Kyivstar and Vodafone are on their way to becoming Ukraine’s dominant telecommunications providers as new data shows that Lifecell lost 2.2 million subscribers in the last two years.

According to Lifecell’s latest financial report, 800,000 subscribers stopped using their SIM cards in 2017. According to the company’s metrics, these users haven’t replenished their accounts for more than three months.

Now, the company has 8.4 million active users. That’s down from 9.2 million at the end of 2016 and 10.6 million in 2015, out of a total market of roughly 55 million SIM cards in Ukraine.

Lifecell insists that such an outflow is normal. The number of Ukrainians with two SIM cards has dwindled, a company spokeswoman argued, meaning that the carrier is not losing ground in the telecom market.

Lifecell says its SIM cards were often used as an addition to the main phone number, partly because the operator is the most recent entrant on Ukraine’s telecom market and offers cheaper plans.

Lifecell spokeswoman Olga Mukha told the Kyiv Post that Lifecell can’t break the duopoly of Vodafone and Kyivstar until there is mobile number portability, a service that allows customers to move freely among networks, taking their number with them regardless of which provider they use.

Ukraine has been trying to launch mobile number portability since 2010, when the respective bill was passed in parliament. Since then, the state has been trying to pick a company to service the database of mobile numbers. The results of the last tender were canceled by court in April and the selection is about to start anew.

The absence of mobile number portability and price hikes in tariff plans create a “club effect” that keeps subscribers “locked in prisons,” Mukha says.

As a result, people can’t spend the money on several operators and tend to stick to only one; in most cases, it is not Lifecell.

According to forecasts from the State Center of Radio Frequencies, only one to two million people are expected to change carriers if mobile portability goes live.

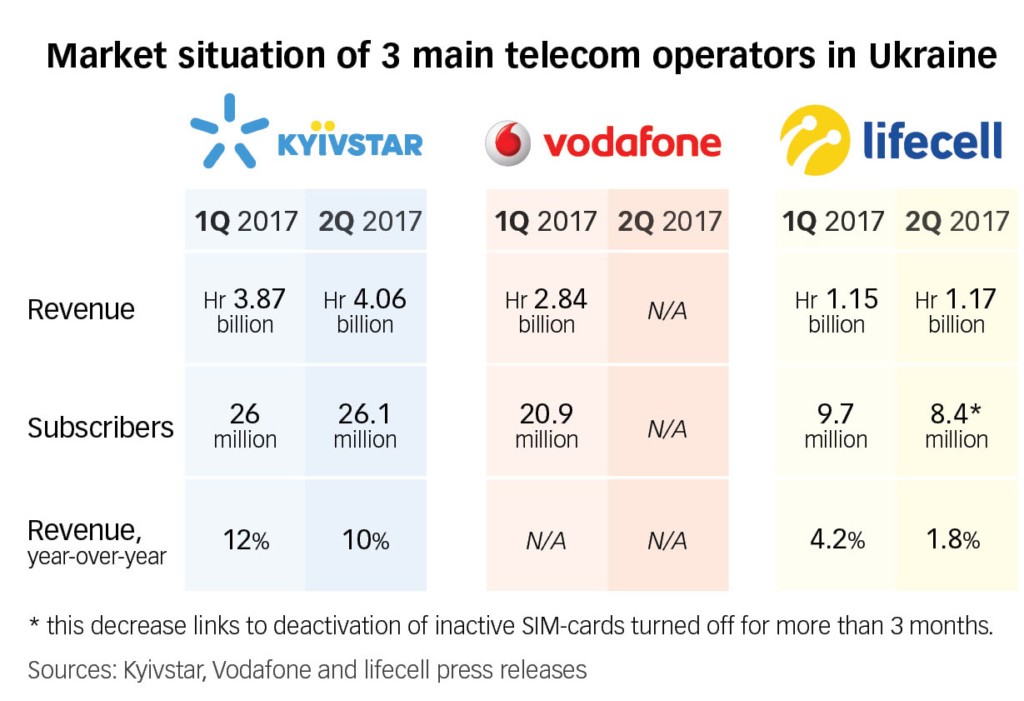

Kyivstar and Vodafone currently have 26.1 million and 20.9 million subscribers respectively. The subscriber bases of both have been growing, albeit slowly.

Financial troubles

Lifecell reports that it has started earning slightly more from those who remained loyal to its brand. With 800,000 fewer active subscribers in the second quarter of 2017, Lifecell demonstrated revenue growth of 1.8 percent, comparing to the same period last year. The revenue reached $46 million.

But it’s literally nothing in comparison with revenue Kyivstar and Vodafone Ukraine demonstrate, thinks Roman Khimich, an independent telecom consultant. On Aug. 3, Kyivstar reported it had earned by 10 percent more than a year ago in the second quarter of 2017, $154 million, while Vodafone reported $108 million earnings in this year’s first three months.

Khimich is sure that Lifecell uses quarter reports to manipulate its investors. By reducing its base of subscribers (showing only active ones), it increases statistics on average spending inside its network. Average revenue per user for all the operators grew from around $1.3 to $1.7 per month.

“Shareholders first of all are interested in money, that’s why financial indicators like average revenue per user are more important than the number of subscribers,” Khimich told the Kyiv Post.

So he says people should not think that Lifecell will leave the market because it has fewer active users. Financial results, however, tell a less pleasant story. “Lifecell revenue grows almost 10 times slower, which means the company loses its market share,” Khimich said.

Such a weak position has prompted speculation that Lifecell’s sole shareholder, Turkey-based Turkcell, may soon sell the company, leaving only two big mobile operators in Ukraine.

“The market for two? Everything is possible,” Alexander Zhyvotovsky, the head of the State Center of Radio Frequencies, said in an interview with the Kyiv Post on Aug. 2. “But if this ever happened, it would be very bad for the market.”

The table compares available financial results of Ukraine’s three biggest phone carriers for the first and second quarters of 2017. Vodafone Ukraine will report its earnings later in August.

Managerial decisions

In April, Lifecell changed its CEO. An official press release claimed the company’s former chief, Burak Ersoy, had resigned. Ismet Yazıcı, the former head of Turkcell in northern Cyprus, took over. He still hasn’t given interviews since his appointment on April 13.

Zhyvotovsky sees 2016 as the year when something went wrong for Lifecell.

“Nothing supercritical happened on the market in ‘16, and so external factors couldn’t affect the company’s business,” Zhyvotovsky said. “There should be a deeper look into some particular managerial decisions, I guess.”

He says the Ukrainian telecom market is fiercely competitive and unforgiving of mistakes.

“If the financial results of Kyivstar deteriorated like they did at Lifecell, the life of its CEO, Peter Chernyshov, would change a lot.”

The Kyiv Post’s IT coverage is sponsored by Ciklum. The content is independent of the donors.