On March 14, the Ukrainian parliament approved the free trade agreement between Canada and Ukraine.

Although the treaty still has to be approved by the Canadian higher house of parliament and signed by Ukrainian President Petro Poroshenko and Governor General of Canada David Johnston, experts have hailed the deal.

It comes a year after a free trade pact with the European Union in January 2016.

“This ‘triangle’ of free trade treaties with Canada and EU provides business with opportunities to be integrated into global value chains and deepen economic and trade relations with two powerful economies in the world,” Nataliya Mykolska, Ukraine’s state trade representative told the Kyiv Post.

The numbers, however, show that Ukraine has a long way to go to replace Russia’s dominance as a trading partner with Western nations.

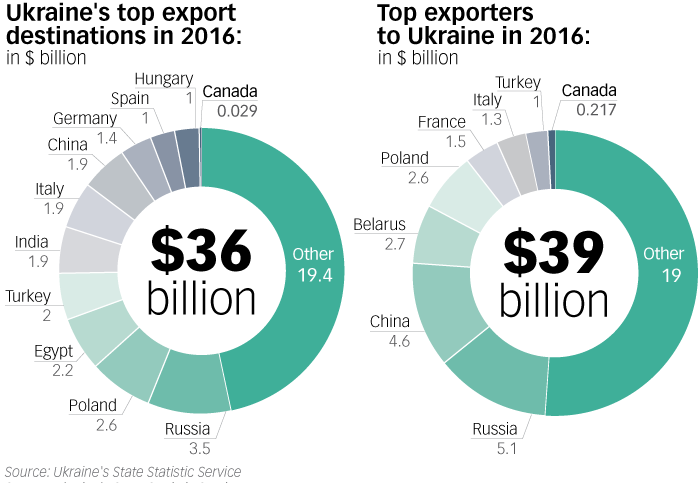

According to the Statistic Service of Ukraine, in a year after European free trade agreement came into force, Ukraine’s export dropped by 4.6 percent, from $38 billion in 2015 to $36 billion in 2016, while import increased also by 4.6 percent, from $37 billion to $39 billion.

The 2016 official trade statistics remain grim for Ukrainians who want to cut trade ties with Russia, which has been waging war against Ukraine since 2014. Russia remained Ukraine’s largest trade partner in exports and imports. Ukraine hopes that free trade agreements with the European Union and Canada will boost Ukraine’s trade with the West. But the reality is that Ukrainian trade with Canada is miniscule.

“When Europe opened markets for Ukraine, we thought we would start selling our goods immediately. Unfortunately, Ukraine has got more goods from Europe, than it managed to sell (in 2016),” Alexey Doroshenko, Samopomich Party lawmaker and the head of the Retail Trade Suppliers Association of Ukraine told the Kyiv Post on March 15.

“After we’ve got numbers, we discovered that in a year after treaty came into force European Union countries increased export to Ukraine for $800 million, while Ukraine increased its export to EU for $ 400 million,” Doroshenko said.

The lawmaker added that during different meetings with European partners, Ukrainian traders asked them to explain the situation.

“Europeans in response only shrugged their shoulders and said: ‘Maybe you just don’t know how to trade,” Doroshenko added.

However, Doroshenko was confident that in future, Ukraine will start getting more and more benefits from free trade. But that would happen only in two or five years in a best-case scenario. Until then every year Ukraine will import more and more high-quality goods from its strong Western trade partners.

Premier League

Doroshenko compared Ukraine’s achievements on the European market with a soccer team that just entered the Premier League and now have to compete with such heavyweights as France, England, Spain soccer teams.

“At first the new entry will get more balls home than score itself,” Doroshenko said. “But that’s not so bad, as we have to learn how to play with the professional and skilled competitors.”

State Statistics data reads that in 2016 Ukraine’s general export to EU countries in general grown from 31 percent in 2015 to 37 percent in 2016.

But among individual countries, Russia still remains the main economic partner of Ukraine.

Despite the ban on double-purpose goods trade and Russia’s ban of Ukrainian food products launched in 2015 and extended in 2016, last year Ukraine exported goods to Russia worth $3.5 billion and imported even more, some $ 5.1 billion.

Ukraine’s other top export destinations were Poland ($ 2.6 billion), Egypt ($2.2 billion), Turkey ($ 2 billion), India ($ 1.9 billion), Italy ($1.9 billion), China ($ 1.9 billion), Germany ($ 1.4 billion), Spain ( $ 1 billion) and Hungary ($1 billion).

Top exporters to Ukraine in 2016 were: China ($4.6 billion), Poland ($2.6 billion), Belarus ($ 2.7 billion), Italy ($ 1.3 billion), France ($1.5) and Turkey ($ 1 billion).

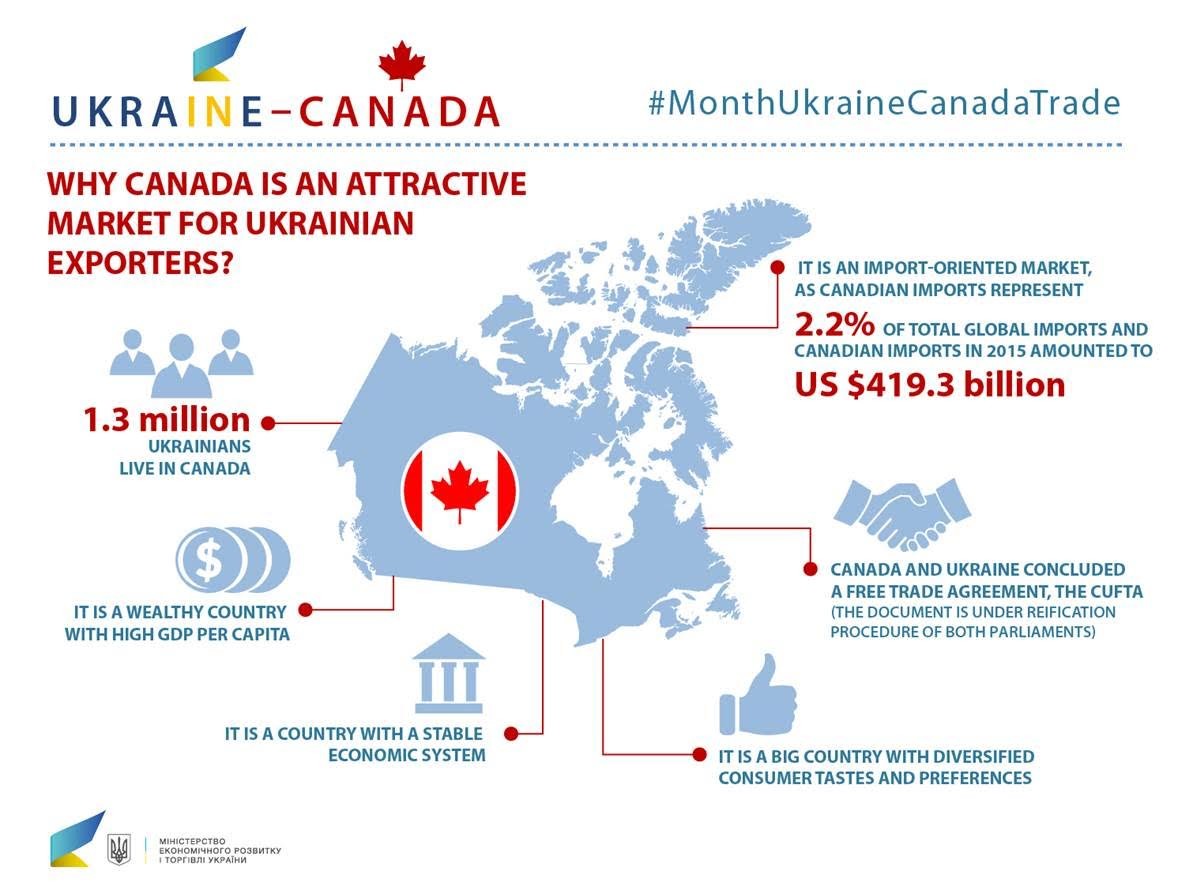

Canada ranked only 54th place among Ukraine’s economic partners, as it imported $28 million worth of goods made in Ukraine and exported goods worth $217 million to Ukraine.

Ukraine’s Economic Development and Trade Minister Stepan Kubiv said in a video address released on March 14 that Canada would help Ukraine reorient away from the Russian market.

Mykolska said Canadians are very interested in products of agro-industrial sector and metallurgy, goods that usually were sold mostly to Russia.

“For example, made in Ukraine railway locomotives and other railway equipment spare parts exports to Canada has grown by 57% in 2016. As you see Ukraine producers are actively reorienting their exports from the Russian market. It works with other categories of products too,” Mykolska said.

However, Doroshenko said Canadian treaty has some problems as Ukraine and Canada export practically the same types of goods.

“We sell grains and metallurgy to them and they sell grains and metallurgy to us in return,” Doroshenko explained.

Ukraine’s Economic Development and Trade Ministry sees Canadian market as very appealing for Ukrainian businesses as every year Canada imports goods on more than $400 billion.

According to the Economic Development and Trade Ministry, in 2016 Ukraine and Canada exported and imported each other machinery and metallurgy products, minerals, agricultural products, consumer goods and more.

“I believe, that Ukrainian exporters should start to study the Canadian market right now, find interesting and priority partners from that part, examine all possible tools that will allow entering the new market,” Mykolska said.

After all the ratification procedures will end Canada and Ukraine will exchange relevant notices and in a month it will enter into force.

Mykolska expects the increase if investments from Canada to Ukraine, as well as investments from other countries, to accommodate processing plants for export to Canada and the EU.

“The agreement on free trade zone is a sign to investors that Ukraine is a reliable partner,” Mykolska said.

Foreign direct investment in Ukraine in the medium term will increase to at least $36 million. This means the modernization of enterprises, new jobs and a general improvement in living standards for Ukrainians.

Market for raw materials

Mykolska said free trade treaties with EU and Canada provide the possibility of so-called ‘bilateral accumulation’. It means that partners may use each other’s raw materials to produce goods without having to prove that the processing of such goods was enough to meet rules of origin.

Doroshenko said that indeed European partners see Ukraine for now as the market to buy raw materials, not complete products.

It is very hard for Ukrainian brands to enter the European market as every retail chain demands individual certificates of quality besides CE or Conformity European (European Standard Certificate). In general, it takes more than two months of hard inspections to get such certificate.

“Europeans always want to buy our raw material more than products. For them it’s good, as raw materials are much cheaper. For Ukraine – it’s rather bad as we got less money,” Doroshenko said.

For example, Poland and Lithuania buy Ukrainian honey with great pleasure. But they buy it raw, packed in big barrels and then repacking it in jars and re-exports to Western Europe under their brands and for higher prices. And that happens with many products, explained Doroshenko.

Although Ukrainians can’t sell much in Europe, the European certificate and presence on European market allow trading successfully on other markets – like Asia and the Middle East.

Ukrainian traders seldom use Europe to get the certificate, business connections and then rush to sell their goods to Egypt, Saudi Arabia, South Korea, China and other eastern countries.

Despite little success on the European market, Doroshenko is confident that free trade agreements are profitable in Ukraine. But first Ukrainian business will have to learn tons of new rules. Fortunately, they learn pretty fast.

In January and February, Ukraine completed the customs-free quotas on seven types of goods. Two years ago there was only one type completed.

“The fact that the number of early completed quotas is growing means that producers have already understood the demands of EU, prepared all the documents and rushed to the market as soon as 2017 started,” said Doroshenko.

Alexey Doroshenko, Samopomich Party lawmaker and the head of the Retail Trade Suppliers Association of Ukraine speaks during the interview with the Kyiv Post in his office in Kyiv on March 15. (Kostyantyn Chernichkin)