Russia's authorities announced Friday, Dec. 31, that soldiers and state employees deployed in Ukraine will be exempt from income tax, in the latest effort to encourage support of its military operation there.

The new measure concerns all those fighting in the four Ukrainian territories Russia has declared as its own, although it does not completely control them: Donetsk, Lugansk, Kherson and Zaporizhzhia.

JOIN US ON TELEGRAM

Follow our coverage of the war on the @Kyivpost_official.

Kremlin spokesman Dmitri Peskov cited an exemption contained in an anti-corruption law, which the Russian authorities published the details of Thursday evening.

Soldiers, police, members of the security services and other state employees serving in the four regions no longer have to supply information on "their income, their expenditure, their assets", said the decree.

The decree also grants them the right to receive "rewards and gifts" if they are of "a humanitarian character" and received as part of the military operation in Ukraine.

It applies to the partners and children of those serving, and is back-dated to February 24, 2022 -- the date Russia launched its military operation in Ukraine.

The Kremlin has rolled out a series of incentives for Russians to fight in Ukraine, offering cash incentives, banking and property facilities and promising financial aid to families in the case of the death or injury of loved ones.

In Russia, soldiers and senior officials close to the country's military-industrial complex are regularly convicted in corruption cases in which large sums of money have been embezzled.

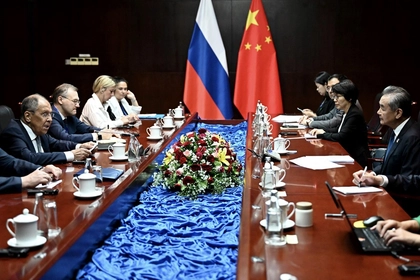

Russia, China FMs Meet as ASEAN Talks Get Underway in Laos

You can also highlight the text and press Ctrl + Enter