Russia’s oil revenue reached $11.3 billion in October this year, accounting for 31 percent of its overall net budget revenue in October and surpassing that of any month in 2021 prior to the invasion, according to a Bloomberg investigation.

According to the report, 70 percent of Russian oil was moved by domestic and shadow fleets, allowing Russia to mitigate – and circumvent – the $60 per barrel price cap G7 nations introduced in December 2022 in an attempt to disrupt its economy – and its war machine.

JOIN US ON TELEGRAM

Follow our coverage of the war on the @Kyivpost_official.

The G7 price cap was designed to curb Russian revenue from oil exports by prohibiting Western shipping and insurance services to tankers shipping Russian oil above the price cap without drastically affecting the global energy supply.

Russia has exported close to 3.5 million barrels of oil a day this year, according to the estimations from Bloomberg, and China and India are the major buyers. The oil has reached $72 per barrel upon reaching Indian shores according to Indian customs data.

The Bloomberg investigation attempted to track numerous ships transporting crude oil from Russian ports and discovered they were registered and insured under a global network of false and dubious entities that allowed them to operate out of Western influence.

The report stated that Iran had employed similar “shadow fleets” for decades, but the participation of a major exporter like Russia could introduce a major shift to the industry at large.

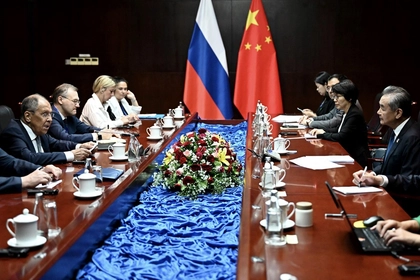

Russia, China FMs Meet as ASEAN Talks Get Underway in Laos

“The shadow fleet and alternatives to Western maritime insurance are not new. Iran has used them for years. Now that a massive producer like Russia is using them, they have become more mainstream,” said Eddie Fishman, a senior research scholar at Columbia University’s Center on Global Energy Policy.

This is the latest in a series of similar reports that have shown Russia’s ability to evade the G7 price cap and continue to finance its war in Ukraine as it increased its federal budget for 2024 by 25 percent despite Western sanctions.

On Nov. 14, the Financial Times reported that “almost no Russian oil is sold below $60 cap,” citing Western officials. The sanctions also meant the trade routes are now extremely lucrative, with Reuters reporting that skyrocketing freight rates of as much as $15 million per voyage have encouraged tankers to take on the job.

The US recently began to enforce the G7 price cap and sanctioned tanker owners in Turkey and UAE who shipped Russian oil above the price cap. Three major Greek shippers who were capable of transporting all Russian oil from its European ports also withdrew from the Russian route likely in fear of US sanctions.

The EU has also asked Denmark to inspect and potentially block Russian oil tankers transiting through its territorial waters as it stepped up price cap enforcement measures, which could affect roughly 60 percent of Russia’s oil exports from its European ports.

You can also highlight the text and press Ctrl + Enter