When a Ukrainian car distributor or a gas station chain needs advanced tech services, they call CoreTeka.

This Kyiv-based startup has a very profitable focus: It caters to drivers, car producers and distributors, and satellite industries, like gasoline sellers.

Founded in 2016, CoreTeka already boasts a portfolio of apps, websites and internal software solutions for Ukrainian and foreign companies.

The firm started with an app called DriverNotes that allowed drivers to monitor their gas spending and make notes on car maintenance. Today, it produces internal software for major car brands like Toyota and Chevrolet that, apart from other things, helps organize the logistics of car production.

The firm’s automotive focus isn’t an accidental choice: the firm’s co-founder Alex Isachenko used to be the digital director of WOG, one of Ukraine’s biggest gas station chains.

“People come to us as they come to a doctor. They have a pain and want us to do something about it,” Isachenko told the Kyiv Post.

Isachenko is convinced automotive industry players should embrace innovation — be it a new mobile app or a complex algorithm for its logistics — as the only way to keep up with competitors.

At the same time, Isachenko says that CoreTeka doesn’t try to convince their clients that all of their technology is necessary. Instead, they look into how a particular technological improvement might upgrade operations and stimulate profit for automotive companies.

The company has two offices in Ukraine — one in Kyiv and another in Mykolaiv. It operates with 35 staff members and has a pool of contractors. It also runs a legal entity in the U.S.

Apart from Ukraine, most of their clients are large internationals based in the Netherlands, Germany, United States, Israel and Kazakhstan. However, CoreTeka can’t reveal much about their international work for big car brands due to NDA agreements.

Compared to Ukrainian clients, Isachenko says foreigners tend to be more business-educated and are “more likely to know what they want and why they hire us.”

In order to support the Ukrainian IT-automotive community, CoreTeka co-organized the Automotive Zone at the iForum 2017, one of the biggest tech conferences annually held in Kyiv. One of the startups presented there was EV HUB that has developed chargers for electric cars. (Maksym Losyev) (Maskitol)

Startup within startup

Before CoreTeka, there was DriverNotes. This app, produced by Isachenko, collects data about the car’s condition and notifies the owner if any its parts are about to need replacement.

It also keeps records of the car’s fuel consumption and calculates its gas and maintenance budget.

The app is free, but the firm charges car parts suppliers a commission for connecting them to app users in search of new parts.

So far the app has been a relative success. It works with iOS- and Android-based devices and has had about 100,000 downloads.

As DriverNotes’ relationship with its customers developed, clients started asking if Isachenko’s team could develop other tech solutions for them. Soon after, CoreTeka was founded.

“We just reacted to the market’s demand,” said Isachenko.

He still spends about 20 percent of his time with DriverNotes, giving the rest to CoreTeka’s other activities.

Automotive hackathons

To advertise its name, learn more about the industry in which it operates, and also to find talented programmers, CoreTeka started to organize automotive-themed meetings and hackathons, gatherings which bring together computer programmers and others to brainstorm on tech ideas and try to make them work.

In 2017, the company organized 10 events in Ukraine.

“If we position ourselves as experts, we ought to understand, what’s going on around (in the market),” Isachenko said, adding that these events are helpful, and also foster the development of Ukrainian industries such as the automotive space.

Ukraine’s industry

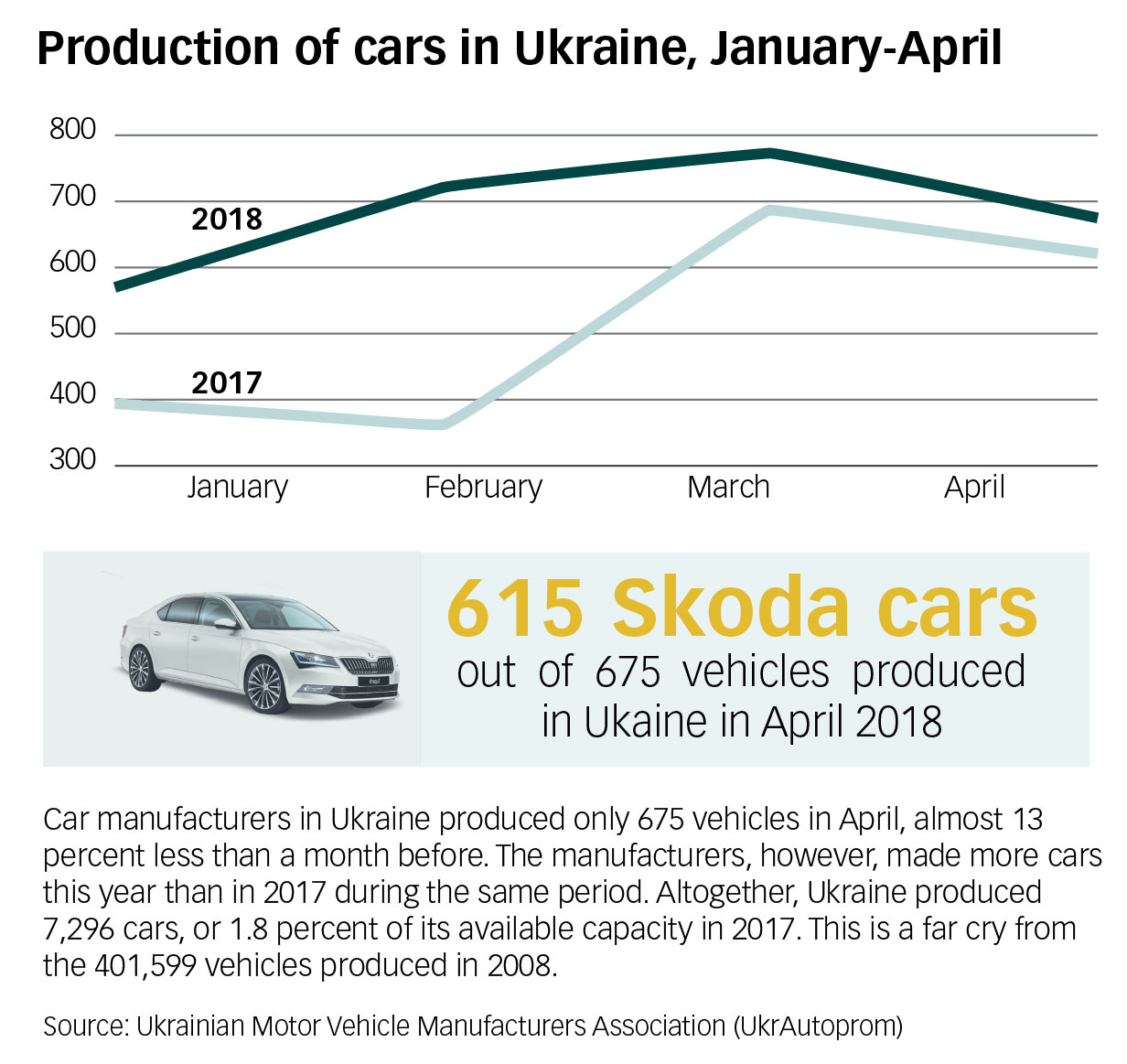

Ukraine’s car market has never fully recovered after the 2008 economic crisis.

Before the crisis, Ukrainian car manufacturers like UkrAvto (ZAZ), Bogdan, and Electron produced up to 200,000 vehicles per year. But this April, the Ukrainian carmakers association UkrAvtoProm reported that automotive plants in Ukraine work at only 2 percent of their capacity compared to 2008.

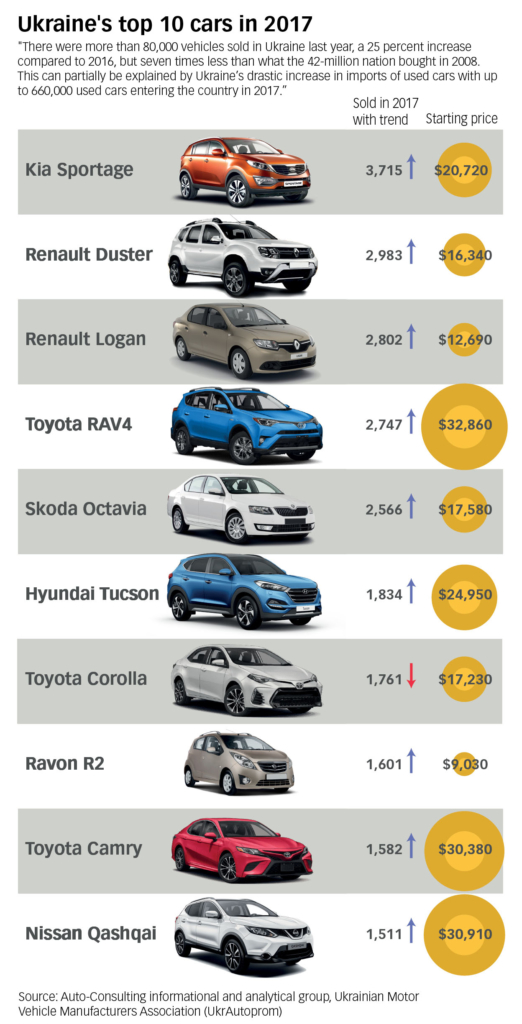

The new car sales plunged as well. In 2008, right before the crisis, Ukrainians bought more than 600,000 new cars. The sales never returned to that level, due to both falling purchase power and the rollback of bank loan programs. Ten years after the crisis, the market players expect to sell just 100,000 new cars in 2018.

But even with a small market, CoreTeka finds ways to succeed. In 2016, it produced a standalone web page for one of the major car sellers, AutoCentre, to advertise and sell a single car — a Kia Sportage. In 2016–2017, this SUV was among the top three most-sold new cars in Ukraine.

“We are just a small gear in the whole process (of creating a good product),” said Isachenko. “But speaking of sales pipeline, we created an interface to apply for a test-drive, and about 30 percent of car sales succeed if there’s a test-drive.”

The Kyiv Post’s technology coverage is sponsored by Ciklum and NIX Solutions. The content is independent of the donors.