It’s been a freezing winter for three of Ukraine’s oligarchs.

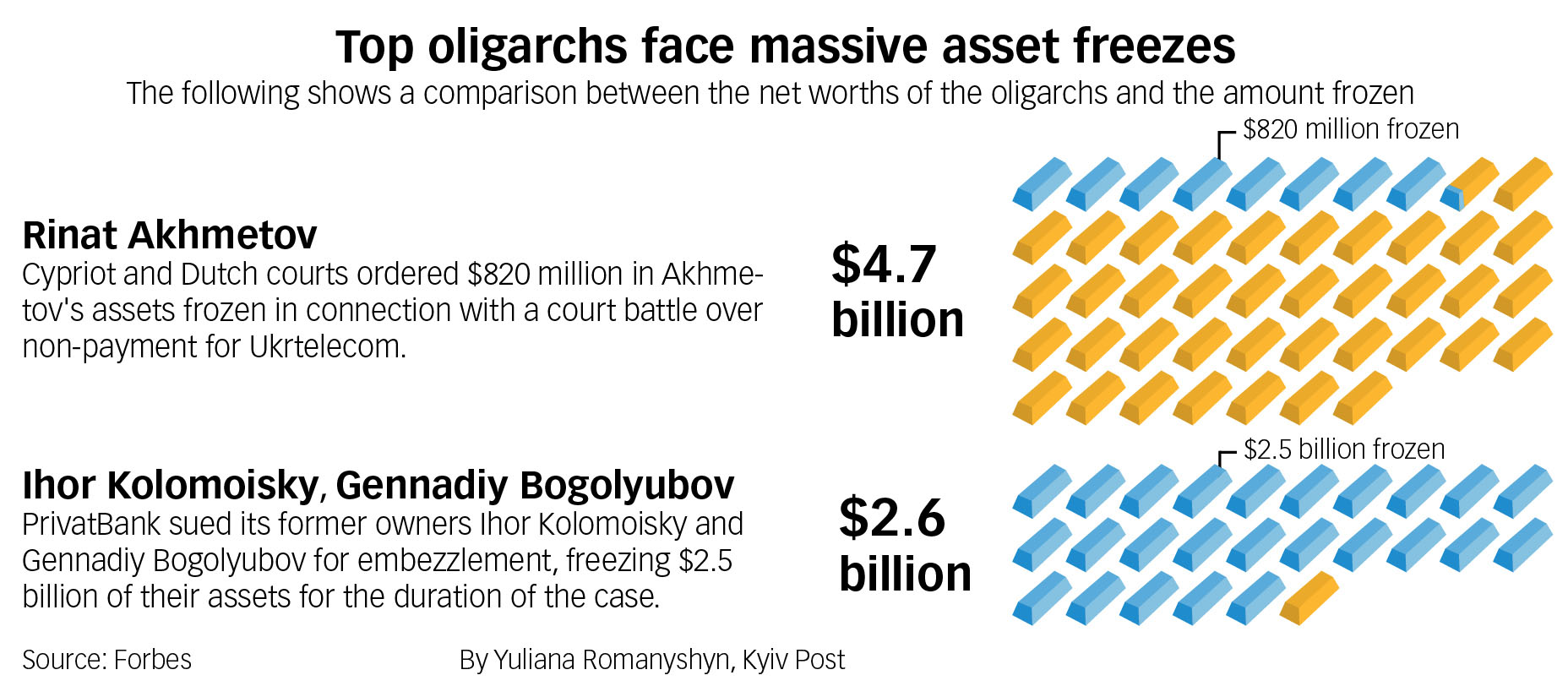

English, Dutch and Cypriot courts have frozen $3.32 billion worth of assets of three of Ukraine’s richest men — Rinat Akhmetov and the business duo of Ihor Kolomoisky and Gennadiy Bogolyubov. That’s almost half of their combined net worth of $7.09 billion.

The freezes come in addition to earlier asset seizures that targeted exiled oligarch Dmytro Firtash, facing U.S. corruption charges that he denies as he fights extradition from Vienna.

But now, the oligarchs are going on the offensive against the instigators of the court cases.

Kolomoisky and Bogolyubov were hit with their $2.5 billion asset freeze in a London court case filed by PrivatBank, formerly owned by the pair and now state-owned, and the Finance Ministry. The case alleges embezzlement forcing the December 2016 nationalization and a $5.4 billion taxpayer bailout of the bank.

The Akhmetov matter is latest phase in oligarch haggling over the fate of Ukrtelecom. A firm called Raga Establishment Ltd. has accused the oligarch of failing to pay $820 million for the acquisition of Ukrtelecom. The freeze order hits Akhmetov’s $213 million London apartment as well as his stake in System Capital Management.

Raga won an arbitration case in June as part of the dispute and is using that win to serve lawsuits on Akhmetov in the Netherlands and Cyprus. The case sheds light on dealings that saw the telephone monopoly go to Akhmetov’s System Capital Management via a deal with Firtash and former

President Viktor Yanukovych’s chief of staff, Serhiy Lyovochkin.

Raga, in turn, owes Firtash’s Group DF $300 million. Group DF did not reply to a request for comment.

“The current allegations by the State Property Fund of Ukraine and other governmental bodies of Ukraine regarding the unlawfulness of the privatization of Ukrtelecom and non-performance of investment obligations all stem from the activities of Raga Establishment Ltd. and its real beneficial owners, as well as persons who funded the privatization in 2011,” System Capital Management spokeswoman Anna Terekhova said in a statement.

Freezing Akhmetov

The Ukrtelecom asset freeze appears to be the result of a conflict between two backers of the now-defunct Party of Regions: Akhmetov, and people associated with Firtash and Lyovochkin, now an Opposition Bloc member of parliament.

Akhmetov and his company System Capital Management are accused of paying only $100 million out of $860 million for the purchase.

Rinat Ahkmetov speaks in Donetsk in 2014. The reclusive billionaire oligarch is rarely seen in public. (Kostyantyn Chernichkin)

The government sold Ukrtelecom in 2011, at the height of Yanukovych’s power, with an Austrian firm, EPIC, buying it for $1.3 billion. The buyout caused a huge scandal as EPIC was the only bidder and its owners were unknown at the time of sale. EPIC is linked to Firtash and Lyovochkin via Denys Gorbunenko, a London-based banker who led Ukraine’s Rodovid Bank in the late 2000s and who filed the claim against Akhmetov.

Gorbunenko was spotted embracing Firtash at a Vienna extradition hearing in February, while his bank played a role in the 2010 bailout of Firtash’s Nadra Bank.

Based on Forbes’ estimates of their estimated net worth, a significant portion of the net worth of billionaire oligarchs Rinat Akhmetov, Ihor Kolomoisky, and Gennadiy Bogolyubov have been frozen because of legal disputes.

Bloc Petro Poroshenko lawmaker and former investigative journalist Sergii Leshchenko helped expose information in the scheme. In a January 2016 article on Lyovochkin’s French villa, Leshchenko linked the directors of a shell firm that used to own the Cote D’azur property with the Cypriot directors of Raga Establishment.

State impropriety

The arbitration case alleges Yanukovych-era Deputy Prime Minister Serhiy Arbuzov personally managed aspects of the Ukrtelecom sale. The

Akhmetov freeze comes as conflict looms between the State Property Fund and Ukrtelecom.

State-owned Oschadbank loaned Ukrtelecom Hr 1.1 billion (worth $137.5 million at the time of the loan in 2011). Oschad accuses the company of failing to repay the loan, while state-owned Ukreximbank filed an Hr 2.83 billion ($353.7 million in 2011) lawsuit of its own over another unpaid line of credit.

The State Property Fund recently moved to launch a reprivatization of Ukrtelecom after a court ruling preliminarily renationalized the asset.

Raga denied that its case was linked, saying in a statement that “payment of the debt and issues relating to the privatization are separate matters.” The company denied links to Firtash in the arbitration suit.

Dragon Capital Analyst Denis Sakva, in a research note, wrote “should the SPF succeed in re-privatizing the company, the existing owner will be eligible for the reimbursement of purchase costs, and thus have the funds to pay Raga. However, the timing of such compensation is very uncertain.

Otherwise, if the privatization is successfully defended in courts, SCM would have to pay Raga with its own funds.”

Attorneys for Akhmetov filed an appeal in the Cypriot court on Jan. 8 and offered no further comment.

Kolomoisky fights back

Kolomoisky and his loose network of affiliated shell companies known as Privat are also fighting back against their own $2.5 billion asset freeze.

After a meeting in Amsterdam in late November between Kolomoisky and General Prosecutor Yuriy Lutsenko, prosecutors got a warrant from a Kyiv court to raid PrivatBank and the NBU for documents related to the hiring of consulting companies AlixPartners and Kroll, which was hired to conduct a forensic audit of PrivatBank. Another court, however, blocked Kroll from conducting the audit itself.

Then on Dec. 28, a former NBU employee fired for failing to adequately supervise PrivatBank when it was under Kolomoisky’s control, filed a complaint to the National Anti-Corruption Bureau of Ukraine, in part over the hiring of Kroll.

The complaint cited details from documents that were seized during the prosecutors’ raid, including the fact that Kroll is receiving 3.4 million euros for its work on the case.

A Kyiv court unblocked intelligence and risk analysis firm Kroll from conducting the audit on Jan. 3.

The same day, Interfax reported that companies affiliated with Kolomoisky had filed an arbitration claim filed against Ukraine in Stockholm for $5.4 billion.

The case emanates from state oil producer UkrNafta, in which Kolomoisky owns a 43-percent stake, but which he has maintained de facto control over for more than a decade. Kolomoisky did not reply to a request for comment.