The $14.5 billion in losses from Ukraine’s banking sector in recent years have put a tremendous financial strain on Ukrainian taxpayers and their government.

The losses — much of it attributable to bank fraud — are divided into three parts: $3 billion in state payouts to insured depositors, another $3 billion in unpaid refinancing loans to the state and $8.5 billion in losses to uninsured depositors.

But Ukraine’s law enforcement and regulatory institutions are working at a snail’s pace in trying to recover the losses. Consequently, the three-year legal statute of limitations on prosecuting money laundering and criminal bank fraud are likely expire without any criminal or civil action being taken.

The state has recovered a pittance — about $150 million, or 1 percent — of the estimated losses.

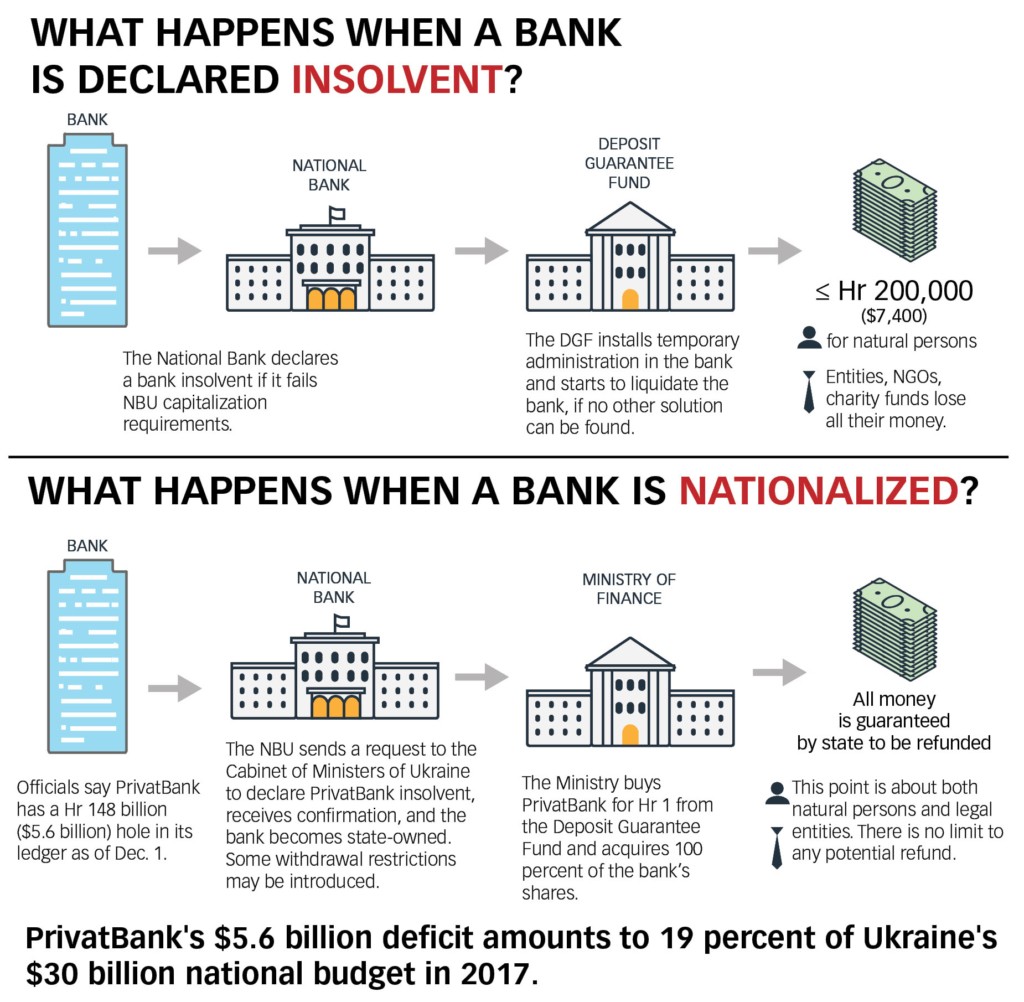

Meanwhile, losses continue to mount. This month’s nationalization of PrivatBank, which used to belong to bilionaire Ihor Kolomoisky, is expected to cost taxpayers another $6 billion or more before all is settled — pushing the banking disaster’s costs to more than $20 billion.

A new state agency for asset recovery designed to coordinate activities will begin working in 2017.

But it’s too little, too late for some cases.

“They all blame each other,” said Daria Kaleniuk, director of the Anti-Corruption Action Center, a Kyiv-based nongovernmental organization. “The National Bank says it has given all its information to the Deposit Guarantee Fund and the General Prosecutor’s Office and then they say they haven’t got enough information.”

The National Bank of Ukraine has not made public the conditions under which many refinancing loans were given, citing banking secrecy. The last refinancing loan the NBU provided was $35 million in June 2015 to Finance and Credit Bank.

A whopping 3,200 criminal cases have been referred to prosecutors y the Deposit Guarantee Fund, tasked with liquidiating the defunct banks.

Few civil lawsuits have been filed, even though they are considered to be a more effective way to get money and assets returned than waiting for prosecutors, who have filed few criminal cases thus far.

Aside from PrivatBank, whose losses will take time to unfold, the Kyiv Post has identified five defunct banks which stand out for the scale of their losses.

Among the five banks, the General Prosecutor’s Office has arrested two former managers, one of whom is in pre-trial detention. Another suspect has been released on bail and 19 others have been charged, yet no one has been successful prosecuted.

Delta owes $1 billion

By far the biggest crime came from those who worked for Delta Bank, Volodymyr Hutsulyak, the Ukrainian prosecutor in charge of the case, told the Kyiv Post in December. Delta Bank was Ukraine’s fourth largest lender until liquidation in 2015.

It owes almost $1 billion to the state and depositors, some $360 million of which was state refinancing that prosecutors allege was siphoned off to accounts in Latvia. The alleged theft of the refinancing is believed to have happened while the bank was being supervised by the central bank’s curators in 2014.

Almost all of its depositors, 97 percent, have been repaid by the Deposit Guarantee Fund, again footed by taxpayers.

Hutsulyak said that, since being given the case in February, his team made great strides in their investigation. They learned how the money was transferred out and through which enterprises.

“Our team will issue assessment of those people at the National Bank who failed to monitor the state funds, those who did not act independently,” said Hutsulyak, though he stressed no individuals at the central bank had yet been placed under suspicion.

Hutsulyak said he knew that Mykola Lagun, Delta Bank’s owner, was responsible for the losses but they had yet to prove that he was directing the fraudulent activities. So far, neither Lagun or any of the bank’s top management have been arrested and no money has been recovered through criminal prosecution, while only $600,000 has been recovered through asset sales.

inance and Credit owes $440 million

Finance and Credit Bank was declared insolvent in September 2015, after the National Bank had lent it $60 million. The Deposit Guarantee Fund has returned 93.7 percent of the depositors’ money, or $380 million.

The money was stolen through fictitious companies connected to the owners, according to Hutsulyak, who is also in charge of the investigations into Finance and Credit. He said the General Prosecutor’s Office has charged three suspects. One of whom, Oleksandr Demchenko, is detained awaiting trial, according to Hutsulyak. But the prosecution is having trouble pressing charges against the owner, Kostyantyn Zhevago, a millionaire and a member of parliament.

“Zhevago is the same story” as Delta, Hutsulyak said. “There is no evidence that he took the decision. We know that it was him. We are looking for the evidence to prove it.”

Hutsulyak said that their aim is not just to hold them responsible but to return the money, which is now offshore.

“There’s a long wait because there have been so many violations, the experts have a lot of work,” Hutsulyak said. “We are waiting for the results.”

No money has been recovered via prosecution. Approximately Hr 33 million ($1.25 million) worth of assets have been sold by the Deposit Guarantee Fund.

Nadra owes $1.5 billion

Exiled oligarch Dmytro Firtash’s Nadra Bank received Hr 12 billion from the National Bank in 2008-2009, which equaled approximately $1.5 billion back then.

Nadra was the only insolvent bank that had received refinancing without its owners having to provide any personal guarantees. National Bank’s Head of Financial Risk Department Ihor Budnik said at the Kyiv Post’s Tiger Conference on Nov. 26 that it used to be normal for central bank to give such loans.

“It was provided based on collateral which was not worth 20 percent of what it claimed and there was no guarantee,” Budnyk said. “We have Nadra and Firtash essentially on the balance sheet pledged to the National Bank but, unfortunately, the value of the balance sheet is not even close to cover the loan amount…There was a guarantee with a company of Firtash but the previous management of the NBU let it expire back in 2010.”

Budnyk also noted that many loans were acquired before Firtash wholly owned the bank.

So far, $13 million has been recovered through asset sales.

VAB owes $600 million

In November 2014, another big bank was declared insolvent and liquidated five months later after it failed to recapitalize – VAB bank, then owned by agriculture oligarch Oleh Bakhmatyuk. So far, investigators have found that VAB gave out at least Hr 3.3 billion ($125 million) worth of loans to the companies of Bakhamtyuk, his managers or business partners.

Bakhmatyuk is Hr 5.5 billion ($210 million) in debt to the National Bank. The Deposit Guarantee Fund has paid 94 percent of Hr 10.4 billion ($395 million) debt owed to the bank’s clients.

The NBU won its court case against Bakhmatyuk and the court ordered his assets to be seized but the court executors squashed the decision without explanation in the last month, according to the NBU.

“In a dysfunctional judicial system, there always are some semi-legal techniques restricting the process. To predict the judgment of the court is virtually impossible,” Budnyk said about the cases against Bakhmatyuk and Zhevago.

Kyiv Prosecutor’s Office opened criminal proceedings against an unspecified number of VAB management and Bakhmatyuk, accusing them of large scale embezzlement on Dec. 12. Bakhmatyuk denies allegations. He called them a PR campaign of the National Bank’s Head Valeria Gontareva against his agricultural company Ukrlandfarming, Interfax reported.

No money has been recovered through prosecution, $3.5 million has been recovered through asset sales by the Deposit Guarantee Fund.

Ukrainians are, unfortunately, becoming well-versed in what happens when banks go bust. The National Bank of Ukraine has declared nearly half of the nation’s 183 banks insolvent 2014, most imploding because of insider bank fraud and economic recession. The nation’s losses from the debacle of unregulated banking are expected to top $20 billion after the nationalization of PrivatBank.

Khreshchatyk: $109 million

Khreshchatyk Bank collapsed in April when the NBU requested the bank to recapitalize and the owners withdrew their assets, an investigation by Radio Liberty/Radio Free Europe found. A Deposit Guarantee Fund investigation further revealed that 85 percent of the bonds issued by companies on Khreshchatyk bank accounts were not properly securitized and that the companies issued the bonds were affiliated with the bank.

Prior to its closure in February, Khreshchatyk Bank received from National Bank Hr 190 million ($7.2 million) in refinancing which has yet to be returned. To date, the Deposit Guarantee Fund, and therefore Ukraine’s taxpayers, has paid back 97 percent or Hr 2.7 billion ($102million) of the Hr 2.8 billion ($106 million) owed to Khreshchatyk’s clients.

In July, Kyiv Prosecutor’s Office said that money laundering conducted by Khreshchatyk managers totaled Hr 81 million ($3.1 million) between 2010-2014 and that they had seized real estate and land connected to 16 of the Kyiv branch managers.

Most of Khreshchatyk’s clients were based in Kyiv. Kyiv City Administration entities owned 25 percent of the bank, and Kyiv’s poverty-stricken citizens were among Khreshchatyk’s clients.

Charitable funds are also not prioritized under Ukrainian law, they are in the same class as companies. The Bohdan Hawrylyshyn Charitable Foundation, founded by Ukrainian economist and philanthropist, was forced to freeze all projects as it lost Hr 44 million when Khreshchatyk collapsed.

“We are beyond these laws,” the chairman Anatoliy Dyachenko said.

No money has been recovered through prosecution or asset sales.

Mykhailivskiy: $38 million

The fraud committed at Bank Mykhailivsky was exceptional. Depositors banked their money for an annual interest rate of 25 percent, but the deposits went to an associated foundation and, therefore, weren’t insured by the Deposit Guarantee Fund.

Rather they were insured by Forte, a company owned by the bank’s alleged owner, Viktor Polishchkuk. The depositors’ money was used to finance business interests connected to Polishchuk, according to the bank.

Mykhailivsky’s finances led the central bank to impose restrictions and declare it problematic in December 2015. The restrictions were inexplicably lifted in March, allowing the bank to be emptied. A law passed in November made the deposits registered with non-bank institutions covered by the Deposit Guarantee Fund. It means that the Mykhailivsky Bank’s depositors will be repaid Hr 1 billion ($38 million).

The NBU also approved a change in the bank’s ownership structure with Polishchuk selling his shares to nominal directors. The board’s chairman, Ihor Doroshenko, resigned and joined Platinum Bank, formerly headed by Kateryna Rozhkova, who is a deputy head of the central bank who oversaw the lifting of the restrictions on Mykhailivskiy.

Doroshenko was arrested in September for stealing Hr 870 million ($33 million), triggering the bankruptcy. He faces up to five years in prison. In December, Doroshenko was released on bail. He denies the bank did anything wrong.

The Kyiv Post was unable to contact anyone working on the case directly.

Olga Veretilnyk of the Anti-Corruption Action Center said that the central bank approved the change in ownership structure, which is a huge obstacle to recovering the funds as nothing proves that Polishchuk owned Mykhailivskiy when the money was stolen.

She also said that it was peculiar that the prosecutors had seized Polishchuk’s Gulliver shopping center, where the businessman had already divested his shares and had not seized a logistics terminal he openly owns near Kyiv. No money has been recovered through prosecution or asset sales. n