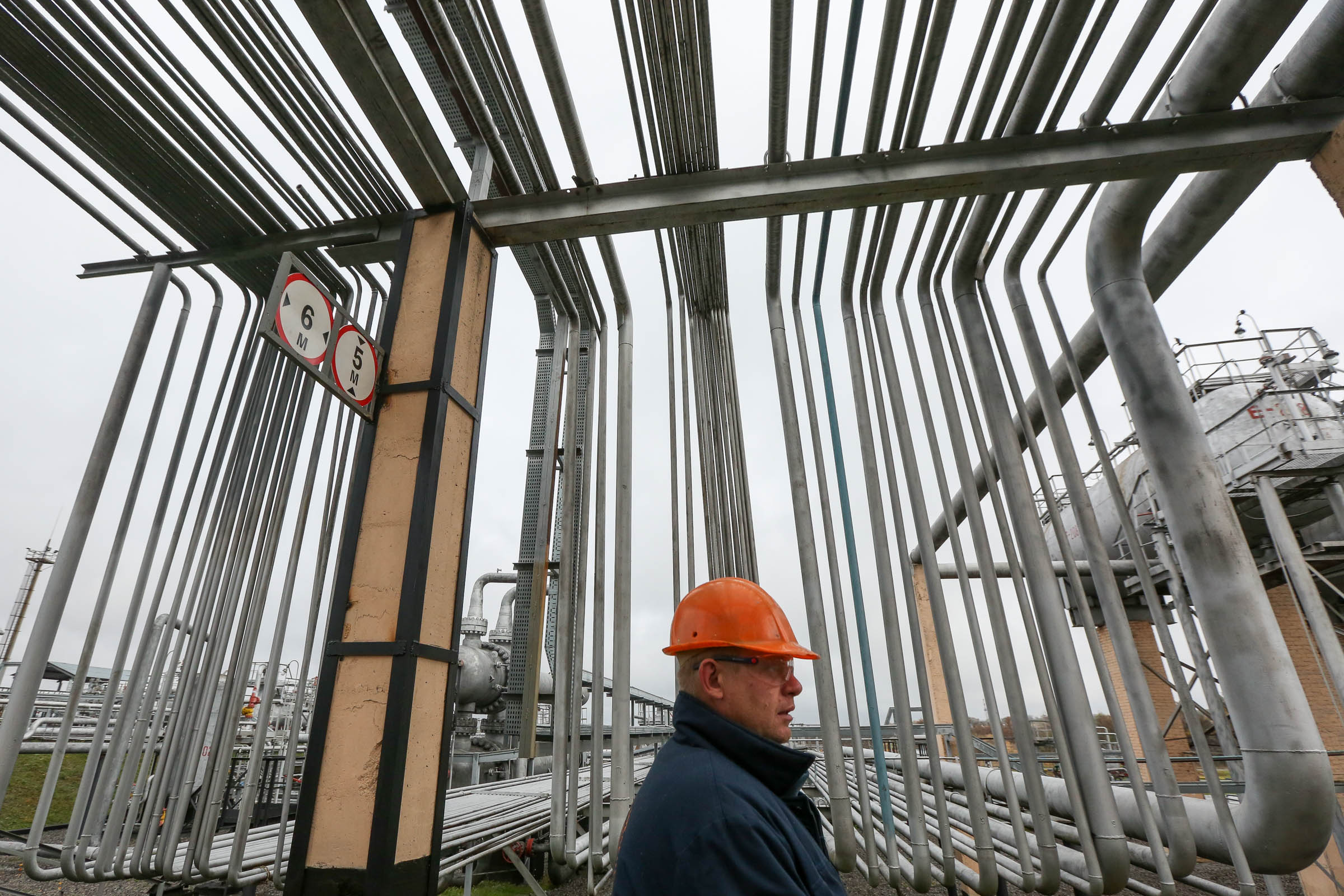

POLTAVA OBLAST, Ukraine – Ukraine’s state-run gas extracting giant UkrGasVydobuvannya, known simply as UGV, is on the up.

Its daily output on Oct. 7 was 43.1 million cubic meters – the highest since 2009.

But the firm could find it hard to top that record, as to drill more wells to expand production, it needs more drilling permits, and the local authorities in the regions of Ukraine richest in gas are not cooperating.

UGV is meeting the fiercest resistance in Poltava Oblast, dubbed “the Ukrainian Kuwait,” and Kharkiv Oblast, the gas fields of which together produce 95 percent of all the natural gas extracted in Ukraine, according to the Association of Gas Producers of Ukraine.

UGV has been refused exploratory drilling permits 63 times by the Poltava Oblast council since 2016, according to Andriy Zakrevsky, owner of the Newfolk oil and gas consulting center. Previously, during the rule of ex-President Viktor Yanukovych from 2010 to 2014, gas extraction licenses were awarded in a completely non-transparent manner, Zakrevsky said.

For example, Mykola Zlochevsky, Ukraine’s former ecology minister (2010-2012), allegedly used his ministerial power to gain access to oil and natural gas extraction licenses for his private company Burisma Holding.

“Yanukovych used to point where to drill and who would do it, but now no one is giving any orders, so currently the local authorities are using this to their own benefit,” Zakrevsky said.

Officials from the Poltava Oblast council say they do not have to check the reputations of the companies to give permits, since before that they have to undergo checks to gain a license from the State Service of Geology and Mineral Resources of Ukraine.

“It will take more than one or two years from the moment the permit is granted to the moment the first gas is extracted, but we need the money now, as the company pays Hr 8,000 per square kilometer of rented area to the budget,” said Evgeniy Holod, the deputy head at Poltava Oblast council, in comments to Radio Free Europe/Radio Liberty.

However, according to UGV’s calculations, if the company obtained licenses, the rental payments to the local budgets of Poltava Oblast could reach Hr 1 billion, or $35 million, by 2021.

Poltava Oblast Council told the Kyiv Post it would not give more special permits to UGV as the company already has more gas drilling plots than any other company – 24 out of 99. Plus, the council said it has received a lot of complaints from local people about environmental pollution caused by drilling waste and roads being damaged by UGV’s heavy vehicles.

UGV denies causing environmental damage, as the company drills wells using environmentally friendly methods, in which drilling waste is carefully collected and buried in landfills, even though it can be used to make, for example, paving slabs.

On the other hand, over the past four years, a large number of permits have been awarded to newly created companies that have not produced any gas and have done nothing to increase Ukraine’s total production, according to Andriy Gerus, an energy expert.

Until a new, more transparent auctioning system comes into usage from early 2019, there is still a chance to get hold of more gas fields under the old, non-transparent schemes, experts say. And since Poltava Oblast is extremely rich in gas, many companies connected to Ukraine’s oligarchs are trying to snap up as many drilling permits as possible.

“During the last meeting of the fuel and energy commission, representatives of companies that wanted to obtain permits did not even know the names of their own CEO’s,” said Tetyana Donchenko, a member of the public council at the Poltava Oblast council, according to Radio Free Europe/Radio Liberty.

On the other hand, Poltava Oblast council granted permits for gas extraction to five firms linked to Russian oligarch Pavlo Fuks on July 12.

For example, East Europe Petroleum, allegedly one of Fuks’ companies, although he himself denies it, gained another 10 plots for gas extraction in Poltava Oblast in July.

So far neither UGV or any other companies have taken any legal action against Poltava Oblast council for its decisions.

“Apparently, if the company sues, then it will not get anything at all in future,” said Zakrevsky.

Not enough gas

In 2017, UGV extracted 15.2 billion cubic meters of gas, or three quarters of Ukraine’s overall gas output.

But that is still not enough to meet the country’s demand of 32 billion cubic meters per year. Since Russia launched its war on Ukraine in the Donbas in 2014, Ukraine has switched to importing the shortfall volume of gas from Poland, Slovakia, and Hungary.

In addition, Ukraine has 1.1 trillion cubic meters of proven reserves of gas – enough to cover Ukraine’s consumption needs for at least 54 years, according to BP’s Statistical Review of World Energy made in 2018.

UGV, Ukraine’s main gas producer, regularly accused of corruption in the years before Ukraine’s Euromaidan Revolution, is trying to clean up its reputation since its new management came in in 2015: carrying out all of its procurement tenders through the electronic public procurement system ProZorro since then. It has also been investing billions of dollars into drilling wells.

“The company plans to drill around 90 wells this year, and 131 next year,” said Mykhailo Paduchak, head of UGV’s drilling department.

New wells, old problems

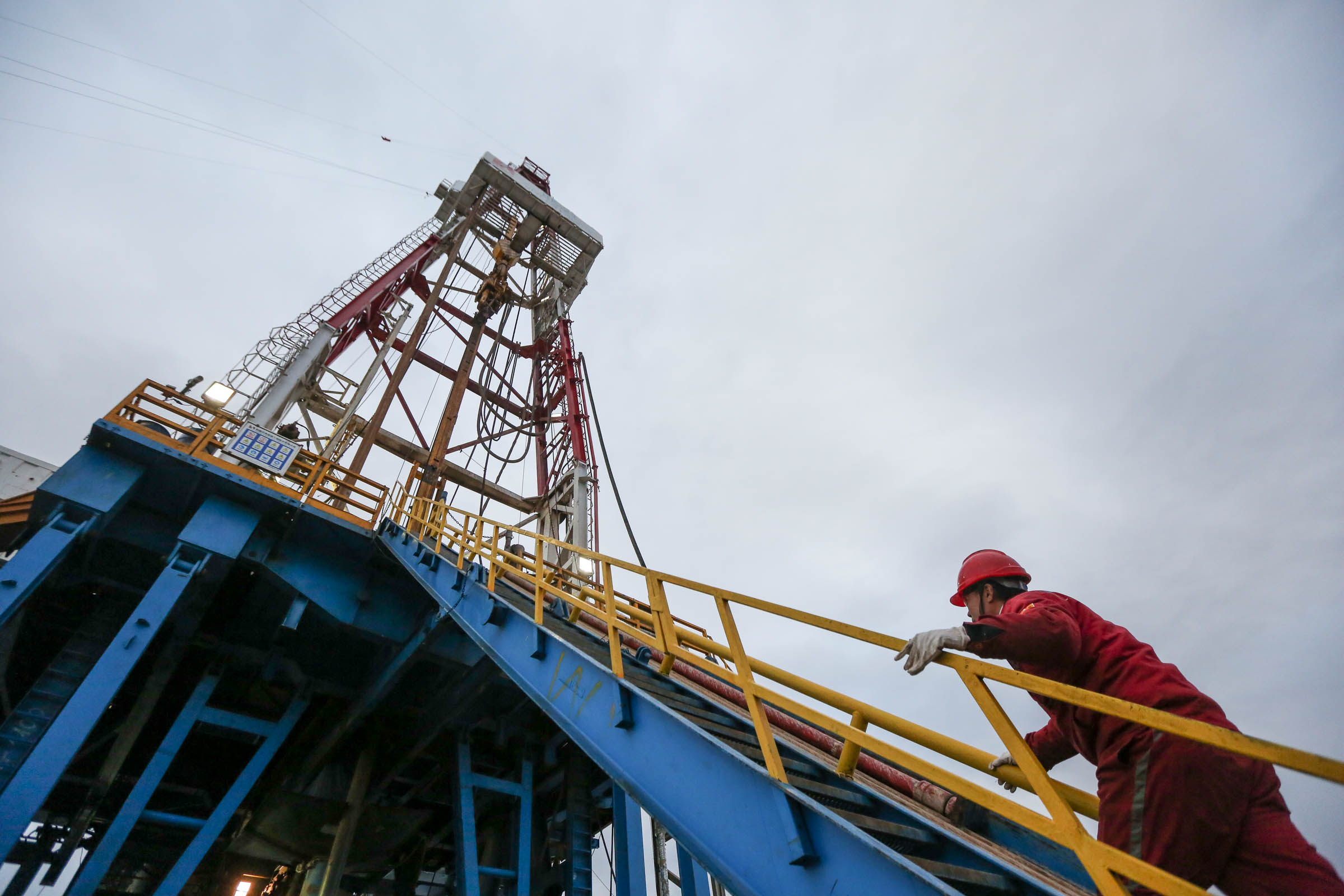

The number of UGV’s wells started to increase only this year, when it brought in external contractors – Croatia’s Crosco, China’s Baiken, and Ukrainian company Spetsmechservice.

Altogether, the contractors have already drilled ten wells for UGV, and another eight are in process.

“Involving contractors is a temporary step of around two years for UGV, which helps it extract gas faster and compensate for the growing needs of the country in the energy sector,” said Paduchak.

As well as a big uptick in well-drilling speeds, the domestic gas industry is benefiting from experience exchanges, as on average half of the workers at Crosco and Beiken are Ukrainians.

Earlier, if a single gas well would take three years, or 1,100 days to drill: Now it takes 100-110 days.

The Chinese company can drill even faster.

“Baiken is ahead of schedule for drilling a well for UGV within 12 days, then we’ll move to another place – Gadyach in Poltava Oblast,” said Zhazar Toktabolat, drilling supervisor at Integrated Engineering Solutions, a Kazakh company that provides operational project management solutions for UGV.

But despite all the visible progress, Paduchak is still not happy enough with UGV’s drilling volumes: “We really could drill more, but problems with obtaining licenses and permits stop us from doing so,” he said.

Another big drag on Ukraine’s drilling progress is a lack of labor – UGV can’t compete with the wages on offer in the oil and the gas-rich Middle East.

“A driller earns Hr 12,000-16,000 ($430-570) in Ukraine, while in Saudi Arabia he can earn $5,000,” said Paduchak.

Offshore licenses

Another concern for UGV is the difficulty it has in obtaining offshore drilling licenses.

Back in 2017, UGV planned to start extracting natural gas from five licensed areas on the Black Sea shelf, where reserves vary from 80 billion to 300 billion cubic meters.

Despite the fact that drilling an offshore well is 16 times more expensive than drilling one on land, (the cost is about $80 million), Paduchak sees a huge opportunity for Ukraine to become energy independent if it can tap these fields.

“Gas production at sea can be three times more efficient than on land. In Ukraine’s situation, (not exploiting offshore gas fields) simply looks like freezing for lack of firewood when you live in a forest,” said Paduchak.

Exploiting offshore gas fields could add 5 billion cubic meters of gas per year to extraction totals for the next 30 years, UGV estimates.

However, the State Service of Geology and Mineral Resources of Ukraine has refused requests from UGV to grant it permits to drill offshore. The service said the company could only obtain the permits if it took part in an auction for them.

Meanwhile, after the Kremlin seized control of the Ukrainian territory of Crimea in 2014, it also deprived Ukraine of access to some of its own gas fields in the Black Sea.

In particular, Russia seized Chernomorsknaftogaz, owned by Ukrainian state company Naftogaz, together with its fields, where the company was producing natural gas and oil, both on land on the peninsula and on the Black Sea shelf.

The Kremlin seized eleven gas fields with total reserves of 58.56 billion cubic meters, according to the Investigative Journalism Center.

“Russia behaves completely like an invader occupying territory, stealing our property and benefiting from illegally annexed gas fields, using this gas for its own needs,” said Paduchak.