Shared workplaces are a tool that can be used to reflect an organization’s culture, values and priorities. The type of shared workplace a company uses gives insight into the norms that company operates within, whether intentionally or not. For example, serviced offices reflect a more formal, private and customary culture, whereas co-working facilities reflect a more progressive, transparent and modern culture. Although both models may reflect much more than just a business culture, choosing one model over the other is certainly a lens into the type of values a company has. Organizations are starting to initiate the use of this new and innovative space model to satisfy the requirements of specific departments or project teams that may not fit the cultural mold of legacy office space. Whether it be to promote innovative thinking, or access a better work experience for employee retention, contemporary shared workplaces offer diverse ways to support the needs of occupiers – from small private firms to large public institutions (Global CBRE Research).

A local survey of the top largest co-working centers and serviced offices in Kyiv conducted by CBRE Ukraine found that core demand for shared workplace in Kyiv originates from IT and Business Services specialists aged 25-44, working remotely as solopreneurs and consultants, or as a part of small project teams and start-up companies.

Co-working spaces offer a diversity of environments that give occupants options to choose where and how they want to work—and optionality is a key value for modern mobile employees. A recent survey of large corporate occupiers by Global CBRE Research revealed that today’s labor force puts a high degree of importance on the desire for a great “work experience”—specifically, the functionality of the workplace, the freedom of work style and the sense of community between related organizations. These spaces offer a unique opportunity for employers to access the work experience much of their talent base is calling for (Global CBRE Research).

There are a number of elements to consider besides the headline lease cost when comparing the costs of shared workplaces with those of traditional leased offices (Global CBRE Research). Aside from vibrant infrastructure and flexible culture at the core of the concept, Kyiv’s shared workplace model attracts modest space users seeking lower-cost and shorter-term solutions compared to those offered by traditional office lease agreements. Besides lower lease cost, the lack of a contract negotiation process, transparent pricing, and turnkey solutions are the other major benefits of co-workings and shared offices.

“There are a number of elements to consider besides the headline lease cost when comparing the costs of shared workplaces with those of traditional leased offices.”

The average desk cost in a given co-working space in Kyiv ranges from $70 to $300 per month, with the price rising the closer the location is to the city center. The cost range for private offices in co-working spaces is therefore higher, starting from $100 per month and reaching $700 per month. Among the two key formats both open space setting and private offices are popular with shared workplace users in Kyiv, where demand for open space seating – whether a hot desk or a dedicated desk – slightly dominates at 55%. With the aim of benefiting from the highest cost efficiency, more than 80% of users choose a monthly rate plan as opposed to daily or weekly, with monthly plans usually resulting in rates 1.5-2 times lower than those offered on a daily basis.

According to a survey of co-working users conducted by Global CBRE Research, community and networking is a top feature co-working space users look for when choosing space – of course, in addition to a convenient location that takes them out of their home environment. With the ever-growing number of alternative office locations in Kyiv, employees have better chances of finding a workplace that meets their location and office infrastructure preferences. Such tailored working environment settings spur workers’ well-being, as the quality of a workplace has been shown to have a growing impact on health and stress levels.

The importance of community and networking is valued by employees of companies large and small, and landlords are responding to this call to action. They are focusing on making the physical building a more connected ecosystem of diverse uses, rich programming and amenities supporting a sense of community. The primary objective is to improve the occupier experience and promote retention, but the outcomes are vibrant campuses that serve a greater purpose than simply being places to work. Today’s business strategy calls for the rapid testing of ideas—the idea of “failing fast.” Co-working models draw on concepts first developed for business incubators by universities to promote shared learning and co-innovation (Global CBRE Research).

In Kyiv, for instance, Ukraine’s first innovation park, Unit City, is about to open a Chasopys-UNIT co-working, a national co-working brand operating another location in Central Business District (CBD) from 2013. Co-working will work within Unit City in order to capture the target audience of start-ups and entrepreneurs from data driven industries. The idea is to allow residents to co-create in the environment where knowledge sharing is welcome.

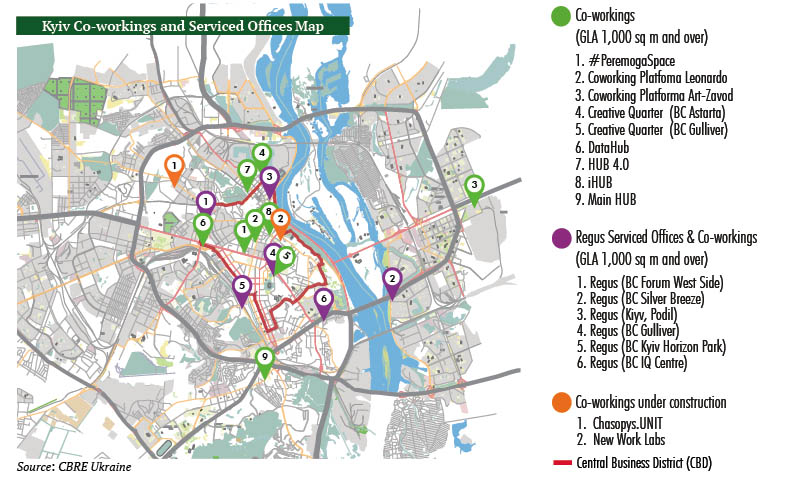

Considering the growing shared workplace supply, ca. 70% of respondents indicated no negative impact of growing competition on their business performance. In fact, ca. 90% of those surveyed have further expansion plans looking ahead to 2018-2020 period, responding to growing interest on the market. Among companies-respondents planning to expand, the majority of respondents (45%) indicated no preference in terms of the geographical location of their future offices. Nevertheless, a clear majority of existing supply is concentrated in Kyiv’s CBD, which is why ca. 40% of respondents still consider CBD as their preferred geographical area for future expansion.

Analyzing interest by property type, almost 70% of respondents favor business centers over standalone buildings and street retail for their properties in the pipeline, as this kind of real estate tends to offer a central location, large floor space, and include installed HVAC and fire safety systems. We anticipate that the shared workplace market of Kyiv will stay dynamic on both the demand and supply side, encouraged by substantially reduced good quality traditional office supply on the market.

The article is based on Global CBRE Research report “U.S. Shared Workplaces Part 2” and a local survey conducted by CBRE Ukraine.