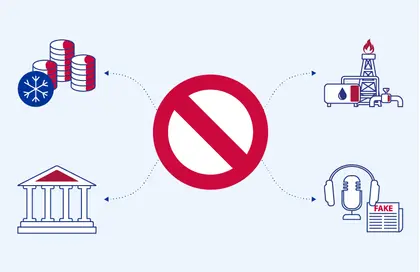

According to the EU, sanctions imposed on Russia for its invasion of Ukraine have been “melting away” Russia’s ability to fund the war, though China and Turkey are assisting Russia in evading Western sanctions.

The EU Commission claimed in an internal report dated Monday, Oct. 10, and obtained by EU observer that the harshest steps taken by the EU have had an impact on Russia’s banking and energy sectors.

JOIN US ON TELEGRAM

Follow our coverage of the war on the @Kyivpost_official.

“Markets are already turning away from trading Russian oil, months before the EU import ban kicks in. Only two-thirds of previously European-bought volumes are currently rerouted, at a major discount of around $25 per barrel,” the EU report stated.

Assisted by a brief rise in energy prices earlier this year, Russia’s budget surplus in the first half of 2022 was RUB 500 billion (EUR8 billion).

However “oil production is down by 10 percent, and gas production declined by 22 percent year-on-year in August,” while the surplus “shrank to just RUB 137 bn over the summer”, the commission stated.

“Russia’s war chest is thus melting away,” it argued.

“The EU oil and petroleum products embargo [due to come into force in December] … coupled with a multilateral ‘oil price cap’ will significantly dent Russian export revenues and further cloud the country’s economic outlook,” it continued.

Russians Bomb Kid’s Hospital in Kyiv: Details From the Scene

Given that all but one major Russian bank has been placed on the EU’s blacklist, Russian lenders have closed 670 offices as a sign of “severe stress” in the industry, the commission claimed.

“Banks will need to be recapitalised” by the Kremlin, it said, with “additional capital injections [that] might amount to about RUB 2 trillion”.

At the same time, few foreign investors were considering purchasing Russian bonds.

“Domestic issuance remains [the Kremlin’s] almost the only source of raising funds, and with dwindling incomes and troubles brewing in the banking sector, demand is bound to remain weak,” the commission noted.

“As a combined result of the war itself and the sanctions, Russia has entered a protracted recession, which might last for an extended period,” it noted.

“The Russian ministry of finance’s plans to cover the budget deficit in the next three years by borrowing domestically do not seem plausible,” it continued.

You can also highlight the text and press Ctrl + Enter