Several lockdowns and quarantine measures have pushed many companies to switch to remote work or move to smaller offices to save money.

As a result, the vacancy rate in Kyiv, Ukraine’s busiest city, doubled to 11% by the end of 2020. This is a record high figure since 2014 when almost one-fifth of offices were empty.

“The number of relocations is amazing,” said Andrii Todorov, lease manager at the Illinskyi business center.

In Lviv, the busiest city in western Ukraine, the situation was even more dramatic — the office vacancy rate soared from 2% to 25%.

On the other hand, with lower demand, rental prices go down. Kyiv’s premium class offices, offering top-of-the-line spaces and amenities, reduced rental rates by 15% to $26 per square meter.

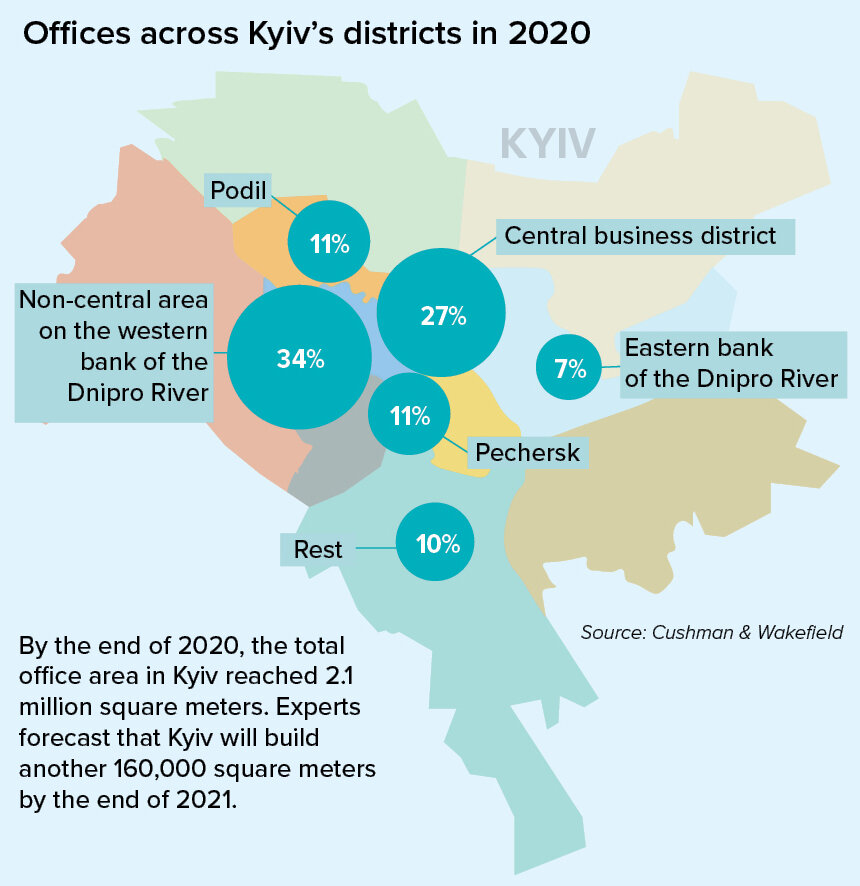

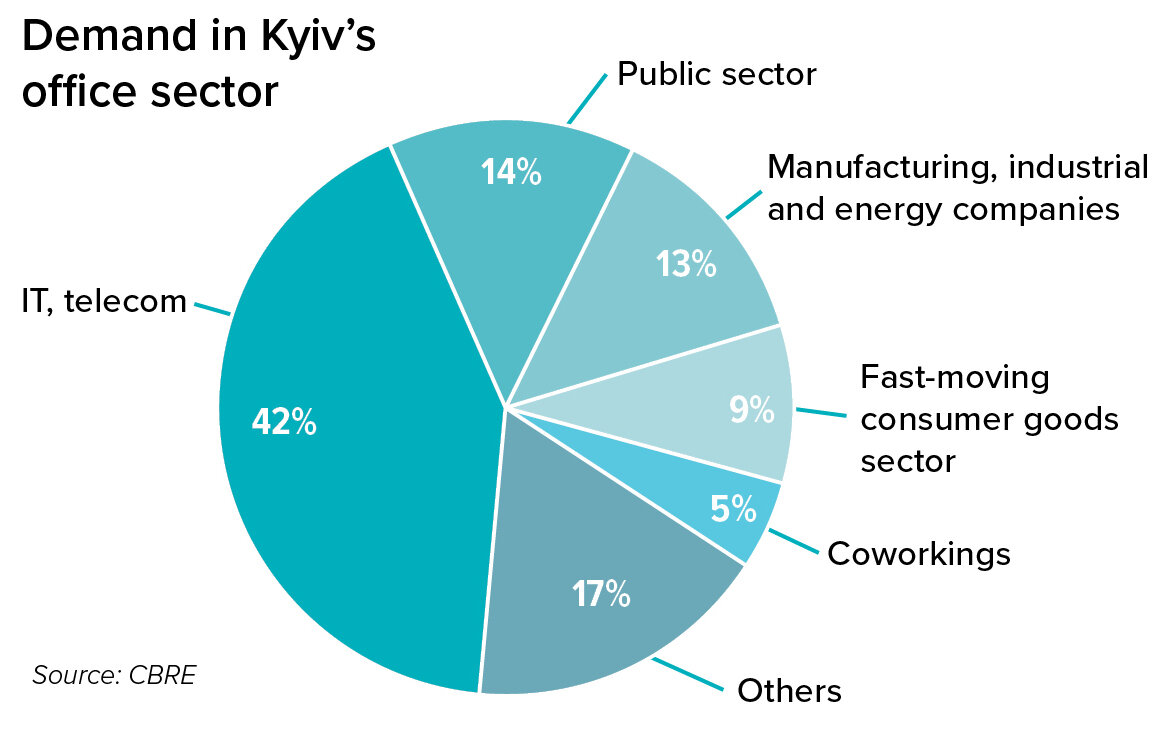

The gross leasing activity in 2020 — also known as take-up — exceeded 125,000 square meters. The information technology sector is driving new demand, accounting for 42%. Kyiv has about 2.1 square meters of office space.

In simpler offices, the price fell by almost 20% and ranged between $11–19 per square meter, according to Alexander Nosachenko, managing director at Colliers Ukraine, a commercial real estate services company.

“The market took the side of the tenant,” said Nosachenko.

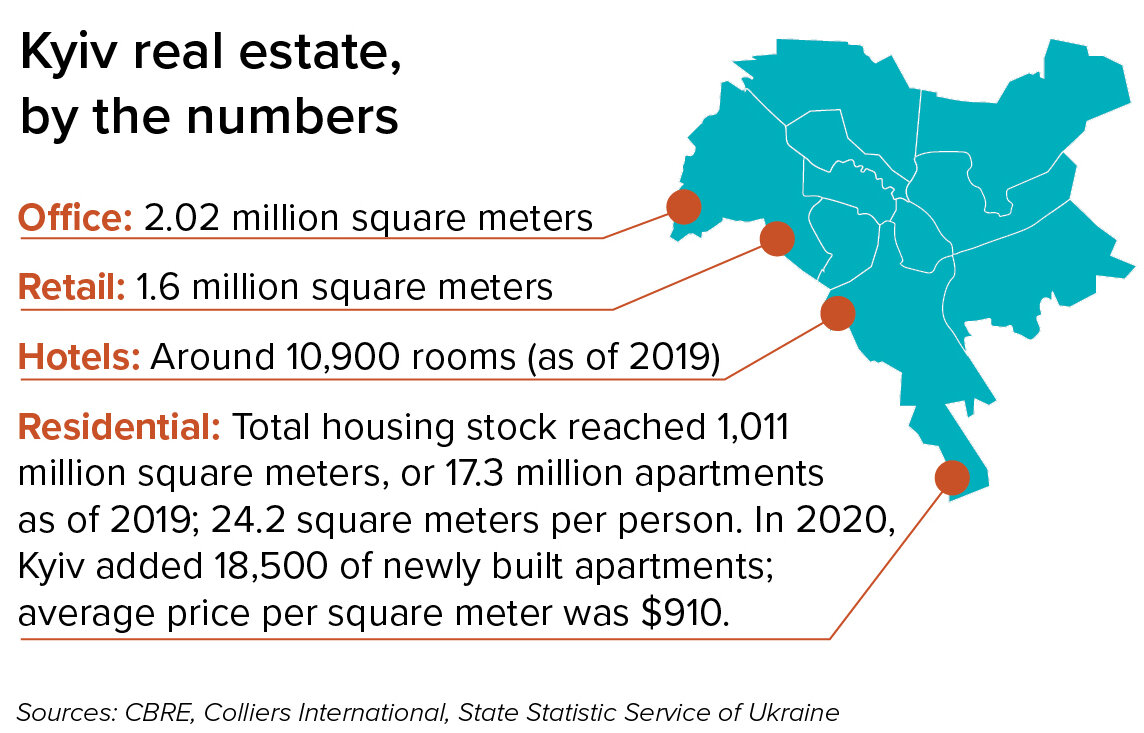

Overall, by the end of 2020, Kyiv’s office market reached 2.02 million square meters, something that Polish capital Warsaw had in 2004.

The largest new business centers in Kyiv include Platforma (19,500 square meters), Avenue 53 (18,500 sqm), Forum Park Tower (11,500 sqm), and M8 (11,000 sqm).

However, due to weaker economic activity and reluctance of developers to enter the office market during the coronavirus crisis, the city added only 125,000 square meters of new spaces — half of what was initially scheduled, according to real estate analyst CBRE Ukraine.

Kyiv will have constructed 160,000 square meters — or about 30 soccer pitches — of new offices by the end of 2021, as forecast by experts from the Cushman & Wakefield real estate consultancy.

Trends and influencers

Over the past three years, the IT industry has been driving the demand in Ukraine’s office market.

Growing by 20–30% annually, tech companies occupied nearly half of what was leased in Kyiv in 2020–54,000 square meters, Colliers reported. Tech companies usually rent more than they need to ensure they have enough space when they hire more people.

In 2020, many tech companies switched to remote work or to work-from-anywhere, or desk-sharing format, C&W report said.

As a result, the hot-desking trend, when workspace can be used by different people at different times, as well as increasing sanitary measures in offices were among the most demanded.

“The practice of 2020 has shown that offices are perceived, first of all, as a place of collaboration,” said Nosachenko. “Typical old-style office space will inevitably become obsolete,” CBRE report read.

In 2021, CBRE analysts expect that the market in Kyiv will add 29,000 square meters of flexible space to the market.