Ukraine’s energy sector heavily relies on fossil fuels.

The industry is a mess of debts, corruption, monopolies, antiquated technology and complicated subsidies.

Out of necessity, the nation is moving towards clean, renewable energy and competitive markets but whether it can reach its goals amid market convulsions and changing personnel is anyone’s guess.

At the same time, Ukraine has opened its electricity market in a bid to make it more competitive and closer to the European standards.

In total, Ukrainian companies produced 148.8 billion kilowatt-hour of electricity in 2020, which is 3.3% lower than in 2019.

Nuclear power predominates, producing over half of Ukraine’s electricity. Coal-fired power plants — mainly controlled by DTEK, which belongs to Ukraine’s richest man, oligarch Rinat Akhmetov — come second.

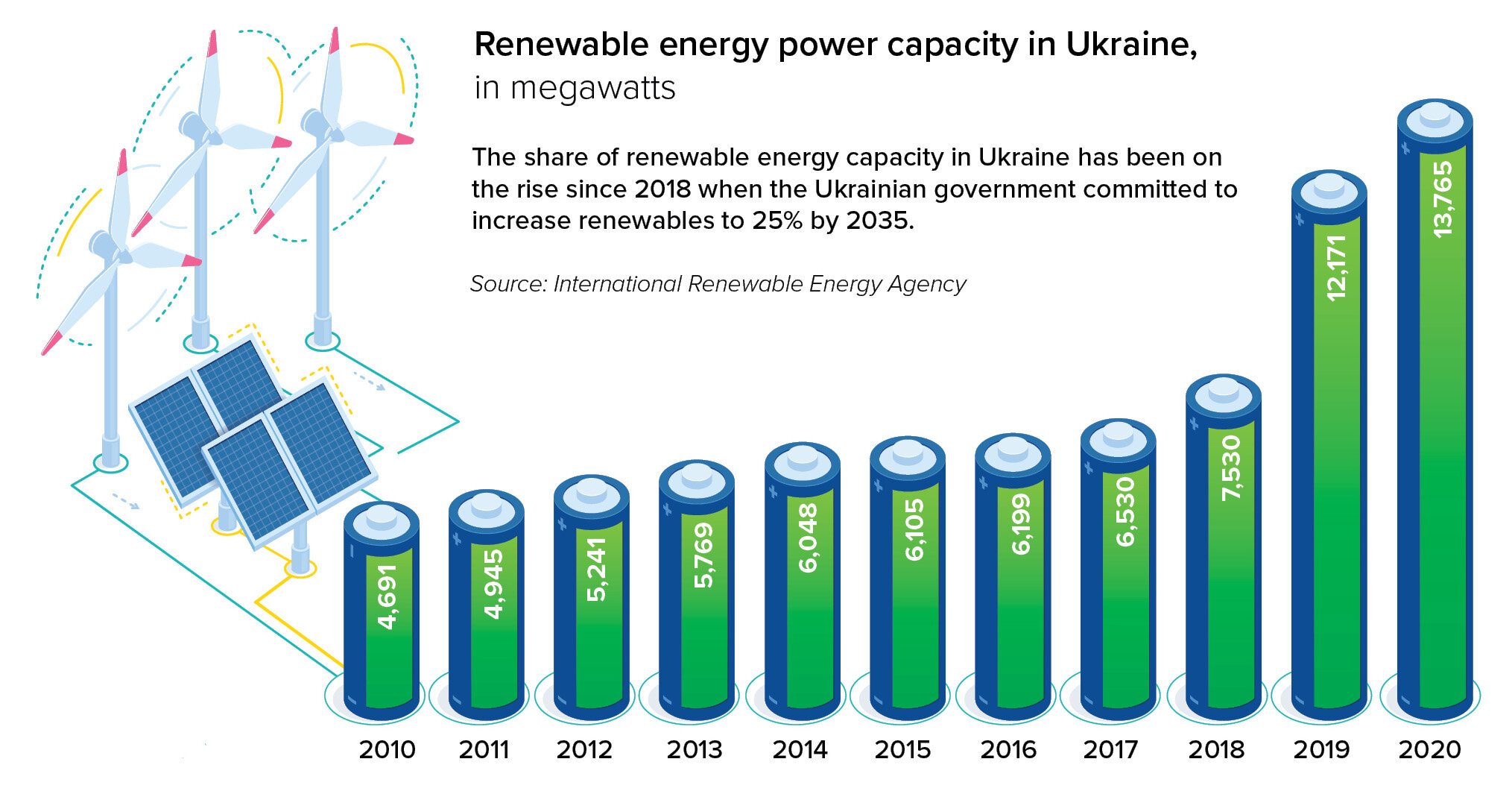

Renewable energy developers produced 7.3% of the total volume. The biggest share of the market belongs to DTEK Renewables, which is also owned by Akhmetov.

Dubious reshuffles

In April 2021, parliament confirmed Herman Halushchenko as the country’s new energy minister, the first in more than a year. Halushchenko is also the former vice president of Ukraine’s state nuclear giant Energoatom.

Experts raised concerns about the nomination. Under Halushchenko, Energoatom sold cheap electricity at knock-down prices to companies associated with oligarchs including Akhmetov and Ihor Kolomoisky.

Energy watchdogs also accuse Halushchenko of connections with Andrii Derkach, a pro-Kremlin independent lawmaker and former head of Energoatom, allegations that Halushchenko denies.

Halushchenko’s appointment comes after Yuriy Vitrenko, former acting energy minister, became the new CEO of state-owned oil and gas company Naftogaz, superseding Andriy Kobolyev.

The Cabinet of Ministers dismissed Kobolyev after Naftogaz reported $684 million losses in 2020, a first since 2015. But the state bypassed the supervisory board to appoint Vitrenko, which Naftogaz and experts said violated the country’s corporate governance principles.

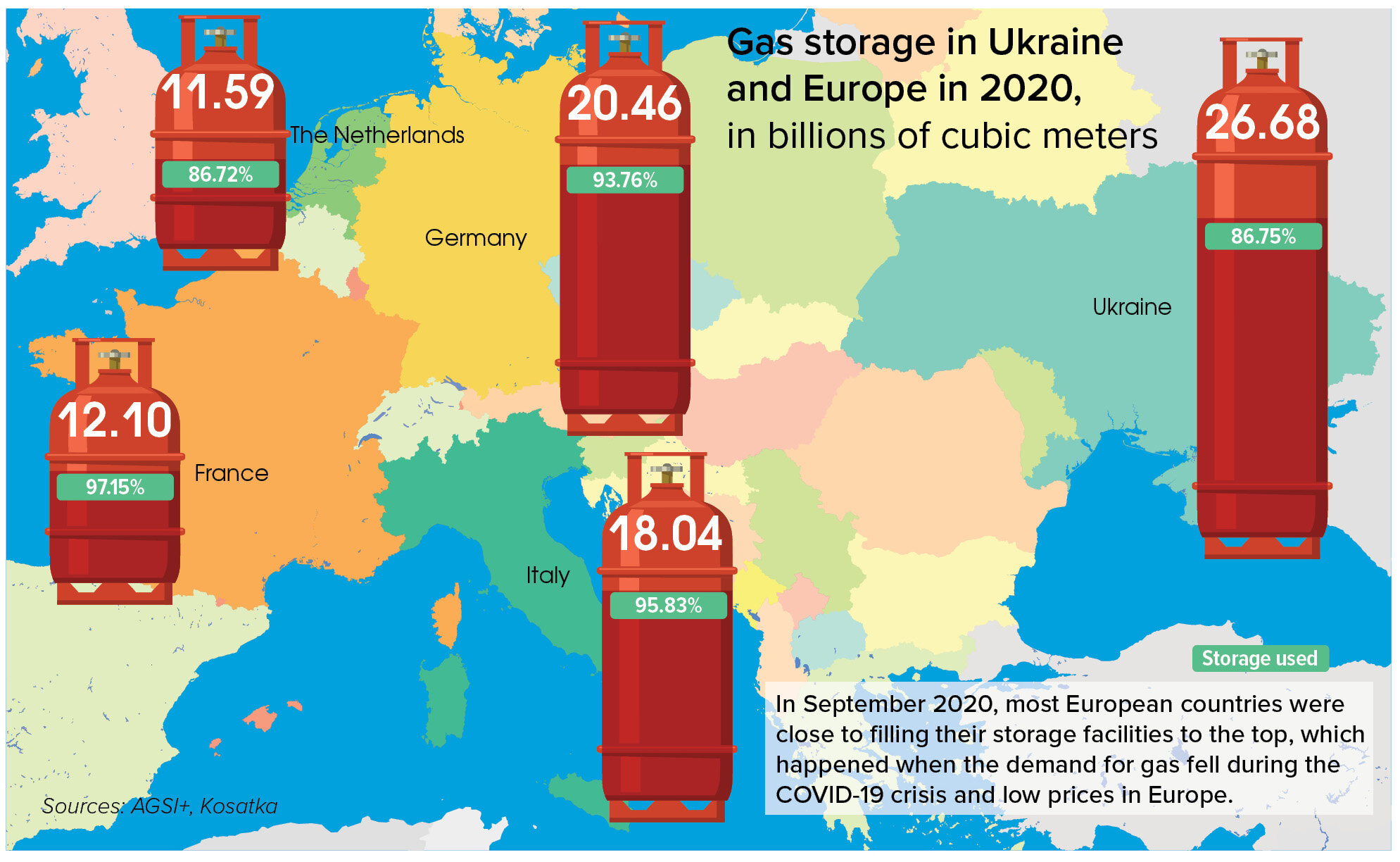

Gas market

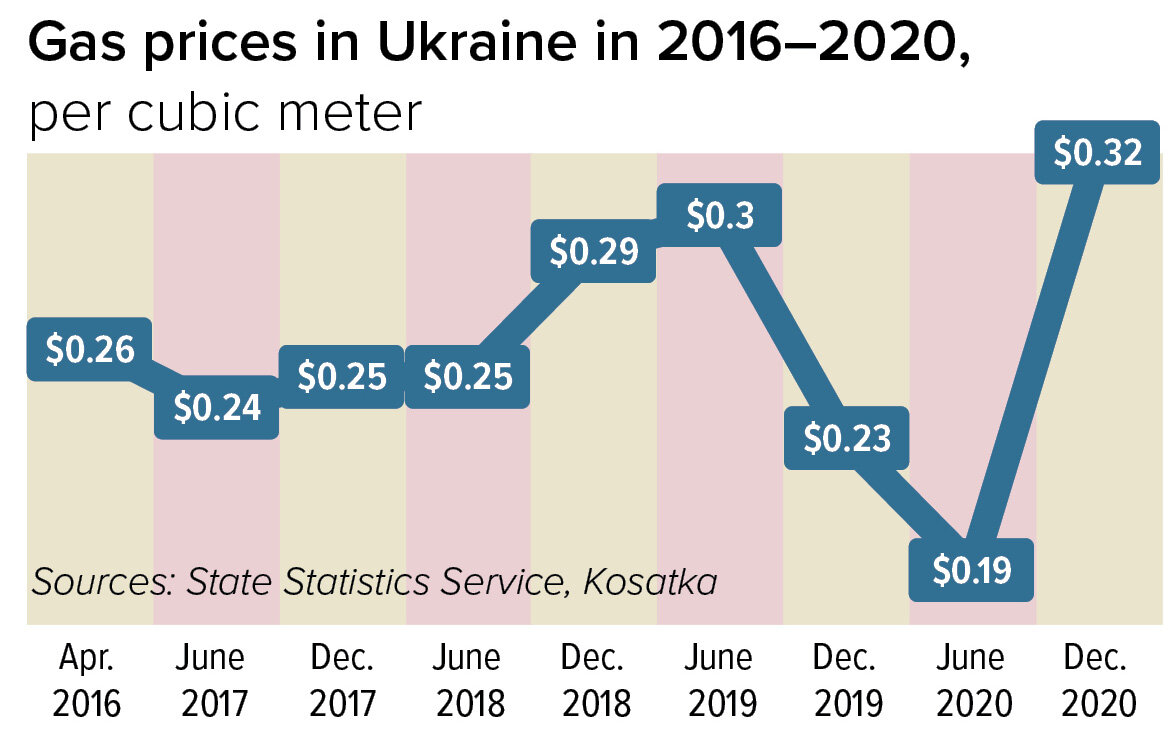

In August 2020, the government canceled Naftogaz’s public service obligations to sell gas at subsidized rates and opened the gas market in Ukraine. From now on, Ukrainian can choose their gas suppliers, another step to a free gas market in the country.

However, exiled billionaire oligarch Dmytro Firtash dominates the retail end of the natural gas trade through regional distribution companies which keep pumping gas from the pipeline without paying for it. Since 2020, these companies already owe a staggering $326 million debt to the state.

The government had to re-impose price controls to prevent gouging.

Ukrainian gas prices could rise now that the market meets European standards, said Olena Pavlenko, president of Dixi Group Analytic Center. “Such reforms are never easy,” said Pavlenko.

Electricity market

2020 was also the first full year of the new electricity market that was launched in July 2019 to make the sector more competitive.

The state lifted the state enterprise Energorynok’s monopoly. The company used to buy energy from producers and sell it to regional electricity distributors.

Customers can now choose energy providers on their own — up to a point. Ukraine’s energy grid is still more Soviet than European, making the formation of a genuinely competitive market impossible.

Oleksandr Kharchenko, director of the Energy Investigation Center, told the Kyiv Post in July 2020 that it can hardly be called a “market” since its segments are either under- or over-regulated.

Volodymyr Omelchenko, head of energy programs at the Razumkov Center, also described the new market as inefficient.

“2020 has shown that the introduced model of electricity (market) is completely inefficient, harmful and leads to the accumulation of huge debts,” he said.

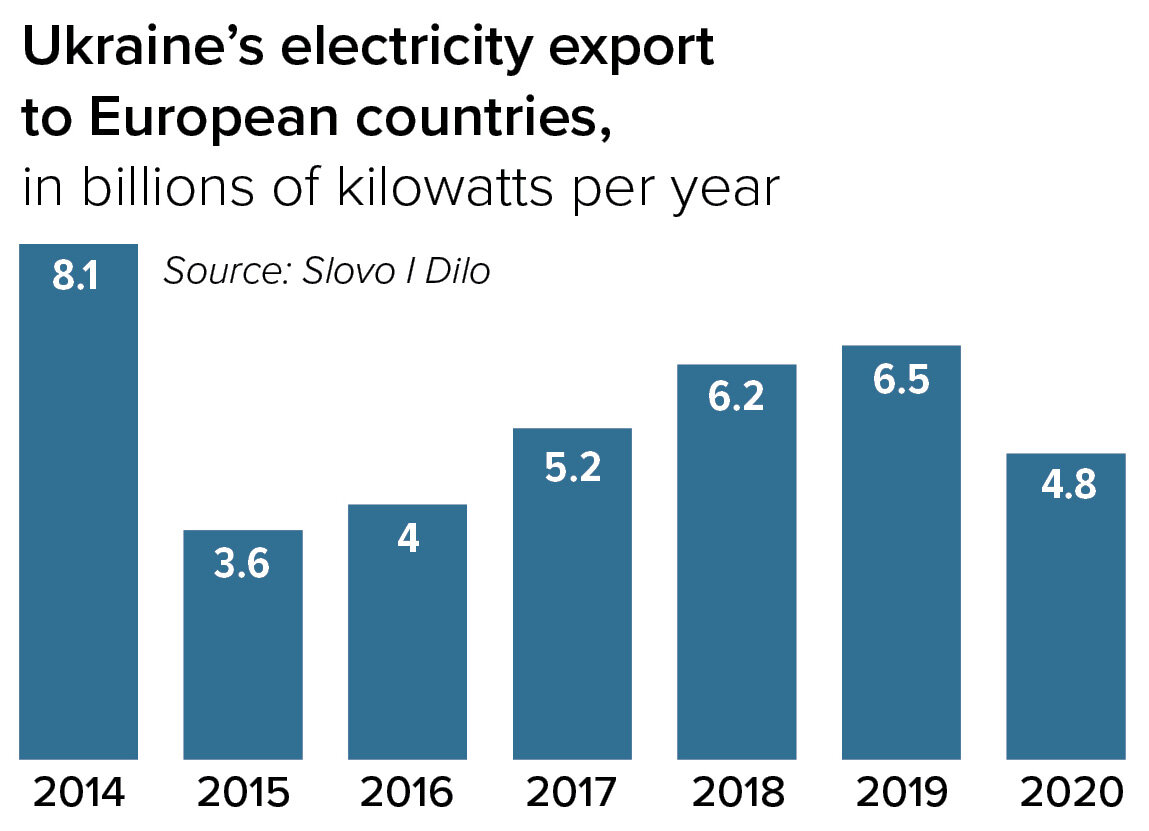

Last year, Ukraine exported 4.8 billion kilowatt-hours of electricity and imported 2.3 billion kilowatt-hours.

The country also resumed electricity imports from Belarus and Russia at the start of the year, before shutting them down again on May 26.

Ukraine said it would modernize its grid and connect it to the European network by 2023.

Losses and debts

Ukrainian energy state-run companies struggled with losses and debts in 2020.

Ukrenergo, for instance, lost nearly $1 billion last year, while Energoatom reported $175 million in losses. Energorynok’s losses, in turn, reached nearly $100 million.

Another problem for Ukraine’s state budget is the debts to its energy producers. The government continues to fall behind on payments.

At the beginning of 2021, the country owed green energy investors over $800 million. The Ukrainian government is obliged to buy all green electricity from renewable power plants at some of the highest fixed tariffs in Europe, which it was unable to afford last year.