In 2016, when Ericsson, the Swedish multinational telecommunications company, acquired Ericpol, a Polish software company with a branch in Lviv, they knew that expanding their work in Ukraine was a good idea.

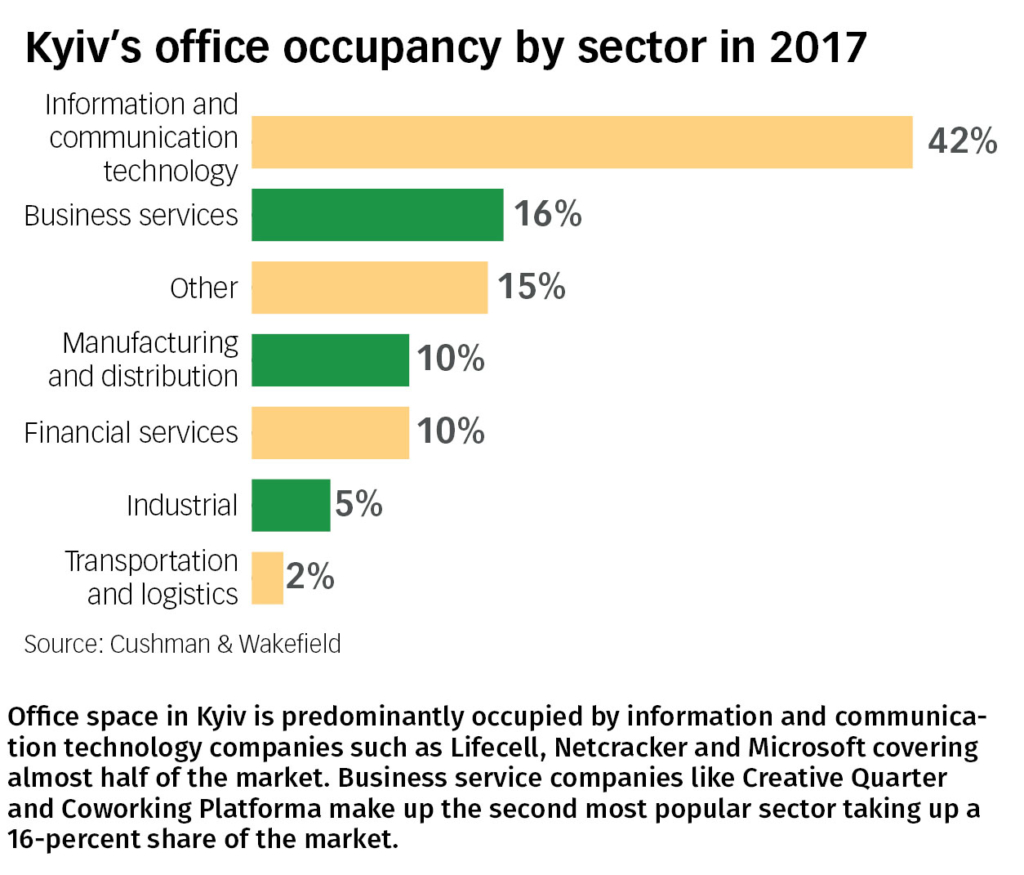

Like many other multinational companies, Ericsson was attracted by Ukraine’s surplus of information technology talent, and wanted to set up a research and development center. IT is a booming market, accounting for an estimated $3.2 billion — or 3.3 percent — of the nation’s annual economic output.

“Ukraine is an important market for Ericsson,” Iryna Shadeyko, Ericsson’s communications manager, told the Kyiv Post. “Our Lviv engineers have a high degree of competence in software and product development.”

But, as a Swedish company, Ericsson had a list of requirements. Buildings needed to meet “Swedish standards of quality,” Olesya Semerenko, Ericsson’s facilities manager, said. That meant meeting 83 pages of technical requirements about the building’s lighting, ventilation and utilities.

Offices had to be comfortable and support “ergonomic design.” That was a tall demand for Ukraine’s landscape of hastily-erected business centers and moldering historic buildings.

But one law firm — Alcor — has made the office needs of international R&D centers into a profitable enterprise. With its slogan “Your own R&D center in Ukraine,” the firm now services international businesses who want to set up an IT office in Ukraine — either for tech support, or as a research and product development center.

Demand is growing, says Dmitry Ovcharenko, Alcor’s head, but finding quality real estate is difficult.

Happy IT workers

Ericsson isn’t Ovcharenko’s client. But, with eight years in the business of finding office real estate for IT companies, he’s received his share of very specific requests.

“We had one client who insisted on an office only in the area of the metro of Lva Tolstoho. Only in that district. They could pay any kind of money, but only there,” he said.

Another IT client was sure they’d be a “unicorn” — a startup company valued at more than a billion of dollars — in a year. They gave Ovcharenko a list of criteria, he said, and told him if they liked the building enough, they were prepared to “push out” all its other residents.

Over-the-top as these requests may seem, Ovcharenko says there’s a reason behind them.

“IT talent is the only resource that U.S., North American companies are interested in in Ukraine,” he says. “They need to fight for it. One of the instruments of this fight are cozy and comfortable offices.”

That said, Ovcharenko characterizes most of his client’s demands as pretty standard: A-class real estate, in a downtown business center like Leonardo or Gulliver.

With few new developments, office space is getting increasingly hard to find in downtown Kyiv. (Photo by Volodymyr Petrov)

Affordable property

In many ways, these offices are a good deal for international clients, as high-quality real estate is relatively inexpensive in Kyiv compared to other European capitals.

Data from JLL, a real estate services and investment company, puts the average price of A-class real estate at $348 per square meter per year — less than a quarter of London’s prices, though slightly more than office space costs in Warsaw and Budapest.

Meanwhile, landlords are happy to accommodate client demands, renting them smaller parts of a floor of a business center. They prize international clients, says Ovcharenko.

“IT companies in Ukraine experience really aggressive growth,” he said. “They start with 10 people… but by the end of the calendar year they might rent the whole floor.”

Alexandra Globina, head of JLL’s office group, agrees.

“Landlords highly appreciate foreign tenants, since they are stable and reliable partners in the long-term perspective,” she says.

Trouble brewing

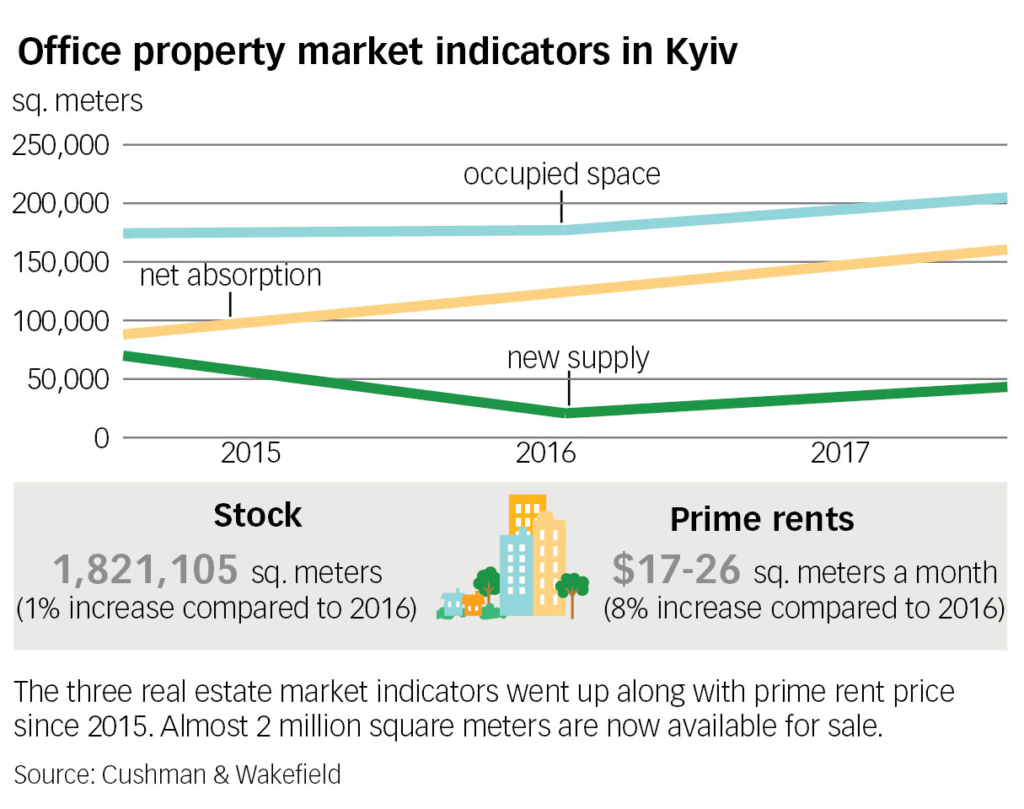

Although landlords are friendly and prices are low, costs are moving up. The average rent price — $348 per square meter per year — has crept up for the first time in five years, according to JLL. In the last quarter of 2017, the average price was just $336 per square meter per year.

The increase, while small, signals a shortage of good real estate. JLL puts office vacancy in Kyiv at 10.6 percent, “a record low in a decade.”

Nick Cotton, a partner at Cushman and Wakefield, a real estate services company, says the vacancy rate is more like 6 to 7 percent.

For Alcor, this has meant a major business slowdown.

“Some years ago, given two or three weeks, we could come up with a few good solutions,” says Ovcharenko. “Now, it takes us two or three months to secure an office. Sometimes longer. Four months. Five months, in some cases.”

Limited space

The reason, according to Ovcharenko and Cotton, is straightforward: there are few new offices being built. With no credit options in Ukraine’s market, developers who want to build real estate have to finance it entirely by themselves, says Cotton.

And with Kyiv’s rent prices at a flatline for the past three years, that’s not an appealing path, says Cotton.

Ovcharenko believes that some solution is coming. He points at UNIT City and Lviv IT district, two large developments designed to house Ukraine’s growing IT industry.

At 300,000 square meters, UNIT city can house hundreds of IT companies, says Ovcharenko.

But it isn’t enough. Lviv IT City, he says, is already entirely pre-leased.

“There’s still a big need for other developers. We need more real estate premises. Not just in Kyiv, but in all big cities,” he says.