Bonds: Investors increase bond holdings

Investors increased investments in domestic bonds, mainly via participation in last week's primary auction that offered both UAH and FX-denominated bonds.Last week, the Ministry of Finance offered three issues of UAH bonds and one of USD-denominated bills. All these securities were sold with minor changes in interest rates (see auction review), including UAH10.3bn (US$288m) of local-currency bonds and US$300m of USD-denominated bills. Almost half of the UAH bonds were the new three-year note, which banks most bought since it is likely to become a new "reserve" paper. The new issue's coupon rate is 19.19%, 1bp higher than the previous three-year "reserve" paper.Last week, non-bank investors (legal entities) increased their portfolios by UAH3.6bn, including UAH1.8bn of FX-denominated bills, and individuals by UAH3.3bn, including UAH2.9bn of FX-denominated securities. Foreigners increased their portfolios by UAH0.3bn, purchasing UAH bonds.In the secondary market, trading in FX-denominated bonds exceeded the volume of trading in UAH bonds, which happens rarely and is due to a large placement of FX-denominated bonds in the primary market.

JOIN US ON TELEGRAM

Follow our coverage of the war on the @Kyivpost_official.

ICU view: FX-denominated bills, expectedly, received considerable demand and allowed investors to reinvest most of the FX proceeds received from the redemption of bonds a week before. Interest in FX bonds was high, with 111 bids submitted, and it helped increase trading in FX-denominated bonds in the secondary market. The MoF plans to offer USD-denominated bills in the next two weeks to refinance the US$345m redemption next week.

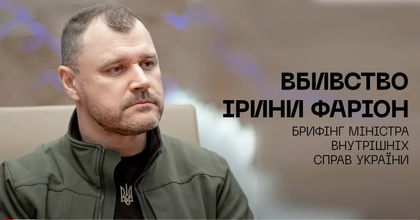

Farion’s Killer Prepared Disguises, Had Another Victim in His Sights, Interior Minister Says

Bonds: Eurobond prices partly reverse decline

Prices of Ukrainian Eurobonds stabilized after a two-week-long decline and reversed slightly.Last week, Eurobond prices increased by an average of 3%, mostly by 25‒32 cents, narrowing the price range for instruments with different maturities to 12.6%. Almost all Eurobonds rose in price, except for the issue maturing next year, which remained slightly below 32 cents. The price of VRIs was up by almost 1 cent or 2% to 43 cents per dollar of notional value.

ICU view: The EMBI index rose 1.2% last week, indicating slightly improved sentiment toward emerging markets. However, the prices of Ukrainian Eurobonds increased even more significantly despite the continued uncertainty regarding financial assistance from the US for Ukraine for 2024. Most likely, this reflects a reaction to information that the MoF started informal consultations with investors about debt restructuring. At the same time, we expect the price volatility of Ukrainian Eurobonds to remain high due to the political turbulence in the US and unclear prospects of future aid to Ukraine.

FX: FX market adjusting to flexible exchange rate

Last week, the UAH official exchange rate strengthened, and the NBU reduced its interventions.The official UAH exchange rate strengthened last week to UAH36.37/US$ due to the NBU participating in the market with FX sale interventions. Bank clients (legal entities) bought US$938m of hard currency in four business days last week, which is 35% less than in the same period of the previous week. Their sale of hard currency increased by only 9%. The NBU cut its interventions to US$575m, slightly above the weekly average this year, and halved compared with the previous week, when it switched to managed exchange-rate flexibility.The volumes of hard currency purchases on the retail market have sharply decreased. The cash rate in systemically important banks shifted from UAH37.4‒38.1/US$ to UAH37.3‒38.1/US$ last week.

ICU view: During the second week of the managed, flexible-exchange-rate regime, the NBU continued to sell hard currency on the interbank market, but the volume of interventions nearly halved vs the previous week. At the same time, the constant presence of a large seller contributed to strengthening the official exchange rate, reducing nervousness and negative expectations. Such exchange rate appreciation may allow the NBU to reduce its market presence further this week and slightly weaken the exchange rate.

Economics: Inflation decelerates sharply again

Ukraine’s annual inflation slowed to 7.1% in September from 8.6% in August. This marked the ninth straight month of deceleration in the CPI, which has far exceeded expectations.In MoM terms, prices grew moderately at 0.5% as sizable increases in prices for education, clothes, and motor fuels (some are due to seasonal factors) were to a large extent offset by a decline in food prices.

ICU view: The significant slowdown in inflation exceeded our expectations by a considerable margin. In recent months, it was primarily driven by a bumper agricultural harvest. In September, prices for vegetables were 25% lower in YoY terms and prices for fruits declined 1% YoY. Disinflation was also supported by a stable exchange rate and only marginal revisions of utility tariffs, which are regulated administratively. We now see the CPI temporarily falling below 6% YoY in October before accelerating back close to 7% by the end of 2023. Looking through 2024, we expect end-year inflation at just above 10%. The pick-up in the CPI will be driven by a gradual depreciation of the hryvnia and the much-needed increase in utility tariffs. Also, any normalization of the agricultural harvest from this year’s unusual levels will likely drive up prices for agro produce.

Research team: Taras Kotovych, Vitaliy Vavryshchuk, Alexander Martynenko.

See the full report here.

You can also highlight the text and press Ctrl + Enter