It’s been called the biggest financial crisis in Ukrainian energy in recent memory.

Power companies are not getting paid. The grid operator groans under massive debt. And industry is made to subsidize forty million domestic consumers, who keep being promised that their power bills will come down even more.

How did this happen? The problems go to the heart of how the Ukrainian market is structured and regulated.

“All of the problems stem from two sources. One is the cross-subsidy,” a scheme under which industry supports low energy prices for the public, said Oleksandr Kharchenko, director of the Energy Investigation Center.

The second? “A battle between two oligarchic groups, one of which is a consumer and the other is a producer of electricity.”

In today’s market, everyone has something to complain about. Industry groups decry high energy costs. Officials want to curb expensive green power. Renewable investors point to the government’s growing debt and the law that guarantees them a return on their investments.

The state nuclear producer complains about being forced to sell four fifths of its energy below market rates. Regulators blast energy lobbyists. Watchdogs point a finger at monopolistic behavior. And the European Energy Community is watching all this unfold with unease.

In name only

The new market model launched last July. The reform was meant to push Ukraine toward European standards and let consumers choose their providers.

The model has four segments. From least to most expensive, they are long term two-way deals; the day-ahead market; the same day market; and the last resort balancing market.

But Kharchenko hesitates to call what Ukraine has now a “market.” Its segments are either under or over-regulated. Instead of letting market forces operate within a set of consistent rules, the energy regulator and ministry put up a wobbly scaffold of spot fixes, restrictions and subsidies.

One example is the energy ministry’s support of coal in this year’s energy balance.

“The ministry says ‘we recommend that you burn coal and not gas,’” said Kharchenko. “Right now, gas is much cheaper than coal… Ask any participant or investor in Ukrainian energy [and they’ll say] it’s cheaper for me not to touch coal. But because the government mines have nowhere to stick it, the ministry pushes generators to burn the coal.”

Certain price caps are another example, when they push some energy prices below the cost of production, Dragon Capital analyst Denys Sakva said.

Price caps make sense for an oligopolistic market like Ukraine, but they will need to be phased out eventually, according to the European Energy Community.

But most problematic of all is the cross-subsidy. Households’ power bills are kept artificially low at the expense of non-residential consumers in a way that massively limits how producers can sell their electricity.

To many experts and the European Energy Community, this is the fundamental issue that underlies all the others.

The financial crisis in Ukraine’s energy market led to many unhappy players. The Cabinet of Ministers and multiple stakeholders had to convene an Anti-Crisis Energy Headquarters to talk out the problems and come up with solutions. (Kyiv Post)

Cross subsidies and PSOs

The cross-subsidy is achieved through Public Service Obligations (PSOs) that put a straitjacket on state energy companies. State nuclear company Energoatom has to sell 80% of its electricity to Guaranteed Buyer, the state company that buys all renewable energy. Hydropower has to sell 30% under the PSO.

As of today, this arrangement is not doing very well. “Currently, Guaranteed Buyer cannot financially cover even the cost of the household PSO through nuclear and hydro energy,” the European Energy Community stated in a presentation.

The Energy Community Secretariat under director Janez Kopac said this model should be switched out for a financial PSO, where companies can sell energy how they want, then use part of their revenue to cover the population’s costs.

In May, the energy ministry lowered Energoatom’s PSO from 85% to 80%, letting it sell 5% of its energy on the competitive two-way market. Acting minister Olga Buslavets said this would improve Energoatom’s dire financial situation and let industries with high energy costs get their power at cheaper prices.

Sounds good. Except there were just a few caveats. First, 5% is very little. Energoatom put out a statement, saying it needed to be able to sell at least 50% of its energy on the two-way market to be competitive.

Second, eligible buyers are limited. Electricity costs have to be higher than 30% of their cost structure, among other restrictions. This de-facto limited customers to water utilities and ferroalloy plants. Oligarch Ihor Kolomoisky is a major ferroalloy player and has been working for a long time to lower his power bills.

Energoatom has failed to find any buyers in the first bilateral auction on June 18, the state company said in a statement.

Kopac sent a frustrated letter to Buslavets, complaining that her ministry did not even look at his suggestions. The acting minister issued a statement that she agrees with him and the decision was a temporary measure.

Still, many experts told the Kyiv Post they don’t think the cross-subsidy is going anywhere. There’s simply no political will to take the unpopular step, even though monthly household electricity costs wouldn’t rise by that much and cost about as much as the phone bill.

It ain’t easy paying green

In 2008, Ukraine implemented a euro feed-in tariff (FIT) to boost renewables.

The tariffs were initially made with oligarchs in mind. Domestic oligarchs dominated the sector for years, making big profits off the high FIT. The fact that it was in euros stuck in many critics’ throats.

But it has done its job. In recent years, a swarm of international players also entered the market, along with many domestic small and medium enterprises. Today about 800 wind and solar companies operate in Ukraine and total investment in the sector has reached over 10 billion euros.

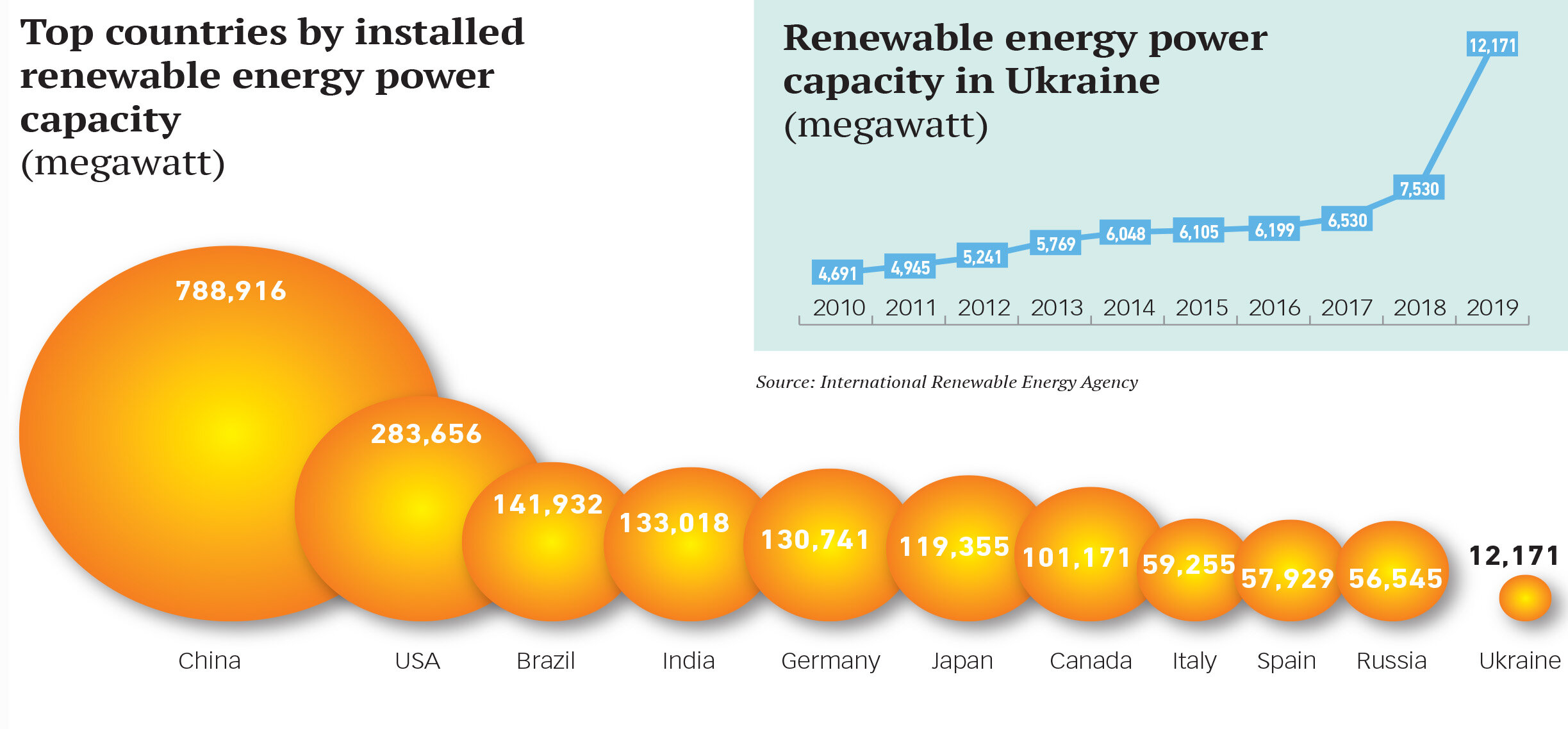

Last year saw the biggest rush. The country went from two percent to eight percent renewable generation. Yet renewable costs ballooned to a quarter of the total.

Last year, the state passed a law replacing fixed tariffs with ones you have to win at auction, starting in 2020. Parliament would set annual quotas and developers would bid on projects, with the most affordable bids winning a power purchase agreement and the right to build.

But the effect was an even bigger surge of renewable investors, foreign and domestic, rushing to squeak in before the end-of-year deadline to try to get a piece of the fixed FIT pie. The amount of green projects was way over what the government had budgeted. The state Guaranteed Buyer could not pay and its debt to the greens began to pile up in the billions.

The ensuing standoff pushed back the very auctions that were supposed to make green energy more affordable — there could be no talk of setting energy quotas until the issue of debts to the greens had been sorted out. And they’re still being sorted out today. For each of the past few months, the government paid less than ten percent of what it owes to renewable producers. Frustrated investors have threatened international arbitration.

In June, two of three major renewable business associations signed a memorandum with the cabinet to take a 15% cut to solar and a 7.5% cut to wind in exchange for the government paying back its debts over the next year and a half. But they did so grudgingly, with many more greens saying this memo was discriminatory and unlawful.

A bill may forge this memo into law. But if Parliament fails to sign it by summer recess, it will only kick this can further down the road.

Despite last year’s meteoric growth in renewable capacity, Ukraine is barely a glimmer compared to the top countries by installed capacity. China remains far ahead of the pack, followed by the U.S., Brazil and India. Ukraine’s poorly-structured market that makes the nation’s grid operator responsible for paying renewables is not sustainable in the long run and may hinder Ukraine’s plans to further scale up its green energy. (International Renewable Energy A)

Buyer not guaranteed

Renewables aren’t the only ones with debt from the government. Energoatom, which makes half of Ukraine’s energy has more than Hr 12 billion outstanding.

Earlier this year, parliament approved a plan to issue government bonds to cover the debt, but that won’t fix the long-term problem. Deep cuts to nuclear energy approved in April also won’t help Energoatom make more revenue.

Besides selling nuclear and hydroelectric energy on the spot market, Guaranteed Buyer gets money from Ukrenergo, which runs the nation’s powerlines. Transmission tariffs were meant to be the source of money for renewables. But the greens grew too quickly and now a huge chunk of Ukrenergo’s revenue goes to paying them.

Ukrenergo was projected to have to pay Hr 10 billion to Guaranteed Buyer for the whole year. But as of July, it’s already being charged Hr 22 billion to cover the renewable FIT and the PSO to households.

“The need to reimburse these costs was not taken into account,” Ukrenergo wrote in an email. Energy officials mistakenly thought Guaranteed Buyer would be able to make enough money on the spot market.

The other problem is that Ukrenergo is not getting paid either. Regional utilities and state and private companies haven’t been paying their transmission bills. Since the start of the COVID-19 pandemic, neither have many citizens. Ukrenergo is missing billions of hryvnias as a result. Energy experts added that state companies are also to blame.

Last year, a group of metallurgical plants, including Ihor Kolomoisky’s Privat Group of companies, successfully sued to block a transmission tariff increase. Also, investigative reporters with the Nashi Groshi television program reported in January that companies of the DTEK holding, owned by oligarch Rinat Akhmetov, owed significant sums as well. DTEK said that this was misinformation.

Kharchenko said it was a mistake to ever put these kinds of obligations on Ukrenergo’s shoulders. The grid operator has to be independent. If it falters under the burden, Ukraine will quite literally be out of energy.

The burdens of industry

But the industrial consumers aren’t getting a free ride either.

On top of having to subsidize households, they and their advocates, including parliamentary energy committee leader Andriy Gerus, point out that Ukraine has some of the highest energy costs for businesses in Europe.

This is partly true. Overall energy costs are actually cheaper than in many European countries due to lower taxes and fees. However, this means the government gets less tax revenue for the budget and the grid operator gets less money, leading to problems down the line, said Gerus.

Energy prices on the spot market — the day-ahead and intraday segments — are in fact some of the highest in Europe according to data from the Ukrainian energy exchange. While most of the energy market consists of cheaper two-way deals, the spot market is about a third of the total.

Higher costs are also being driven by monopolistic behavior in some segments of the market. DTEK has long been accused of holding this position in the Burshtyn energy island area, and is currently under investigation by the Anti-Monopoly Committee. DTEK responded that it does not engage in monopolistic behavior and that this investigation has yet to find the company guilty.

Recently, the energy regulator NEURC stated that it will increase transmission fees in order to help Ukrenergo and Guaranteed Buyer deal with their debt problems.

Predictably, the proposal was very unpopular. But since the savings to be achieved by the memorandum with green energy producers to decrease the FIT are small, the rest of the money has to come from somewhere.

“There are only two sources — industry (the country’s economy) and there is the population,” said NEURC Director Valeriy Tarasyuk. “We have no other sources.”