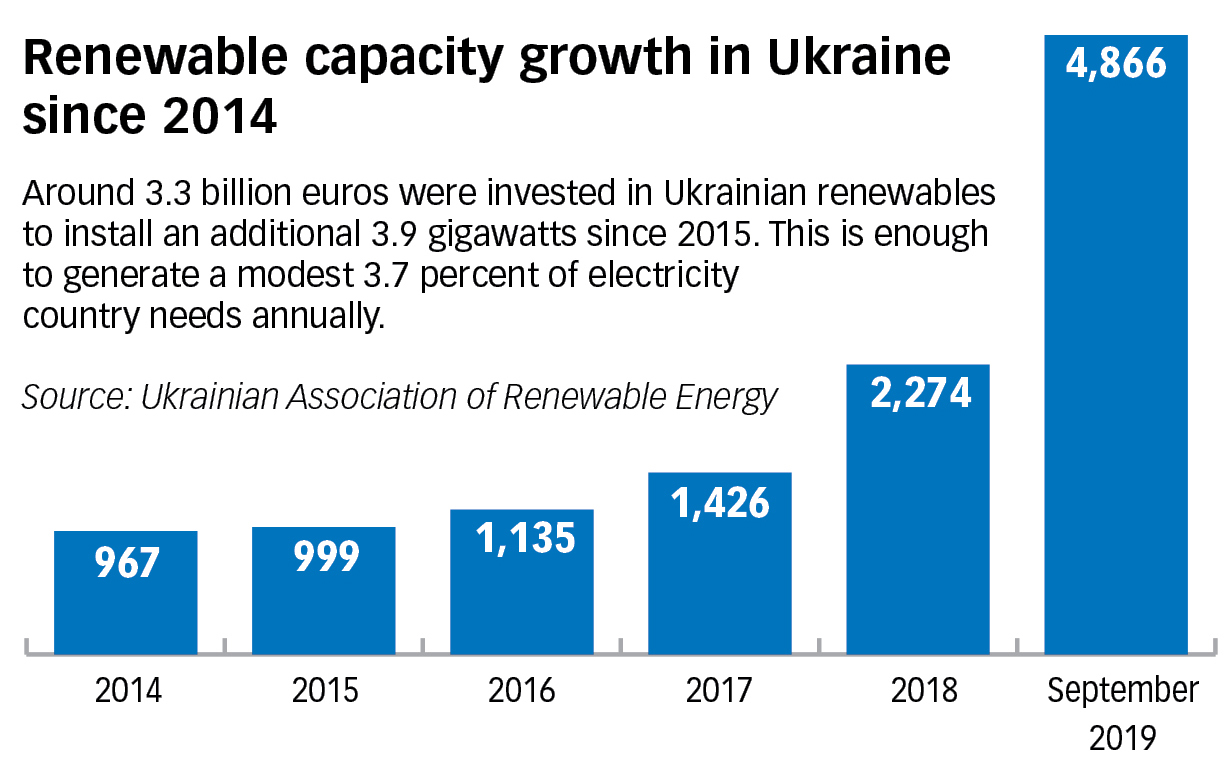

In the last year before Ukraine moves from a generous and unaffordable green tariff regime to an auction-based system, the renewable sector has shown dramatic growth — although renewables still account for only about 3.7 percent of the nation’s energy needs.

For the first nine months of the year, more than $2 billion were invested in the Ukrainian renewable energy, adding another 2.5 gigawatts to the market, according to Sergiy Savchuk, chairman of the State Agency for Energy Efficiency and Energy Saving.

Some 80 percent went to solar, 15 percent to wind, with biogas and small hydroelectric power stations also represented. In total, the renewable sector now generates 4.86 gigawatts of clean energy, five times more than in 2014.

“2019 is the year of a ‘green fever.’ Even starting the construction this year, everybody wants to finish it by the end of the year,” said Maksym Sysoiev, counsel at Kyiv office of Dentons law firm.

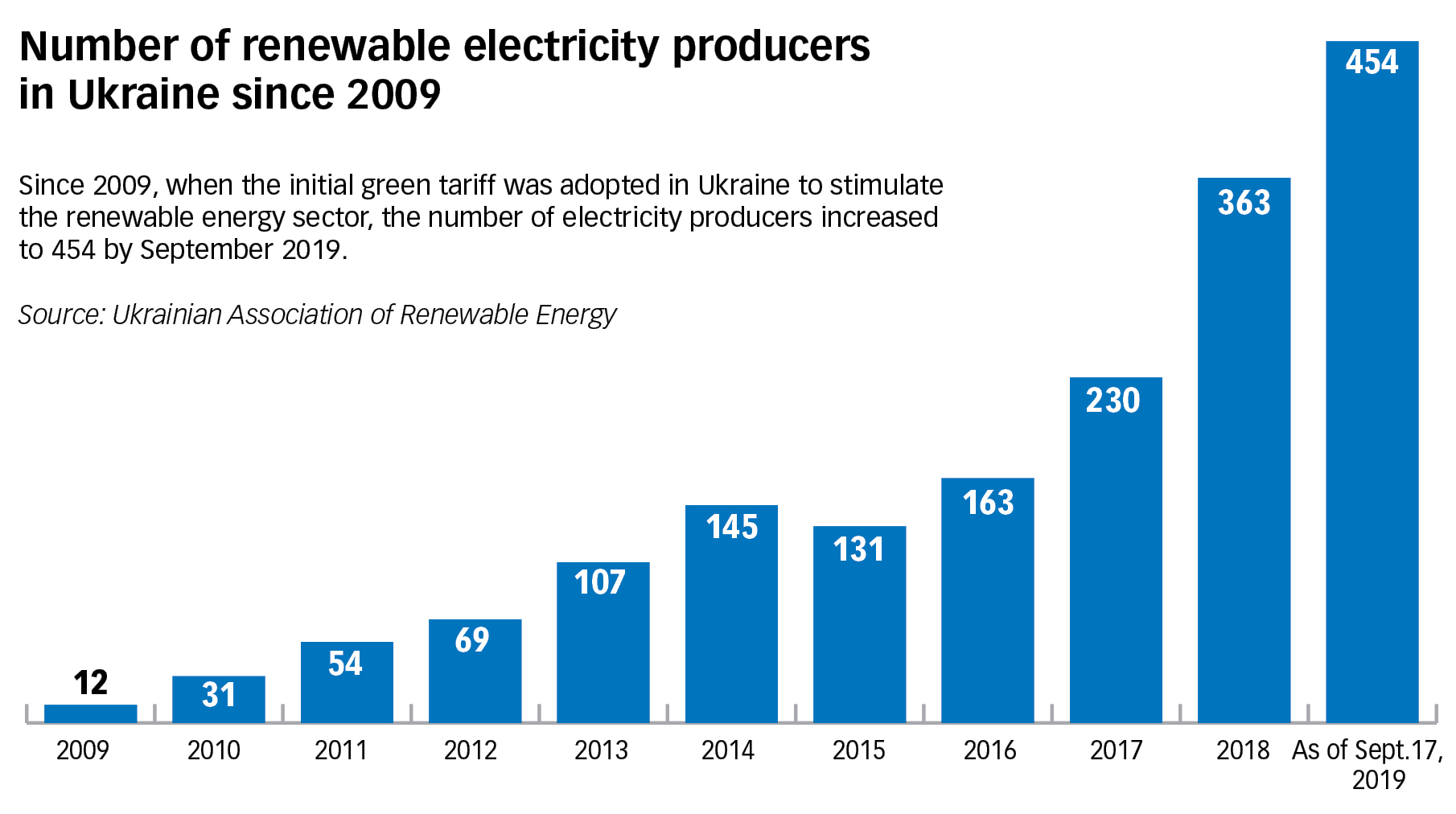

Currently, Ukraine has 454 registered companies producing electricity from renewables, something impossible to imagine 10 years ago, when only 12 producers, according to the Ukrainian Association of Renewable Energy.

“Ukraine demonstrates remarkable growth. This is something that encourages, and indicates that the sector still stays attractive,” said Andriy Olenyuk, partner at Everlegal law firm.

However, the sector needs ten-fold growth to reach the national strategy goal of 30 percent of electricity generated from renewables in country’s energy structure by 2030, replacing traditional energy sources such as coal, gas, oil or nuclear power.

And, with the pace likely the slow in coming years, moving up from the 3.7 percent in renewables will be challenging indeed.

“We will keep financing renewable projects in the future, but starting next year we will do it more carefully, taking into account today’s trends,” said Rodion Morozov, director of the environmental department at Ukrgasbank, a state-owned bank which has financed projects with total capacities of more than one gigawatt across Ukraine worth around 600 million euros.

Trends and threats

The auction law, adopted by the Ukrainian parliament on April 26, eliminates the generous state-guaranteed tariffs in favor of a more market-based approach.

Projects which already operate under the green tariff, currently three times higher than traditional energy, will continue to benefit from it until 2030.

But, after 2020, wind power plants with capacities of more than five megawatts or solar power plants with capacities of more than one megawatt, will have to bid in auctions for the state tariff. The lower the tariff, the longer it will take the investor to recoup the investment.

Moreover, the guaranteed purchaser, a government enterprise, must also approve the qualifications of a bidder. “You can win the auction, but for some reasons if submitted documents will not comply with the requirements of the guaranteed buyer, you can get a refusal as a winner of the auction,” Sysoiev said.

Ukraine’s renewable sector has less corruption than other sectors and pays producers for electricity in a timely manner, according to Olenyuk. “We hope very much that this trend will persist in the future as it’s one of the key indicators of healthy market situation,” he said.

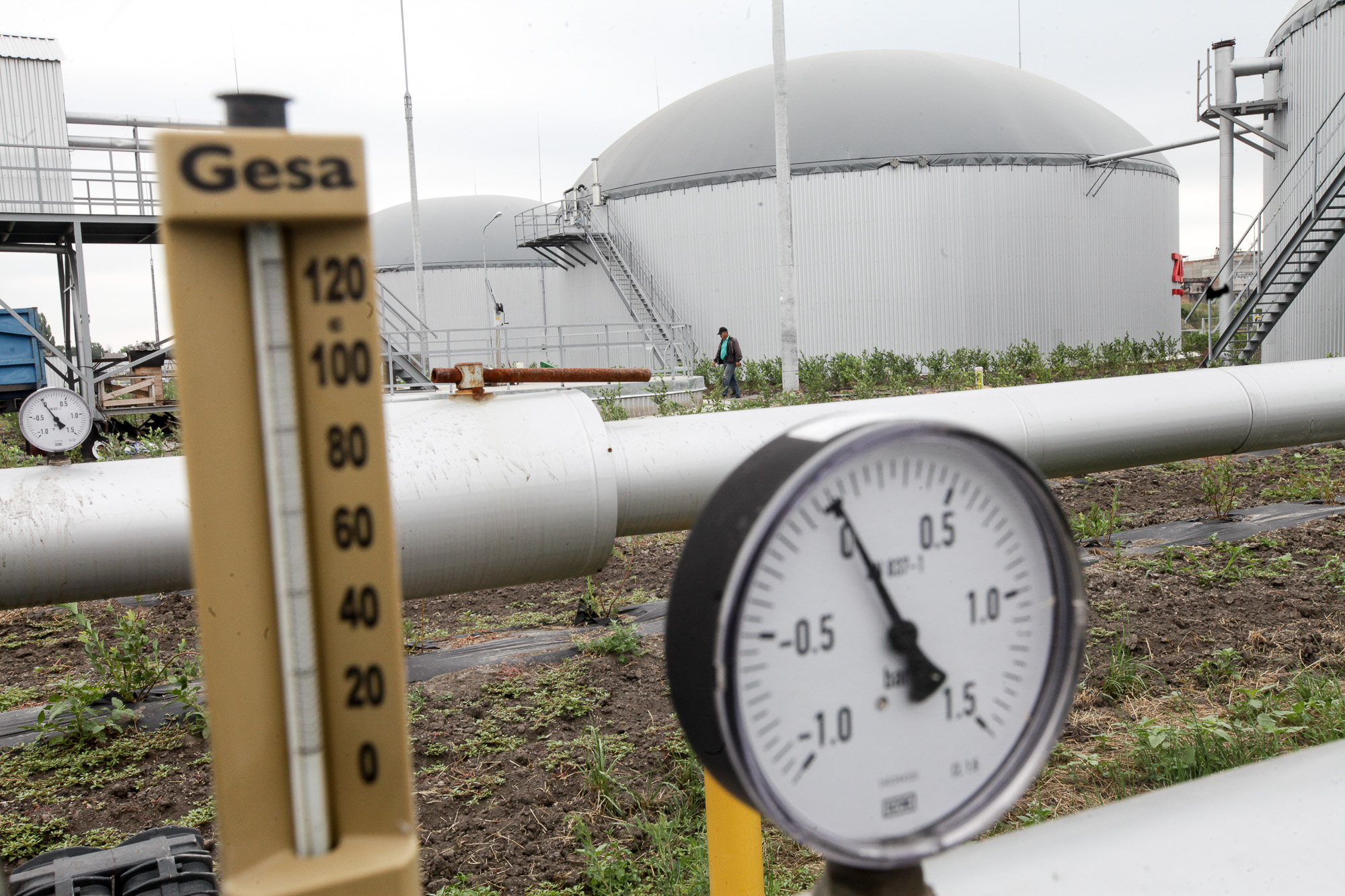

The biogas plant in the town of Rokytne in southern Kyiv Oblasts generates annually 2.25 megawatts of electricity. Overall, the amount of biogas from Ukraine’s agricultural sector alone potentially could cover almost six percent of the electricity consumption in the country, according to the State Agency on Energy Efficiency and Energy Saving of Ukraine. (Pavlo Podufalov)

Recently, producers had some serious doubts about government payments, but Kostyantyn Petrykovets, director at Guaranteed Buyer, says that there are no reasons to worry.

“The Guaranteed Buyer fully paid to renewable electricity producers in July around Hr 3 billion ($120 million), in August — Hr 3.4 billion ($136 million),” he said. Overall, the state company paid $329 million for three months to green energy producers as of Sept. 27.

In the future, auctions could be replaced by direct agreements between producers and consumers, including corporate clients, according to Sysoiev. “To some extent, this might be even more interesting than auctions,” he said.

Another trend in Ukraine for the past two years is the growing quality of projects launched in the renewable sector, experts say.

Another problem is the infrastructure to accommodate increased capacity. Ukraine already has more prepared projects than the electricity grid can accept.

“Today Ukraine has run out of technical capabilities. It’s like rolling an immense boulder up a hill. The farther you go, the harder to do it,” said Yuriy Podolyak, commercial director at Iknet, consultancy for renewable projects.

In addition, according to Olenyuk, from 10 projects his company supported, nine had the final cost for connection higher than expected. Technically, when agreement on connection to the grid is signed there is no indicated price.

“This is not a typical thing in developed countries, but it’s a standard in Ukraine,” he said. “If this could be changed and the price for connection will be projected, this would make the market much more attractive.”

When it comes to available land, another headache for investors appears.

The worst thing experts see while doing legal due diligence is when the land, on which project is planned to be built, had become private under opaque circumstances. As a result, very often some documents required for the land registration are simply missing.

“60 percent of all projects we’ve checked were cut off at the ‘land stage’. It’s the first thing we are looking into,” said Olenyuk.

Where to invest next?

According to Andriy Bantser, chief investment manager at UDP Renewables, Ukrainian company operating the projects of 140 megawatts in total in six Ukrainian Oblasts, investor’s portfolio was simple enough for three past years — the sun was competing with bonds and real estate.

“Bonds have predicted coupon revenue, in real estate there is foreseeable cash flow from the renter, same with sun — regular monthly payments fixed in currency,” said Bantser.

But not anymore. Solar power stations will bring more risks amid falling profitability, he says. “How investor’s portfolio will look like in the next three years even we can’t predict,” said Bantser. It could lead to more investment in biogas plants, Bantser said.

According to Podolyak, investors are expected to look into energy storage, installations that accumulate electricity during peak solar hours and return the energy to the grid when needed.

“I personally know one investor who already searching in southern Ukrainian region a small one megawatt solar power station to put energy storage just to test how it will work,” said Podolyak.

In the near future, experts expect the adoption of legislation on energy storage, which can help to balance energy system and, in parallel, stimulate the new segment of the market.

“It’s not enough just to produce electricity, the system must be balanced somehow,” said Sysoiev.