As consumers around the world try to save money and reduce emissions, the electric car market is booming. But it’s not only picking up momentum in developed countries like Sweden and Germany. Electric vehicles are also gaining popularity in Ukraine.

Since 2015, sales of new electric vehicles have increased almost 13-fold, reaching 4,214 cars in November, according to UkrAutoProm, the Ukrainian Motor Vehicle Manufacturers Association. Altogether, there are 8,491 electric vehicles registered in Ukraine as of November. It’s a rising but still a limited share of the estimated 100,000 new cards expected to be sold in Ukraine in 2018.

Moreover, the growth is not powered by any government incentives. Instead, more Ukrainians are simply opting for the benefits of using an electric vehicle themselves.

“The creation of the electric vehicle market in Ukraine happened by itself, without the support of the government or the involvement of key manufacturers,” Pierre-Vladimir Joliot, the general manager at consulting company ALD Automotive, told the Kyiv Post. “It was created by the people themselves for several reasons — the (2014–2015) economic crisis, and the significant increase in (global) oil prices.”

Even though electric vehicles are more expensive to buy than regular cars, they tend to pay off in the long run, as it is almost 10 times cheaper to operate an electric vehicle compared to a traditional petroleum-fueled car.

“Driving 200 kilometers in a Hyundai IONIQ will cost around Hr 70, or $2.50, while for a gasoline car it will cost Hr 600, or $21.50,” said Igor Kovalev, head of STRUM, an initiative launched by Ukraine’s DTEK energy company that aims to upgrade electric vehicle infrastructure.

Last month alone, an additional 643 electric cars were sold in Ukraine, which is two-and-a-half times more compared to the same period in 2017, according to HEvCars, a Ukrainian internet platform that analyzes the electric and hybrid car market.

And for the past two years Ukraine has been ranked among the top 10 countries with the highest rate of electric vehicle sales, according to InsideEVs, the largest global platform that analyzes electric vehicle markets.

The report specifies that the majority of Ukraine’s electric cars are bought used, as they are typically half the price of a new vehicle.

“Ukraine is pretty much the only country officially considered poorer-than-average that has any serious electric vehicle game going,” the report stated. Ukraine was ranked 9th, ahead of France, and after Germany, in 2017.

Within the last 10 months, more than 4,200 electric cars were registered in Ukraine – almost twice as many compared to the same period in 2017 and 13 times more than in 2015. Experts list several reasons why: increased oil and gas prices, the temporary abolishment of excise and value-added taxes on imported electric vehicles, as well as the public’s desire to become more environmentally friendly.

Market leaders

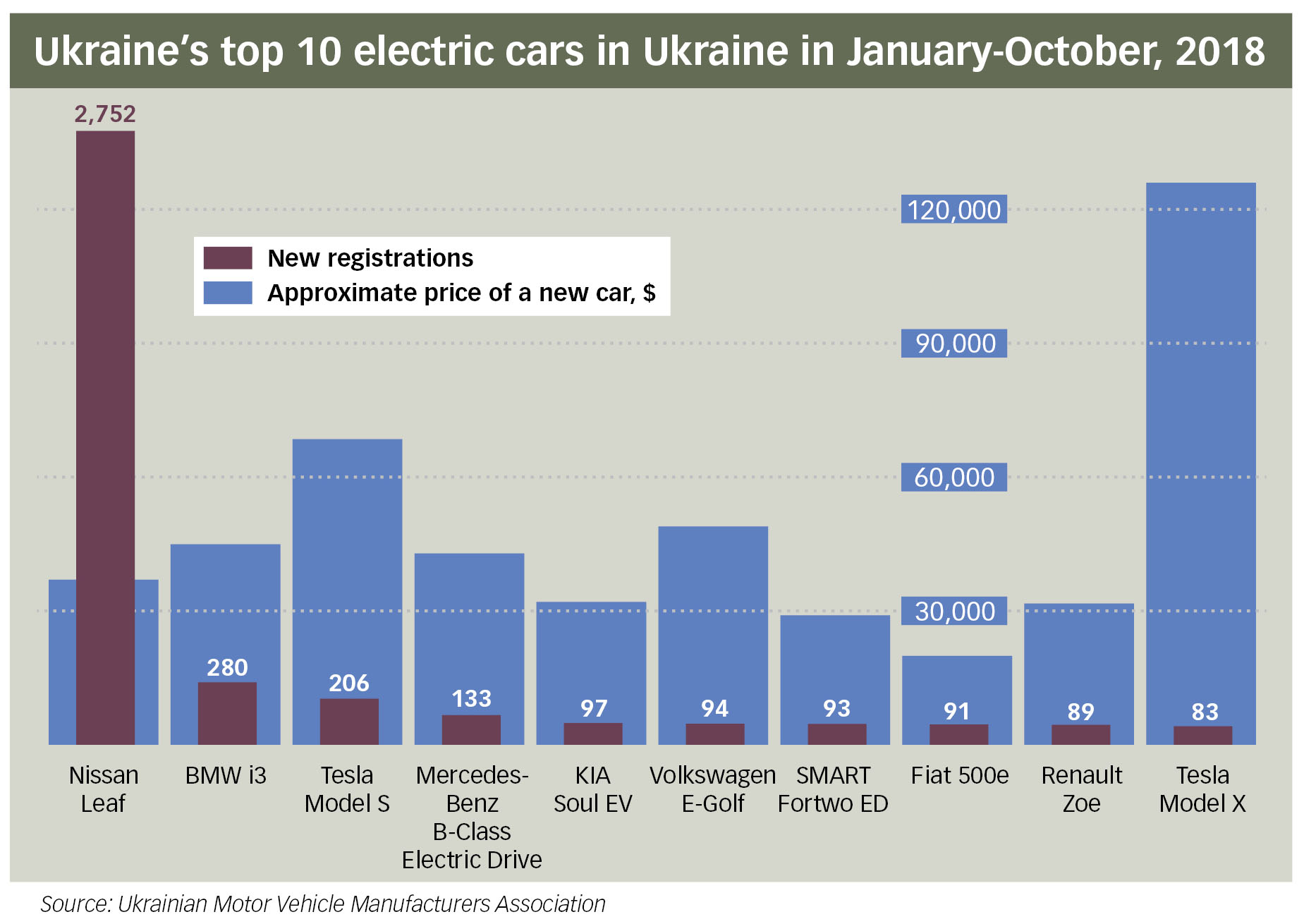

Two thirds — or 2,752 — of all of the electric cars newly registered in Ukraine over the past 10 months are of one particular model: the Nissan Leaf.

Nissan started to sell the Leaf back in 2011, and it has become a worldwide sales leader, with 300,000 cars sold as of today, according to the company’s official website.

However, despite the popularity of the Leaf in Ukraine, the company is not in a rush to target the market in Ukraine.

“We can’t just take a European car and start selling it in Ukraine, because the car has to be adjusted to the quality of roads,” said Andriy Nesterenko, Nissan’s country director. “And in Ukraine the roads are bad.”

“This costs money, which has to be paid off from sales, but so far officially in Ukraine only 50 new electric vehicles have been sold since the beginning of the year,” he added.

Besides the Nissan Leaf, other electric vehicles popular in Ukraine include the BMW i3, the TESLA Model S, and the Mercedes-Benz B Electric Drive.

Altogether, 619 cars have been sold over the past 10 months, according to UkrAutoProm.

These sales are still too low for a country with a 42 million population. In Norway, a country with the highest market share (40 percent) of electric vehicles, sold 62,000 vehicles in 2017. Norway’s population is only 5.2 million.

With such low sales volumes in Ukraine, the overall trends in the electric vehicle market are quite volatile.

For example, the Nissan Leaf’s share has slowly dropped from 80 percent to as low as 60 percent, while the demand for BMW i3 and Tesla models has increased, according to Oleksandr Kravtsov, the founder of ElectroCars, a company that imports used electric cars from the United States.

His company has already sold about 400 cars since 2015, the year when the company was founded.

“We buy cars mainly at auctions in the United States, where the average car costs $10,000, and then we resell it for $15,000 in Ukraine,” said Kravtsov.

Kravtsov says that electric vehicles are a specific niche in the car industry, and the average Ukrainian still prefers a petrol-engine car. Electric vehicles are typically bought either by businesspeople who want to stand out from the crowd or IT professionals who are trying to set a trend.

Three key barriers

One of the potential electric car buyer’s main concerns is finding a place to charge the vehicle.

Currently, Ukraine has very few powerful charging stations — ones that can quickly charge a car in 30 minutes to at least 80 percent of its battery capacity. Such a charge will typically last for 130–150 kilometers.

Market players say that the electrical cars market will shift to mass production once the point of disruption is 320 kilometers of range (without recharging) and under $30,000 per vehicle in price.

Regular charging stations take approximately four hours to charge a vehicle, which is inconvenient during longer road trips.

“There are no fast-charging stations between cities in Ukraine, so it is very difficult to use electric vehicles at the national scale,” said Joliot.

In addition, most of the regular charging stations in Ukraine use old charging methods, which are not well suited to the most modern electric vehicles, according to Joliot.

And in contrast to most Western countries, Ukraine doesn’t even have a single Tesla supercharger station.

Igor Kovalev, head of DTEK’s project STRUM, demonstrates on Aug. 30 how to use the company’s car charging mobile application, which helps drivers find electric vehicle charging stations in Kyiv. (Oleg Petrasiuk)

Slight improvements

However, electric vehicle charging infrastructure is slowly starting to improve.

For example, this year DTEK installed 10 50-kilowatt charging stations in Kyiv under the STRUM project, mostly in business centers and shopping malls.

DTEK invested $550,000 into purchased charging stations made by Swiss-Swedish company ABB, as they have higher quality software than the Ukrainian alternatives.

A single ABB station costs around $25,000, and has a payback period of at least 10 years.

“This is expensive” and slows the process of upgrading the infrastructure, said Kovalev.

New electric cars, which typically cost around 30,000 euros ($34,250), are still too expensive for most Ukrainians, given the official average wage in Ukraine is only $323 per month.

In addition, unlike in other European countries, Ukraine’s government doesn’t provide any subsidies to stimulate electric vehicle sales.

“Subsidies from the state can be up to 5,000 euros when purchasing an electric car in the Netherlands or Norway,” Nesterenko said. “In Ukraine, there’s no such thing.”