If time is money, Ukraine is losing a lot of both because its roads, railways, ports and airports are in need of modernization — at least $30 billion in investment by 2030.

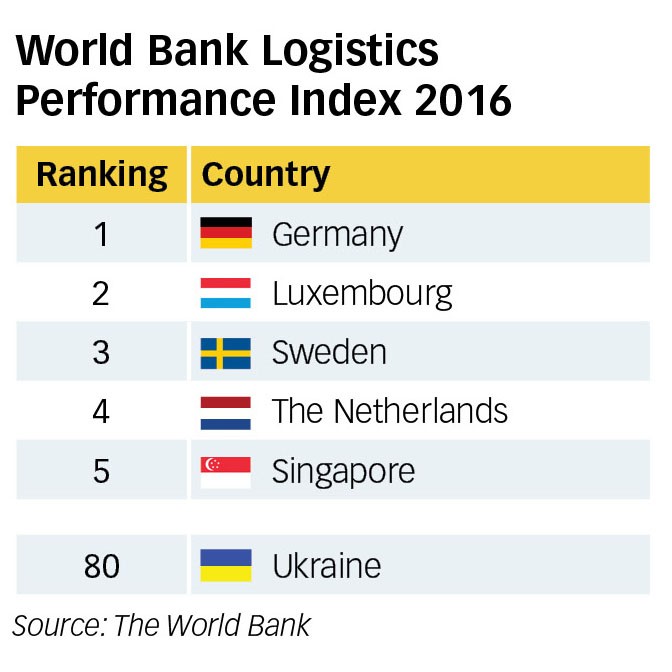

If mediocrity is good enough, however, Ukraine’s infrastructure fits the bill — ranking 80th among 160 countries in the World Bank’s annual Logistics Performance Index ranking.

But average doesn’t cut it internationally, in terms of safety, speed and efficiency. Of course, there’s a plan in the works and Ukraine’s Infrastructure Ministry is no different. This plan is called Ukraine’s Transport Strategy 2030.

Problems abound, not least of which is the sense that those who benefit from non-transparent and oftentimes subsidized tariffs and faulty government regulation are coming out ahead.

“We have railways but not enough wagons. But business doesn’t want to invest in that, so it has to blame Ukrzaliznitsya,” Alexey Doroshenko, head of the Retail Suppliers Association of Ukraine, told the Kyiv Post. “As for roads, frequently their bad condition is not the government’s fault, as many of them are being made stick to the norms, but destroyed within several months by overloaded cargo trucks.”

The government only started to control the weight of trucks on the road in 2015.

“As for the ports, in Ukraine, they are like states inside of a state,” Doroshenko said. “There is a significant lack of influence and control of Ukrainian authorities in ports. It doesn’t create a healthy business environment.”

![]()

Railways

Ukrzalyznytsia, a state-owned railway monopolist, provides 50 percent of passenger and 82 percent of cargo transportation services in Ukraine. The current network, excluding Russian-controlled Crimea and Donbas, covers more than 41,515 kilometers.

Problems: The poor condition of the railways doesn’t allow for high-speed travel. Ukrzalyznytsia doesn’t supply enough wagons and locomotives. At transshipment stations, there is a long delay for cargo to be transported to seaports for export.

Anna Derevyanko, executive director of the European Business Association in Ukraine, said during the Infrastructure Forum in April that Ukrzalyznytsia fulfilled only 30 percent of traders’ demands on cargo wagons and locomotives, forcing potential exporters to wait and pay for idle time.

“The quality of wagons and locomotives is also low. We want a transparent system of tariffs on cargo transportation and we are against the upcoming 22.5 percent increase,” Derevyanko added.

Alexander Kava, an infrastructure expert and former infrastructure minister adviser, told the Kyiv Post on May 29 that tariffs should be at least doubled.

“Ukraine has the lowest tariffs in Europe and frequently business uses those prices for their own benefit,” Kava said. “For example, some traders use cargo wagons as storage on wheels.”

Irrational tariffs are a big reason for Ukrzalyznytsia’s poor service. “The government has to stop milking the enterprise. Due to low tariffs, it practically donates to agribusiness and metallurgy, and just doesn’t have money to renew the infrastructure,” Kava said.

Railway workers prepare locomotive for a ride during the technical stop near Darnitsya railway station in Kyiv on May 30. (Kostyantyn Chernichkin)

With all that in mind, experts say Ukrzalyznytsia needs $10.5 billion in investment.

The Cabinet of Ministry took control of Ukrzalyznytsia in January, relieving the Infrastructure Ministry from management duties. Omelyan told RBC-Ukraine news website that the Cabinet took Ukrzalyznytsia away from him because of his conflict with Ukrzalyznytsia head Wojciech Balczun.

Omelyan said that Balczun, considered by Ukraine’s Prime Minister Volodymyr Groysman as a strong reformer, is failing. The conflict erupted during Balczun’s report to the Cabinet on Jan. 25.

After the Ukrzalyznytsia head reported that Ukrzalyznytsia finished with more than Hr 1 billion profit in 2016, Omelyan accused Balczun of manipulating the numbers. Omelyan said a 15 percent increase in cargo tariff, not reforms, was the reason for the profit. Groysman took Balczun’s side.

Despite refusing to be interviewed, the Ukrzalyznytsia press service issued a statement complaining about low tariffs set by government: “Current tariffs do not cover spending. In 2017, the minimum wage was raised by 25 percent, the fuel tariff raised by 20 percent and the electricity tariff by 26 percent. Tariffs need to be indexed according to that.”

Infrastructure Minister Volodymyr Omelyan has been highly critical of Balczun’s team, blaming him for Ukraine getting bypassed in the Chinese “One Belt One Road” initiative or the South Silk Road, China’s global multibillion-dollar campaign to improve global infrastructure and trade ties with the world’s largest nation and second-largest economy.

“I still believe Silk Road could become a perfect alternative for Ukrainian export transit to Asia, banned by Russia in 2016. We’ve already tackle all the technical issues with Georgia, Kazakhstan, and Azerbaijan,” Omelyan said.

Since 2015, Silk Road high-speed trains have been delivering goods between China and Europe through Russia and Belarus, bypassing Ukraine.

Another big problem is featherbedding.

According to Deloitte audit and consulting firm, Ukrzalyznytsia had the largest number of employees among the top 500 companies of Eastern and Central Europe, with more than 270,000 people. Polish State Railways, by comparison, has just 79,000 people.

The Infrastructure Ministry tried to cut the staff by at least 10 percent in 2015, but backed off in the face of worker protests and threats to block the railways.

After Balczun became Ukrzalyznytsia’s head a year ago in June 2016, he told Novoye Vremya news magazine that, rather than dramatic reductions in staff, he would save money by fighting corruption. That commitment has firmed up since then.

Alexandr Mushenok, deputy head of the Railworkers Association in Ukraine, told the Kyiv Post on June 2 the association even got an agreement from Balczun — in the form of a memorandum of understanding — that there would be no mass layoffs. Workers even got a 25 percent wage increase, Mushenok said.

“Even with the current (more than 270,000) staff Ukrainian railways need 50,000 more people who would serve the railways,” Mushchenok said. “We can talk about cuts if there are technological innovations in the enterprise. The better wagons and locomotives, the fewer people need to operate them.”

Solution: Ukrzalyznytsia’s press service told the Kyiv Post that the enterprise has a strategy to repair wagons, railways and locomotives within five years — but not on the scale required. In 2017, the company will buy 12 new diesel locomotives for cargo transportation worth Hr. 1.5 billion, according to the press service, along with more than 3,000 cargo wagons.

![]()

Roads

Ukraine has more than 169,600 kilometers of public roads, with 51,700 kilometers state highways and 117,000 local roads. Ukraine ranks near the bottom in quality — 132nd place among 140 countries in the World Economic Forum Quality of Roads index 2016.

The government expects to spend Hr 35 billion for road reconstruction in 2017, still far short of the estimated Hr 800 billion needed.

Problems: According to an Infrastructure Ministry analysis, 90 percent of Ukrainian roads haven’t been repaired for more than 30 years. Businesses overload cargo trucks, causing extensive damage to the roads. In 2015, the Cabinet of Ministers of Ukraine established weight limits at 24 tons.

During a May 14 press conference, Ukrainian President Petro Poroshenko said he’s seen improvement in road construction and repair in the last two years. Prime Minister Volodymyr Groysman wasn’t so positive when he told to 112 TV channel the third part of Ukrainian roads are being repaired poorly.

Moreover, Groysman said he was going to file a claim in the National Anti-Corruption Bureau as about 7 percent of finances allocated for roads construction are being stolen by corrupt officials.

A man rides a bicycle on a bumpy road in Kyiv Oblast on June 3. (Oleg Petrasiuk)

The Infrastructure Ministry has reported that in 2016 Ukravtodor repaired more than 1,000 kilometers of roads, and plans to repair 2,000–2,500 kilometers of roads in 2017.

Solution: The government is planning to put more than 120,000 kilometers of roads under local government responsibility as part of government decentralization reform. The State Roads Agency will remain responsible for the rest — nearly 50,000 kilometers of major highways. The government also plans to create a State Roads Fund in 2018 and hopes to attract investment.

![]()

Rivers

River transport brings cost advantages. The Infrastructure Ministry estimates that it costs $10 to transport a ton of cargo by railways, $16 by roads and only $8 by river. Ukraine has 1,562,600 kilometers of navigable waterways mostly on the Dnipro, Pivdenny Bug and Danube rivers. In 2016, Ukraine’s river fleet counted 1,300 ships, with 440 cargo vessels. But, according to a 2015 World Bank survey, river transportation is insufficiently used in Ukraine.

Problems: Kava said Ukrainian rivers were frequently used to transport the cargo within Ukraine and abroad during the Soviet Union. But during Ukraine’s independence there was no money to deepen the bottom of rivers to make way for travel with bigger and better barges and ships.

“It is indeed the cheapest way to transport goods, but river transportations have lots of nuances.

It is convenient only for businesses located near the river. Others would have to pay for double cargo transshipment,” said Kava. “Nowadays agrarians, sand and gravel producers have high demand on river transportation. Unfortunately, rivers can’t be used year around, because logistic companies provide navigation only from six to nine months.”

Solution: Infrastructure Ministry counted that, to repair sluices, terminals and other river infrastructure, Ukraine needs more than $2 billion in investment. Liberalization of the market would also help the industry. In December, Olexiy Vadaturskiy, the head of Ukraine’s private Nibulon agricultural holding signed a $74 million deal with the European Investment Bank to finance reconstruction of the Nibulon dockyard in Mykolaiv Oblast and deepen the bottom of Pivdenny Bug River.

Ukrainian Danube Shipping Company plans to upgrade its fleet by 2031, Esmerk Ukraine News agency has reported. The company intends to buy 40 barges and modernize 21 tugs, costing $50 million. The company expects that foreign investors from China National Import and Export Corporation and Serbian HBIS GROUP Serbia Iron & Steel company and others will provide funding.

Ukraine has five international transport and trade corridors with a total length of 5,000 kilometers passing through its territory.

Ukraine shares borders with Belarus, Russia, Poland, Slovakia, Hungary and Romania. It also has a direct connection with Black Sea countries Georgia and Turkey.

Pan-European transport corridors (Cretan 7 and Cretan 9) link Ukrainian ports in Odesa Oblast with Germany (Cretan 7) and connect Russia and Finland, Estonia, Latvia and Lithuania with Greece (Cretan 9).

Baltic Sea – Black Sea Transport Corridor offers a direct connection across the continent between the port cities of Gdansk in Poland and Odesa Oblast ports Chornomorsk and Pivdenny in Ukraine.

Black Sea Transport Circle connects all the Black Sea Region Countries by the land.

TRACECA Corridor or Trans-Caspian Corridor connects Ukraine with one of six trade routes of the Chinese “One Road One Belt” economic initiative, also dubbed the New Silk Route.

Ports

Ukraine operates 18 seaports in the Black and the Azov seas, in general, capable of handling 132 million tons of cargo transshipment a year. But, according to the Infrastructure Ministry in 2016, Ukraine’s cargo transshipment in ports dropped by more than 9 percent compared to 2015 as the ports operated only at 56 percent of full capacity. Cargo transit also dropped by 35 percent. But in four months of 2017, Ukrainian ports have shown revival, with 4 million tons of cargo handling, which is two percent higher than in the same period of 2016.

Problems: According to the Infrastructure Ministry, port charges in Ukrainian ports are in general 2.5 times higher than in other regional ports. Denys Rusin, the head of the Asket Shipping company, told the Kyiv Post that in 2015 Odesa ports charged a $15 per ton сargo transshipment tariff and $13 in Mykolaiv. In 2016–2017, tariffs decreased by 30 percent, but were still 2–3 times higher than European tariffs ($5-$7 a ton) a ton, said Rusin.

The ministry said that Ukrainian ports need to bring down the prices up to 60 percent.

Ukrainian ports waters are too shallow to let heavy cargo ships to enter. While many world cargo companies use the Capesize-type cargo vessels, that can carry 100,000 tons and has sea gauge of 15 meters, only one Ukrainian port, Pivdenny, with 19 depth waters, can accept such heavy vessels.

Solution: Omelyan said for 2017 the government plans several major improvements in Ukrainian ports worth more than Hr 3 billion: new terminal construction in Odesa and Mykolaiv ports, channel dredging in Pivdenny and Chornomork ports, terminals reconstruction in Chornomorsk, Odesa and Mariupol ports. All the works will be under control of the state agency Sea Ports Association of Ukraine and The International Federation of Consulting Engineers.

“International port operators Hutchison Ports and DP World (P&O Ports) are going to enter Ukraine in 2017. And they won’t just rent the state enterprises equipment, but also develop the ports’ territories and process raw materials, export value-added products from Ukraine and bring more cargo vessels into the Ukrainian ports,” Omelyan said.

![]()

Airlines

Ukraine has 23 airports, including four in Russian-occupied Crimea and Donbas. According to Ukraerorukh, Ukrainian airports carried more than 8.2 million passengers. In 2016, passenger traffic in Ukrainian airports increased by 31 percent against 6.2 million passengers in 2015.

However, due to low pass-through function of local Ukrainian airports, about 90 percent of passengers’ and cargo traffic concentrated in seven airports: Boryspil International Airport, Airport Kyiv (Zhulyany), Odesa, Lviv, Kharkiv, Dnipro, Zaporizhzhia international airports. There are 20 airlines in Ukraine while another 28 international airlines also provide transit flights through Ukrainian territory.

Ukraerorukh has reported that in 2016, Ukrainian airlines made 79,500 flights, which is 17 percent more than in 2015 (66,300 flights).

Problems: Ukrainian International Airlines, owned by billionaire oligarch Igor Kolomoisky, has a stranglehold on the market — accounting for 50 percent of the passenger’s flights in Ukraine.

Under the European Union-Ukraine Association agreement, Ukrainian government is obliged to liberalize the market by inviting international low-cost operators.

Omelyan said on May 25, that the high ticket’s price is the main reason of Ukraine’s avian transportation industry bad performance.

“In general, Ukrainian airlines serve 13 million passengers a year with population of 42 million people, while for example, Polish airlines serve 34 million a year with 36 million people,” Omelyan said.

Airports and airlines income depends on a passenger.

Ukrainian Prime Minister Volodymyr Groysman evidently has decided to double as an inspector of road repairs throughout Ukraine. Periodically, Groysman’s press service announces visits to regions where roads are under repair. One can only hope that his visits are bringing improvement, since most of Ukraine’s roadway network is considered to be in poor condition.

Irish low-cost Ryanair in March announced it is going to enter the Ukrainian market in October. While the price for a one-way ticket to Stockholm on the Ukraine International Airlines website starts from 300 euros, while Ryanair offers from 22 to 34 euros on its official website.

Ukraine International Airlines lawyer Oleg Bondar has said that, according to the secret deal supposedly signed by Omelyan, Ryanair will get a significant discount and pay $7.50 per passenger airport tariff, while other companies will pay $13.

“For such a discount Ryanair is obliged to carry 150,000 passengers a year. What discount will Ukrainian Airlines, that carry 6 million passengers will get then?” Bondar asked Omelyan during the conference on May 25.

The minister denied any secret deals, saying in terms of liberalization, all the aircraft companies will get the same conditions and tariffs.

Andriy Guck, Ante law firm attorney told the Kyiv Post that there were talks about $7.5 per passenger for Ryanair, but no deals were signed yet.

“Ryanair agreed to pay for every flight, not in the end of the year. And 150,000 passengers a year means it has to carry 150 per flight to get the discount. If there are 149 people on board, Ryanair would pay $13 as everybody else,” Guck said.

The expert said when such company as Ryanair enters the market, it won’t change for the market, but the market has to change for it.

“It is an international brand. By entering Ukraine, Ryanair sends the signal to other airlines, like Qatar, that Ukraine is a safe market with benefits,” Guck added.

Solution: In general Ukraine’s air industry needs more than $8 billion in investment, reads Ukraine’s Transport Strategy 2030. The government is going to liberalize and create the competitive market in Ukraine by offering equal conditions to Ukrainian and foreign airlines.

Omelyan said that in 2017 Ukraine is going to lower the air tariff from $17 to $13 per passenger.

“Ryanair hasn’t even entered the market yet, but (Ukraine International Airline) has already launched several low-cost flights to stay in the market. I think it is a good sign,” Guck said.