Jobs in information technology are highly sought after in Ukraine. Local techies work in modern offices and develop services for big overseas clients, some earning enough to afford to work remotely from under palm trees in Bali or Thailand.

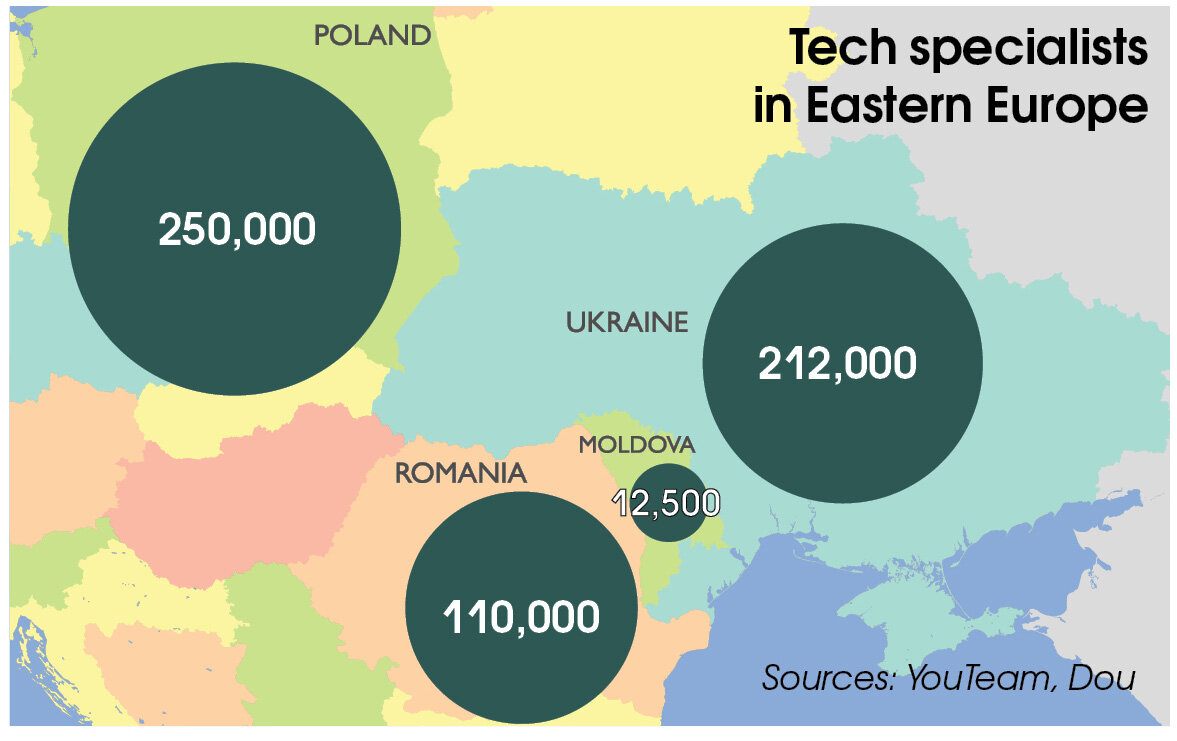

Today, Ukraine has over 212,000 tech specialists, 11% of the country’s 1.9 million individual entrepreneurs. Over 16,000 tech students graduate from Ukrainian universities every year, which is still not considered enough. That number is expected to grow by 23% in 2024.

Today, Ukraine has over 212,000 tech specialists, or 11% of the country’s 1.9 million individual entrepreneurs. Over 16,000 tech students graduate from Ukrainian universities every year.

Ukraine encourages local undergraduates to study computer science because the country’s tech industry is thirsty for talents: in the second half of 2020 alone, Ukraine’s 50 biggest tech firms, including EPAM, SoftServe, GlobalLogic and Luxoft hired nearly 8,000 IT specialists.

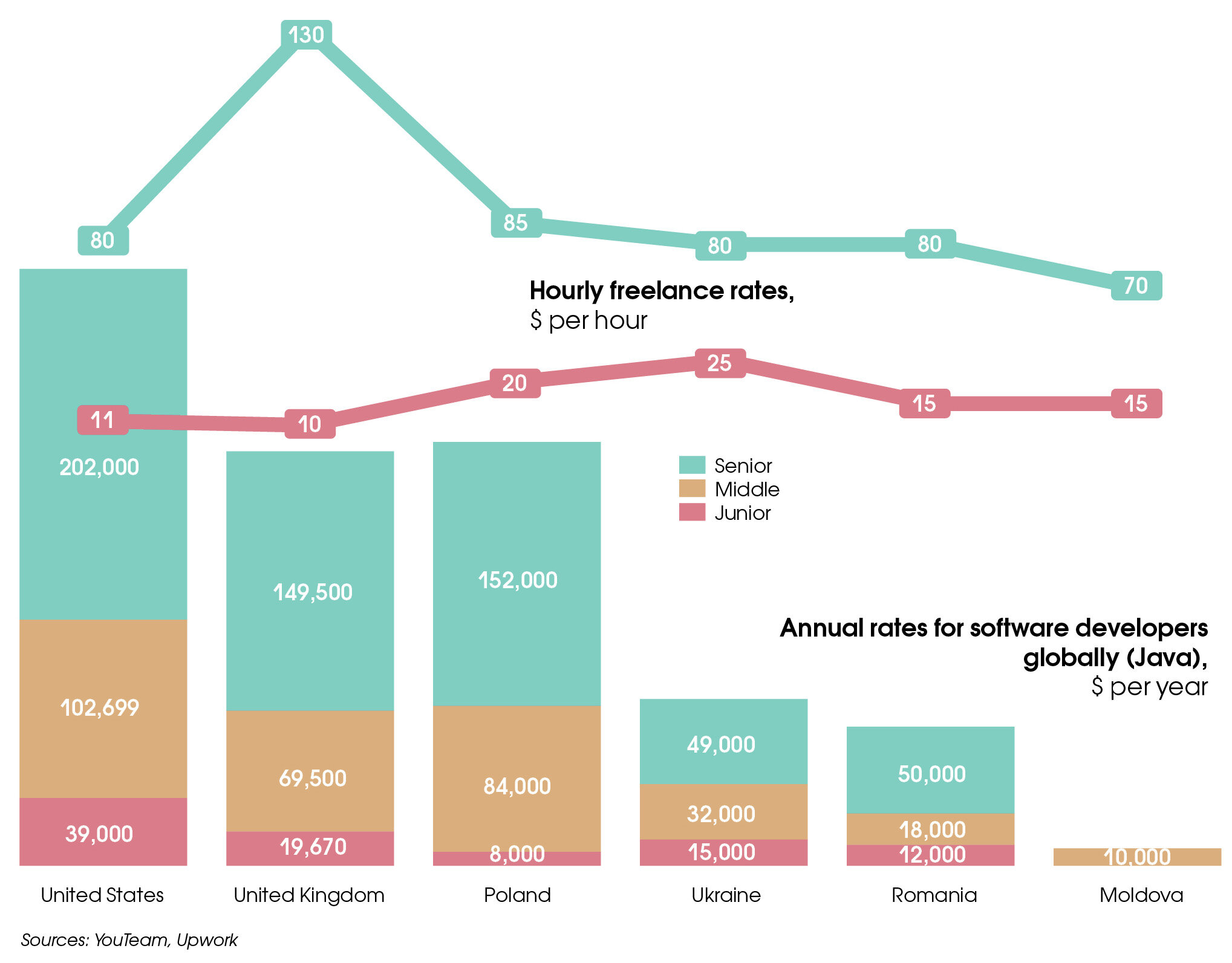

Ukrainians can earn $2,500 a month working for a tech company, paying a mere 5% income tax. In addition, they can choose any field they like: e-commerce, fintech, game development, education or entertainment — technology is in demand everywhere.

As Ukraine’s tech industry continues to grow, it is becoming more mature and progressive, experts say. Twenty years ago, the country’s IT sector consisted of just a few firms paving their way through many economic downturns without the government’s support. Now, the industry secures over $5 billion in exports and generates nearly $588 million in taxes.

The tech sector grew by 20% even amid the pandemic while other businesses suffered. Technology helped Ukraine survive the coronavirus crisis and the government seems to be interested in helping the tech industry to grow even more.

In 2020, Ukraine’s Ministry of Digital Transformation introduced a project called Diia City, an economic zone with taxation, legislation and employment benefits tailored for local and foreign tech firms. Ukrainian techies are suspicious of the project: They overtly criticize the bill and ask to amend it, saying “the government shouldn’t change a system that works.”

In April, the parliament submitted an improved bill on Diia City in the first reading and now has to amend a tax code to adopt other novelties offered by the Ministry of Digital Transformation.

And while a fully digital Ukraine has a long way to go — a new ecosystem for tech specialists is emerging in Ukraine. For years, Kyiv, Kharkiv and Lviv were the main venues for tech specialists — nearly 70% of Ukraine’s techies still work there. But smaller towns are becoming popular too because they are cheaper, more ecological and are doing their best to prevent brain drain.

For example, Ivano-Frankivsk, a city of 238,000 people nearly 600 kilometers west of Kyiv was named the best city to do business in 2020, according to Forbes. In a survey by tech media Dou, Ukrainian tech specialists called Ivano-Frankivsk the most comfortable city to live in, along with Lviv and Vinnytsa.

According to Dou, nearly one-third of tech specialists in Kyiv are originally from small towns across Ukraine. Techies flock to the capital or other big cities because that is where the country’s 100 research and development centers are located and the market of startups is thriving.

Ukrainians can earn $2,500 a month working for a tech company, while the average monthly wage in the country is $490.

For tech firms, it is easier to find clients and new specialists in big cities. However, some businesses are reconsidering this approach. For example, Ukraine’s biggest tech company EPAM that employs nearly 10,000 techies across Ukraine announced in May that it will open a new office in Ivano-Frankivsk to attract new talents there.

Another trend that is transforming Ukraine’s tech environment is the focus on products rather than services. According to Dou, the share of product companies grew from 28% to 35% in 2020.

Ukraine is still the best outsourcing destination in Eastern Europe with 11 outsourcing tech firms, including Ciklum, Eleks, Intellias and N-iX, all listed among the best in the world.

But if more companies start selling and developing their products within the country, it will make Ukraine more innovative and competitive, experts said.

Today, Ukrainian tech companies and startups attract investment from the U.S. or Europe and sell their products in the foreign markets. Young startups are reluctant to grow in Ukraine because of poor legislation and a poor investment climate that can’t afford to invest in tech.

Tech companies with Ukrainian roots attracted $571 million from local and foreign investors in 2020 — $27 million more than in 2019.

To change that, Ukraine founded a startup fund that awards grants ranging from $25,000 to $50,000 to local tech entrepreneurs. This money supports them at an early stage, while the ideas are still half-baked or in need of financing to take off.

But Ukrainian investors can’t compete with foreign funds. Last year, Ukraine-founded startups attracted $571 million of investment — 80% of that money came from foreign investors.

Ukraine boasts many local startups, including Grammarly, People.ai, and GitLab, valued at $1 billion, but they all are registered in the U.S. where they pay taxes.

Many big Ukraine-founded tech companies support the local market and try to improve its reputation. But, according to them, Ukraine needs more money, better laws and less bureaucracy to thrive.