The number of complaints filed to the Business Ombudsman Council in Ukraine has increased. Among those complaining, most are dissatisfied with the work of State Fiscal Service, law enforcement authorities and local municipalities.

Most of the complaints come from small or medium-sized manufacturers, wholesalers, distributors, agribusiness, real estate and telecommunications market players, as well as individual entrepreneurs. They are based in Kyiv and Kyiv Oblast, Odesa, Dnipropetrovsk and Kharkiv regions.

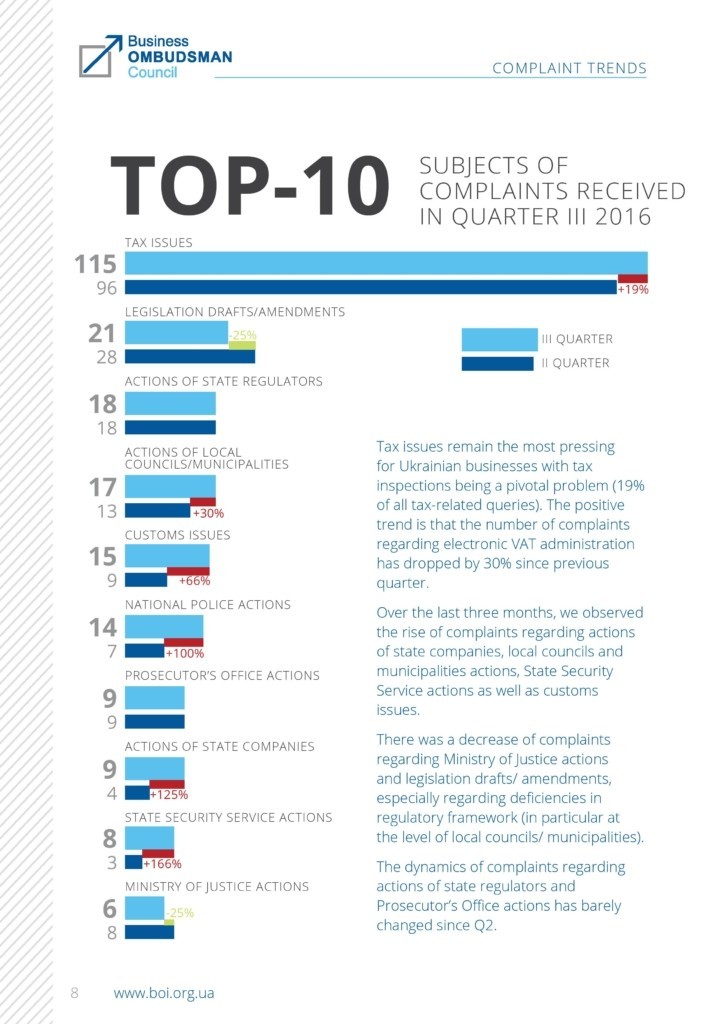

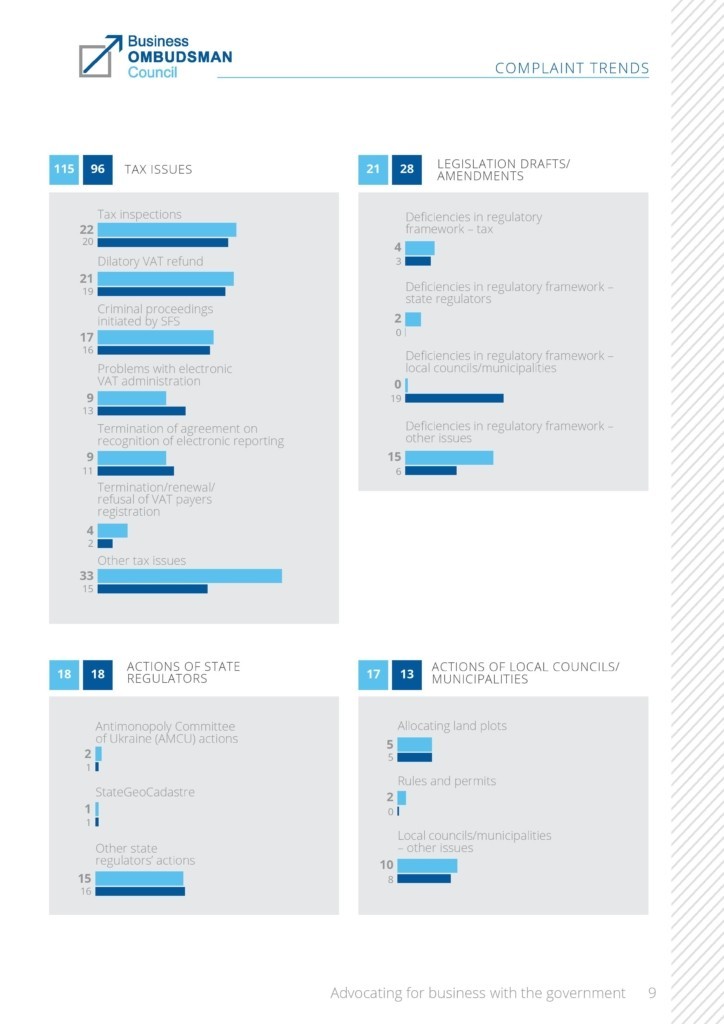

In the last three months of 2016, the council received 242 complaints, the most since it started functioning 16 months ago. More than a half of them involve the State Fiscal Service, including Tax Inspection and Customs Service. Tax issues remain the most troubling with tax inspections being a pivotal roadblock.

“This tendency indicates the necessity to improve fiscal legislation and its execution,” said Business Ombudsman Algirdas Šemeta. “The majority of tax-related complaints that we receive are caused by the violation of law and failure to follow in-house instructions. It’s not that the existing laws are poor; they’re merely not executed.”

On Nov. 3, the Ukrainian parliament passed amendments to improve some laws on state regulation, including State Fiscal Service’s activities too.

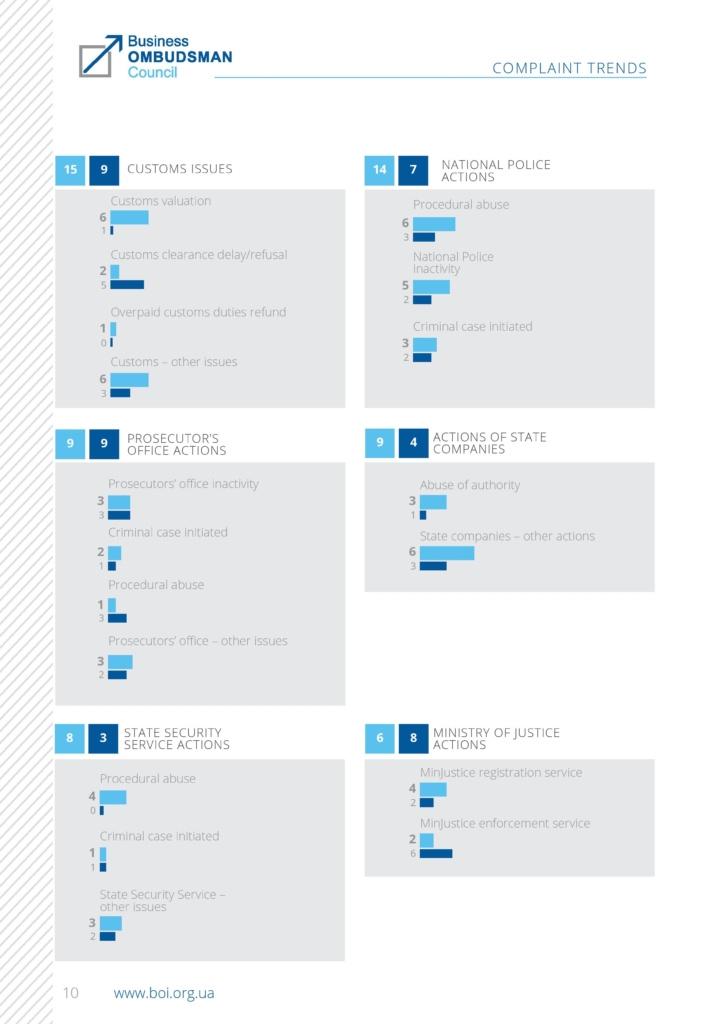

Šemeta also expressed concern with growing pressure on business from law enforcement agencies such as Prosecutor’s Office, National Police, and State Security Service, as the number of complaints of them rose by a third.

There have been reports of criminal proceedings started before the results of fiscal inspection. Use of criminal law against businesses remains a serious challenge from the standpoint of business climate in Ukraine and the country’s reputation in the eyes of international investors.

“The problems won’t disappear fast. The system will need a lot of time to clean itself,” concluded Šemeta.

According to the State Fiscal Service of Ukraine, in 10 months of 2016 the five largest taxpayers were three public companies — UkrGazVydobuvannya, Naftogaz, and Ukrainian Railways — and two tobacco producers, Phillip Morris and British American Tobacco.

Improving tax and customs administration is one of the key points in the lending program of International Monetary Fund, Ukraine’s major creditor. In addition, fiscal decentralization has been a part of reform package supported by the European Union.