France looks forward to the day when Ukraine’s economy takes off. That time has not arrived, although the numbers are looking better. Ukrainian-French trade has seen ups and downs. After a major dip during the 2014-2015 crisis period, French exports to Ukraine started to rise again with overall bilateral trade in 2017 at 1.4 billion euros – nearly 10 percent above the previous year.

Of the European Union countries, France is the fourth biggest exporter to Ukraine, behind Germany, Poland and Italy, and the ninth biggest overall.

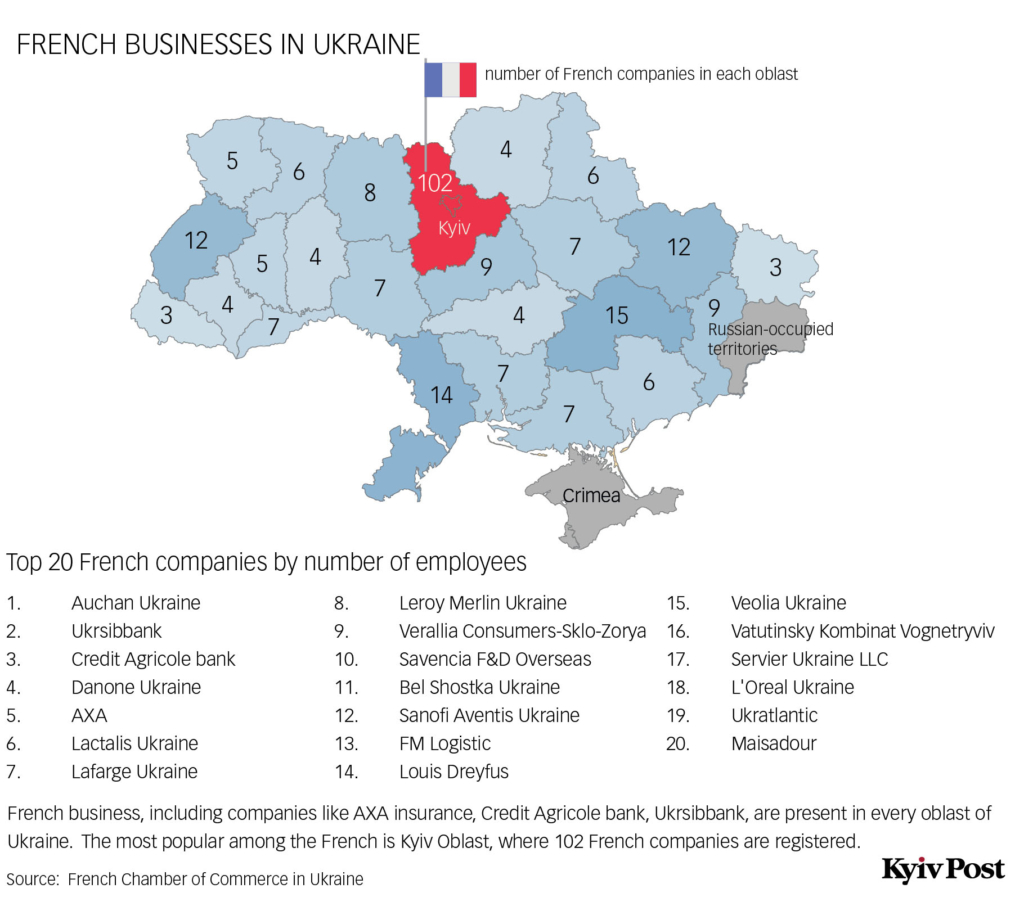

Altogether, there are roughly 160 French companies in Ukraine.

Jean-Paul Piotrowski, the president of the French Chamber of Commerce in Ukraine, or CCIFU, says French companies are committed to Ukraine.

“It’s important to know what these members represent in terms of employment,” Piotrowski said. “We’re talking about 30,000 (employees) in Ukraine.”

Of the more than 120 companies his chamber represents, about 45 percent are large international firms. About a quarter operate in the agriculture sector.

In the past month alone, three companies have joined the chamber: agricultural firm Louis Dreyfus Company, pharmaceutical company Mayoly Spindler and global communications group HAVAS Media’s Arena Media.

Alexis Struve, the director of Business France Ukraine, a government body that promotes French businesses, says that in 2014 and 2015, the group’s activity plunged, and it had to cut its nine-person staff by four. His branch, however, was regrouped with Central Europe instead of Russia. The business mood started to improve at the end of 2016 with the return to slight economic growth.

“We felt some sort of change, especially an increase of demand from French companies,” Struve said. “This helped French companies see that there is an opportunity here. Ukraine today is the only country in Europe with such large potential for growth.”

Development plans

Today, Business France is back to its pre-crisis level of operations and is continuing to grow in its mission to support French businesses.

“Our role is to help them find a reliable partner and to tell them if it’s possible to work here in a specific industry or not,” Struve said.

More French expats are returning to Ukraine, meaning that French companies have plans to develop in Ukraine.

“There was a period in 2015 when expats were returning to France and to other countries, being replaced by local directors,” Struve said.

Other positives: At least seven French craft beer producers are interested in selling in Ukraine’s supermarkets; a French entrepreneur wants to purchase up to 3,000 hectares of land in Ukraine; another company is looking to establish a pharmaceutical laboratory.

“There is real, solid interest,” Struve said.

French companies also have the support of Bpifrance, a state investment bank. “Bpifrance is more and more interested in Ukraine,” Struve said.

Ukrainian entrepreneurs who want to purchase equipment for their businesses can take a low-interest loan from the bank as long as they pass an audit.

Piotrowski, who is also the CEO at Credit Agricole Bank’s Ukraine branch, says that the chamber of commerce is often contacted by French companies looking to invest in Ukraine. “That’s not to say that today they are still completely ready to go, but there is a trend.”

New opportunities

French companies are most interested in the agriculture sector (Soufflet and Malterurop), the energy sector (Engie, Egis), manufacturing (Verallia), waste management and recycling, logistics, and steel. French sports goods retailer Decathlon will open several stores in Ukraine soon, and some French companies, such as FM Logistics in Boryspil and Nexans in western Ukraine, are already expanding their businesses.

Another expanding company is Auchan, the top-3 player in the retail segment, which purchased Ukrainian retailer Karavan in June 2017.

Viktoria Lucenko, the CEO of Auchan Retail Ukraine, says that the past three years have been critical for the company.

“Auchan always had very specific goals in Ukraine, how it wanted to develop here, and it was very good when we got this opportunity to develop with (the purchase of) Karavan,” Lucenko told the Kyiv Post.

She said that Ukraine is one of Auchan’s best performing markets. The company is to open its first supermarket in Dnipro this month.

Another French retailer that recently invested in Ukraine is Leroy Merlin, which specializes in home improvement and gardening. It opened its fourth store in Kyiv last year and launched its e-commerce market on April 1.

“We’re interested in opening a new store in the capital, and in the regions,” Cédric Brosset, the general manager of Leroy Merlin’s Ukraine branch, told the Kyiv Post. “We’re expanding in Ukraine because the potential of the market is real, and huge.”

So far the company has 600 employees in Ukraine, Brosset said.

Jean-Paul Piotrowski, president of French Chamber of Commerce in Ukraine. (Kostyantyn Chernichkin)

Weak growth

But business is constrained by the continued weakness of the economy and low single-digit growth rate forecasts.

“This is probably not enough for a country like Ukraine, because we now consider normal growth to be 6-8 percent,” Piotrowski said. “But it’s much better than the negative 12 percent we saw in 2014 and 2015.”

French companies are also concerned about persistent corruption and the difficult working relationship with the current authorities.

“Everybody expects more improvement at this level,” Piotrowski said. “This is really a point of concern that has to be understood as a (tipping) point for bringing more investment to Ukraine.”

“Now the questions are not about the situation in eastern part of Ukraine,” Piotrowski said. “The key questions are: what about the corruption, what’s about justice, what about this anti-corruption court?”

A lot of companies still face bribery and raider attacks, he said. “This is the case for various members of the French Chamber of Commerce… It’s still a problem, in spite of some improvement.”

The French Embassy attends court cases to keep judges accountable. This often helps, but takes up a lot of time and effort that could be invested elsewhere.

But despite the pressures, most of the major French companies have stayed in Ukraine. The only exception is ARGO’s Promod clothing network, which announced in February it was leaving.

Exit of professionals

Another concern is the brain drain in Ukraine, with professionals continuing to look for better lives outside the country.

“It’s quite difficult now to find people to fill some vacant positions,” he said.

Solutions include offering employee perks such as training and career plans, the opportunity to travel abroad, higher salaries, and generous insurance coverage.

However, the newly appointed general manager of Renault Ukraine, Francois Mariotte, says the French car maker has no problem finding qualified Ukrainian staff.

“We have lots and lots of examples of countries that have seen people leave for economic reasons – this was true in Spain, in Portugal years ago, in Poland – and when you look at the situation in those countries, it has since improved a lot.”

Ukrainian lawmakers should ensure business conditions are fair and safe, Mariotte said. “I hope that within a few years – because it will take time – there will be some kind of normalization of Ukraine,” he said.

Big potential

Renault has 60 people working in its Kyiv office and 37 dealers around the country. So far, the company hasn’t experienced corruption.

“The job of the government, the job of the authorities, is to create fair conditions for business,” Mariotte said. “Stopping corruption is absolutely necessary if you want to create trust, and if you want to create fair conditions in the future.”

But Struve is hopeful if Ukraine does its part to fight corruption and create the right business climate. “Ukrainians have put in a lot of effort to reform, and it will be so sad if they don’t see it through to the end.”