Ukrainian oligarch Ihor Kolomoisky and his business partner Gennadiy Boholyubov are set to face English justice following an October 15 judgment passed by the second-highest court in the United Kingdom, the Court of Appeal of England and Wales (COA).

In December 2018, the pair successfully argued before the High Court of Justice that PrivatBank could not bring a $1.9 billion lawsuit alleging “fraud on a massive scale” against them in England because there was not sufficient jurisdiction to bring the claim there.

But that ruling, by High Court Justice Fancourt, was overturned on Oct. 15 by a three-person panel of appellate judges. The panel concluded that three English companies and three more firms registered in the British Virgin Islands could have been instrumental in the alleged fraud – sufficient grounds to have the claim litigated in England.

Boholyubov and Kolomoisky co-founded PrivatBank and were the co-owners of the bank before it was nationalized by Ukraine in 2016. The country’s largest lender faced collapse when forensic auditors discovered a $5.5 billion hole in its ledger. Its co-owners were accused of a fraudulent, Ponzi-like insider lending scheme.

The accused have strongly denied all wrongdoing, arguing that the bank’s seizure was politically motivated, and have sought the return of the bank or their shares.

Kolomoisky’s lawyers have stated they will seek permission to challenge the appellate decision before the U.K. Supreme Court, but it is not yet clear if that appeal will be allowed.

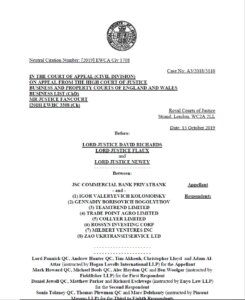

The Kyiv Post obtained the entire, unredacted 74-page judgment, authored by some of the most experienced judges on the appellate court, Lord Justice Richards, Lord Justice Flaux and Lord Justice Newey. The entire ruling is available in full here:

While much of the judgment relates to technical deliberations over jurisdiction, it also contains a number of critical findings on the strength of PrivatBank’s overall case, factors that are likely to pose a significant challenge to Boholyubov and Kolomoisky as they prepare for the next part of their defense.

The ruling is also likely to be scrutinized at length by any parties with a stake in the case, but here are some key extracts the Kyiv Post identified in the PrivatBank v. Kolomoisky judgment:

- The Court of Appeal notes in multiple paragraphs of its ruling that the defendants do not dispute the existence of a good and arguable fraudulent case against them. It also states that Kolomoisky and Boholyubov have not offered explanations to questionable offshore transactions that are under scrutiny. Here are some key extracts on this from the judgment:

Paragraph 21: “The defendants, including Mr. Kolomoisky and Mr. Bogolyubov, accept, for the purposes of this appeal, that there is a good arguable case that the Bank lost approximately US$515 million through these transactions and that they were orchestrated by Mr. Kolomoisky and Mr. Bogolyubov… Mr. Kolomoisky and Mr. Bogolyubov have not themselves to date proffered any explanation for the transactions in question or sought to explain their commercial rationale if any.”

Paragraph 25: “This centers on the role of the English and BVI Defendants… The defendants accept that there is a good arguable case that a net amount of US$1.9 billion was paid to the English and BVI Defendants… and that it was not repaid to the Bank. They accept that there is a good arguable case that the Borrowers and the English and BVI Defendants were knowing participants in the fraudulent scheme, that they were controlled by Mr. Kolomoisky and Mr. Bogolyubov and that the Bank suffered a loss of approximately US$515 million as a result.

Paragraph 26: “However, they submit that the amount arguably derived from the Relevant Loans was not $1.9 billion but was, at most, $514 million…”

Paragraph 138: “…as already set out, the defendants accept that the Bank has a good arguable case against the English Defendants for $515 million in respect of their part in a fraud “on an epic scale”, to use the judge’s phrase.”

Paragraph 256: “The judge was approaching matters, of course, on the basis that the amount for which the Bank had a good arguable case did not exceed $515 million, in part because Relevant Loans had been repaid. We have taken a different view, concluding that the Bank has a good arguable case to recover the full $1.9 billion given in the particulars of claim…”

- Throughout its ruling, the Court of Appeal judges reference material evidence and expert testimony that it has taken under consideration. Here is one key example:

Paragraph 236: “Mr. Hunter placed at the forefront of his submissions the fact that the Bank’s case reflects contemporary documents. One of these is a spreadsheet (“the Gurieva Spreadsheet”) found on the laptop of Ms. Tetiana Gurieva. According to evidence adduced by the Bank, she was a trusted confidant of Mr. Kolomoisky and Mr. Bogolyubov who headed a “secret” unit within the Bank referred to as “BOK” which dealt with lending to companies ultimately owned by Mr Kolomoisky and Mr Bogolyubov. The spreadsheet had been deleted from her laptop but was recovered.

- The Court states, after extensive deliberation and studying of precedents and law, that there is a strong and arguable case (paragraphs 133-134, 147-148) for the claim to be heard in England. This overruled the December 2018 High Court decision on jurisdiction, which the COA has judged was based on “too many false grounds:”

Paragraph 134: “We have reached the conclusion that the assessment by the judge of the Bank’s reasons for bringing these proceedings is based on too many false grounds for it to stand…”

- PrivatBank is now seeking to recoup $3 billion from its former owners. The claim’s principal amount was initially $1.9 billion, growing to $2.6 billion with interest as proceedings in England got underway. Interest continues to accrue at $500,000 per day. The COA has ruled that there is an arguable case for the bank to pursue this:

Paragraph 246: “In our view, the judge was wrong to attach the importance he did to the Lafferty Schedules and to reject the Bank’s analysis in favour of the defendants’ approach to tracing… The validity and significance of (this) approach need to be assessed, not at this interim stage, but at trial, with full evidence and a proper understanding, informed by expert evidence…”

Paragraph 247: “As mentioned earlier, the judge characterized the Bank’s alternative claim in unjust enrichment as “hopeless”. We have already said that we disagree. It seems to us that the Bank has a good arguable case in unjust enrichment.”

- The appellate decision also maintains the worldwide asset freeze on the former owners’ fortunes (up to $2.6 billion) while the case is open in England but states that PrivatBank should have done better in spelling out the connection to English jurisdiction:

Paragraph 266: “On balance, we consider that the Bank should have gone further than it did and spelled out more clearly the fact that pre-payments passed through the English and BVI Defendants’ hands-only “fleetingly” before being passed on to other entities. However, Nugee J was aware that the money had “go[ne] through” the English Defendants and that there was no evidence that any of the English and BVI Defendants still had funds…”

Paragraph 267: “Since we have arrived at substantially different conclusions… we must decide for ourselves whether the WFO granted… should be discharged… We have concluded that it is not appropriate to discharge (the order). While we take the view, as we have said, that the Bank should have spelled out more clearly the fact that pre-payments passed through the English and BVI Defendants’ hands-only “fleetingly” before being passed on to other entities, we do not think that the failure was deliberate or that it can have affected (the order). It does not, as it seems to us, warrant the discharge of a freezing order made in support of a claim for US$1.9 billion in respect of which there is a good arguable case.”

Paragraph 269: “We, therefore, allow the appeal.”

- The ruling also reflects on deliberations that took place over the alleged fraudulent scheme itself, how it was allegedly implemented, and what evidence allowed the COA to conclude that PrivatBank had an arguable case. Reminder: according to the U.K. judges, Kolomoisky and Bogolyubov had already admitted that there is “a good arguable case of fraud on an epic scale.”

- While some of what follows will be new information to many, some are already in the public domain. Here are some key takeaways, all available in the provided text of the entire ruling:

Paragraph 7: “The Bank… was founded in 1992 by, among others, the first and second defendants, Igor Kolomoisky and Gennadiy Bogolyubov. They became, if they were not already, the majority shareholders, with direct and indirect holdings varying between 80% and almost 100% between 2006 and 2016. They sat on the Bank’s supervisory board until 2016 and it is the Bank’s case, which for present purposes is not denied, that as regards the key decisions relevant to these proceedings they controlled the Bank…”

Paragraph 16: “The Bank alleges that this misappropriation was achieved through loans by the Bank (the Relevant Loans) to some 46 companies (the Borrowers), all incorporated in Ukraine and controlled by Mr. Kolomoisky and Mr. Bogolyubov. The Relevant Loans were made over a period of 17 months between April 2013 and August 2014 in either US dollars or Ukrainian Hryvnias.”

Paragraph 17: “The Borrowers entered into supply agreements with some 35 companies… all of them incorporated outside Ukraine and most of them in offshore jurisdictions. The Bank alleges that the Suppliers were controlled by Mr. Kolomoisky and Mr. Bogolyubov and that the supply agreements were bogus. They were for the supply of wholly unrealistic quantities of commodities and industrial equipment and were never intended to be performed. Their terms were uncommercial, and in particular, provided for the pre-payment of the entire purchase price before the time for delivery of the commodities or equipment in question.”

Paragraph 22: “The judge observed in his judgment at [25] that there was no difficulty with the Bank proving a good arguable case of a fraudulent scheme. The evidence was “strongly indicative of an elaborate fraud perpetrated by someone, allied to an attempt to conceal from any auditor or regulator the existence of bad debts on the Bank’s books, and money laundering on a vast scale”. The Borrowers had no commercial track record or any substantial assets. The documentary evidence clearly demonstrated that the supply agreements were shams, and “were used as a deceptive basis on which to justify very large sums of money flowing out of the Bank”. The artificial complexity of the re-cycling of funds was “itself indicative of a fraudulent scheme”. At [104], the judge noted that Mr. Kolomoisky and Mr. Bogolyubov had admitted “a good arguable case of fraud on an epic scale”.

What comes next?

The Cort has ordered lawyers acting for Kolomoisky and Boholyubov to file a “line of defense” by the end of November. This has to be in response to the accusations of fraud that PrivatBank filed against the former owners back in December 2018.

The key rulings in the appellate judgment from London are:

- The English Court has jurisdiction over the claims brought by PrivatBank and has jurisdiction to continue hearing the bank’s claims against Kolomoisky and Boholyubov, despite their request to be domiciled in Switzerland. The bank is entitled to sue English companies in England.

- Proceedings in England should not be stayed. The Court of Appeal says the bank’s fraud claim in England should be heard without further delay.

- PrivatBank can claim for $1.9 billion-plus interest. The Court of Appeal confirmed that the bank could pursue the full loss amount that it claims was caused by the alleged fraud, which is now $3 billion (including interest).

- A worldwide order freezing the assets of Kolomoisky and Boholyubov (up to $2.6 billion) must remain in place.

The accused continue to strongly deny all wrongdoing. “Mr. Kolomoisky is seeking permission from the U.K. Supreme Court to appeal these decisions,” his lawyers stated on Oct. 15, adding, “there was no fraud and no loss was caused to the Bank… The Bank’s claims are misconceived and will ultimately fail.”

The Court of Appeal has denied the defendant’s permission to appeal against its decision in that court, but they could still appeal directly to the Supreme Court and have 28 days to do so.

However, lawyers close to the case say that the Supreme Court rarely overturns such Court of Appeal rulings and this would not prevent PrivatBank from moving ahead with its complaint in the High Court. Kolomoisky’s lawyers unsuccessfully requested for the case to be suspended while they appeal.

In December, after Kolomoisky’s legal team provided the High Court with their defense argument, lawyers say that a lengthy exchange of legal arguments will begin, followed by procedural hearings.

An actual trial is unlikely to happen before mid-2021 and could last a few weeks. The procedure requires the defendants to testify before the court in person unless there are serious extenuating circumstances.

If the alleged fraud claim brought by PrivatBank is proven in the High Court, it is possible that the U.K. Serious Fraud Office could begin a separate criminal investigation into the defendants which could result in a trial.

Read also: PrivatBank wins London court appeal against Kolomoisky (UPDATED)