Since the beginning of this year, Ukraine has hit more than ten major oil refineries and depots, some of them more than once.

This appears to be causing disruptions inside Russia, and consternation at the White House, which, according to a source at Financial Times, has called on Kyiv to cease such attacks for fear of raising global oil prices. Kyiv has rejected such demands, declaring that Ukraine has “an absolute right to deplete the Russian army,” according to the Daily Wrap.

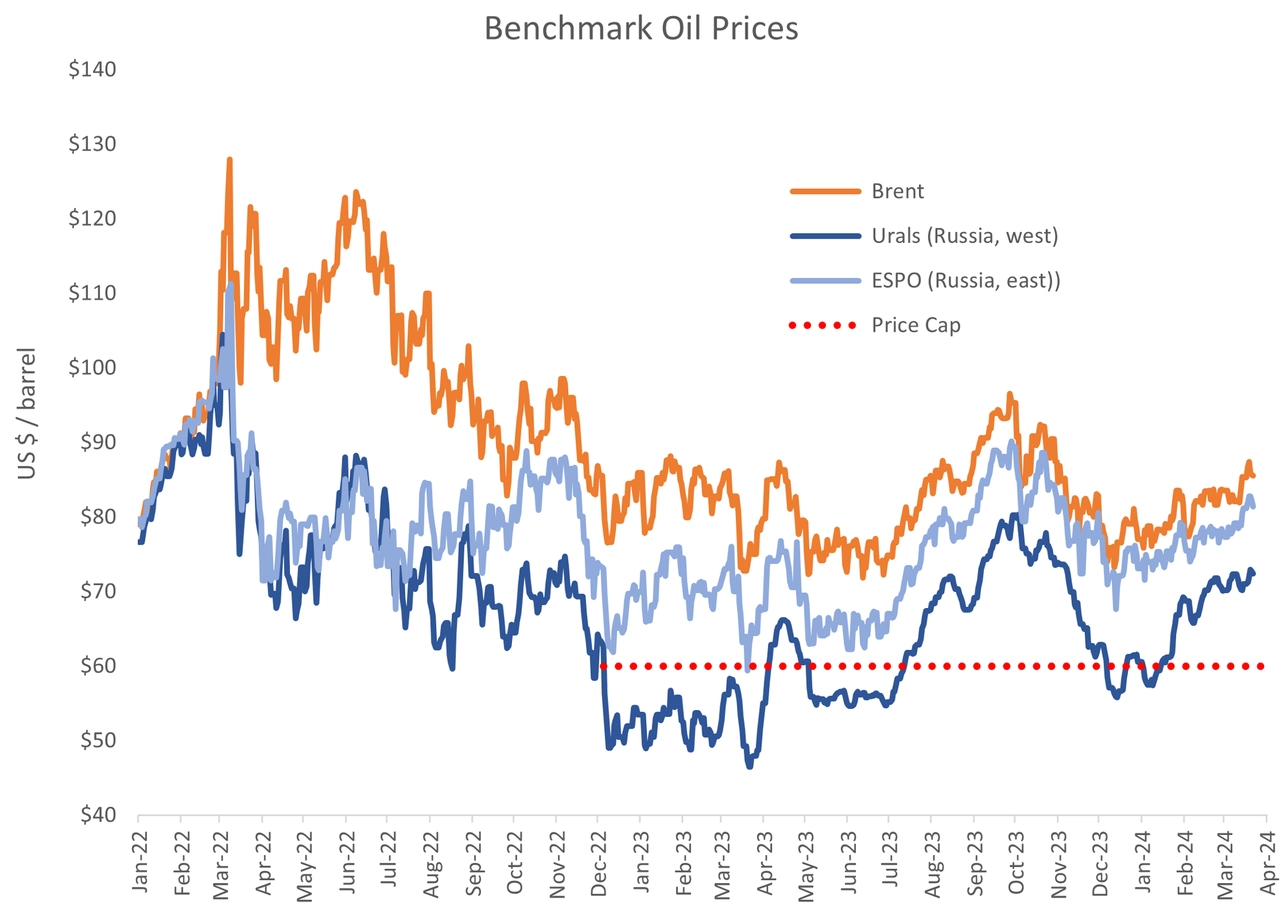

Let’s take a look at the numbers. Brent closed on Friday at $85.50, which is a bit higher than recently, but nothing special. ING Bank sees Brent at $87 for Q2, and given that Brent is almost there right now, oil would appear range-bound for the moment. Copper prices, which tend to correlate with oil, also suggest Brent only marginally above current levels.

The risk of Ukrainian attacks on refineries is not on crude oil prices. Refinery attacks do not affect crude oil production. Rather, they constrain the ability to convert that crude oil into refined products like gasoline and diesel. If Russian refinery capacity is reduced, the Russians will simply export less refined product and more crude oil.

EXPLAINER: Consular Service Suspension for Ukrainian Men Abroad – What We Know So Far

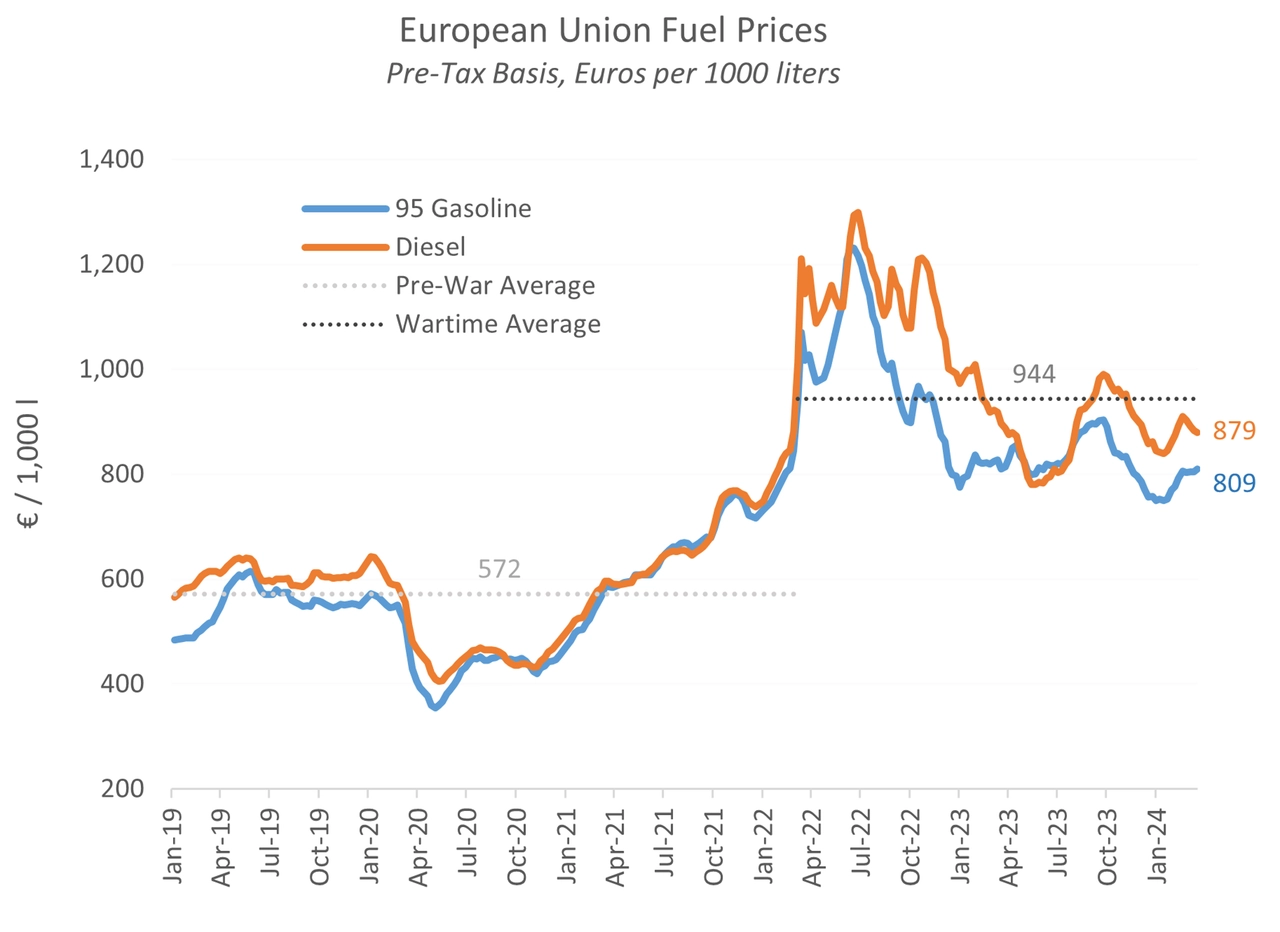

For the moment, the Ukrainian strikes affect only a small portion of Russian throughput and are not influencing European fuel prices, as the graph from the European Commission below shows. If the crude is not refined in Russia, it will simply be exported as crude and refined elsewhere.

Source: European Commission

The graph above does, however, show that European pre-tax fuel prices are about 50 percent higher than before the war, owing principally to the price cap and embargo.

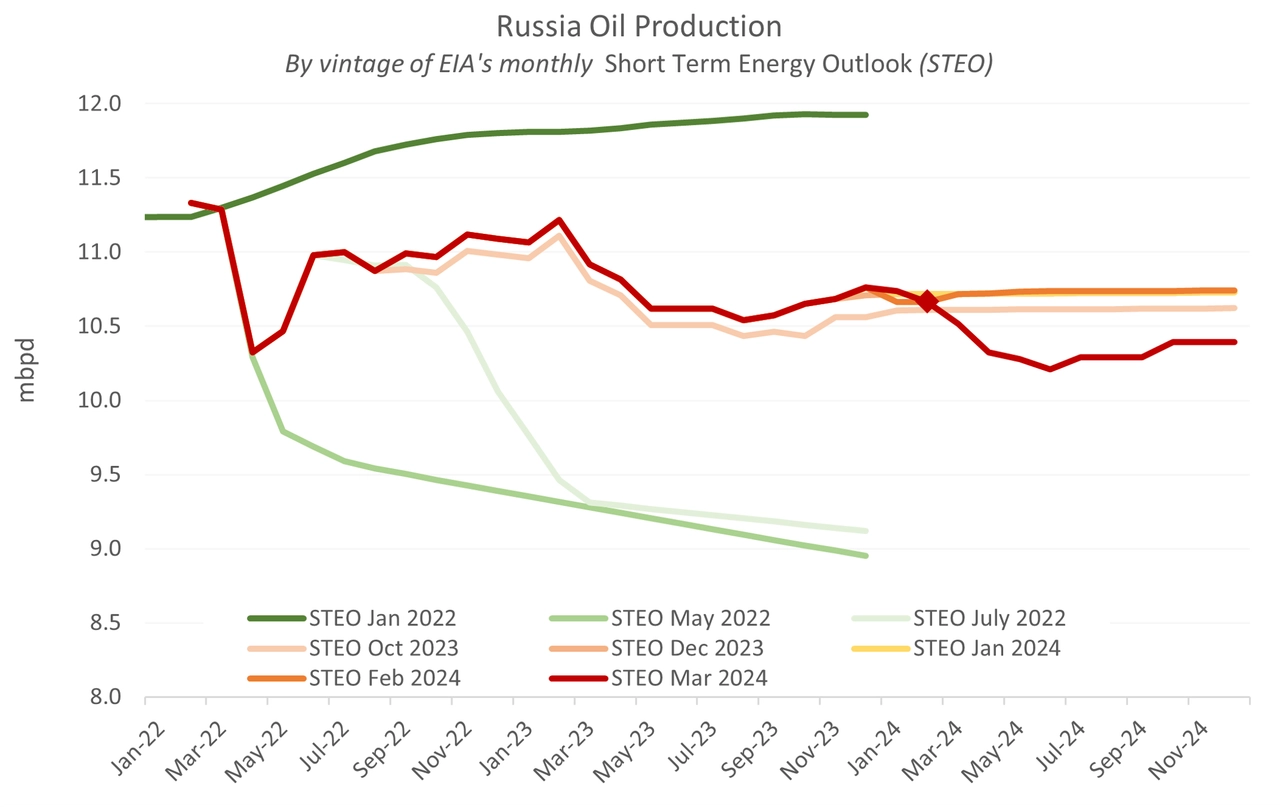

The greater risk to oil prices is announced production cuts. Russia will cut its oil supply by almost half a million barrels per day in the second quarter of 2024, according to the Moscow Times. Russia’s Deputy Prime Minister Alexander Novak said that Moscow plans to reduce its output by 350,000 barrels a day (bpd) in April, by 400,000 bpd in May and then 471,000 bpd in June.

These cuts are reflected in the EIA’s forecast for Russian production, which anticipates the Russian crude oil supply to decline by 530,000 bpd from January to June and bottom at 10.3 mbpd before returning to previous levels in mid-2025.

Russian supply reductions are part of a larger OPEC+ production cut of 1 million bpd announced in late November. As oilprice.com opined, “Saudi Arabia and allies like Russia would prefer to see Donald Trump reelected, and they may therefore try to drive prices up ahead of the election. It will be harder for President Biden to win reelection if gasoline prices are skyrocketing ahead of the election.”

The simple response to this is a restructuring of the price cap.

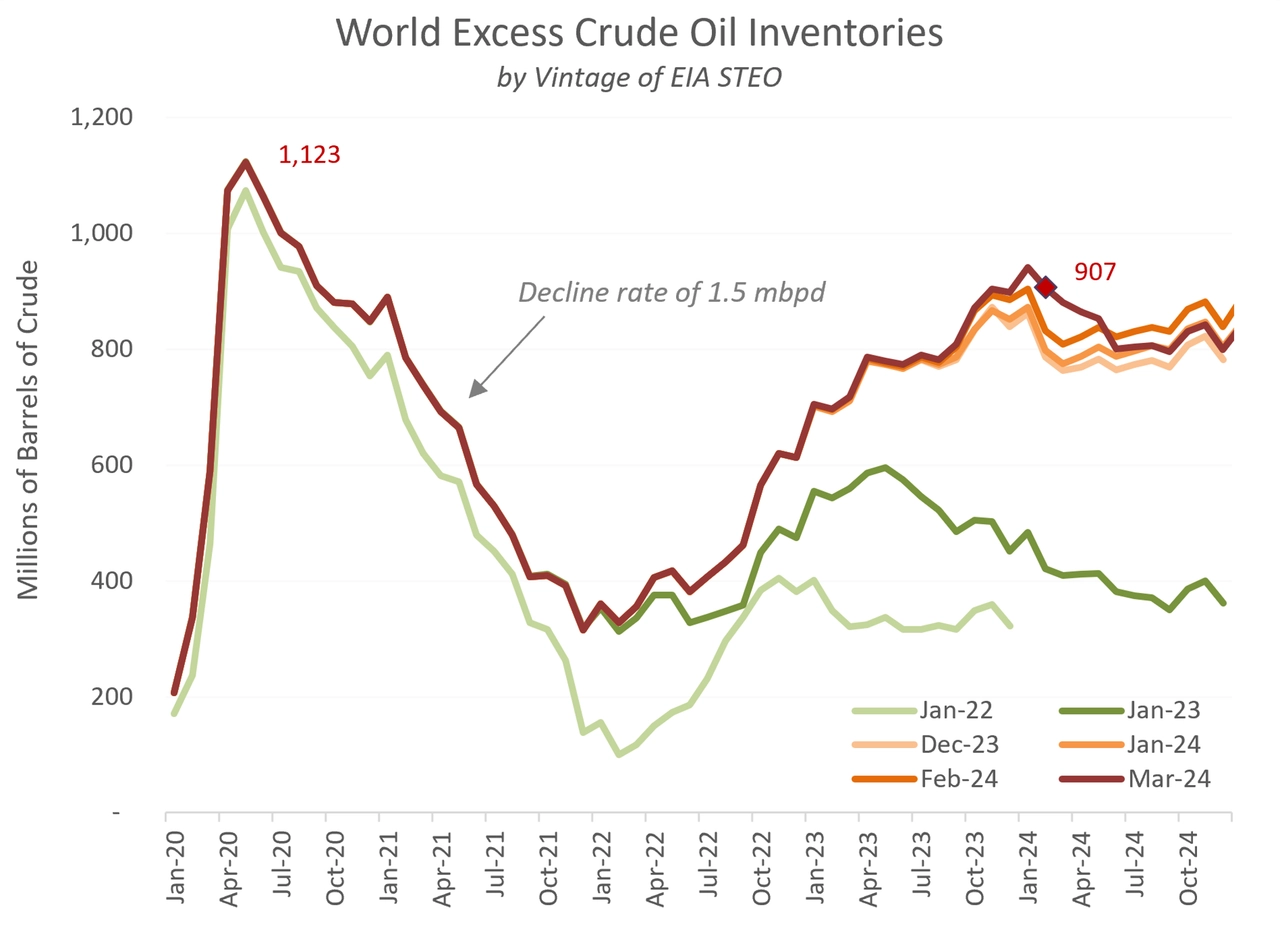

The price cap has led to the hoarding of crude oil stocks. If oil is selling below the market price – and Russian oil is – then traders will load up with as much as they can store, knowing they have profits locked in.

We estimate global excess crude oil inventories (those above the level needed for the everyday operation of refineries) at 900 million barrels. This is only 200 million barrels below the pandemic peak, when analysts were expecting the entire oil sector to collapse.

Put another way, excess crude inventories are at all but historic highs.

Source: Princeton Policy estimates using EIA STEO data

A restructuring of the price cap and embargo would allow this oil to re-enter the market, as it would redirect the excess profits currently captured by Chinese and other oil traders to a G7-controlled entity. This would eliminate the incentive of traders to hoard inventories above normal levels, and they would consequently liquidate most of the excess crude.

We can also estimate the pace of liquidation based upon the post-pandemic experience, which was 1.5 mbpd. As a rule of thumb, each incremental supply of 1 mbpd will reduce the price of oil by $10 per barrel. Thus, releasing excess crude inventories would be expected to knock $15 per barrel off the price of Brent for approximately 18 months, implying a Brent price around $70 per barrel.

For purposes of comparison, the average price of Brent from the peak of excess pandemic inventories in May 2020 to the end of liquidation in Dec. 2021 was $57 per barrel, about $67 per barrel adjusting for the impact of lockdowns.

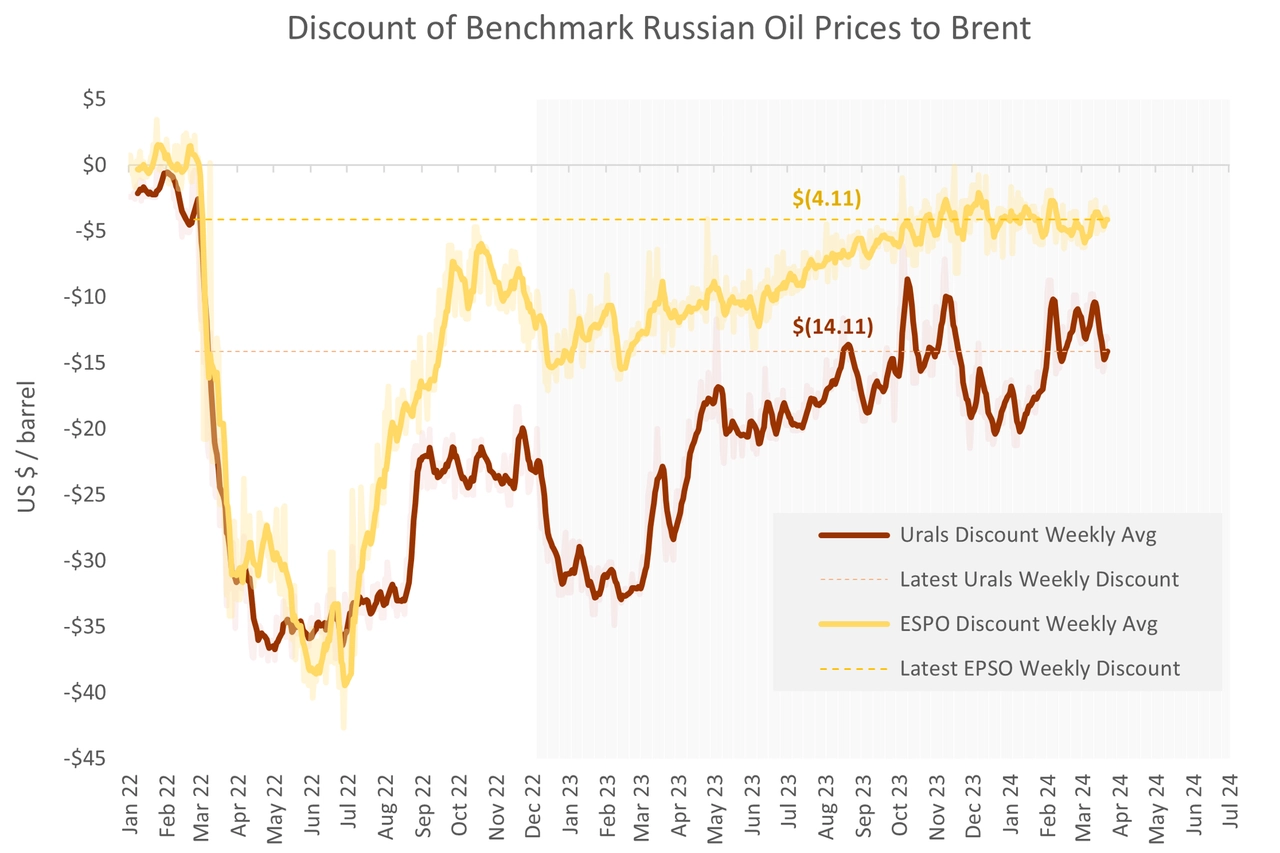

Therefore, the expectation for $70 Brent and $65 West Texas Intermediate (WTI) is plausible with a restructured price cap. Further, Urals would be pushed down to $55 per barrel, well off the Central Bank of Russia’s forecast of $71 per barrel for 2024. The Urals discount, which today stands at $14 per barrel and has averaged $12.50 over the last two months, might be expected to expand modestly to $15 per barrel, with all of that captured by the G7.

For the time being, Ukrainian strikes on Russian refineries appear to have no effect on diesel or gasoline prices in Europe, and the Biden administration should therefore yield to Kyiv’s priorities in the matter. By contrast, announced production cuts by Russia and other OPEC+ members represent an appreciable risk of higher oil prices.

The answer to that challenge is a much needed and vastly overdue restructuring of the price cap. As the Biden administration has been slow on the uptake, the Ukrainians may ultimately be forced to take the matter into their own hands and sink a Russian oil tanker in the Black Sea. Now that would concentrate minds. The price cap would be restructured within days.

The views expressed in this opinion article are the author’s and not necessarily those of Kyiv Post.

You can also highlight the text and press Ctrl + Enter

Comments (4)

Do not listen to voices saying that Ukraine should not destroy Russian Oil Refineries. Destroying them is exactly what Ukraine should be doing. Those trying to limit Ukraine's ability to fight Russian aggression should be totally ignored. Continue to attack inside Russia is a sound plan that lets the Russian people understand that they also will feel the pain of their war of aggression. Russia has had to limit oil exports to just a few other nations. If the price of oil goes up slightly then so be it but I doubt the price of oil generally world wide will be effected by Russia's refinery problems, but possibly, by the attacks on shipping by Arab terrorists claiming they are supporting Palestinians by causing a rise in shipping costs on far more than just oil. Do not let anybody limit Ukraine and it's response to Putin aggression. Take the war to them and hopefully Ukraine will get many more weapons this year as we are constantly trying to get MAGA republicans to allow a vote on support for Ukraine. We must always remember who supports Ukraine and who did not and we must all stand firm supporting Ukraine and democracy as we in the USA have our own fight trying to save our own nation from the forces of Fascism as todays republican party turns it's back on every thing they used to stand for.

If the US don't want destruction of Russian refineries, then they could deliver much needed weapons for destroying the Russian military instead. As Americans isolate themselves, their opinions get less relevant.

@Helge Hafting, well said.

DENYING RUSSIA’S ONLY STRATEGY FOR SUCCESS:

SPREAD THE WORD !!

https://www.understandingwar.org/backgrounder/denying-russia%E2%80%99s-only-strategy-success

Financial Times story is based on anonymous sources and is written by an apologist for Russia. This is total crap. The likelihood that the Biden administration has any position on Ukraine taking out refineries is close to nil.