Ukraine is still not a car culture, but it’s trying.

Demand for new cars in Ukraine is up so far this year. Since car sales closely track with economic growth, this is a good sign for the nation. Even better news: Growth in new car sales is likely for years ahead.

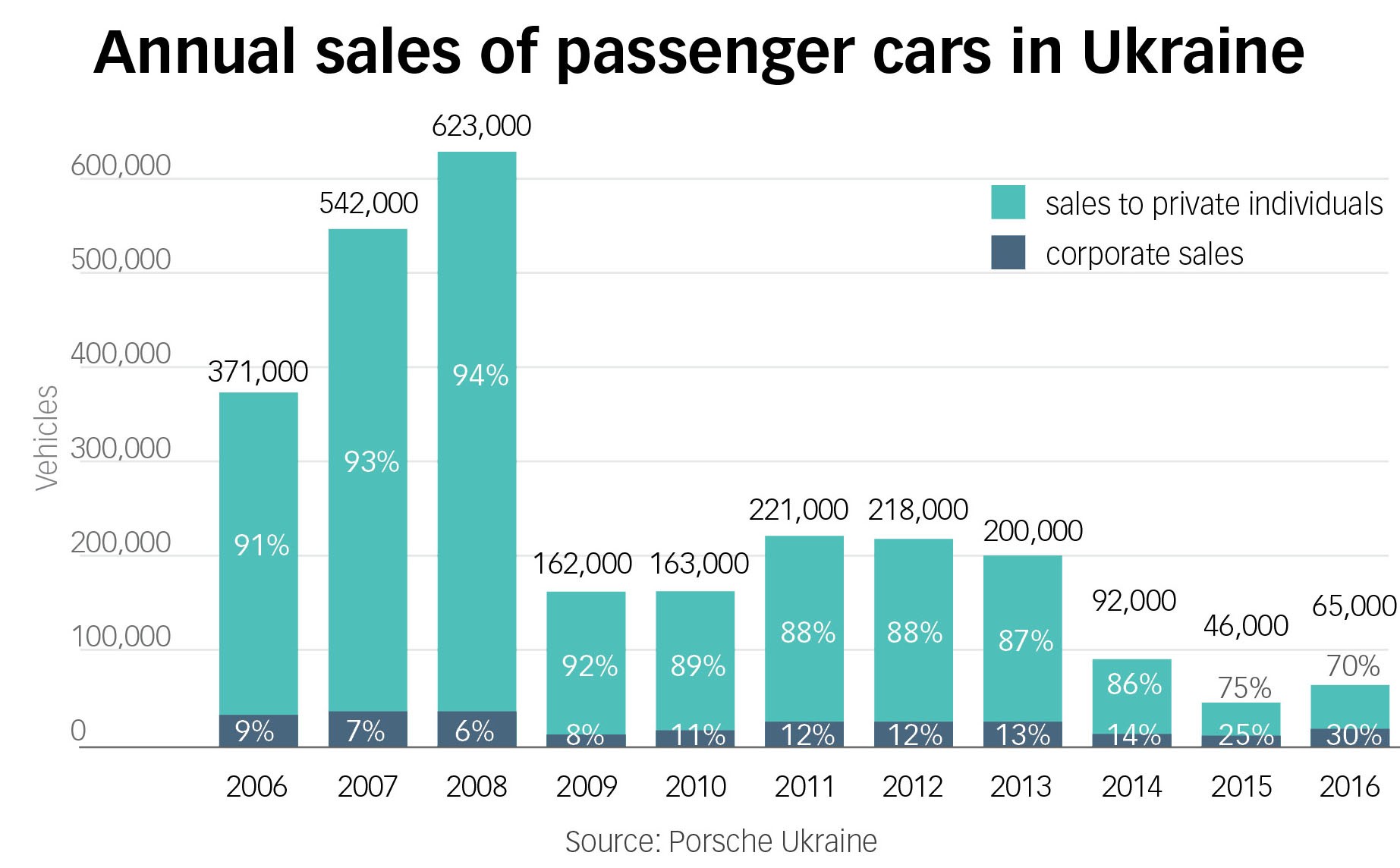

But new car dealers are still climbing out of a sales trough that hit hard in 2014. For them, the golden year was 2008 – when new car registrations topped 600,000 vehicles – and they haven’t seen a year like it yet. Last year clocked in at 70,000 new car registrations.

Another wrinkle showing car buyers are trying to economize: The used car trade accounts for 90 percent of all vehicles sold.

Applying brakes

In 2008, Porsche entered the Ukrainian market motivated by a hope that the country was about to become a major part of Europe’s commercial landscape. But it soon became clear that the record pre-crisis sales were the result of cheap lending that has mostly dried up since then.

When the credit bubble burst amid the global financial crisis car sales – mirroring the drop in gross domestic product – fell off a cliff. Just 175,000 new cars were registered in 2009.

“In 2007 and 2008 we expected Ukraine to become a serious player on the European market,” Josef Graf, the managing director at Porsche Ukraine, told the Kyiv Post. “There was a quite significant orientation in the country toward European values and European business. But everything developed differently than expected.”

A view of a Kyiv car lot at ALD Automotive, a specialist in corporate leasing and fleet management. The company is seeking to expand its presence in the used car market, where 90 percent of all vehicle sales in Ukraine take place. (Kostyantyn Chernichkin)

Recovery came only to be interrupted by the 2013–2014 Euromaidan Revolution that toppled President Viktor Yanukovych and Russia’s war against Ukraine, now in its third year with 10,000 people killed.

Confidence returning?

With the hryvnia finally stabilizing after shedding two-thirds of its value since 2013, car dealers say consumer confidence is returning. But with purchasing power still low, most people are looking to buy used cars from each other.

Still, this has created new opportunities for car dealers.

One of them is ALD Automotive, a major international player whose core business is corporate leasing and fleet management.

That market, however, is relatively small, so the company is now seeking to increase its presence in used-car sales. It does this chiefly by auctioning off cars to local resellers once their corporate customers have returned their leased cars.

“The big potential for resellers today is to concentrate on the used car market,” Pierre-Vladimir Joliot, general manager of ALD Automotive Ukraine, told the Kyiv Post. “We have the possibility to differentiate our cars from what exists on the market because these cars have a clear and clean service history. We are providing a stamp of quality and compliance. This means the dealers who buy from us, they are able to sell used cars even in showrooms and offer them as alternatives to new cars.”

According to Joliot, many of the used vehicles being sold today in Ukraine are the same cars that were purchased new at the peak of the market in 2008.

“This is exactly what happened in Russia after the crisis of 2008 and if you look to western Europe, this is also what happened. Dealers in the 1950s were selling only new cars and in the 1980s they were selling used cars as well.”

Driving forward

Beyond the horizons of the Ukrainian market, the automotive industry is on the verge of serious disruption.

Car bans in certain areas of major European cities like Oslo, Paris and Madrid are presenting new challenges to manufacturers intent on keeping sales figures healthy. Purchases of electric vehicles, meanwhile, continue to rise and car sharing schemes are appearing in a growing list of locations.

In Ukraine however, those trends have yet to materialize in any meaningful way.

“Consumers here have different demands,” said Porsche chief Graf. “There is still a high need for mobility solutions, but at the same time we cannot implement the more ecologically oriented solutions that we see growing in Western Europe because of a lack of infrastructure.”

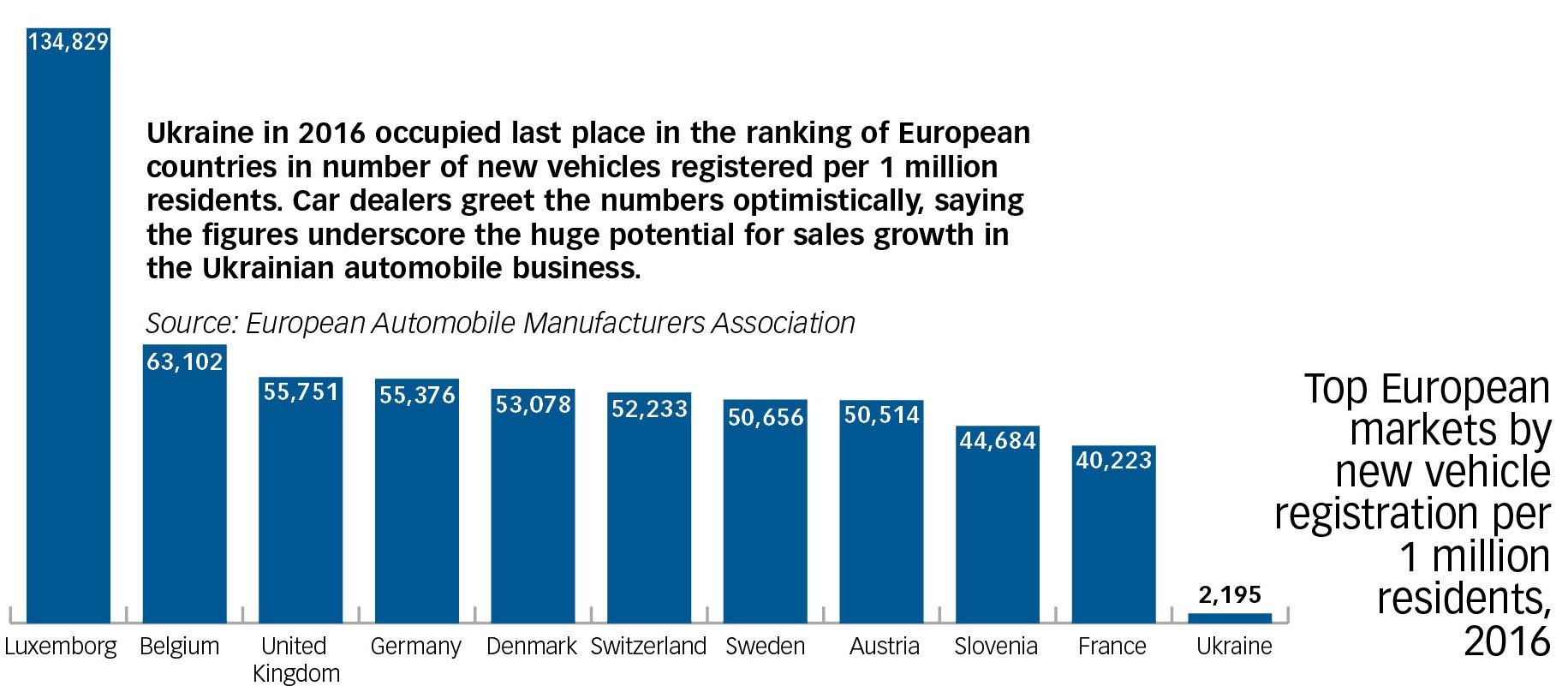

For Graf and other market players, it is the “motorization grade” which provides the key indicator for car-buying potential. This metric measures the number of vehicles in use per 1,000 inhabitants. In Germany, the figure is over 500 and in the U.S. it hovers around the 700 mark.

In Ukraine it is estimated to be around 200 vehicles per 1,000 residents, a number that tantalizes car dealers as a sign that there remains plenty of untapped demand.

“We have so much headroom,” according to Petro Rondiak, head of the management board of Winner Group Ukraine. “It’s a big country. Ukraine has a lot of resources, an educated workforce. It’s the land of perpetual potential. If it was really unleashed by a true judicial system and regulation, then this country would take off.”

When it comes to the need for better regulation, Joliot agrees.

He believes that without changes to the law, vehicle ownership will remain a priority for many consumers and alternatives now gaining ground in others part of the world will not take hold.

By way of comparison, Joliot points to Moscow, where a car-sharing scheme was launched in September 2015. Stricter traffic rules and enforcement of illegal parking created the right incentives, he said. Those same incentives are lacking in Ukraine.

“If you look to a city like Kyiv where everyone can drive how they want, park where they want and there is no police control, car sharing will never appear,” Joliot said. “If there is no evolution in the way transport is organised and controlled in Ukraine, it will never change.”