Ukraine is looking into ways to address the high cost of its renewable energy tariff and some investors are concerned.

The past nine months saw record growth in Ukraine’s renewable sector, adding 2.5 megawatts of energy via investments of more than $2 billion. Developers are scrambling to get in on the last days of Ukraine’s sky-high feed-in tariff, which will be replaced by renewable auctions starting in 2020. Those who get the tariff can keep it until 2030, albeit at increasingly lower amounts.

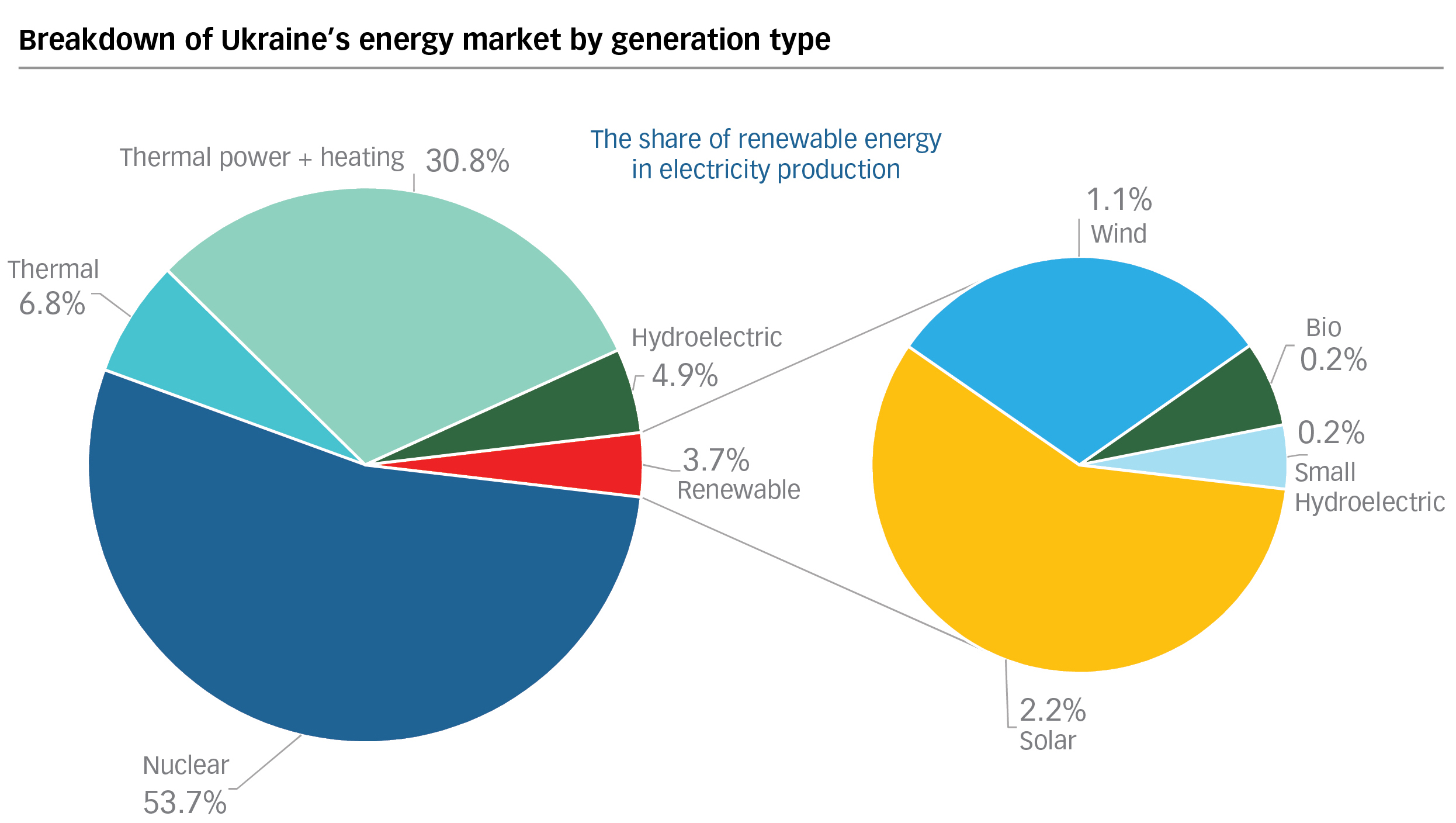

While renewables account for 3.7 percent of Ukraine’s energy mix, according to the Ukrainian energy regulator, they represent more than 8 percent of total energy costs in the country. Some lawmakers and industrial consumers argue that the economy can no longer shoulder this disproportionate burden.

The Parliamentary Committee on Energy, Housing and Utilities Services has been discussing a way to lighten the load. A working group to explore policy changes may be launched soon. A recent roundtable at the committee discussed possibilities from a reduction of the tariff to the introduction of new taxes, among other methods.

Consumers vs. investors

“Our green tariff is 2–3 times higher than in Europe, and green (power plants) are being built at a very rapid pace,” Servant of the People lawmaker Andriy Gerus, the committee head, told the Kyiv Post. “This is already tens of billions of hryvnias.” Multiple members of the energy market had come to him asking for help, he said.

On the other hand, multiple renewable energy investors told the Kyiv Post that they are worried about a possible retroactive tariff cut. While no decision has been taken, developers and investors said they don’t have a clear idea of what will happen.

“We already now see investors pulling out of the Ukrainian market, and we do not expect to see any significant investments in renewable energy in Ukraine unless there is certainty that the government is honoring its obligations under the existing law,” wrote Thorstein Jenssen, the senior vice president of the Norwegian wind company NBT AS. “Any changes to existing obligations will trigger an avalanche of legal cases.”

In the shadow of this debate, some commentators see warring oligarchs.

Since his return to Ukraine, billionaire Ihor Kolomoisky has been working to increase his control over the energy sector. His industrial concerns, especially his ferroalloy plants, have everything to gain from a reduction in mandatory renewable tariffs that are paid by energy transmission fees. Kolomoisky has publicly come out against feed-in tariffs in recent months.

Other ferroalloy plants and industrial energy consumers have also complained about high energy costs related to Ukraine’s new energy market that launched on July 1.

On the other side is Rinat Akhmetov, Ukraine’s wealthiest billionaire, who controls some of the largest renewable energy generation projects in the country through his company, DTEK, which is expected to have 1 gigawatt of renewable capacity in 2020. It is in Akhmetov’s interest to keep renewable tariffs high. Some critics say that he will take advantage of foreign investors to defend his revenue flows at the expense of energy consumers.

Read also: Zelensky addresses green tariff controversy

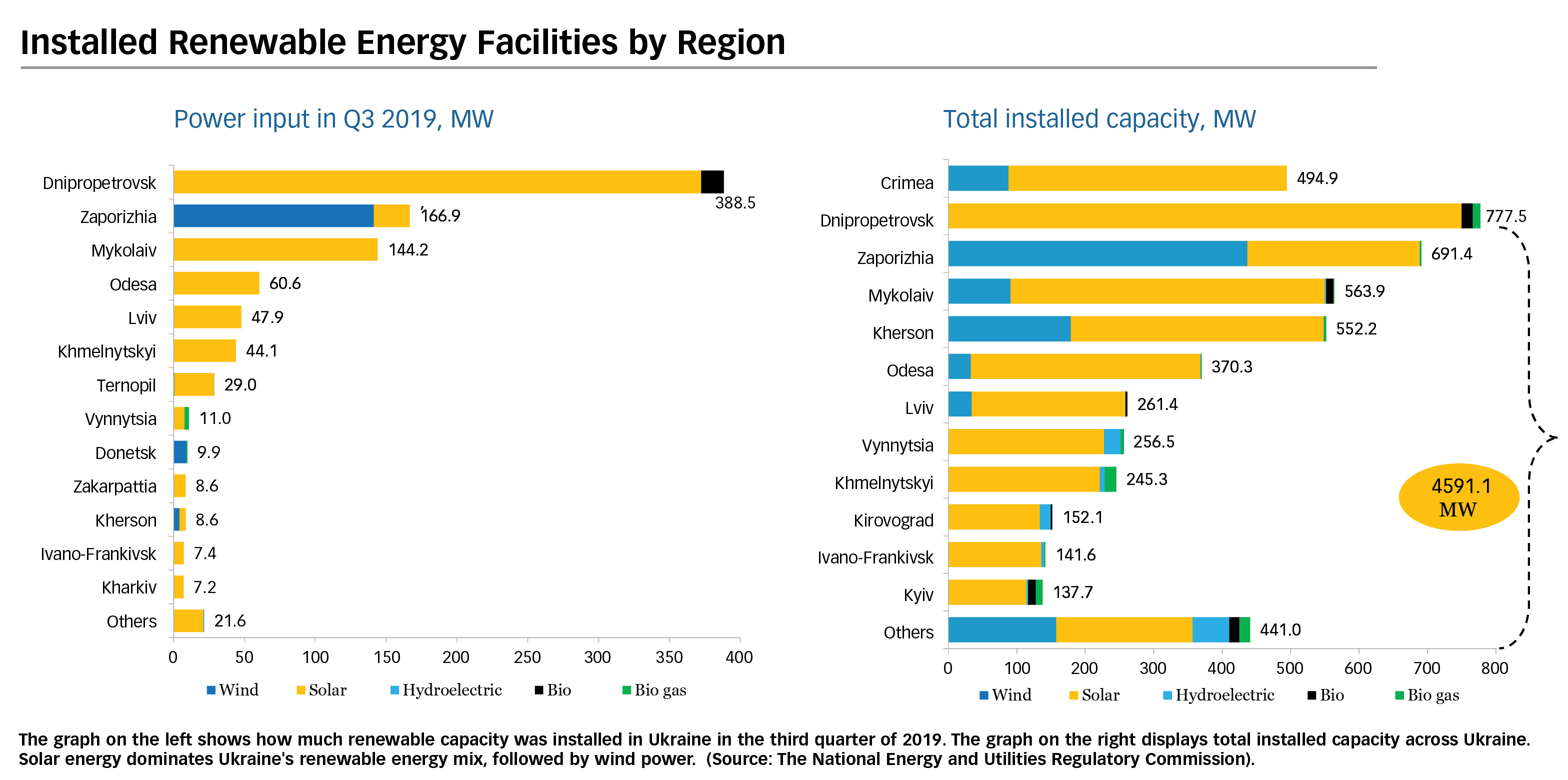

Pending plans (Source: The National Energy and Utilities Regulatory Commission)

The energy committee convened a roundtable on Sept. 27 to discuss “problems with financing ‘green’ energy generation” and the “need for legislative changes,” according to an Oct. 8 statement.

Participants at the round table discussed several possibilities, including a retroactive cut to the feed-in tariff that many, including Gerus, do not support. Other suggestions included new forms of taxes on income or existing power plants; changes in the limits on pre-Power Purchase Agreements; or changes in the feed-in tariffs to be received from 2020 onwards. The round table also considered a separate tax on carbon dioxide emissions as a way of financing renewable energy.

According to the announcement, these changes may affect wind and solar plants installed in 2017–2019. Plants that had been installed later, with cheaper capital expenditures, could see more tax increases.

“In Ukraine, there was already a default on ‘green’ energy payments in June-July this year,” the committee wrote. “According to experts, at the end of 2019, the Guaranteed Buyer’s net profit will not be enough to make all payments on ‘green’ generation. Thus the need for legislative changes in order to ensure long-term development of renewable energy.”

Oleksiy Feliv, a partner at the law firm Integrites, who consulted on the renewable auction law passed earlier this year, doubts that the feed-in tariff will be lowered retroactively, which would go against the government’s guarantees enshrined in the law.

Instead, he expects an alternative, lower tariff that might extend beyond 2030. He also expects that companies will be able to voluntarily stay on the old feed-in tariff or switch to a new one.

Rising concerns

Developers and investors are unhappy. Some told the Kyiv Post that major deals are being halted, especially in consortium projects. Even if retroactive changes do not pan out, they said that partners on some projects have already started pulling out, which might lead to financing being unrealized.

Rumors were swirling even before business representatives went into the Sept. 27 meetings. Yuri Kubrushko, managing partner at energy advisory firm IMEPOWER said that the meeting did little to dispel concerns. “Instead, it poured more fuel onto the fire because everyone left the room with a different understanding” of what will or will not happen.

He added that the scant information available thus far has not made clear which stakeholders back which solution. Investors dislike unpredictability — he said businesses want to hear “honest communication” about the current status of the problem.

“Retroactive measures should not be on the table because they will only result in arbitration cases the damage of which to the government will be worse than any payments under the green tariff,” wrote Magnus Johansen, a development manager with the Norwegian company Scatec Solar.

Metalworkers protest in front of Ukrenergo, the state operator of Ukraine’s backbone electrical grid on August 16, 2019. In July, Ukraine implemented changes to its wholesale energy market, which caused industrial consumers to have to pay higher prices for electricity. The loudest criticism came from several metallurgy factories tied to oligarch Ihor Kolomoisky — they initiated multiple protests and lawsuits against Ukrenergo and energy authorities. (Volodymyr Petrov)

Problems

But experts and lawmakers told the Kyiv Post that the move to reduce the astronomical green feed-in tariff is nothing new and has been under constant discussion in parliament for two years already. The recent discussion is no surprise, they say.

Victoria Voytsitska, a former lawmaker who did a great deal of work on energy policy, said that the renewable auction law in its current form was the result of a compromise that pushed back the auctions’ start date and delayed the reduction of green tariffs, while giving companies enough time for a green “gold rush” through the end of 2019.

Kubrushko said that the time to reduce Ukraine’s high green tariffs was a year ago. In 2018, the capital expenditures on renewable projects fell drastically, making them increasingly profitable. Parliament failed to react and lower the green tariff, allowing for the possibility of a huge surge of renewable capacity.

“Ideally, last year, in the spring, the auction law should have been adopted,” he said. “If the green tariffs were reduced throughout 2019 and if auctions were introduced in 2019, we would have smoothed out this wave of construction… There would be fewer investors, but they would still be there.”

Gerus said that renewable energy tariffs are one of the factors in high energy costs for industrial consumers, which is a problem that needs to be resolved. Otherwise, tens of thousands of jobs are at stake.

Other experts told the Kyiv Post that the rapid growth of renewables brings instability, which requires balancing. Solar power surges during the day and ebbs away at night. Wind power is also inconsistent. Conventional energy sources are required to balance them out and deliver consistent power. While Ukraine’s hydropower can take some of the edge off, much of the balancing would be handled by thermal energy from coal.

Oleksiy Ryabchyn, a former lawmaker and the former head of the parliamentary committee on fuel and energy complex, said that to deal with these problems, it will be important to support energy decentralization and smaller-scale renewable projects. “So we should have more energy cooperatives for people or distributed generation in cities,” he said. Voytsitska agreed, saying that supporting “prosumers” will be critical.

Sector monopolization

Since the feed-in tariff was introduced in 2009, renewable projects and subsidy streams became concentrated in the hands of a select group of politicians and business elites.

When Viktor Yanukovych was still president, 85 percent of the country’s solar power production was owned by his close ally, Serhiy Kluyev, who fled the country after Yanukovych was ousted in 2014 by the EuroMaidan Revolution.

The China National Building Material company, a state-owned enterprise in Beijing, acquired Kluyev’s six solar plants in 2016.

Over time, DTEK became a major player in the market. According to a statement from the company, it is now on its way to having 1 gigawatt of renewable energy in 2020.

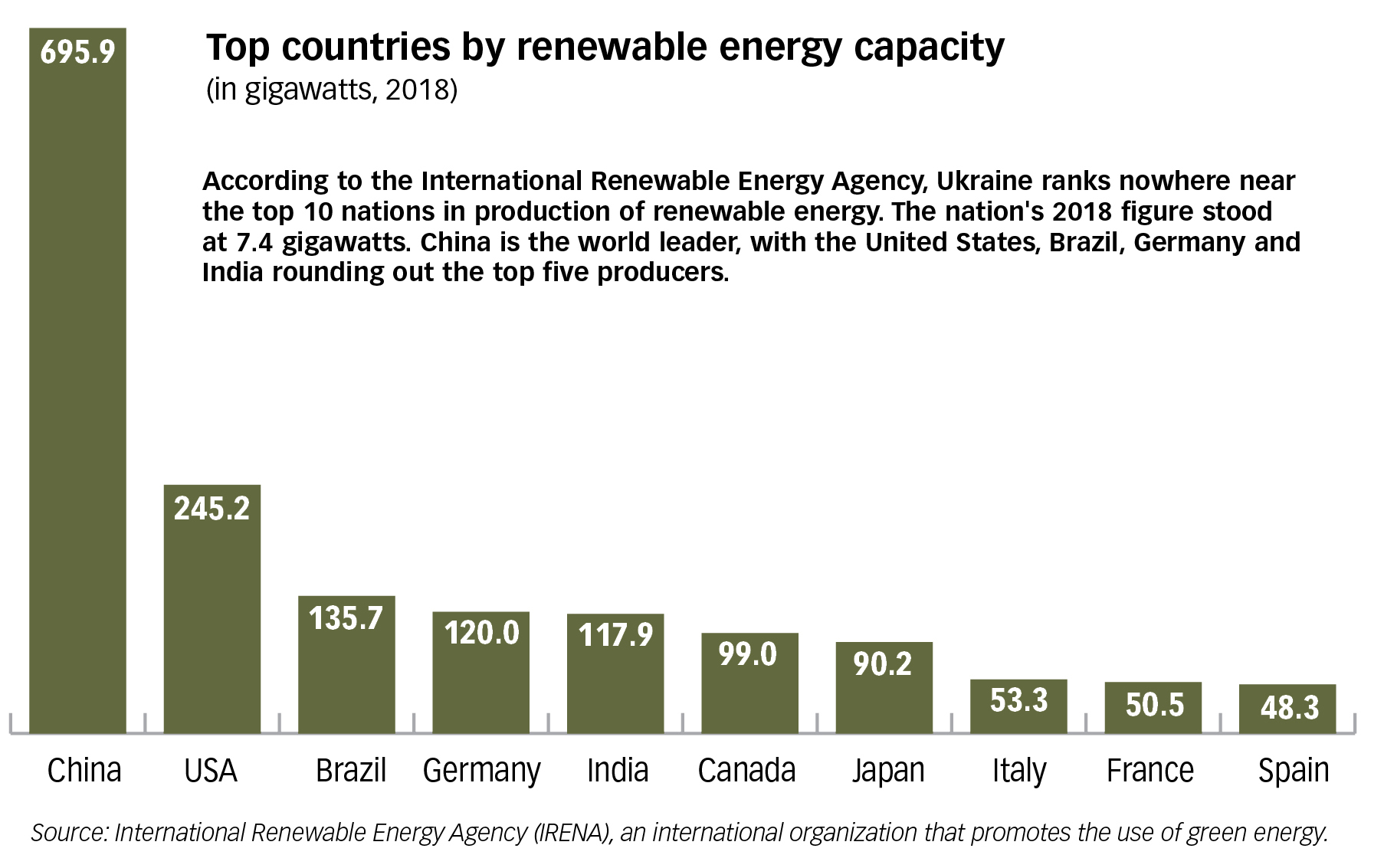

Renewable energy now accounts for 3.7 percent of total energy produced in Ukraine. More than half of all installed renewable capacity is solar, with over one quarter being wind. Biomass and small hydroelectric power plants have considerably lower profile. Following this year’s rapid growth in renewable capacity, experts expect next year’s market to slow down, following the introduction of the renewable auction law.

The past few years have seen a surge of investment interest from companies outside Ukraine. Feliv had told the Kyiv Post that renewable energy is one of the top sources of large-scale foreign investment into Ukraine. Still, an investigation by Bihus found that 65 percent of renewable funds paid out by the state in 2018 went to the top 10 business groups.

Ilya Ponomarev, a former Russian politician and energy executive, now a Ukrainian businessman in Kyiv, said that he sees an ongoing battle between energy producers and consumers in Ukraine in light of artificially inflated energy prices. In general, he said, lower energy prices would be good for the economy.

Johansen said that the tariff is high in part due to the conditions in Ukraine — the country is high risk, with low solar irradiation, a relatively low, 10-year power purchase agreement and with relatively poor energy infrastructure.

Kolomoisky

Renewable energy is currently under increasing pressure from a different direction.

In September, Ukrenergo stated that multiple energy consumers are continuing to withhold payments for energy transfer and dispatcherization since the launch of the new energy market as a result of court cases filed by ferroalloy plants, including Kolomoisky’s. The total gap may reach Hr 2 billion by the end of the year.

The state enterprise wrote that it will be critical to receive these payments and that continued failure to pay threatens Ukrenergo with bankruptcy. This might become a problem for the entire energy market, according to a statement by Ukrenergo head Vsevolod Kovalchuk.

Kolomoisky’s enterprises are not just fighting high renewable energy tariffs but higher transmission costs in general, with some of his supporters arguing that Kolomoisky’s efforts could also be beneficial to consumers. These increases kicked in around the launch of Ukraine’s new energy market in July.

According to Kolomoisky’s ferroalloy plants, energy costs are a huge percentage of their expenses and that increase in power costs meant millions in losses per month, resulting in possible closures.

Read also: Despite investment spurt, only 3.7% of energy from renewables