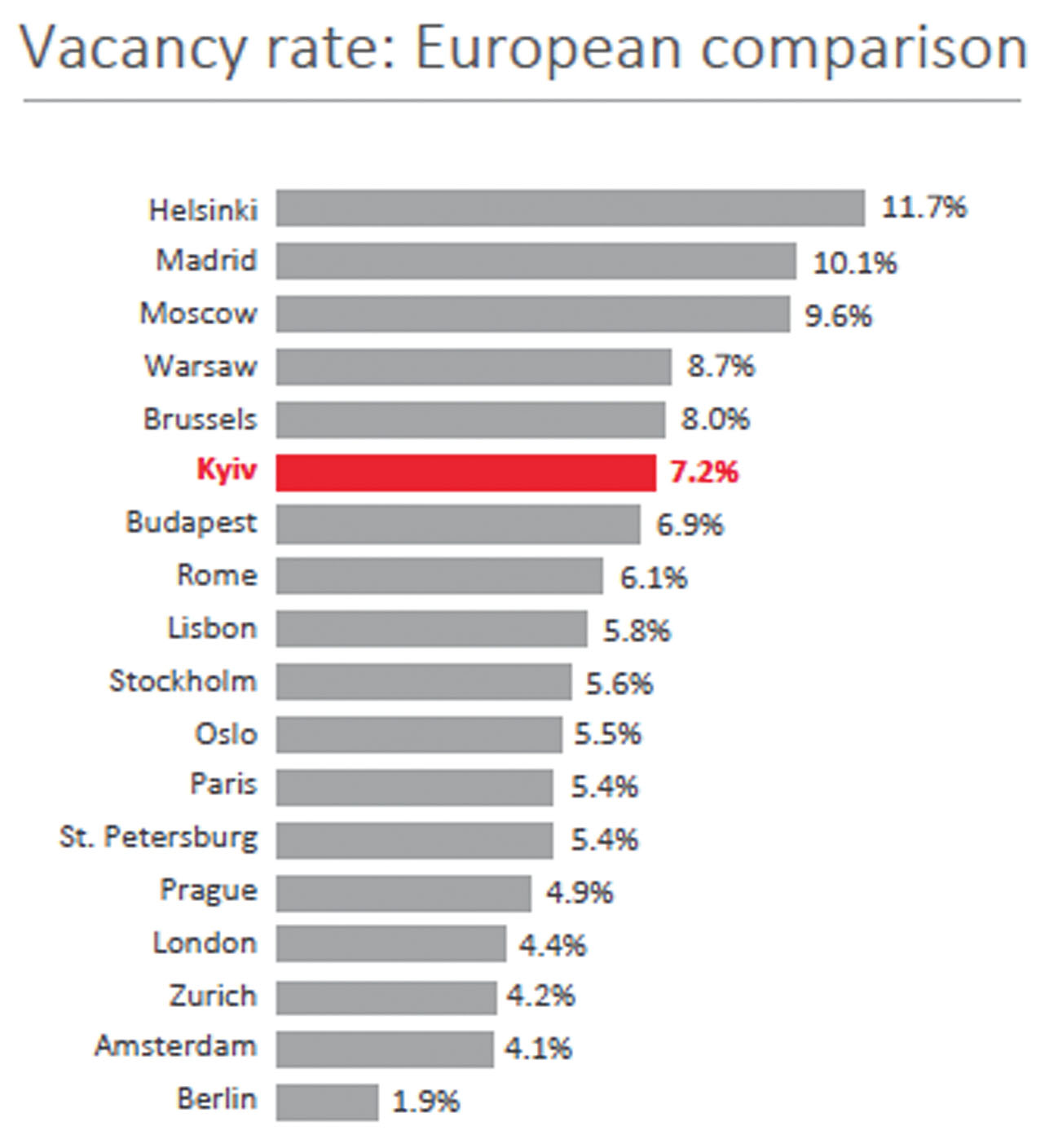

Rozumna and her peers say that this figure demonstrations Kyiv’s “unbalanced market.” For a market to be balanced, the rate must revolve around 10 percent, the experts say.

“This low vacancy rate is more of an indicator of an underdeveloped market,” Rozumna said.

“No significantly big projects were delivered for the last four to five years,” she said. “90,000 square meters will be delivered in 2019 if everything goes according to plan, but it isn’t sufficient. In 2014 for instance, (only) 150,000 square meters were delivered,” she added.

This creates difficulties for big companies such as IT firms that wish to gather all of their departments under the same roof but are forced instead to scatter them around the city.

“Several massive sites are in the early stages of construction, but it will take another year-and-a-half or more to deliver them to the market,” Rozumna said.

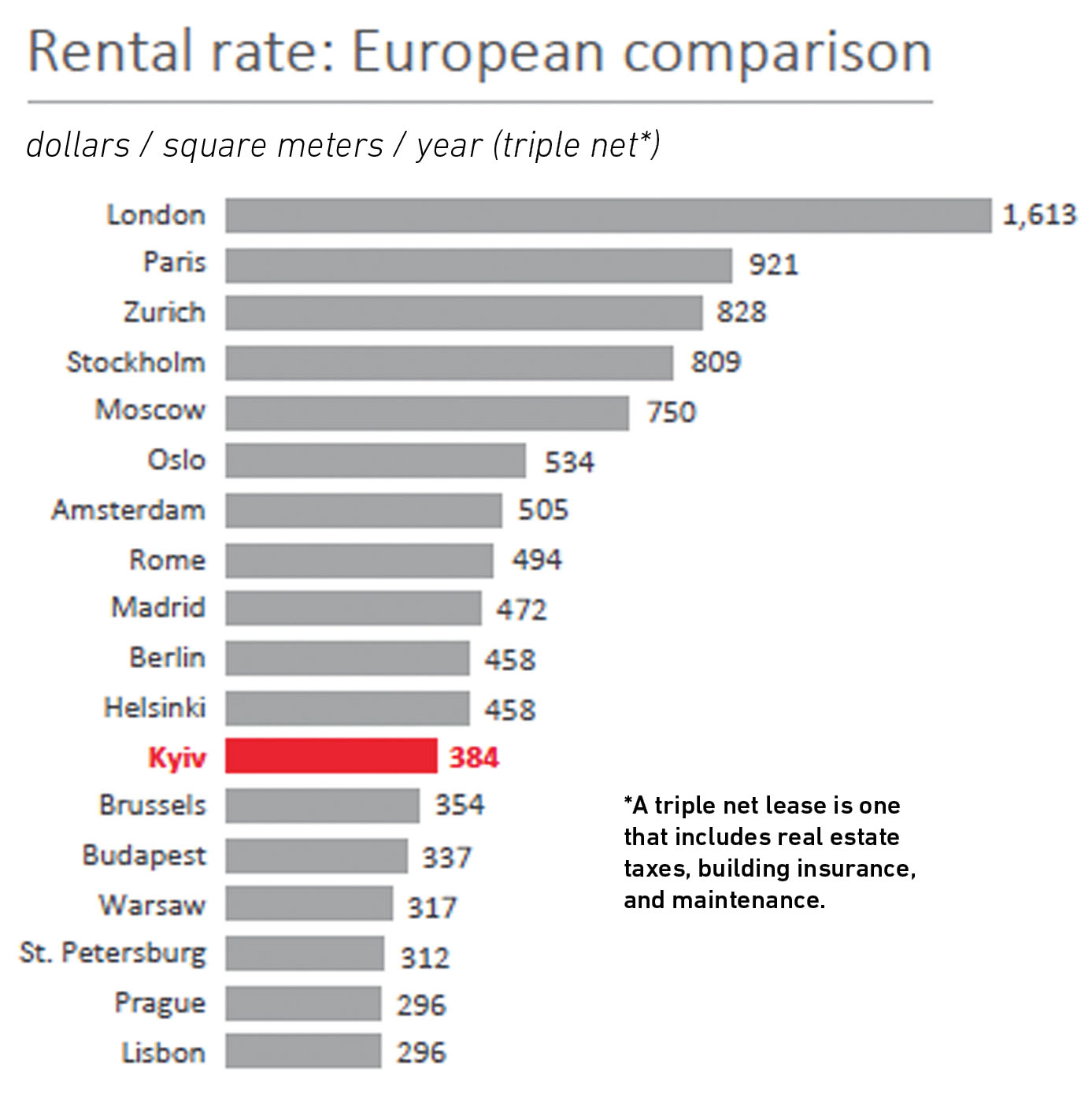

With a vacancy rate of 7.2 percent, Kyiv’s market is not as balanced as neighboring capitals, according to JLL. For example, Warsaw’s vacancy rate is 8.7 and Moscow’s is 9.6 percent. However, it is higher than in Budapest (7.3 percent) and Prague (5.1 percent).

According to JLL, Kyiv stood as one of the most expensive cities for prime rents in Eastern Europe with an average of $360 per square meters during the fourth quarter of 2018. Kyiv’s average prime rent has increased slightly for the first quarter of 2019, up to $384, whereas Russia’s capital remains stable.

In 2018, 35 percent of the space acquired was taken by the IT industry followed by the financial industry (23 percent). The wholesale-retail as well as manufacturing industries come in respectively third and fourth with 15 percent and 12 percent. In 2019 so far, only the IT industry has increased demand, reaching 55 percent of the overall acquired space.

Altogether, currently there are five major business centers scheduled for commissioning in 2019.

Retail real estate

Kyiv’s retail real estate is showing more positive signs compared to the office space. Some major retail companies have decided to come to Ukraine in 2018 such as H&M, Polo Ralph Lauren, Ted Baker, Karl Lagerfeld and Zara Home.

French sporting goods retailer Decathlon has just arrived in April and additional iconic brands are scheduled to enter the Ukrainian retail market by the end of 2019 or soon after such as: Swedish giant Ikea, Steve Madden, the Kooples and North Face.

All these new players have created more demand for retail space and considerably lowered the vacancy rate since the last quarter of 2016, going from 12.1 percent to 4.2 percent during the first quarter of 2019.

According to Igor Zabolotskyi, a retail expert at Colliers International, a low vacancy rate is the sign of an economy that is on the right path.

“In one or two years, lots of new projects are coming, which will greatly influence the market,” he added.

In terms of prime rents, Kyiv’s rate has grown 11 percent from $85 per square meter in the first quarter of 2018 to $95 during the first quarter of 2019.

Hotels

According to a Ukrainian Trade Guild report from 2016, the hotel occupancy rate fell from 53.2 percent in 2012 to 30.4 percent in 2014. The EuroMaidan Revolution had a major impact on the attractiveness of the city as the media showed Ukraine as an unsafe — and therefore unattractive — location.

Tatiana Veller, the head of JLL’s hotels and hospitality department, confirmed that Ukraine’s capital took a major hit in 2014, but added that Kyiv’s hotel occupancy rate rarely goes over 55 percent even during non-crisis periods.

But five years later, the rate now revolves around 50 percent for five-stars hotels and between 55–65 percent for four and three-stars hotels, according to Colliers International.

In terms of prices, the average rack rate (highest rate without discount per room) for three-star hotels was $54 in 2015 and stood at $61 toward the end of 2018. Four-star hotels went from $130 in 2015 down to $120 in 2016, and up to $143 at the end of 2018.

Veller highlighted the good job done so far by the city administration “to attract large scale international events that promote the city.”

Crowds walk on the new pedestrian bridge in Kyiv during the opening of the bridge on May 25, 2019. (Oleg Petrasiuk)

The UEFA Champions League Final hosted in Kyiv on May 26, 2018 is a prime example. According to official city estimates, 300,000 football fans visited the city and all hotels reached 100 percent occupancy.

“This is very good because it helps show the world community that the city is hospitable… and in general making the image of the city better,” she added.

Four hotels entered the market in 2018: Aloft, Ibis Kyiv Railway Station, the Favor Park Hotel and Bursa.

“A hotel is a long-term investment,” Teller said. “When we see that new projects are being unfrozen, completed and put into operation… it means that investors are confident enough in the future of the economy and the stability of the country… so they are ready to risk a 10-to‑15-year long investment.”

Warehouse market

According to a 2018 report by CBRE Ukraine, a commercial real estate and investment firm, the past year has shown improvements for the country’s warehouse market since 2014.

2018 was a good year due to the take-up volume increase of 31 percent up to 157,000 square meters in comparison to 2017. The market was mainly dominated by the wholesale and retail trade sector that took up 59 percent of the total share volume.

The vacancy has recovered since 2014, going from around 16 percent to 3.7 percent at the beginning of 2019. Prime rent today is at $5.1 per square meters, down from $6.3 in 2013.

But Sergiy Sergiyenko, managing partner at CBRE Ukraine, says there’s still plenty room for growth.

“The warehouse market looks healthier than it used to, but there is no financial market that can give some impetus to development,” he said.

According to him, the main issue is the absence of an effective lending market in Ukraine.

“You cannot take a loan for commercial real estate development… the cost of funds is so high and lending limits are so low that commercial real estate just doesn’t fit the bill… The only way (to develop commercial real estate today) is through the equity that has questionable origins,” he said.

“Nobody wants to commit to develop in this country; if internationals wish to come they just buy something already standing, otherwise development risks are way too high.”