Construction of new apartments in Kyiv is booming — with 20,700 built in the first six months alone this year, equal to the entire total for 2016, acccording to City Development Solutions, a real estate consulting agency.

But the new supply is outstripping demand, with many units going unsold as residents still lack purchasing power or credit. City utilities, moreover, aren’t keeping pace with the new construction as well.

At the moment, Kyiv has 56,100 unsold flats in 252 new residential complexes. If development continues at the current pace, that number will grow to 70,000.

What developers build

Most of the new flats, or 84 percent built, are classified as “lower budget segment.” The rest is divided between business class, 14 percent, and premium class, 2 percent.

One-room flats lead in the economy segment.

Although the majority of new residential complexes are built on the right bank of the Dnipro River, developers are building out the left bank too — especially in Darnitsky and Dniprovsky districts. Holosiivsky district on the right bank is also among the most popular.

Roman Gerasimchuk, a consultant at City Development Solutions, said Kyiv developers are having such a hard time finding available land plots that they are building on former industrial zones. Comfort Town residential complex, advertised as “Little Europe in Kyiv,” is on the site of Vulcan, a former rubber products plant.

But the main limitation is infrastructure. Many new apartment buildings stand without proper utilities.

“To some extent problems with electricity, gas, hot water, or heating exist in all new build houses. The city’s pipe networks can’t handle the load,” Gerasimchuk explained.

He said Kyiv needs to upgrade its utility networks and pipelines, build new metro lines and public amenities to keep up.

The private sector is filling in the gaps.

A cluster of a dozen new apartment buildings is considered to be a housing estate, with developers offering supermarkets, health clinics and on-site kindergartens.

Is it worth investing?

Kyivans and even foreigners still view property as an investment for resale or lease. Besides low prices compared to many European capitals, Ukraine has no or very low property taxes. While the situation deprives local governments of much-needed revenue, it’s a boon to owners of residential real estate.

The buyer’s market has spurred discounts, leading to increased demand for small, inexpensive accommodation.

But since April it’s been harder to find such deals, which have fallen by 60-70 percent.

Yaroslava Chapko, director of City Development Solutions, says that 92 percent of online searches are for flats costing $30,000 or less.

Demand is heavy for two-room apartments up to 50 square meters – considered to be the most liquid.

In some sectors, it’s a seller’s market.

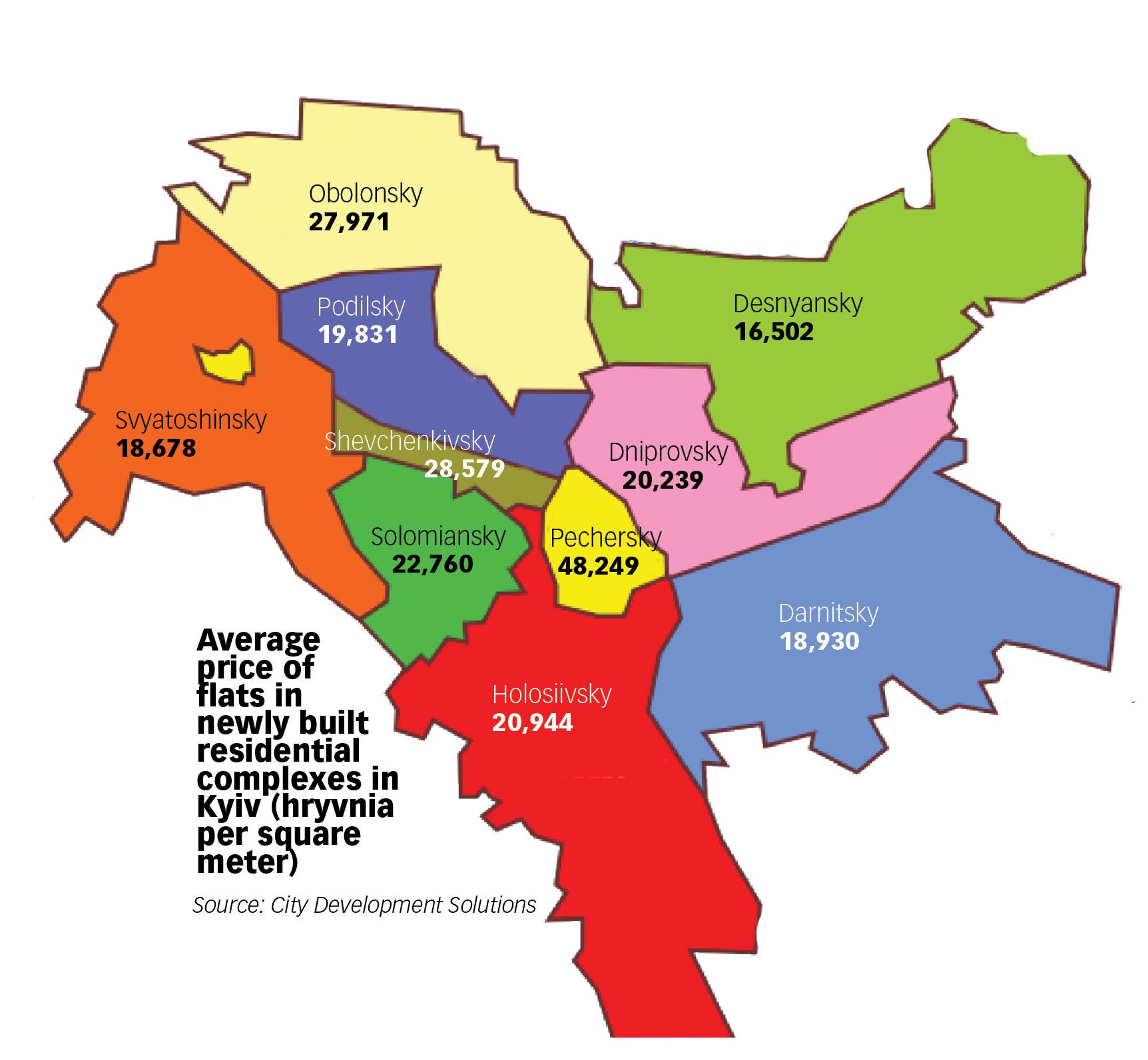

The lack of new premium class residential property has driven up prices as high as 17 percent in the last year in Pechersk district.

The price per square meter in the economy class is Hr 14,000–24,000 compared to Hr 62,000 per square meter in the premium segment.

“This discrepancy in the volume of supply of new build apartments of economy and premium segments will continue growing,” Gerasimchuk said.

The strong demand for cheap property often leads to situations where the customers must invest in interior renovations themselves.

Analysts calculate that it would take 13.7 years to return the investment from renting an economy class flat bought for $20,000 and 16 years from renting a business class flat. The average annual return on investment from property resale is estimated 9.4 percent.