While Kyiv’s hotel market is growing, driven mainly by business travel, political and social instability in the country is holding it back.

Just over half of Kyiv’s hotel rooms — almost 11,000 of them — are filled throughout the year, much lower than in other key European cities, which have an average occupancy of about 72 percent, according to research firm STR. Still, Kyiv continues to gain prominence as a destination for business trips and cultural tourism, which is driven by large events such as 2017’s Eurovision song contest and 2018’s UEFA Championship League finals.

Hospitality experts and managers are cautiously optimistic that growth will continue in 2019. However, the upcoming elections cast uncertainty over Ukraine, as international travelers wait to see if the country will remain stable.

At the same time, international brands are gaining interest in the Kyiv market, but it’s uncertain whether the growth in demand will match rising supply.

“We can see that source markets are diversifying which is good and that demand is overall growing,” said Ivana Neskovic, a senior account manager with STR. “If the situation is stable and depending on new supply, the trend should continue to be upward.”

But, she added “it is really very much dependent on the political situation.”

Revenue growth

Revenue per available room in Kyiv’s hotels grew by 9.4 percent, to Hr 1,503 ($54) per room, in 2018, according to STR. However, some of that growth can be explained by currency fluctuation — in euro amounts, the revenue per room grew by 3.7 percent to 47 euros.

CBRE real estate consulting firm had similar findings when examining the first three quarters of 2018. Hryvnia fluctuation, the commercial real estate consulting firm wrote, mitigated the growth of average daily rates and revenues per room. The company also found that much of the growth was absorbed by lower-end, economy hotels.

“Improvements in dollar-denominated revenue per room in upper midscale, upscale and luxury segments were driven by growth in average daily rates, whilst revenue per room in economy and midscale segments was for the most part due to higher occupancy,” according to CBRE.

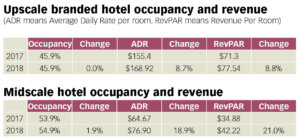

According to JLL, upscale hotel occupancies did not change in 2018 compared with the previous year, while midscale occupancy saw a slight increase.

Market saturation

Data from CBRE shows that total hotel stock in Kyiv grew by 7 percent (757 keys) in the first three quarters of 2018, bringing the total up to 10,800 keys in 110 properties. Some of the new entrants included Aloft Kyiv, Ibis Kyiv Railway Station, Favor Park Hotel and Hotel Bursa. Additionally, the five-star boutique Riviera House opened in January. Two more hotels are expected in 2020–2021 — one more Ibis and Adagio City Aparthotel.

Despite an increase in market capacity, 2018 occupancies are not too different from 2017 data, according to Olena Tsytovych, the public relations director for Premier Hotels & Resorts. Kyiv’s general occupancy grew by 2 to 3 percent in 2018, compared to the previous year.

“Kyiv managed to absorb new offers without detriment to operating activities,” said Tsytovych. However, she added that Kyiv is seeing “a revival of attention to its market by international operators, which will undoubtedly affect the supply-demand balance.”

The new supply puts pressure on existing hotels, given Kyiv’s relatively modest occupancy rate. According to consulting firm JLL, the upscale branded hotels in Kyiv only had 45.9 percent occupancy in 2018 and that percentage remains completely unchanged from 2017. Most of the occupancy increase occurred in lower-end establishments.

According to Colliers International, mid-priced hotels saw their occupancy increase by 5 percentage points in 2018, to 55-65 percent.

“I do think that this level of occupancy definitely should raise some questions in terms of need of development and which category of the hotels should be built in the city,” said Neskovic. “On one hand, new hotels and brands open up the visibility of the market, but on the other, additional supply will put pressure on existing hotels even further.”

“Right now, more hotels are not needed,” said Andrii Virchenko, director of sales at the five-star Opera Hotel owned by the richest oligarch in Ukraine Rinat Akhmetov and which hosted the Real Madrid football team during 2018’s championship finals in Kyiv. “If occupancy is 40 percent this year, there is no point in building.”

Business and leisure

Business is the main market driver, analysts and hotel managers told the Kyiv Post.

CBRE found that business tourism “will continue to take the largest share in the demand structure” in 2019. Virchenko said that between 70 and 80 percent of guests in Kyiv’s high-end hotels are there on business trips or to attend business conferences. These conferences are a main function of the city’s hotels, Virchenko added.

“The market for business conferences stayed at the same levels,” as the previous year, said Andriy Davydenko, the general manager of Ibis hotels. “This segment is doing pretty well.”

Hotels have seen growing numbers of visitors from the U.K., U.S., France, Spain, Germany, Israel and Turkey. China’s businesspeople are also an increasingly frequent sight in the city’s hotels. However, the majority of visitors to Kyiv are domestic — Ukrainians traveling on a budget.

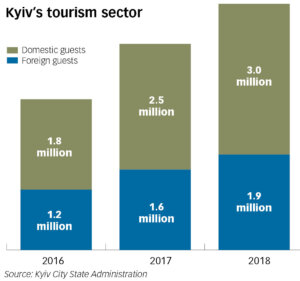

Total tourism to Kyiv hit 4.9 million in 2018, an increase of 20 percent, according to the city’s tourism commission. The measure, based on tourism tax receipts, includes 3 million Ukrainians and 1.9 million foreigners. Davydenko said that increasing numbers of international flights helped raise Kyiv’s profile as a destination. Yet, “there is room to grow,” he said.

CBRE thinks so too, expecting both business and leisure tourism to grow, driven by “multiple medium scale cultural events” such as exhibitions, concerts and conferences. However, there will be nothing as big as last year’s football championship, which caused a surge in demand last May.

Kyiv continues to grow as a tourist destination for both foreign and domestic visitors, yet the numbers are still low compared to European Union capitals. (Kyiv City State Administration)

Instability

Despite 2018’s positive notes, the latter half of the year showed a weaker performance. Much of the damage was done by the martial law declared in November into December. As a result, December 2018 occupancy declined by 9 to 12 percent compared to the same period in 2017, depending on the hotel segment, said Tsytovych.

The drop in demand and mass cancellations caused by the military situation has had a delayed effect on hotels, limiting their efficiency in 2019.

“The introduction of martial law in Ukraine at the end of 2018 and consequently massive cancellations of hotel room bookings effected negatively at main hotel operational indicators,” Colliers International wrote in a report.

Virchenko said that international business travelers and the companies they represent are carefully watching the country, to see how the political and economic situation will develop. This might lead to more conservative occupancies.

Tsytovych added that retention of qualified staff is becoming a challenge due to the drive for the top people to work abroad. At the same time, apartment rental services such as AirBnB are becoming more popular and may start encroaching on Kyiv’s hotel market.

Changing tastes

But there are ways to take advantage of some social changes in Ukraine, managers said.

For example, one way to draw in niche customers is through their taste buds, according to Serhiy Larionov, Opera Hotel’s food and beverage manager. Ukrainians, he said, increasingly crave authentic international food as well as locally-sourced, artisanal preparations. “Something original that they haven’t tried yet,” he said. “People are increasingly going to restaurants for the emotions.”

While Opera is constrained by a series of five-star standards, it supplements its restaurant’s menu with seasonal items celebrating various foreign cuisines, as well as Ukraine’s traditional holidays.

Marriott is also considering launching its Moxy hotels in Ukraine, said Janusz Mitulski, the Senior Director for Central & Eastern Europe. Moxy is a boutique brand that targets millenial guests and eschews formality to focus on fun common spaces such as bars and lounges. Moxy hotels exist in 16 European countries, from France, to Poland, to Georgia.