Britain is known for its strong rule of law. Yet London is also a global hotspot for money laundering, tax evasion and other financial crimes. Experts say that a no-questions-asked approach to opening U.K. companies has exacerbated this problem.

However, the U.K.’s transparent registries and its freedom of information laws make it easier to detect potential wrongdoing than in many parts of the world, including Ukraine.

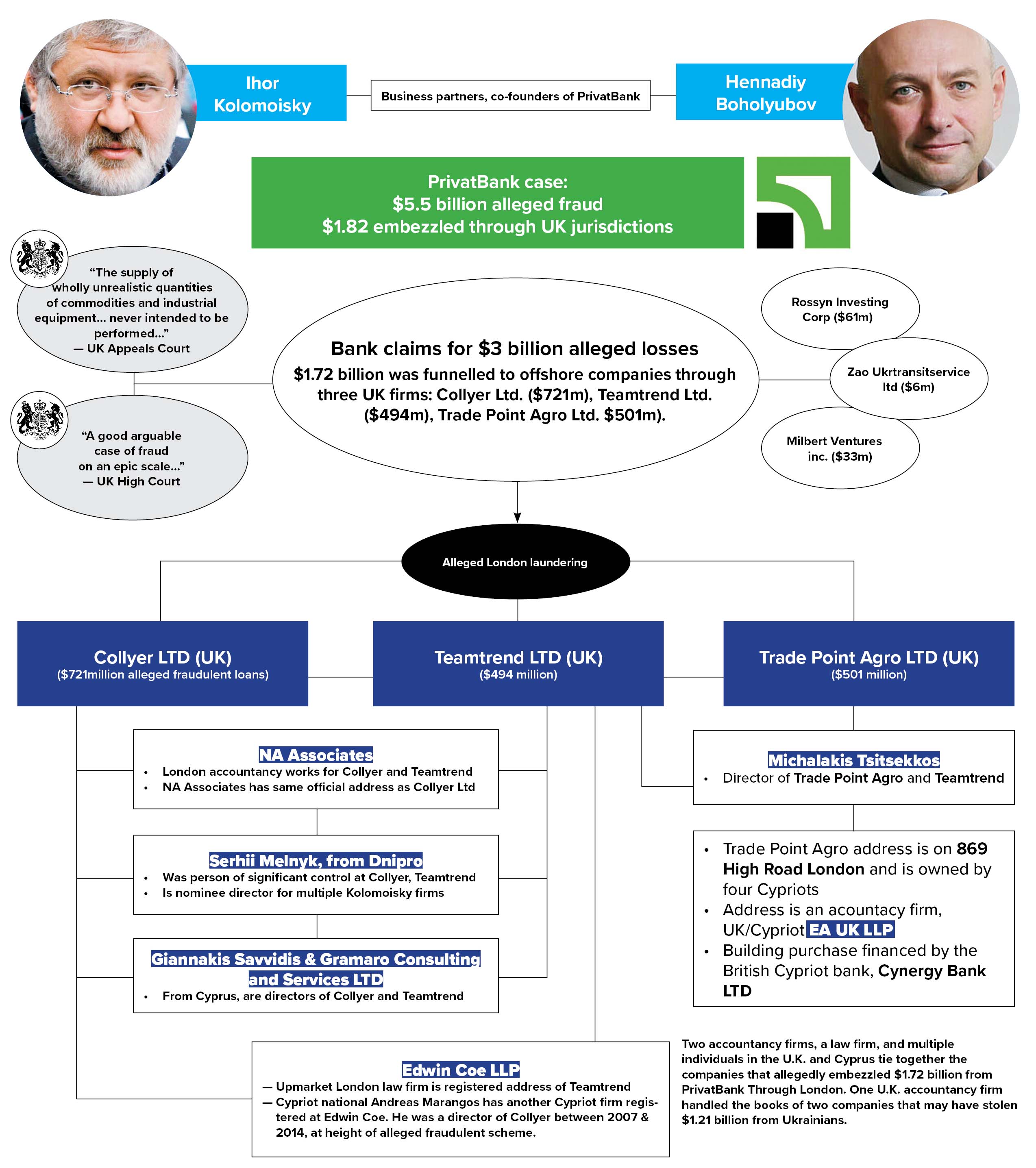

And that may become a problem for Ukrainian billionaire oligarchs Ihor Kolomoisky and Hennadiy Boholyubov, who face a London civil suit alleging they used fake purchasing agreements and fraudulent loans to embezzle $1.72 billion from Ukraine into offshore firms through three U.K. companies.

A Kyiv Post investigation has uncovered two accountancy firms, a law firm and multiple individuals in the U.K. and Cyprus connected to these companies that may have played a role in the alleged scheme.

Billions gone

PrivatBank — Ukraine’s largest lender, co-owned by Kolomoisky and Boholyubov until its nationalization in 2016 — claims a total of $5.5 billion was looted from the bank into offshore holdings. The Ukrainian central bank and Ministry of Finance said the bank faced insolvency without a bailout financed by Ukrainian taxpayers.

Since then, state-owned PrivatBank has been suing its former owners in the U.K., U.S. and Cyprus, trying to reclaim its assets. PrivatBank’s total claim in the U.K. was $1.9 billion, which has ballooned to at least $3 billion as interest and legal costs accrued. The London case is built around three U.K. companies involved in the alleged schemes, which fall under U.K. jurisdiction.

Lawyers acting for the bank claim that $721 million was embezzled through the firm Collyer Ltd, $494 million via Teamtrend Ltd, and $501 million went through Trade Point Agro Ltd, to offshore companies owned by the defendants in locations like Cyprus and the Carribean. Another $100 million was allegedly funneled through three more companies in the British Virgin Islands (BVI).

PrivatBank allegedly “loaned” the funds to 42 Ukrainian shell companies connected to the defendants and incorporated in different offshore havens in the Caribbean.

According to a recent judgment from the U. K. Appeal Court, Kolomoisky and Boholyubov accept that there is “a good arguable case that the Borrowers (in Ukraine) and the English and BVI Defendants were knowing participants in the fraudulent scheme” and the three English companies and three BVI companies were “at all material times owned and/or controlled” by the defendants.

Despite that, Kolomoisky and Boholyubov have repeatedly denied any wrongdoing in relation to PrivatBank. They maintain that the state takeover — backed by the International Monetary Fund — was politically motivated.

Accountants, lawyers

The three English firms under scrutiny appear to be shell companies. But behind them are a number of real accountancy and law firms in the U.K. and Cyprus.

Collyer Ltd is registered to the North London address of NA Associates, an accountancy firm with strong ties to Cyprus and majority-owned by a well-known British Cypriot accountant, Nicholas Antoniou. Some 412 firms with ties to the U.K. and Cyprus have been registered at the firm’s address.

Teamtrend Ltd. is registered to the Central London address of Edwin Coe LLP, a major law firm. Another 81 companies are registered there.

NA Associates has acted as the accounting firm for both Collyer and Teamtrend, according to both companies’ documents in public registers.

Trade Point Agro Ltd. is registered at 869 High Road, North London. A property title acquired from HM Land Registry by the Kyiv Post shows that the building was purchased for 800,000 pounds, and this purchase was financed by a London-based bank with ties to Cyprus, Cynergy Bank Limited. Until recently, it was the U.K. subsidiary of Bank of Cyprus.

Property titles show that the building is owned by four individuals of Cypriot origin: Evagoras and Maria Evagora and Andreas and Erene Christoforou. The address is also home to the accountancy firm EA UK LLP and the Cypriot names of the building owners appear multiple times throughout its company records and filings. The accounting firm has registered some 545 companies.

Edwin Coe LLP, NA Associates and EA UK LLP did not respond to multiple requests for comment and did not answer questions about their ties to Collyer, Teamtrend or Trade Point Agro.

PrivatBank and its lawyers declined to comment on the Kyiv Post’s findings, stating that many elements of the ongoing proceedings remain confidential.

Hollow accounting

Limited liability companies are popular tools in the U.K. because their accounts do not have to be audited, according to Graham Barrow, a London-based banking and anti-money laundering expert.

“Potentially, you could just shove a set of books in front of an accountant’s firm and they can say ‘on the basis of what we see, these are fine,’” said Barrow. Companies reviewed in this way would not be considered audited.

Collyer and Teamtrend filings show that NA Associates signed off on the books of both companies for a number of years but has not audited or reviewed them. In 2016 for Teamtrend and 2017 for Collyer, NA Associates noted in its accounting that it did not accept responsibility for the companies’ bookkeeping.

Those years came after details of the alleged fraudulent PrivatBank scheme had already been made public.

“It is your duty to ensure that (the firm) has kept adequate accounting records,” the accountancy wrote then as a disclaimer on the books. “We have not been instructed to carry out an audit or a review of the accounts… For this reason we have not verified the accuracy or completeness of the accounting records…”

Another possibility is that an accounting firm could prepare an account, knowing full well that it is false. That carries much more stringent penalties, Barrow said. “If an accountancy firm is actively involved, it would be preparing the accounts, often without having sight of the underlying bank statements or invoices.”

According to the expert, it is often the case that when a limited liability company shares an address with an accounting firm, it is because that firm “probably created the company in the first place.” But this is not always the case.

The Kyiv Post did not find any direct evidence of wrongdoing by NA Associates, Edwin Coe or EA UK, only a strong connection to defendant companies in the London proceedings.

Cypriot nominees

Several directors, most of them from Cyprus, tie together the U.K. defendants and the lawyers and accountants with whom they share addresses.

Giannakis Savvidis is a Cypriot from the city of Limassol who has been listed as a director of Collyer since 2014 and of Teamtrend since 2017. Savvidis is also the director of Dagosel Investment Ltd, which owns a 5.21% stake in Kolomoisky’s oil refining company Ukrtatnafta, according to Ukrtatnafta’s 2018 financial statement.

Michalakis Tsitsekkos, another Cyprus national and lawyer from Nicosia, was named director of both Trade Point Agro (between 2007 and October 2019) and Teamtrend (between 2003 and 2017). He was also the director of the now-dissolved Andrena Great Ltd., which was a Cypriot company registered at 869 High Road London, the address of EA UK LLP.

Tsitsekkos appears to act as a nominee or proxy director for firms and can be linked to 167

different companies based in Cyprus. He is also named in the Offshore Leaks Database of the International Consortium of Investigative Journalists as connected to multiple offshore schemes.

The Kyiv Post previously reported that Tsitsekkos had served as the nominee owner of Alstrom Business Corp, an offshore business used in a 2009 media deal, where Kolomoisky was the beneficiary, according to a filing with the U. S. Securities and Exchange Commission.

Cypriot lawyer Andreas Marangos was director of Collyer between 2007 and 2014, throughout the peak of the alleged fraudulent scheme. According to public registries in the U.K., he is also the director of another firm, Soccer Marketing International, registered at Edwin Coe LLP.

Tsitsekkos and Savvidis could not be reached for comment. Marangos told the Kyiv Post that he no longer works with any of the mentioned companies, but added “it may have been the case that we provided fiduciary and/or legal services and/or acted as nominee directors for said companies through a law firm which I previously worked for.”

Questioned about ties to Collyer, Edwin Coe and Ihor Kolomoisky, he said, “information of this nature is… confidential and legally privileged,” adding that the law firm he previously worked with “offered such services to a multitude of companies and individuals.”

Barrow said that people listed on limited company records can be nominal directors who have nothing to do with operating the companies’ actual bank accounts. The people in control of suspicious money flows are often not listed on company records at all.

“I think they’re just directors in name only,” he said, referring to the directors in the public records. “The bank would have been given a list of authorized signatories… who are actually allowed to operate the bank account, and often they’re very different.”

Cyprus web

Cyprus is widely known as a haven for shady finance, especially among Eastern European oligarchs. Kolomoisky is no exception, reportedly holding triple citizenship in Ukraine, Cyprus and Israel.

Many of Kolomoisky’s extensive assets are held through Cypriot firms. One of his top trusted officials is Panikos Symeou, a Cypriot and managing partner at Symeou & Konnaris LLC. According to research by the Anticorruption Action Center, Kolomoisky entrusts Symeou with steel, tire production, water terminal and media assets in multiple countries, including Ukraine and the U.S.

When PrivatBank still belonged to Kolomoisky and Boholyubov, its Cyprus branch was an alleged key transit point for the billions of dollars extracted from Ukraine. Insider loans for bogus transactions would allegedly be transferred from Kolomoisky’s companies’ PrivatBank accounts in Ukraine to their PrivatBank accounts in Cyprus before being cycled through dozens of affiliated bank accounts and into external companies in other jurisdictions.

According to former central bank head Yakiv Smolii’s statements to the Organized Crime and Corruption Reporting Project, Ukrainian authorities did nothing to regulate the huge sums funneled out of the country, as Ukraine treated the Cyprus branch the same as any domestic branches.

The Central Bank of Cyprus only conducted investigations in 2015, after which it alerted Ukrainian authorities. In 2016, as the nationalization of PrivatBank loomed, billions of dollars from PrivatBank’s Cyprus branch were rapidly shuttled to other European jurisdictions where the Ukrainian authorities could not get to them, according to the PrivatBank.

Who is Serhii Melnyk?

One person appears to connect the dots between different firms and Kolomoisky more than any other individual: Ukrainian national Serhii Melnyk.

Both Collyer and Teamtrend were, according to U.K. records, briefly and mysteriously controlled by Melnyk between Feb. 21 and March 12, 2018, before he was removed as a person of significant control.

Melnyk is directly linked to Kolomoisky and his business partner Hennadiy Boholiyubov. The 38-year-old resident of Kolomoisky’s native city Dnipro is the nominee director or beneficiary owner of a number of companies linked to the oligarch, both in Ukraine and worldwide.

But Melnyk is also something of an enigma. There is not much about Melnyk in the public domain, in the press or on social media.

This may be explained by the role he appears to play in Kolomoisky’s dealings, suggests Volodymyr Ariev, a lawmaker in the European Solidarity party. “He is just a nominal actor, no one in fact. One of the people in Kolomoisky’s environment, just a person with a passport. It is a syndicate.”

However, Melnyk may not even exist, suggests Vadim Shulman, a former business partner and now nemesis of Kolomoisky. Their 15-year friendship and business relationship turned extremely sour, ending in multiple court cases.

Shulman currently resides in Monaco and is wanted in Ukraine, where he faces allegations of fraud and embezzlement. He claims the charges are Kolomoisky’s revenge.

“This person does not exist, trust me. I am 100% sure. I know Kolomoisky, and it is hard to imagine him registering so many companies to one person,” said Shulman. “He might have existed a while ago but passed away and no one knows about it. The entire Kolomoisky system works this way,” he added.

The Kyiv Post found evidence of a Serhii Melnyk, born Jan. 17, 1981 in Dnipro, registered in the public database of Ukrainian citizens. The name, address and birth date match the person who controlled the U.K. firms Collyer and Teamtrend for less than a month in 2018.

The same person is a beneficiary owner of EstateGlobal, a Dnipro-based company incorporated in 2008. Public records show that EstateGlobal was controlled by PrivatBank and two other firms related to Kolomoisky’s Privat Group, Dolma and Spectrum-Energo, before the bank’s nationalization in 2016.

In 2017, EstateGlobal was briefly controlled by the Cypriot lawyer Panagiotis Zevlaris. His name appears in the Paradise Papers offshore leaks, connecting him to multiple offshore schemes.

Zevlaris follows Melnyk on the list of founders of the company. Currently the main stakeholder at EstateGlobal, with 94% of the shares, is Lux-Office, a company tied to Kolomoisky’s unofficial Privat Group of companies.

When Melnyk resigned from EstateGlobal, it was acquired by Edinor, the beneficiaries of which are Kolomoisky and Boholyubov.

Melnyk also used to be director of another firm, Ricona LTD, also part of Privat Group.

According to Ariev, Melnyk controls over 40 companies that have accounts in PrivatBank in Cyprus and sits on the editorial board of the company Privat TV Dnipro, owned by Privat Group.

Serhii Melnyk could not be reached for comment. An employee of EstateGlobal, reached by phone, suggested that Melnyk was the company’s beneficiary owner, but then declined to comment further.

London laundromat

In the case of PrivatBank v. Kolomoisky, which is still ongoing, the High Court has already recognized that “fraud on an epic scale” took place, and the Appellate Court recently ruled that PrivatBank has a “good arguable case” against its former owners, who even accept that a fraudulent scheme existed.

Aside from the flagship PrivatBank case, however, tax base erosion and profit shifting costs the Ukrainian economy some $50 billion per year, multiple tax experts told the Kyiv Post.

And the U.K. is a perfect laundromat for looted money, as there is no compulsory auditing for LLCs and minimal disclosure is required when opening a firm.

A 2018 study by the anti-corruption NGO Global Witness and data scientists from DataKind UK found troubling levels of suspicious activity throughout public registers of British companies.

More than 335,000 companies in the U.K. declare they have no beneficial owner, while at least 10,000 companies declare a foreign company as their beneficial owner, and 72% of these are linked to a secrecy jurisdiction.

Britain’s National Crime Agency estimates that money laundering in the U.K. may extend to hundreds of billions of pounds each year. “The ease with which U.K. companies can be opened, and the appearance of legitimacy that they provide, means they are used extensively to launder money derived both from criminal activity in the U.K. and overseas,” states a 2018 report by the crime agency.

You can also highlight the text and press Ctrl + Enter

Comments (0)