The Russian Ruble (RUB) has continued to slide as it traded at a 17-month record low of 94.42 against the US Dollar on Wednesday.

From its highest value in the past calendar year, 57.25 to the USD, the Ruble has lost 64 percent of its value – nearly 40 percent of that since this past January.

Is this a big deal?

It certainly is. Dr. Volodymyr Lugovskyy, a Professor of Economics at Indiana University, told Kyiv Post that the decline in value was “very significant.”

What’s caused the latest jitters?

Lugovskyy says it was likely due to two things.

Firstly, Ukraine’s second night of successfully launching drone strikes on a high-end financial district of Moscow, prompting Russian society to see that there are increasing risks to Russia’s economy.

Secondly, mounting uncertainty as to how the Russian Ministry of Finance would – or could – maintain an exchange rate closer to 90 against the Dollar.

How do you maintain an exchange rate?

It’s a tricky process and there are numerous methods but currently, Moscow has been forced to sell off billions in foreign currency reserves, to make up for the loss in oil revenues.

Earlier this year, Bloomberg reported that Moscow was planning on buying $200 million of Chinese Yuan (CNY) to replenish its rapidly depleting foreign reserves reported by the Russian Central Bank.

Earlier this week, Russia’s Central Bank announced plans to up its battle against inflation by sharply raising interest rates, from 8.5 to 9.5 percent, to reduce access to Rubles.

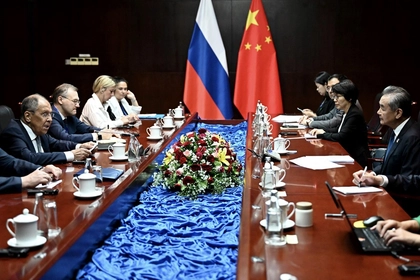

Russia, China FMs Meet as ASEAN Talks Get Underway in Laos

However, some experts have argued that the Kremlin has undermined its own monetary policy by continuing to pump liquidity into the economy in order to maintain the popularity of the Putin regime by not allowing citizens to feel the full burn associated with abnormally high inflation.

What does this mean for the average Russian?

Consumers in Russia – who have complained in recent months for having seen the real purchasing power of their Rubles decline as it buys just shy of half what it did earlier this year – have no reason to be optimistic, Lugovskyy says.

He predicts soaring prices for goods and services, a “coming hyperinflation with prices increasing and wages not being adjusting.”

“Recall that a very large part of the consumer basket in Russia is based [on] imported goods, so prices will go up very fast,” he adds.

What’s hyperinflation?

Hyperinflation is caused by a surplus supply of a currency which triggers a loss of value sometimes exceeding 50 percent per month.

Russian investors, concerned by reports of Russia’s failure to shore-up support in the Middle East or with China, may begin to sell their Rubles, which would only exacerbate the problem of surplus Rubles with few markets willing to buy them.

Given the limited market for Rubles, Lugovskyy says that the Ruble predominantly "serves some purpose in international trade, but in general, the exchange rate is very artificial. Not being able to maintain even that is a sign of extreme problems and weakness."

What’s the bigger economic picture in Russia right now?

Despite some economists arguing that the data released by the Russian Central Bank may be fudged, others have expressed surprise that in light of the largest packages of sanctions in history being set against Russia, the Russian economy has not only seemingly maintained itself, but may actually be growing.

This past May, Reuters reported that Russia had reached its lowest unemployment rate, 3.3 percent, since the collapse of the Soviet Union in 1991.

A Business Insider piece this week, verbosely entitled “The Kremlin has pumped so much money into the economy that it’s creating a boom – but this house of cards could topple anytime soon,” cautioned that “Putin is boosting the production of military equipment and raising pensions, salaries, and other benefits for people who are not well-off. The state is also subsidizing mortgages.”

So, things might not be too bad despite the Ruble jitters?

Not so fast – a confluence of geopolitical matters unfavorable to Russia and its war in Ukraine, says Lugovskyy, assures that the Ruble “will keep falling.”

The question is how fast. “If traders start believing the RMoF stops supporting it, it will fall very fast---very fast,” he says, adding “the exchange rate and Ruble might be then in free fall.”

One of the first signs of a coming ruin of the Ruble would be increases in prices for durable goods but would be more evident and felt by average citizens when non-durable goods, such as household goods and food start to become more expensive.

However, the big warning sign is that things are spiraling out of control when there are delays in making payroll for the government's employees, Lugovskyy says.

You can also highlight the text and press Ctrl + Enter