The hrvynia’s loss of two-thirds of its value since 2014 also depressed the commercial property market.

If there’s good news, it may be that the market has hit rock bottom and has nowhere to go but up as the economy stabilizes and returns to expected growth.

Today, however, Kyiv has lots of unfinished buildings and vacant construction sites with no potential for being developed in the foreseeable future. Although Kyiv has seen a significant increase in commercial space delivered in 2016–2017, the projects were started before 2013.

Nick Cotton, managing director of Kyiv office of Cushman & Wakefield, talked to the Kyiv Post about how transparency and introduction of a vacant property tax might spur development in Kyiv. The real estate consultancy is formerly known as DTZ. The two global companies merged in 2015.

Kyiv Post: When are we going to get to a functioning property market in Kyiv?

Nick Cotton: The property market does function, but it’s obviously very depressed. One of the reasons is the absence of bank finance. So to build purely out of equity is a brave move. The risk to invest into development is even higher in an uncertain market like the Ukrainian one, where all costs are fi xed in dollars or euros, but revenues are most likely to be in hryvnia. It’s not so unusual for Central and Eastern Europe to have a higher degree of opacity than in U.K. or the U. S.

In Ukraine, there isn’t any statutory database of transactions of ownership or an objective assessment of the quality of buildings. On one hand, this opacity makes our role as experienced real estate consultants more important because we know the market and its players. However, we would prefer to see more transparency.

KP: How would Ukraine benefit from more transparency?

NC: The main shortcoming of opacity is that it reduces the confidence of potential developers and investors into real estate on top of country’s risks and relatively low GDP (gross domestic product).

Enhanced investors’ confidence… could potentially have a trickle-down effect. More transactions, more liquidity on the market, development starts moving ahead.

I don’t think there has been any governmental drive to resolve this issue. I?think there are bigger challenges Ukraine’s administration is currently facing than transparency on the real estate market. At the end of the day they probably view operations on real estate, of ownership or transactions, as private matters between the parties involved, and therefore why should there be transparency?

KP: There are so many vacant buildings all around the center of Kyiv.

NC: First, we must make a distinction between buildings and land. There are a number of undeveloped land plots in and around Kyiv which were disposed of to developers between 2004–2008 on short-term leases for 10–15 years.

What we saw was that many of those developers speculated on land, trying to secure development rights without actual developing. They were holding them in anticipation of value growth so that they could sell their lease rights.

As for unfinished buildings, the reasons vary too. Very often parts of those buildings are in third party control or ownership, and it frustrates the development of a larger plot. Typically, developers own the buildings but the land plot would be allocated for the use of the building, not owned or leased. It basically means that the holding cost is very low, whilst the cost of the land lease has gone up over the course of last three-four years.

KP: Would you favor property tax system based on assessed market value?

NC: I think it would stimulate the transfer of a lot of those properties. But who is going to assess market value? Ukraine doesn’t have infrastructure that would allow to do it on such a massive scale. There would have to be statutory basis for such tax, and it would take many years to implement. Also I would have concerns that there would be opportunities for manipulation, particularly for larger buildings. Evaluation is extremely subjective, and especially on a such an immature market like Ukraine that lacks transparency and liquidity.

Another problem is what to develop them into.

KP: Is residential property market more robust than commercial?

NC: Yes, it is far more outstripping all forms of commercial development. All of the land plots that we’ve been involved in the sale over the course of last 18 months have been for potential residential development. The developers are buying land plots presently zoned for commercial construction with the purpose of converting them into residential.

The cost of residential development is significantly lower than of commercial one. In addition, the sales may start on the development phase. Ultimately, apartments have a higher degree of liquidity than, let’s say, shopping centers. With the latter you have to build it, lease it, hold it for three years for maturity, and only then try to sell as a whole for a price of dozens of millions dollars.

There’s also a real appetite for new residential build in Kyiv. Many citizens would prefer to live slightly farther but in a new building rather than in an older one but in the city center.

We see that most of the residential property developers focus on smaller-sized flats in the city center. Gone are the days of huge 100–200 square meter apartments, today the average size is 60–85 square meters. This also keeps the liquidity together since many purchases are often is a form of investment when one doesn’t trust banks.

KP: What is the current situation on commercial real estate market?

NC: Whilst the offi ce market is improving in terms of rising space occupancy, the vacancy is still very high, 15–20% according to our data. Therefore, rent rates are still low, so today it’s not financially viable to build and deliver new office property.

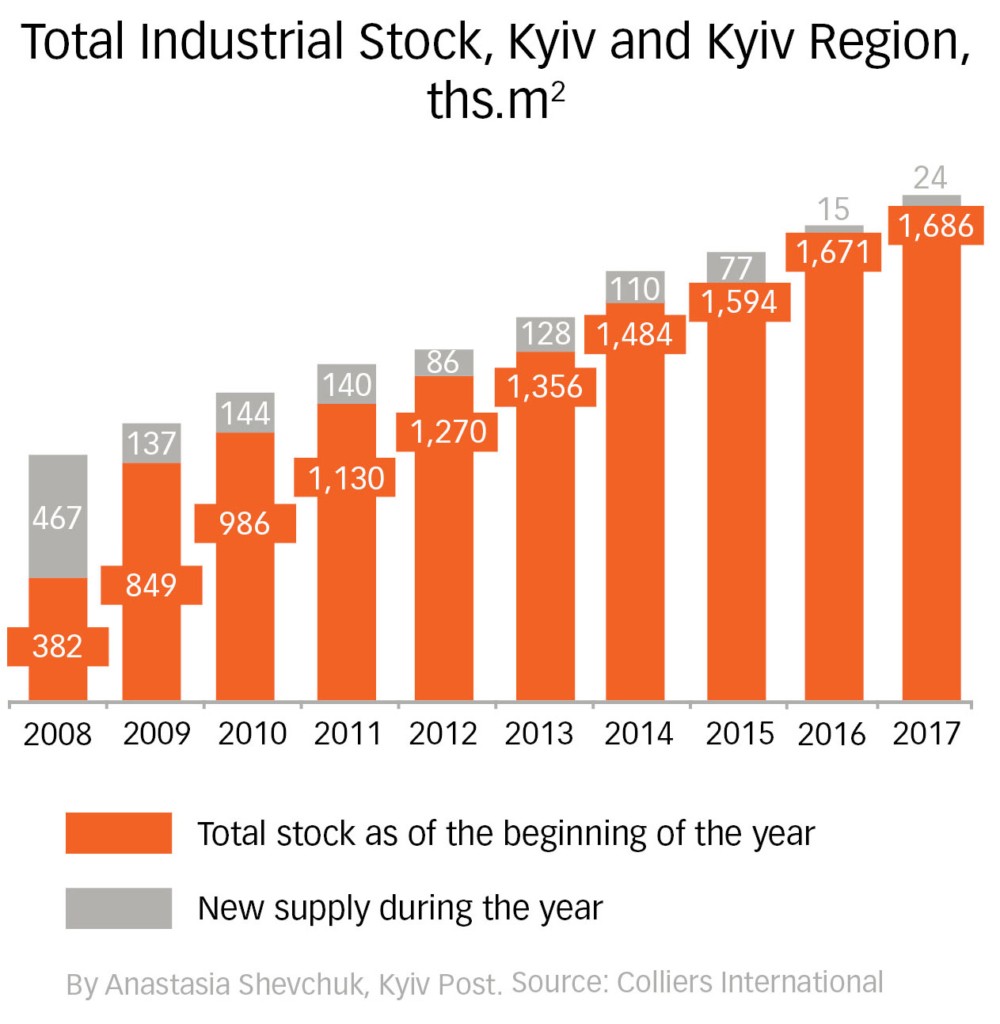

At the moment office space in Kyiv amounts to 1.8 million square meters, mostly legacy development from 2012–2013. Recently it has become harder to find smaller offices in the center. There aren’t any large projects ongoing, and it allows to suggest that we will continue to see vacancy going down.

KP: Retail space development seems to be more robust than office.

NC: Retail is certainly seen as a riskier investment. Unlike office market, whose rents are fixed in dollars, retail has become more hryvnia-based. Under massive currency devaluation and drop in population incomes, many shopping centers had to adopt rents in hryvnia, and retailers restricted their capital expenditures. It became more expensive to open new stores.

KP: In the West, shopping centers and malls are struggling by virtue of e-commerce. Ukraine seems to have opposite trend. Three malls opened in Kyiv last year, a dozen others are in pipeline.

NC: I don’t think there will be any collapse on the retail property market to the point when we see malls turning into ghost towns. Yes, we see a lot of projects, but it’s a long-term pipeline, and a lot of them are frozen so highly unlikely to suddenly oversaturate the market.

What I see is that increasing e-commerce is starting to have an impact on Ukraine too. It will primarily impact the positioning of malls. The global trend is malls becoming places for socializing. More progressive centers always look to ways to extend visitors stay time by offering more amenities.

I think, with careful and considered positioning that suits their audience, Kyiv malls can be very sustainable, be it a convenience mall in a high-density residential area like Pyramida, acquired by Dragon Capital, or a destination mall like Ocean Plaza.

KP: What will happen to hotel and logistics property market in the nearest future?

NC: I think there’s going to be more attention to affordable business travel. We forecast growth in three-star hotel and boutique hotel segment. Next month Radisson opens Park Inn. There are plans to open a new Ibis in Podil. As for logistics, I?think it has bottomed out. Rents used to be $10-$12 per square meter in 2008. Today $4 is considered good.