Editor’s Note: Sergiy Sergiyenko is a managing partner of CBRE Ukraine. In 2020, CBRE Ukraine had 300 employees and managed 800,000 square meters of shopping centers and industrial space, as well as 32,000 square meters of corporate real estate. The Kyiv Post asked him about how COVID‑19 affected the commercial property sector. The answers were edited for space reasons.

Kyiv Post: Where did you see the most dramatic changes among the three commercial areas you work in — industrial/warehouse, office and retail?

Sergiy Sergiyenko: There was shock initially, but everyone adjusted. Office and retail were hit hard, as expected. Warehouse was the segment that benefited. Everyone went online. More business for warehouses will hopefully mean more warehouse space. In 2015–2016, there was zero new supply. In 2017–2018, there were 10,000 new square meters; in 2019–20,000; in 2020–60,000 square meters. Very little. Vacancy declined from 30% to 3% now. But there’s no long-term financing, no low interest rates to build new warehouse space. Everyone builds out of equity and it’s extremely expensive. We are in a cul-de-sac — no huge supply but huge demand, yet leasing rates are not growing. Something has to give. Maybe developers will build and accept a lower return. But that is unlikely. Rental rates will have to go up to justify new construction or construction prices will have to go down.

KP: What about the office sector?

SS: There was lots of construction activity and a healthy amount of leasing activity — a surprise for all of us. While the office market declined noticeably, it did not disappear. Offices were locked down and employees locked out. But there was no broad dumping of leased offices. There was a revelation that working from home or from the cafe is actually effective. The office footprint will drop down maybe by one-fourth to one-third from March 2019 in about three-four years. In other words, if there are 2 million square meters in total supply — 400,000 to 500,000 square meters will be vacated. The market will re-adjust. Senior management of a given company is working off the mindset of the last 20–30 years, while younger generations do not want to commute two hours anymore. We are blessed by the huge footprint of the information technology community, which is not dependent on the Ukrainian economy. High-quality business centers will be occupied, with maybe average tenant office space resized from 3,000 square meters to 2,000 square meters. Offices are not going away. They are places for ideas, collaboration, socializing. A company is a social entity. It can’t be a social entity if everyone is sitting at home and looking at the screen.

People stand outside the Astarta Organic Business Centre in Kyiv on May 18, 2020. Over the past three years, the information technology industry has been driving demand in Ukraine’s office market. Tech companies occupied nearly half of new leasing in Kyiv in 2020 — 54,000 square meters. (Oleg Petrasiuk)

KP: What about shopping malls? Are they dying because of COVID‑19 and the growth in online retail?

SS: Yes and no. Shopping malls provide more than a shopping function. Living in Kyiv and Ukraine, in general, there are no quality public spaces in winter. Once the weather gets unpleasant, there is nowhere to go. So, people go out and go to a mall. There’s a higher rate of public interest than in North America, where malls are dying because you have to drive to them. There are public places all around in North America and a very developed local retail infrastructure. That is why you do not need to go to a large mall outside the city. Ukraine still has public transport. Malls are places for hanging out, window-shopping, or for trying on clothes. They may not be so profitable, but they still continue to be used, so they will continue to exist. Rental rates in shopping malls did get hammered, but they will recover gradually.

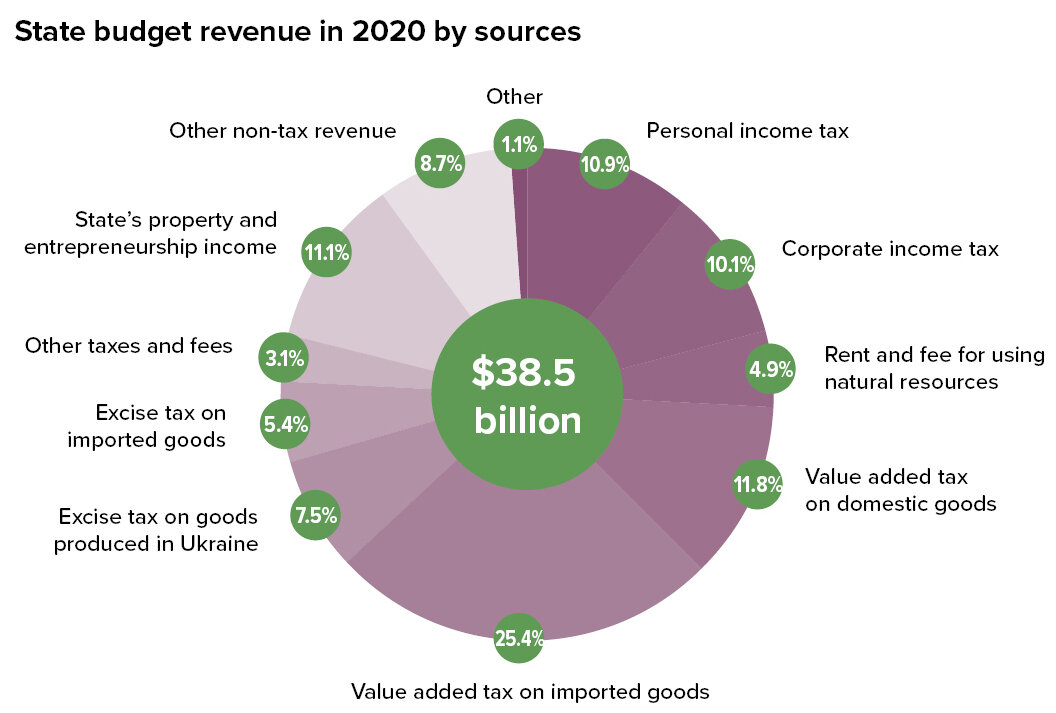

In many Western countries, property taxes provide the backbone of local budgets, often accounting for more than half of tax revenues. But in Ukraine, property tax contribution is worth only 3% of revenues. The State Treasury Service doesn’t even have a separate category for the property tax and combines it with other personal income tax revenues, which together secure 10.9% of the budget.

KP: You spoke two years ago about the high barriers to new construction projects because of the high level of corruption. Do the barriers still exist?

SS: Not to the same degree. There are some positive changes. But there are still many corrupt levers of the government approval machine. The construction industry is still only open to insiders because of corruption. Internationals will not pay bribes.