Yesterday's auction brought UAH8.5bn (US$225m) to the budget, just half of last week's proceeds, but without significant changes in interest rates.

Demand for a 10-month paper increased fivefold to UAH1bn (US$26m), with interest rates within the 16.8%‒16.84% range, or between the cut-off and the weighted average rate of the last auction. However, only two bids for UAH0.2m (US$6’000) were with rates higher than the weighted average rate of the previous auction. Hence, the Ministry of Finance rejected them without a noticeable impact on the volume of borrowing. The MoF set both the maximum and weighted average rates at 16.8%.

JOIN US ON TELEGRAM

Follow our coverage of the war on the @Kyivpost_official.

Bills maturing in October next year received the greatest demand, three times higher than last week and only UAH22m (US$579'000) less than the cap. As all bids were similar to the previous two auctions, the Ministry satisfied all bids in full, mostly at 17.6%.

The demand for three-year "reserve" notes increased by only UAH65m (US$1.7m) from last week's UAH1.4bn (US$37m), with interest rates unchanged since the end of November: 18.5%‒18.6%. So, the Ministry also satisfied all the demand by setting the maximum and weighted average rates at 18.6%.

Demand for EUR-denominated bills decreased fivefold compared with last week, but the new paper is not comparable as it does not have a put option. The most comparable is 12-month EUR-denominated paper tenor sold in September last year at the same rate of 3.25%.

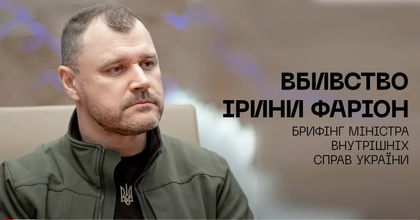

Farion’s Killer Prepared Disguises, Had Another Victim in His Sights, Interior Minister Says

The auction demonstrated the dominance of interest in UAH instruments over FX-denominated bills, and the Ministry of Finance was only about EUR16m short of fully refinancing the debt redemption paid last week. Therefore, the MoF can offer the same instrument next week or at the end of the month to complete the refinancing of debt redemptions paid in January in each currency.

At the same time, interest in UAH bonds demonstrates that the market agrees with the current level of interest rates without active attempts to lower or raise them. Therefore, the Ministry of Finance can continue to keep the current rates.

RESEARCH TEAM: Taras Kotovych.

See the full report here.

You can also highlight the text and press Ctrl + Enter