It was a good harvest in Ukraine.

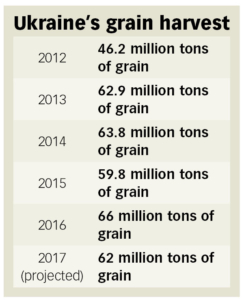

The Ministry of Agriculture expects 62 million tons of corn and wheat to be harvested by the end of the season. That would make this year’s harvest the second-best ever, after last year’s record, when the nation’s farmers gathered 66 million tons.

But it was, nonetheless, disappointing as grain harvests have been on a rising trend since 2013.

Bad weather

The government blames lower yields this year on bad weather.

Maksym Martynyuk, acting agriculture minister, said that the result is still good “thanks to the fact that the weather was not bad everywhere.” He said that the country’s central steppe had received less precipitation in winter than expected. Dragon Capital investment bank also noted low rainfall. It wrote in a recent research note that it expects a 15 percent decline in corn yields compared to last year because of a lack of precipitation in July-September.

“The latest 2017 harvest estimates are still above Ukraine’s average for the past five years of 60 million tons,” the bank wrote.

But Dmitry Churin, an analyst at Eavex Capital, argued that weather did not play as decisive a role as many argue. Instead, he said that years of record harvests had led to the soil being overfarmed.

“The land cannot deliver higher results every year,” Churin said. “After three years, it’s very hard to have the same harvest yield.”

Another factor is that many farmers were forced to add less fertilizer during planting season, in large part due to the shutdown of the Cherkasy Azot plant. The plant, which belongs to exiled billionaire oligarch Dmytro Firtash through his Ostchem plant, has faced difficulties over debt and access to natural gas. Firtash is fighting extradition to the U.S. from Austria on corruption charges that he denies.

“The agroproducers tried to reduce their fertilizer distribution into the land, and that could be one of the reasons,” Churin said.

There are no other big domestic fertilizer suppliers, forcing farmers to import more expensive fertilizers from abroad.

Fewer exports

Profits from this year’s harvest likely won’t be as towering as many in Kyiv would like. The drop in production is likely to lead to a lower volume of exports over the coming six months.

Dragon Capital wrote that it expected grain exports, from now until June, to drop by as much as 12 percent in comparison with last year, hitting around 40 million tons.

A little more than 20 million tons goes to domestic Ukrainian consumption.

Other areas could see an uptick. Poultry production is spurred by Myronivsky Hliboprodukt’s expansion of their Vinnytsya production plant. “But (MHP) will have cost pressures,” Churin said. “Feed cost will be higher for MHP because of the lower harvest.”

Martynyuk said that other areas of potential expansion and investment could help increase future harvests.

Foreign investors are interested in Ukrainian agriculture, but “generally those with whom I’ve talked on the official level in the last year are not European investors,” Martynyuk said.

He said that the Iranian government and Saudi Arabia had expressed interest in increasing their investment in Ukraine.

One potential agreement with Iran would see Tehran lease thousands of hectares of agricultural land in Ukraine. The food produced by these farms would go back to Iran as part of a joint venture with Ukrainian companies.

Martynyuk said the amount of grain produced in Ukraine could reach 100 million tons per year, requiring multimillion-dollar investments in more storage terminals and elevators.