Plenty of people mourned the departure of Natalie Jaresko last year as Ukraine’s finance minister after she lost out to Volodymyr Groysman as prime minister.

But Oleksandr Danyliuk’s performance in more than a year as Jaresko’s successor has won praise and helped some people forget — even as many others remain dismayed by the halting pace of reforms under President Petro Poroshenko and Groysman.

“He has surprised me positively and turned out to be the reform anchor in a government that has been less committed to reform than the previous government and he has managed to keep the state finances in good order,” said Anders Aslund, the Swedish economist and senior fellow at the Atlantic Council.

But being the finance minister of Ukraine involves trying to plug a lot of holes in the leaky ship of state.

The size of Ukraine’s official economy is highly unimpressive for a European nation of 44 million people. It will come in at less than $100 billion a year. If the state budget takes up 40 percent of gross domestic product, that’s only $40 billion — about the size of the budget of the state of Maryland, with 6 million people, or half the size of New York City’s municipal budget.

Of course, Ukraine’s economy is much larger than is officially reported.

If estimates are correct that half of the economy remains in the shadows, then Ukraine’s GDP doubles to $200 billion. Such an economy, if taxed adequately, could also double Ukraine’s state budget — providing better investment in public services and sectors starved of money.

But such bounty is not happening yet in Ukraine.

Few know the hard fiscal realities better than Danyliuk, whose supporters say he has provided continuity and more in many key areas of budgeting, accountability and transparency to build on Jaresko’s 15-month tenure.

Danyliuk sat down for an extensive interview with the Kyiv Post in late May to explain the ins and outs of Ukraine’s financial situation and his reform goals.

Fixing VAT refunds

On the positive side of the ledger, Danyliuk said he’s plugged one big hole for corruption — the fraudulent chicanery involving value-added tax refunds that likely cost the state budget countless billions of hryvnias per year while making insiders rich at the expense of taxpayers.

It worked this way: Workers at the State Fiscal Service — the agency that oversees taxation and customs services — decided who got VAT refunds and who didn’t. Under President Viktor Yanukovych’s time, companies said they were forced to pay bribes to get their refunds, sometimes as high as 20 percent of the amount of the refund.

Under Poroshenko’s time, the problems continued, with suspended State Fiscal Service chief Roman Nasirov now fighting criminal charges of charges of orchestrating a multimillion-dollar tax fraud.

Danyliuk decided to make the entire VAT process online and transparent — so the public would know who is getting VAT refunds, when and why, and who isn’t getting the refunds. Although the Finance Ministry oversees the State Fiscal Service, it did not even have access to the VAT databases until recently.

Before the VAT process went online, easing huge backlogs of unpaid refunds to companies and reducing the possibility for abusive and abritrary rulings, Danyliuk said he received a lot of complaints.

Now he doesn’t.

“I used to receive so many calls: ‘Help us,’ from companies as well as embassies. Now silence. Why is that? It’s working. Now I can switch to other things. I don’t miss it at all. It was the wrong thing to do for a minister of finance to intervene in such things. We’re policymakers. We need to change policies.”

Customs ‘black hole’

But if Danyliuk and the nation found success in shutting off the financial corruption involving VAT refunds, much work remains to be done in other areas.

When asked to name the biggest fiscal “black hole” in Ukraine, Danyliuk didn’t hestitate to respond that it could be found in customs services, part of the same notorious State Fiscal Service.

“There is a black hole in customs. I know what to do and we’re going to work on it,” Danyliuk said. “There’s just incredibly so much vested interests there. It requires a lot of attention. That’s the next thing we’re going to focus on. We need to fix the victory with VAT — make sure it’s irreversible. We need to cement our success in one area and move to others.”

The problem in customs, again, is one of an unaccountable state bureaucracy.

Too many offices at state customs checkpoints have tremendous powers to extort bribes and arbitrarily set tariffs while, even worse, untaxed smuggling flourishes in and out of the nation. The widespread suspicion is that the illegal smuggling — which again robs the state budget while making smugglers rich — is being done with the connivance, if not at the direction, of powerful customs officials, law enforcement officials and their powerful political patrons.

Four IMF priorities

But Danyliuk’s early summer is booked with devising state budget plans for the next three years and ensuring that parliament passes legislation in four key areas critical to keeping credit flowing from the International Monetary Fund.

The IMF has lent Ukraine about half of the $17.5 billion envisioned in a program that expires on Jan. 1, 2019. But to get further installments of the loans, Ukraine needs to make four big changes:

- Overhaul its pension system, which now eats up 12 percent of the GDP and runs at a huge deficit;

- End a 26-year ban on the sales of agricultural land and create a liberal market that should boost the overall economy, especially agricultural production as farmers are able to use land as collateral;

- Start selling off most of the remaining 1,800 state owned enterprises, many of which are so corruptly managed that they create public losses and private profits for insiders; and

- Creation of an anti-corruption court. Ukraine’s judiciary remains distrusted and politically subservient. Since the EuroMaidan Revolution that drove President Viktor Yanukovych from power on Feb. 22, 2014, the national’s law enforcement system has not brought anybody to justice for major crimes including $40 billion in financial corruption, another $20 billion in bank fraud and the murders of more than 100 demonstrators during the revolution, to name the most serious cases.

The prospects of parliament summoning the political will to approve all four changes before the July recess are questionable.

If Ukraine comes up short, then the ball is in the IMF’s court. The international lender could relax conditions, as it has done in the past, or take a hard line and halt credit to Ukraine. While losing out on IMF loans won’t cause Ukraine’s economy to collapse, the damage to investor confidence and the reform agenda could be severe.

Danyliuk thinks staying with the IMF program is important for Ukraine as a way to stimulate critical foreign private investment and stimulate reforms.

“The IMF provides support for our reforms efforts and is assisting us in building a sustainable and competitive economy,” Danyliuk said. “Continuation of the program is also a positive indicator for the investors and the international community at large that we are on the right track and are keeping up with our reforms plan.”

At the same time, he said, Ukraine should adopt these reforms regardless of the IMF because they are the right thing to do.

“I am a big supporter of having the Ukrainian government own the reform agenda,” he said. “We should lead. When we implement such a reform agenda, it’s only to our benefit.”

Reform budgets

Given Ukraine’s precarious financial state, it’s fair to say that nobody is satisfied with what they get from the state budget — from public employees to pensioners. The lack of resources is even more critical since Ukraine oversees a large public infrastructure — from railways to roads and ports — that, aging and lacking investment for decades, have damaged the nation’s competitiveness.

Danyliuk plays a key role in setting priorities for public spending. Given that he doesn’t have a lot of money to spend, Danyliuk said he’s trying to achieve two big goals with the budget: institute three-year planning and financially reward ministries that carry out essential reforms.

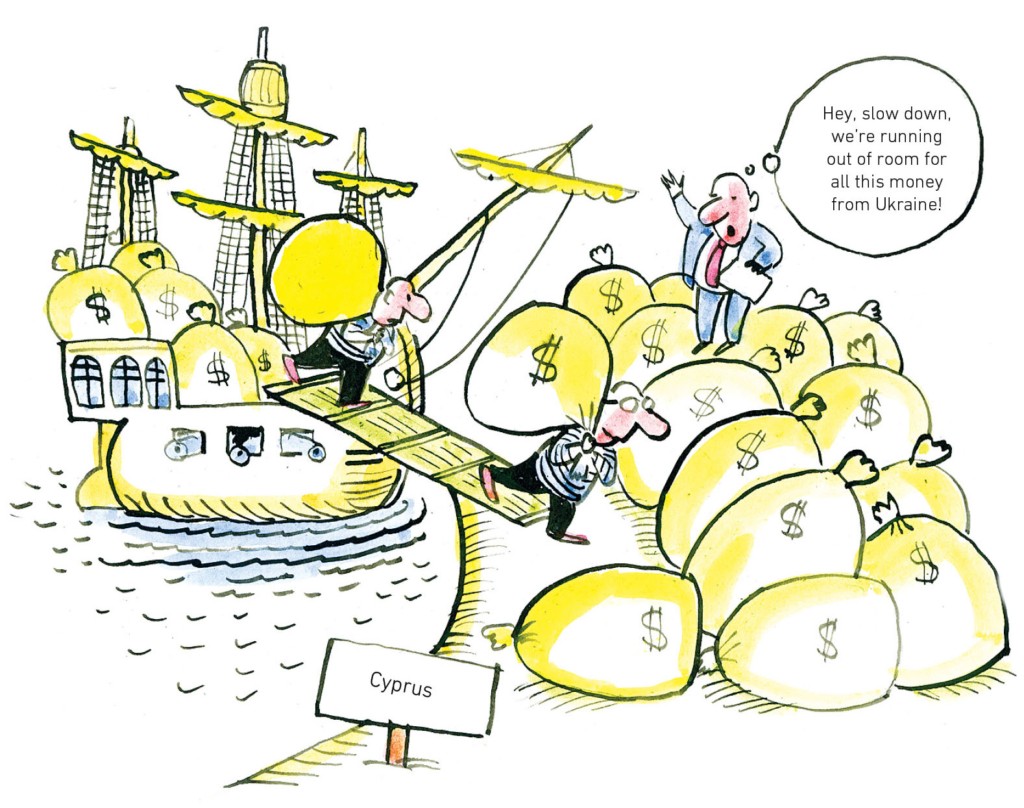

Ukraine’s foreign direct investment figures pretty much say it all: Most of what little returns to Ukraine comes from Cyprus, a notorious tax haven. Estimates have ranged as high as $10 billion — more than 10 percent of the nation’s economy — being spirited out of the country annually, untaxed and much of it suspiciously earned.

Investigating financial crime

Danyliuk is so busy that he has little time to concentrate on his priority project: Setting up a state Financial Investigation Service — an elite financial crimes squad — capable of solving the biggest and most serious financial crimes.

Ukraine’s current law enforcement agencies have proven utterly incapable or uninterested in investigating or prosecuting financial crime. Often, Danyliuk said, the state agencies run up against the world’s “top lawyers,” providing a mismatch. “What we need is to have people of the same intellectual capacity with the right motivation and the right values to fight against and to prevent the most serious crimes against the state.”

As just one example, the nation’s banking system has been pilfered by insiders for the last decade before the house of cards collapsed — with $20 billion in losses to taxpayers. That’s half of the entire annual state budget.

While such authorities as ex-National Bank of Ukraine governor Valeria Gontareva said that most of the losses were easily proved bank fraud, no one has been convicted and trifling sums have been recovered by the state.

Additionally, no serious dent has been made in complex financial offshore and transfer pricing schemes that loot billions of dollars from the nation, by most estimates, along with other unpunished economic crimes like capital markets fraud, tax evasion, embezzlement and money laundering.

Danyliuk said such a “transparent and independent” Financial Investigation Service would be an elite squad focusing on “the most serious economic crimes against the public interest, unlike the current situation when the National Police, the Security Service of Ukraine, the Tax Police and the General Prosecutor’s office investigate such crimes.”

He envisions the new service as as staffed with people “who have not previously worked in the uniformed agencies and who have relevant financial and analytical background,” Danyliuk said.

Creation of the Financial Investigation Service is part of the solution that will require “comprehensive reform of the law enforcement system,” Danyliuk said. “In particular, there should be fewer formal reasons for the law enforcement to be involved in economic processes, such as privatization, for example.”

‘Unacceptable’ enforcement

As incapable as law enforcement is when it comes to solving the most serious financial and violent crimes, its agents — from police to prosecutors and ultimately judges — interfere in too many aspects of the economy, Danyliuk said.

“The weakest spot is the judiciary system,” he said. “That’s what makes the country less attractive for investors.”

“Ukraine’s law enforcement system is outdated. The country has moved to develop free market and pursue liberal values, but law enforcement remained unreformed and repressive,” Danyliuk said. “Neither the size — they are too big — nor the functions —repressive — of the existing law-enforcement agencies are adequate for the current situation. In particular, various law enforcement agencies continue exerting pressure on business. This comes in the form of excessive inspections, ungrounded criminal cases against businesses, searches, confiscation of equipment, extortion and etc. It is unacceptable in a free economy.”

Ukraine’s repressively antiquated law enforcers hinder the economy in many ways.

“Law enforcement agencies also have influence over the decisions on economic matters made by other state bodies,” Danyliuk said. “For example, privatization stumbles in part because officials responsible for the process are afraid to sell. Why? Because if they sell a state company and a prosecutor decides that the price is too low, the officials may be subject to prosecution. In a free economy, the market sets the prices not the prosecutor’s office or some other state institution.”

“In the situation which we have now, the state is losing money,” Danyliuk said. “State-owned enterprises are managed inefficiently and they are depreciating in value, hence, becoming less attractive for potential investors.”

The only way out

Given the state’s poor capacity, both in finance and management, Danyliuk said that stimulating private investment is “the future of Ukraine.” He recently completed talks with international financial institutions in Washington, D.C., in which “one of the main themes was: How do we direct the support of such institutions to support the private sector?”

The state’s role is to create attractive conditions for the private sector to flourish. While some progress has been made, the numbers don’t show it — Ukraine’s cumulative stock of foreign direct investment is a weak $40 billion or so since national independence in 1991, while it attracted only $4 billion last year, mainly from Russia, its top export and import partner as well.

“When we spoke with the World Bank, the European Bank for Reconstruction and Development and the European Investment Bank, we asked them to work closely with private sector, with municipalities, not just with the central government,” Danyliuk said. “This is a new thing.”

Danyliuk also has made inroads with top officials of U.S. President Donald J. Trump’s administration, including a spring meeting with Commerce Secretary Wilbur Ross, during which the discussion focused “primarily on how we can bring American companies to Ukraine, American money to Ukraine” to “exploit the potential of our market.”

Trump is looking at converting more financial aid to Ukraine — estimated at $360 million next year — from grants to loans on the philosophy that much of government-to-government aid is not used effectively. But of all forms of aid, helping Ukraine’s military is the most important right now, Danyliuk said. “This is what our country needs at this stage,” he said.

Ukrainian Finance Minister Oleksandr Danyliuk listens at a Kyiv Post CEO dinner on May 23. (Oleg Petrasiuk)

Self-sufficient economy

If the major reforms go forward in pensions, land, state-owned enterprises, law enforcement and health, Ukraine should be able to wean itself off international loans in 2019.

“By then we need to become economically self-sufficient,” Danyliuk said. He says people will not be satisfied for long with 2–3 percent annual growth rates. Ukraine, in fact, needs 6–8 percent annual growth rates in the next several years to catch up to its 2013 GDP high of $180 billion.

It’s entirely possible, even realistic, with the right changes, Danyliuk said.

“Look at our productivity levels. They are so low. Even by getting to the average productivity levels in Europe, our result will be stunning,” he said. “We need new technologies to exploit our competitive advantages that make us more productive.”

Before becoming finance minister, Danyliuk was an investor in the private sector.

As such, “my personal view” is that “Ukraine is not there yet” in terms of being an attractive place that offers “high returns and less risk” that all investors prize. While Ukraine remains “on the radar” of investors for many reasons, he said, it still hasn’t made the transition yet to a market economy. “At the moment, it’s not obvious (to investors) why you come to Ukraine,” he said.

Looking for breakthrough

Unhealthy distortions, inequalities and monopolies remain in Ukraine’s transition from Soviet to market economy, he said, stunting growth and investment.

“The fact that we privatized companies doesn’t mean we became a market-driven economy,” Danyliuk said. The transition requires effective regulation to create market conditions, an area where Ukraine continues to come up short, he said.

“We are freeing up sphere by sphere to be attractive to private money,” the finance minister said. “But in all spheres the job is not done yet — the energy sector and health care are not yet completed.”

In the electricity and natural gas sectors, there’s “always a regional monopoly that owns distribution networks,” Danyliuk said, including the outsized role played by exiled billionaire oligarch Dmytro Firtash, now fighting U.S. corruption charges from Austria.

“Naftgoz is a monopoly, from the market point of view, state or not state; it is a monopoly,” he said. Ukraine will become a market economy only when competitive conditions in place. Without them, any others interested in investing in the sector “will have a struggle.”

PrivatBank and others

With the state takeover this year of the nation’s largest private bank, PrivatBank, whose collapse could cost the taxpayers $5.6 billion or more, the state — specifically the Finance Ministry — is now the largest banker in the nation, when combined with state-owned Oschadbank and UkrExImbank.

Danyliuk went from direct to dodgy in answering questions about PrivatBank, specifically when a recently completed audit will be released publicly.

“The audit is done. It’s not approved. We’re working with it,” he said cryptically. “Eventually, the government as shareholders will need to put additional capital.” When asked whether the amount is $5.6 billion, he said: “We’re looking at such numbers.”

He cautioned not to “get so fixed on the audit. The fact we already put 116.8 billion hryvnias ($4.4 billion) in the bank. Isn’t it sufficient already for the taxpayers to raise the question of what happened in this bank? There will be some adjustments as a result of the audit. The key thing is what already happened.”

The money hasn’t been recovered and bank fraud charges haven’t been filed against PrivatBank’s former owner, billionaire oligarch Igor Kolomoisky, and none are expected given the sorry state of Ukraine’s law enforcement agencies and inability to successfully prosecute any big case.

No big tax changes in offing

Danyliuk said that there is no urgent need to make any other big tax rate changes, apart from the ones in recent years that cut income tax rates to 18 percent and payroll taxes to 22 percent.

In terms of stimulating investment, “reducing tax rates will not give you the result. Tax is important when you have no other barriers.” The key focus is on transparent and better administration of taxes, including the ongoing tranformation of the State Fiscal Service.

‘Team of reformers’

Danyliuk said the Ministry of Finance is “a catalyst for reforms” in the nation. “We have a team of reformers. We understand, in each area, what has to be done. We create conditions for reforms to happen. One of the most effective tools for that is called the state budget,” he said.

This will be the first year in which ministries will be asked to submit expenditure requests for “a real three-year horizon,” accompanied by a detailed outline of reforms anticipated by 2020. “We will allocate accordingly,” he said.

After the ministries submit their budgets, “then we will have a very pragmatic discussion” about priorities — especially reform priorities that need to be financed.

“Those for whom reform is a priority, they will get everything they need,” Danyliuk said.

National Bank of Ukraine Governor Valeria Gontareva and Ukraine’s Finance Minister Oleksandr Danyliuk arrive at the nationalization of PrivatBank press conference on Dec. 19 in the Ministry of Finance of Ukraine. (Courtesy (UNIAN))

Good guys ‘winning’

Looking at the big picture, the Kyiv Post asked Danyliuk whether the good guys or the bad guys are winning in Ukraine’s quest to be a prosperous democracy.

“We are not building a new country. We’re rebuilding the country,” Danyliuk said. “The guys are in battle. Of course, the good guys are winning, not as quickly as we wanted, with maybe more casualities. But winning.”

About Oleksandr Danyliuk

Oleksandr Danyliuk has a master’s degree in business administration from Indiana University. He worked in the private sector for several companies, including in McKinsey & Company’s London and Moscow offices for three years. Between 2006 and 2010, Danyliuk chaired the Rurik Investment fund. Danyliuk worked as an economic adviser to Ukrainian Prime Minister Yuriy Yekhanurov and, in 2014, worked as President Petro Poroshenko’s representative at the Cabinet of Ministers and later as deputy head of the Presidential Administration. In 2016, Danyliuk was appointed as minister of finance.

A look at Ukraine’s tax rates

Payroll tax – 22%

Value-added tax – 20% (7% for drugs, health care products)

Corporate tax – 18%

Personal income tax – 18%

Tax rate for dividends, royalties, interest and investment income – 18%.