Editor’s Note: The Kyiv Post today starts a four-part series called “Unkept Promises” about the lack of progress in four key areas since President Volodymyr Zelensky took office in May. The first article takes a look at Ukraine’s multibillion-dollar bank fraud of the last decade and examines why no one has been successfully prosecuted and so little money has been recovered. The next installments will focus on law enforcement, mayors of big cities and oligarchs.

The widespread bank fraud and financial malpractice that took place in Ukraine up until 2014 cost the country at least $25 billion in direct taxpayer losses and likely much more. Yet six years later, nobody of consequence has been prosecuted, while recovery of lost and stolen money is feeble — hindered by sabotage and costly legal delays.

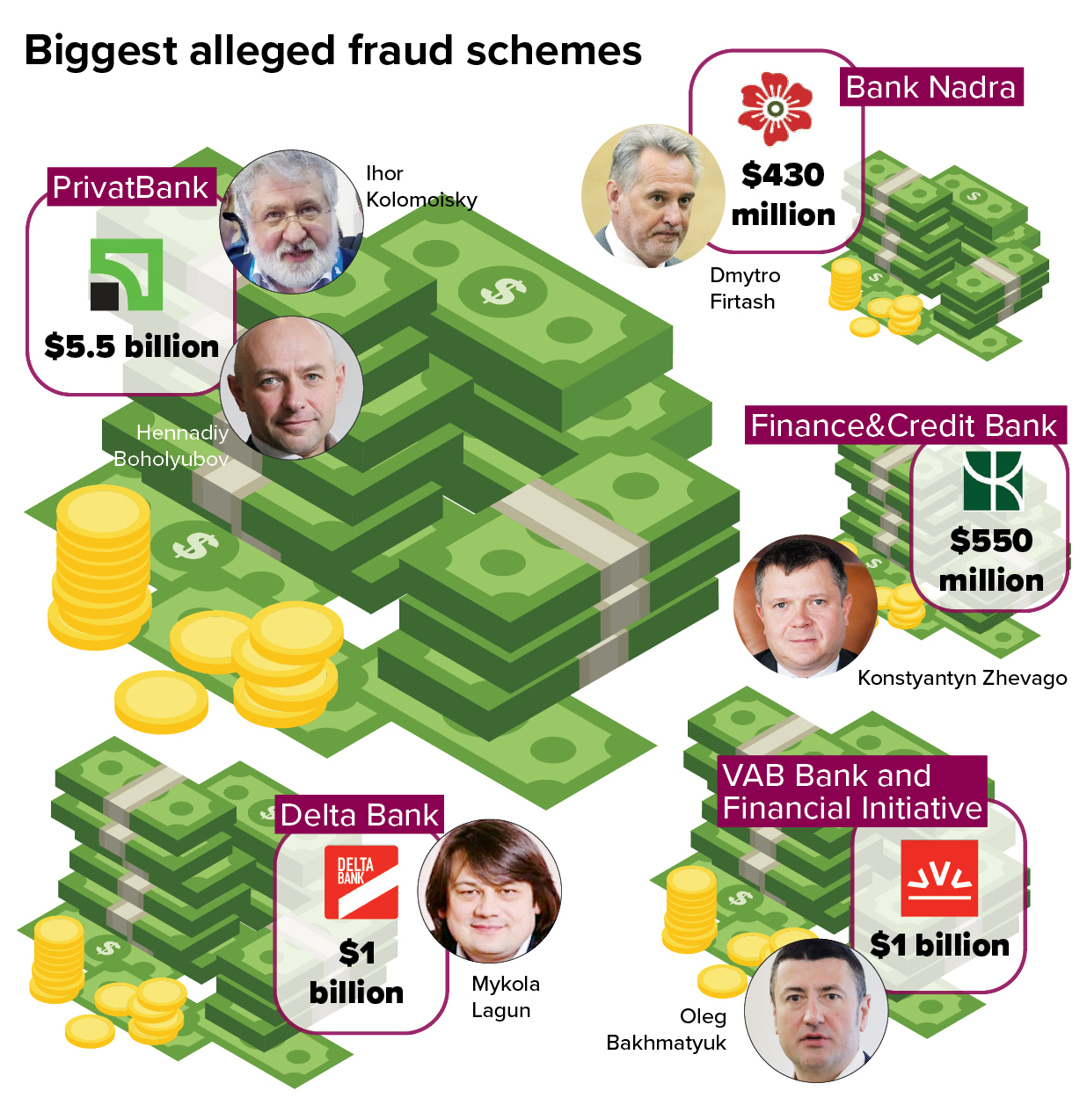

The largest and most famous case of alleged fraud involves the now state-owned PrivatBank. Ukraine’s largest bank is trying to recover at least $5.5 billion it claims was stolen during a decade-long insider lending scheme by former owners Ihor Kolomoisky and Hennadiy Boholyubov. In London, where the bank is suing the two founders, judges have not passed judgment in the case but noted that “fraud on an epic scale” took place at the bank.

Both Ukrainian oligarchs deny all wrongdoing and are suing for the bank to be returned.

But PrivatBank was not alone. Since 2014, 90 banks were put up for liquidation or needed taxpayer bailouts. Even state banks have been accused of acting as pocket banks for powerful individuals in government. To date, law enforcement and the courts have made minimal headway in prosecuting the alleged culprits.

President Volodymyr Zelensky, who has historic business ties with Kolomoisky, promised that he would cut through the lawlessness and corruption that plagues Ukraine, including in its banking sector. And while the Prosecutor General’s Office and the National Anti-Corruption Bureau of Ukraine showed a surge in activity in the latter half of 2019, the detentions and notices of suspicion concerned relatively small-scale fraud cases.

Former customers and clients of Mikhailivsky Bank protested near the National Bank of Ukraine on June 28, 2017. They sought reimbursement by the state for their lost deposits after bank failed, following an alleged scheme that emptied the bank’s holdings. (Kostyantyn Chernichkin)

‘Massive fraud’

Valeria Gontareva, governor of the National Bank of Ukraine between 2014 and 2017, recalls that shady banking practices back then triggered a financial crisis that would cost the nation 15% of its GDP.

“This was the fiscal cost of our banking crisis in 2014–2015,” she said, recalling that dozens of banks needed state bailouts. Some 20% of banks in the country were being used only for money laundering, she said.

PrivatBank, where a third of the country’s deposits were held and half of the country’s business transactions were conducted, was the flagship example. “We saw that 97% of the loan portfolio was related-party lending,” Gontareva recalls.

While $25 billion is the total direct cost of taxpayer bailouts to Ukrainian banks due to the financial crisis of 2014-2015, the real bill may be much higher. Experts say some fraud went undetected and many unprotected deposits were lost. Interest and legal fees are also rarely considered.

Deemed too important to fail, PrivatBank was taken under state ownership in December 2016 and survived. Plenty of other banks were not so fortunate.

Some $15 billion in recapitalizations due to non-performing loans, or NPLs, were needed throughout the entire banking sector and 89 banks that were shuttered have been described by Gontareva as “empty shells” used to launder or steal money.

“An additional $10 billion was injected into state banks before 2014,” Gontareva recalled, adding that more money was lost by customers that had deposits in liquidated banks, not all of which were protected by the limited capacity of the state Deposit Guarantee Fund.

While PrivatBank is the case so big that it became a litmus test for banking reform and Ukrainian justice, the picture was equally grim elsewhere in 2014–2015. Shady schemes were so commonplace they became the norm, threatening the whole financial sector with collapse.

“The banking system is a critical driver of economic growth for any country and even more so for an emerging economy like Ukraine, where the level of penetration of banking services is so low and needs to grow much faster than the overall economy,” said Artem Shevalev, deputy chairman of the supervisory board at PrivatBank and former deputy finance minister.

“The bank failures in Ukraine had a dual effect — they destroyed the public and business trust in the banks (and trust is a key element to a healthy banking system), whilst undermining the surviving banks’ capacity to lend,” he added.

Gontareva, who is writing a book about her time as governor at the NBU, recalls the bleak banking landscape back then: “Massive lending to related parties. Opaque ownership structures with the real owners hiding behind a line-up of nominal directors. Window-dressing of financial reports. Fake correspondent accounts at foreign banks. Politically motivated lending by state-owned banks, resulting in large losses and a subsequent massive injection of public funds.

“Money laundering as a bank’s business model. Shareholders and management walking away from failed banks with clients’ money, escaping charges for driving them to bankruptcy… Sounds like a horror movie? Impossible in real life?” she asks. “Wrong. It was a common way of doing financial business in Ukraine before 2014.”

These are some of the largest estimated bank losses in Ukraine. Many were due to alleged related-party lending, unsecured loans and other fraudulent practices. Figures cited from NBU and DGF estimates. In total, 90 banks were closed or bailed out by the state in the last decade..

Bank fraud free-for-all

The plundering of banks in Ukraine was often brazen to an absurd degree. One scheme that pumped tens of millions of dollars out of Delta Bank JSC even used a bogus company called Bonnie and Clyde LLC, named after the famous bank robbing duo of Depression-era America.

Delta, which was owned by Ukrainian businessman Mykola Lagun, had over $250 million siphoned off from it, allegedly by its own staff. the DGF estimated total damage to creditors at Hr 24.5 billion (about $1 billion.)

Businessman Viktor Polishchuk’s former Bank Mykhailivskiy’s alleged lending fraud led to it going bust in 2016, leaving its depositors in the dust. Polishchuk sold his share in the bank days before it folded. This plus the businessman’s other alleged schemes cost Ukraine just under $1 billion, according to the NBU. Polishchuk was not even served with a notice of suspicion until December 2019. In a 2016 interview with the Kyiv Post, the businessman denied wrongdoing.

According to the Deposit Guarantee Fund, up to 99% of loans from some banks were made to related companies.

“Bank owners took money from the public and gave it to their companies, which used it for their own ends,” said Olga Bilai, the deputy managing director of the Deposit Guarantee Fund. “There were times when those companies put that money into their business and times when they simply took it across the border,” she added.

Polishchuk’s company Tri O is also alleged to have received loans from state-owned Oschadbank for its business center Gulliver in central Kyiv. The debt became part of Oschadbank’s substantial NPL portfolio, along with other deadbeat debtors.

Oschadbank, along with other state banks including Ukreximbank, have been accused of serving as pocket banks for powerful state officials including former President Viktor Yanukovych, former Deputy Prime Minister Serhiy Arbuzov, former Finance Minister Yuriy Kolobov and politicians and businessmen Andriy and Serhiy Kluyev. They all deny wrongdoing.

Alexei Omelyanenko, the former owner of the now-nationalized Ukrgasbank, is the subject of many criminal cases and investigations, accused of laundering hundreds of millions of hryvnias while serving as the bank’s CEO and later as a member of its supervisory board. He was arrested in February 2019 but released in July without bail. Multiple court cases are ongoing between the bank and Omelyanko, who has denied any wrongdoing.

Lawmakers were also frequently connected to alleged schemes. According to the Deposit Guarantee Fund, top management at the Finance and Credit bank, owned by businessman and former member of parliament Kostyantyn Zhevago, withdrew around Hr 5 billion from the bank before it defaulted on its debts in 2015. The DGF stated that the bank’s owners and officials cost the state about Hr 15.5 billion (about $550 million) in damages.

Even an alleged top fraudster, Oleg Bakhmatyuk, admitted to the Kyiv Post that insider lending was a “general tendency” in the country.

The agricultural tycoon is accused of embezzlement and shady lending using his two banks, VAB Bank and Financial Initiative, which had 64% and 96% insider loans, respectively, according to Gontareva. He owes the Ukrainian government about $1 billion, according to the NBU, but denies that his practices resulted in the banks going bust.

As their banks’ insolvencies neared, some owners tried to steal as much as they could. State officials said that Hr 2.3 billion ($82 million) were smuggled out of Khreschatyk Bank very shortly before its bankruptcy, with the money going to shell companies. Altogether, Khreschatyk lost about Hr 7 billion or $245 million to poor management, investment in worthless securities and alleged corrupt schemes.

Former finance minister Oleksandr Danylyuk and former National Bank of Ukraine head Valeria Gontareva speak at a news conference announcing the nationalization of PrivatBank, Ukraine’s largest lender in Kyiv on Dec. 19, 2016. Danylyuk and Gontareva have both expressed blistering criticism of the banking sector and the impunity of the former bank owners accused of fraud. (UNIAN)

No justice, little hope

Despite the years-long orgy of banking fraud in Ukraine, which brought the entire economy close to collapse, no one of any consequence has been successfully prosecuted.

The Deposit Guarantee Fund says that it has sent 5,692 criminal allegations to law enforcement. It reported that these alleged crimes account for more than Hr 374,925,870,000 (about $15 billion) in losses for the state budget. Gontareva confirmed that, after she took charge of the central bank, thousands of banking cases were filed with law enforcement but they went nowhere.

“There is no information on the prosecution of perpetrators, which means it can be concluded that the facts… are not being properly investigated,” said Olena Korobkova, head of the Independent Association of the Banks of Ukraine. “Unfortunately, the effectiveness of these investigations and the prosecution of perpetrators is close to zero.”

Oleksandr Danylyuk, finance minister between April 2016 and June 2018 and then secretary of the National Security and Defense Council under Zelensky for the summer of 2019, is not optimistic about the prospects of bank fraud justice in Ukraine. “I expect more from the foreign jurisdictions,” he said.

Multiple legal experts agreed that there is a better chance that PrivatBank’s former owners may face justice abroad. Civil cases are ongoing in the U.K., U.S. and now Israel. Kolomoisky is also under investigation by the FBI.

In contrast, Ukraine’s law enforcement, justice system and politics are so badly “compromised” that the likelihood of prosecuting fraudsters and recovering stolen funds looks bleak, said Danylyuk.

“The whole system is broken,” he added. “I don’t have much hope for justice in Ukraine.”

Some experts blame former prosecutors general and the National Bank of Ukraine before it was overhauled, bringing greater transparency to the banking system.

Gontareva accused the lower courts in Ukraine and two prosecutors general, Viktor Shokin and his successor Yuriy Lutsenko, for the failure to properly investigate cases. “Totally ineffective and totally corrupt,” said Gontareva.

Danylyuk goes further, charging Lutsenko, who was prosecutor general between 2016 and 2019, with blocking the advancement of legitimate cases, starting politically motivated investigations against the NBU and PrivatBank and protecting the oligarch Kolomoisky.

As finance minister, Danylyuk demanded Lutsenko’s resignation in December 2016 because the former prosecutor general “was trying to block the submission of PrivatBank cases in London.”

Around the same time, Danylyuk’s efforts to establish a Financial Investigation Service that could properly investigate and prosecute bank fraud were being “obstructed” and “sabotaged” he recalled. “It was resisted by everyone… the SBU [State Security Service] and [former President Petro] Poroshenko.”

The latest prosecutor general, Ruslan Riaboshapka, who took the job in August 2019, says he is under pressure to get quick results. In an interview with the Kyiv Post, the top prosecutor said that anybody who commits a serious crime for which there is sufficient evidence of guilt will be prosecuted under his watch.

“There are not any untouchable persons in this country,” Riaboshapka said in November 2019.

“I enjoy the right to prosecute anybody who is guilty, even Kolomoisky, even (billionaire oligarch Rinat) Akhmetov, and any other oligarch. Anybody can be prosecuted if they committed a crime and there’s evidence to show it,” he said.

The political will “is there, absolutely” to solve the greatest crimes, Riaboshapka said, but “the second part is the capability to prosecute someone who is extremely powerful.”

Proving criminality, however, often requires concrete records that the former owners directed the alleged fraud, and such records are scant. Also, many owners had proxies working in their stead. “It’s unlikely that anyone will agree to act as witnesses against them because these are very influential people,” says researcher Andrii Ianitskyi.

In October, Riaboshapka’s office announced that it is reviewing case files concerning six problematic banks. Asked by the Kyiv Post about the status of these six cases in February, the prosecutor general and his assistant did not respond to questions by press time.

“How are these promises taking form?” responded Danylyuk, when asked about pledges made by Riaboshapka and other officials in the Zelensky administration to protect PrivatBank and tackle unpunished bank fraud.

“We have to pay attention to the actions and the results,” he said. “The new prosecutor general seems committed, but the results are not there. We have to judge by the results.”